(Cartoon Credit: www.lastlemon.com/harolds-planet/) “Success in investing is not a function of what you buy; it’s a function of how much you pay for what you buy.” That is Howard Marks of Oaktree Capital Management – the world’s largest stressed assets investor. What is a Stressed Asset? The Reserve Bank of India (RBI) has issued a paper titled ‘Early Recognition of Financial Distress, Prompt Steps for Resolution and Fair Recovery for Lenders: Framework for Revitalising Distressed Assets in the Economy’ […]

INVESTING IN SIN – THE RECESSION PROOF PORTFOLIO

(Cartoonist: Doug Pike: Cartoonstock.com) (Anheuser-Busch is the company that manufactures Budweiser beer, and Philip Morris makes Marlboro cigarettes) Warren Buffet investing gospel has always been – invest in what you know and what you understand. Looking at Indian demographics the CNX FMCG Index will always continue to do well irrespective of economic and political considerations. Is it a sin to invest in this sector? What is Sin-investing? To understand that one must know what a vice is. A vice […]

INDIAN GDP: LIES, DAMNED LIES & STATISTICS

(Cartoonist: Mike Shapiro: Cartoonstock.com) Lies, damned lies and statistics is a quote by the 19th century British Prime Minister Benjamin Disraeli. It is used to signify that numbers have persuasive powers and that they are often used to bolster weak arguments. GDP Statistics: De-jargoned Practically every research report on a stock or the Indian economy refers to India’s GDP and its inflation. It is the basis for the bull run. Hence, the importance of the new GDP regime announced on […]

EFFICIENT MARKETS: WILL THE U S FED HIKE CUT RATES?

(Cartoonist: Doug Pike: Cartoonstock.com) On Friday, 13th February 2015 European equities touched seven-year highs, and the S&P 500 closed at an all-time high. The Nifty is within striking distance of its all-time closing high of 8952.35 (29th January, 2015). Is the euphoria justified? Is this an efficient market? What is the Efficient Market Hypothesis? 1. Eugene Fama is the father of the Efficient Market Hypothesis. The hypothesis says that markets are informally efficient. As a consequence, one cannot consistently […]

SMALL CAPS: IS THE PREMIUM JUSTIFIED?

(Cartoonist: Brad McMillan: Cartoonstock.com) A lot of people do invest on the basis of the idiom that ‘great things come in small packages’. The relation between size and returns is significant for several reasons. The most important one is that it forms the cornerstone for mutual fund classification. With the increasing participation of the retail investor in the mutual fund space, it is indeed imperative to understand the stock rating and returns equation. Is there really a ‘returns’ advantage […]

NIFTY TARGET : ‘I DON’T KNOW’

(Cartoonist: Mike Baldwin: Cartoonstock.com) On the last day of the January, the sell off in the markets resulted in what Jesse Livermore (the great bear of Wall Street) used to call a ‘reversal’. It means any stock or index that makes a new all-time high (ATH) and then closes below the lowest level of the previous day, on a larger volume. All of this happened on Friday, 30th January, 2015. Have a look at the image below: In the past, […]

WHY YOU SHOULD BUY THE TATA MOTOR DVR

(Cartoonist: Doug Pike: Cartoonstock.com) Pursuant to the Securities and Exchange Board of India (Research Analysts) Regulations, 2014, I was hitherto debarred from making any stock recommendation. Having obtained the required approvals, I am making an ‘attempt’ to provide a stock idea. For the sake of disclosure, I hold no shares of Tata Motors or the DVR. I will also not be acquiring any, till I am out of the regulatory ‘window’. Why Tata Motors DVR? The answer is in the […]

HOW TO TRADE VOLATILITY?

(Source : Cartoonresource/Shutterstock) A lot is written on volatility. Until volatility began climbing, the most common complaint in the financial community was that volatility was too low. So why all the hand-wringing over volatility? The Volatility Index – India VIX The Volatility Index is a measure of market’s expectation of volatility. It is a measure of the amount by which an underlying index (Nifty) is expected to fluctuate, in the near term. India VIX is the volatility index based on the Nifty […]

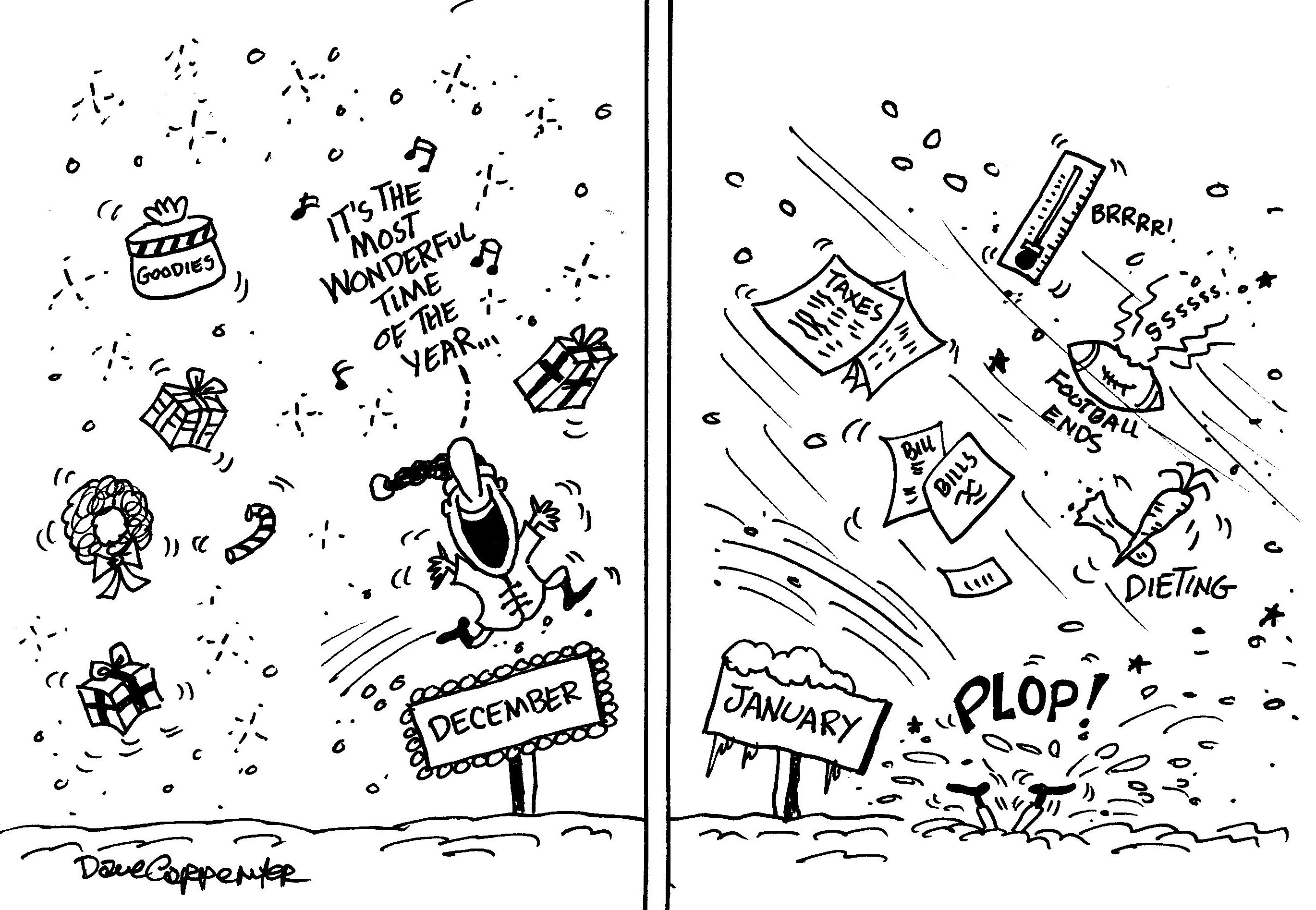

THE JANUARY EFFECT & THE DOGS OF 2015

(Cartoonist: Dave Carpenter: Cartoonstock.com) Very long ago, some one taught me that ‘well begun was half done’. As far as markets are concerned, can the first trading day, week, or month be used as an indicator, for the remainder of the year’s stock market performance? Market participants are known to be superstitious. Just like ‘Sell in May and Go away’, there is another stock market parable which says ‘As goes January so goes the year’. This is popularly called ‘The January […]

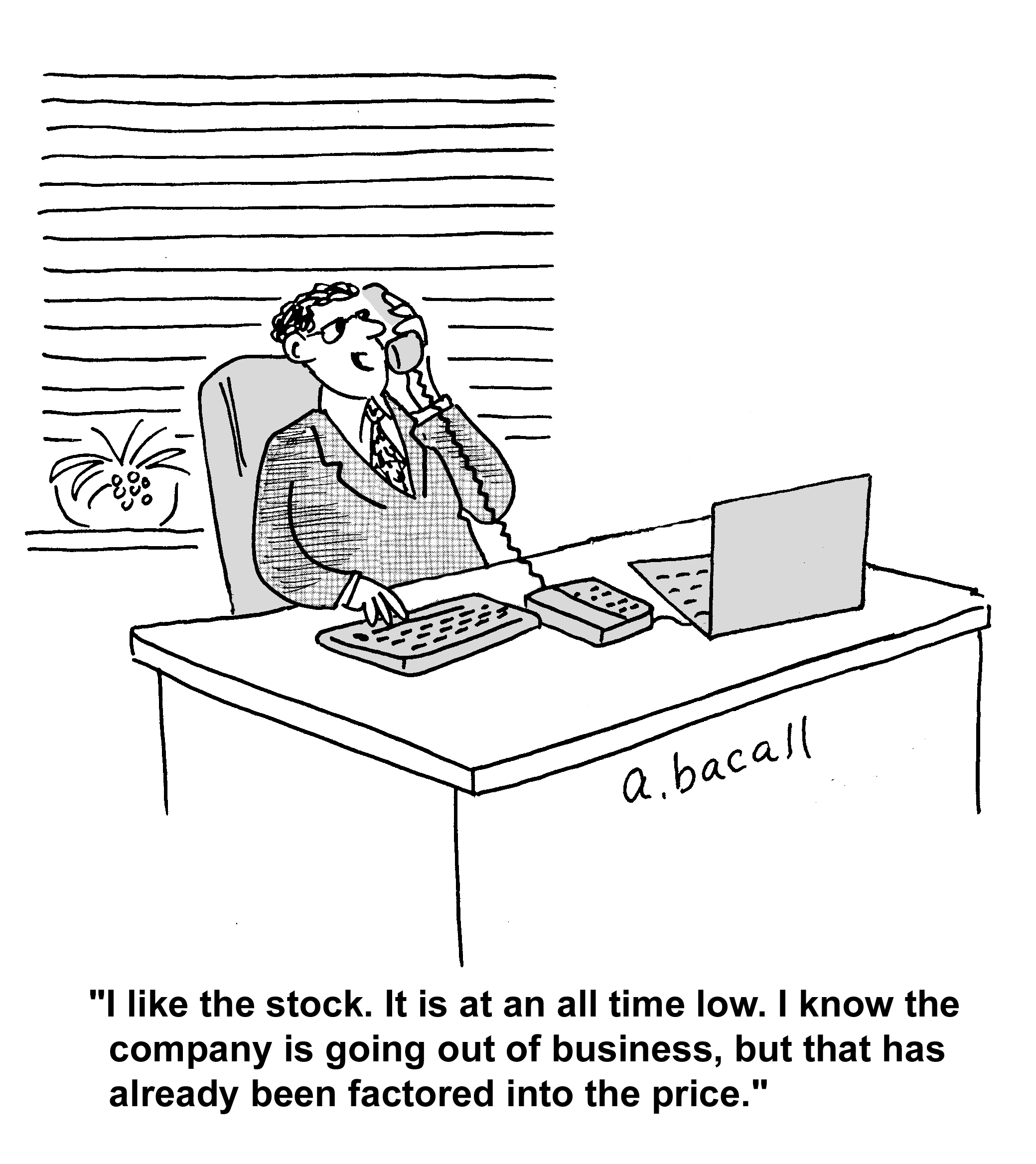

REVERSION TO THE MEAN – STOCKS FOR 2015

(Cartoonist: Aaaron Bacall: Cartoonstock.com) Historical data does show that reversion to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance. With so much of the stock market’s volatility based on expectations (emotions rather than business economics), what else could we expect? What is Reversion to the mean? 1. It is commonly said that if we learn enough about […]