(Cartoon Credit: www.lastlemon.com/harolds-planet/)

“Success in investing is not a function of what you buy; it’s a function of how much you pay for what you buy.” That is Howard Marks of Oaktree Capital Management – the world’s largest stressed assets investor.

What is a Stressed Asset?

The Reserve Bank of India (RBI) has issued a paper titled ‘Early Recognition of Financial Distress, Prompt Steps for Resolution and Fair Recovery for Lenders: Framework for Revitalising Distressed Assets in the Economy’ dated January 30, 2014. Click here to read the entire paper. In a nutshell, the paper says the following:

- The framework has become effective from 01 April, 2014

- Banks will be allowed to finance ‘specialised’ entities meant for acquisition of troubled companies.

- Appropriate incentive structures for PE (private equity) firms and other corporations – they may invest if the intention is to restructure ‘troubled company accounts’. In addition to funds, these institutions may also bring in business expertise.

Why the sudden interest in stressed assets?

The above referred RBI paper is more than a year old. How has it become relevant in 2015? RBI has a Corporate Debt Restructuring Scheme (CDR) that has been in operation for the last couple of years. As per the CDR guidelines:

- Banks have only till 31 st March, 2015 to restructure stressed assets. In case they don’t, they will have to make the necessary provisions in the books. It will have an adverse effect on their profits and their bad loan portfolio.

- In other words, with effect from 01 April, 2015 the RBI will not allow banks to qualify restructured assets as standard.

- The banks have been asking the RBI for an extension of the deadline for another year. The RBI has not obliged, as yet.

- To put matters in the correct perspective: In case of restructured assets – at present banks are setting aside 5 percent of the value of the loan to cover risk of default. With effect from 01 April, 2015 all restructured assets will be termed as non-performing assets. Then banks will have to set aside 15 percent of the value of the loan to cover risk of default.

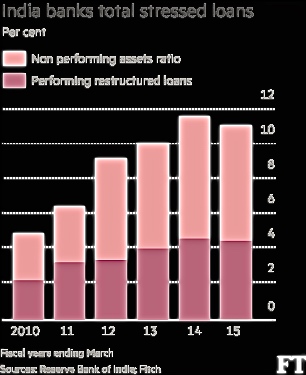

- In case there is no extension by RBI, the banks say that their Gross Non Performing Assets (NPA) ratio will rise to 10 percent, from 4 percent at which it stands currently. Have a look at the image below to get a feel for the size of the stressed asset class:

INDIAN BANKS TOTAL STRESSED LOANS

How does this translate into an Opportunity?

Whether the RBI obliges, only time will tell. The above is the regulatory position as of now. To my mind, this translates into an opportunity for the following reasons:

-

Since the RBI is hell-bent on CDR, even if it extends the deadline the banks will still be under pressure to clean up their books. It will be a continuous process.

-

If the banks don’t hurry up, the requirement of increased provisioning will creep in. Pressure on the banks is bound to translate into even more stress for the owners of the stressed assets!! At the same time, the smart money will only be too willing to invest in stressed assets. The simple reason being that they are available for attractive prices.

Stressed Assets and the legacy of Walter Schloss

There was a legendary investor by the name of Walter Schloss, who never possessed a computer and got all his financial data from the newspapers. He knocked the daylights out of investing and the indices. Warren Buffet refers to him as the super investor. He used to pick his stock on the basis of buying assets at a discount rather than on earnings. In short he was recommending valuing companies on the basis of assets rather than earnings. As per Schloss, earnings can change dramatically in a short time but assets change slowly. It implies that if one were to value companies on the basis of earnings one has to know much more of the enterprise. It is not possible to understand a company’s business and prospects just by a cursory reading of its published accounts. As per Schloss, buying assets does not require one to know which way earnings would go. The idea is to buy at a significant discount to the market value of assets.

Is the market showing a bias towards any stressed sectors?

I decided to add another filter to the stressed assets story. I used the two in conjunction with each other – stressed assets and stressed sector. I tried to see if the movement of the benchmark and its sectoral cousins is pointing in any particular direction. This is how it looks thus far:

| INDEX | JAN 01, 2015 | FEB 28, 2015 | % GAIN/LOSS |

| CNX NIFTY | 8284.00 | 8901.85 | 7.46 |

| CNX BANK | 18750.45 | 19691.20 | 5.02 |

| CNX AUTO | 8318.80 | 8935.35 | 7.41 |

| CNX ENERGY | 8630.95 | 8696.15 | 0.76 |

| CNX FINANCE | 7449.95 | 8033.45 | 7.83 |

| CNX FMCG | 20057.60 | 21102.35 | 5.21 |

| CNX IT | 11215.70 | 12659.80 | 12.88 |

| CNX MEDIA | 2378.30 | 2231.45 | -6.17 |

| CNX METAL | 2693.25 | 2600.05 | -3.46 |

| CNX PHARMA | 10923.25 | 11798.65 | 8.01 |

| CNX PSU BANK | 4294.65 | 3857.55 | -10.18 |

| CNX REALTY | 203.05 | 239.40 | 17.90 |

From the above it is clear that:

1. The CNX Realty is the best performing Index till 28th February, 2015.

2.The Bank Nifty is trailing the CNX Nifty, despite two rate cuts in the current year. The CNX PSU Bank Index is bleeding. Incidentally, it was the best performing Index of 2014.

3. The CNX Metal, CNX Energy and the CNX Realty Sectoral indices are the laggards of 2014. Of these, the first two continue in the same vein in the current year. The CNX Realty seems to have upped its ante. It is common knowledge that most realtors are debt laden and face poor business conditions. Hence, I went about looking for stressed companies in this sector.

4. The most popular way of trying to see stress in a balance sheet is to see the debt equity ratio. I decided to ignore it since debt is part and parcel of any business. It does not show me the ‘investment opportunity’ kind of stress. I decided to follow the Walter Schloss philosophy. Hence, I sorted the companies forming part of the CNX Realty Sectoral Index. The table below shows the results from highest to lowest, on the following basis:

- The percentage of promoter shareholding that has been pledged – to identify stress.

- Within this, the factor of the gross block (assets) as a multiple of total debt – to emulate Schloss.

- Within this, on the contingent liabilities. The higher the contingent liabilities, the higher the stress.

| SR.NO. | SYMBOL | CONTINGENT LIABILITIES (Rs. Crores & Consolidated) | % OF PROMOTER HOLDING THAT IS PLEDGED | ASSETS/DEBT (Basis – Consolidated numbers) |

| 1 | UNITECH | 7207.68 | 90.39 | 1.11 |

| 2 | SOBHA | 387.03 | 18.01 | 0.42 |

| 3 | DELTACORP | 115.98 | 13.92 | 3.02 |

| 4 | OBEROIRLTY | 4395.23 | 0 | 13.73 |

| 5 | PHOENIXLTD | 369.67 | 0 | 1.46 |

| 6 | DLF | 12379.20 | 0 | 1.31 |

| 7 | PRESTIGE | 1683.08 | 0 | 1.03 |

| 8 | IBREALEST | 773.31 | 0 | 0.14 |

| 9 | HDIL | 698.56 | 0 | 0.10 |

| 10 | GODREJPROP | 1735.86 | 0 | 0.03 |

Disclosure: I am long Unitech. Why?

1. Sometime in 2010, I had an investor asking me whether he should deposit money in a Fixed Deposit with Hdfc bank or buy an assortment of listed stocks. I remember my advice that he should buy the shares of Hdfc Bank instead of parking money in an FDR with them. With the benefit of hindsight, I can safely say that the advice turned out to be prophetic. No prizes for guessing what the investor did. I find an almost similar situation in the real estate market today. Virtually every household has more than one dwelling. They usually call it a second home or a farmhouse if it is far away. Having a second home or a farmhouse is now a status symbol. My feel is that if you are thinking of buying a second, third or fourth home with any of the real estate companies listed above by all means go ahead and do that. Just add a twist to the tale – also buy 100 quantity of the listed stock.

2. The CNX Realty is best performing index in the current year. I ran the numbers on whether this is an annual phenomenon – meaning does it occur in the first two months of every year. I found that it doesn’t. The only conclusion I could arrive at was that it has a beta of more than one – if the CNX Nifty rises or falls by 1 percent the CNX Realty will rise or fall by more.

3. The realty sector is a significant beneficiary of falling interest rates. This factor alone will lead to improved balance sheets in the year ahead. In the table above Unitech seems to be the most stressed realty stock. It fits into the Walter Schloss philosophy entirely.

4. The business conditions are poor. Supply of new homes exceeds demand. Realtors talk about the need for housing. No one is talking of affordability. Moreover, in terms of corporate governance, the less said the better. This makes the decision to call a ‘Buy’ in this stock very difficult.

5. I have seldom done this kind of investing in my life. Whenever I have tried, I have failed. This time I am once again tempted to make an attempt. In case the stocks halves, you have only two choices, hold on to it and start praying or book a loss. Please don’t double down, meaning buy more at a lower price. An alternative strategy could be to buy all the ten stocks in the CNX Realty Sectoral Index. You can tailor it whichever way you want.

6. Alternatively if you want to invest in stocks forming part of the CNX Realty but wish to invest in the best in class, just read the table from the last line upwards. That gives the least stressed stocks – toggle the selection to suit yourself.

7. Please remember that this is not a recommendation to buy Unitech. It is a recommendation to invest in stocks forming part of the CNX Realty Sectoral Index. I have given the mandatory disclosure. I am betting that the ‘the shit will hit the ceiling’. Will it hit the floor instead? Only time will tell.

Actually there are a few stocks in realty if anybody is really serious on the sector e.g. Pratibha Industries, which is around 60% in infrastructure (mainly in water projects and metro tunneling projects) and 40% in construction, has an orderbook around 8,700 crores as on 30th Sept 2014. Company is also undertaking US 250 million project for Sri-lanka. Going ahead company is expected to grow around 12% CAGR. Avg. performance for last 5 years – N. P. around Rs. 65 crores on the equity of Rs. 20 crores. Considering its reserves around Rs. 700 crores its debt around Rs. 1,700 crores though on the higher side of tolerance limits, looks manageable due to the management decision of monetizing non-core assets around Rs. 300 crores. As I heard, the board has also passed a resolution for QIP around Rs. 250 crores and company is in find of a banker.

Kolte-Patil is a stock which is in pure construction business. It is mainly focused on properties in Pune, Mumbai (redevelopment), Bengalore. Today also 74.5% shareholding is with promoters 10% shares are held by FII. It has a capital base of around Rs. 75 crores. What I liked most is it has a conservative debt policy. It earns around Rs. 100 crore on the turnover around Rs. 1,000 crore business. Maharashtra government has changed a few norms recently in respect of computation of FSI which will offer benefit around 15 lac sq. ft. over three projects of the company. It has got an extremely good response recently to its trend setter mobile apps fest in real estate sector. In 3 days the company has claimed to have sold 1.25 million sq. ft and value of inventory booked was around Rs. 750 crores. Kolte Patil app will be available on Google Play Store and Apple App Store from 18th February.

I would still like to insist that one needs to take a cautious approach, while investing in realty sector. This is because though opportunities are on their way, historically very less they percolate to the common investor!

Pratibha – you may be right. Kolte Patil is debt free, no stress. I tend to look at the Sectoral indices and whether a stock is in any of them. That acts as a safety net since my assumption is that cos that form part of the sectoral indices won’t vanish all of a sudden. I will give you the example of Accentia – a tech co. It was 350 three years back now it is below 10. I have no clue what happened. Similarly Zylog. So to be on the safer side I stick to those stocks that are in the Sectoral or Thematic Indices published by NSE. Again, I restrict myself to the NSE.

Bankers generally have around 25% exposure to the real estate sector (Construction, development, infrastructure). Bankers used to progress with an average 10% CAGR. In short, RBI will certainly tend to give support to the bankers, to the extent possible.

Still I would not buy the idea to purchase a stock for the discounted assets. As in Indian scenario, we have political vengeance in housing sector, regulatory whims and wishes in construction sector and government apathy in infrastructure sector. Consequent effects due to delays in projects tend to destruct the health of concerned bank/s, quite obviously.

Better to keep away from realty sector in toto and bankers who are akin to support this sector, as the theory worldwide fails ….because it happens only in India!

Agreed. The point is trying to identify ‘stressed’ assets. How does one go about identifying those? At the same time, one has to attempt to remain in sync with the market movement. I am looking for a way to determine stressed assets that have not flown – doubled or tripled. In doing so, one has to go down the value chain. You are not going to get good quality companies and promoters with stressed assets at these index levels. If there are any, do share. So a prospective investment candidate has to satisfy all three parameters – stressed assets, under priced, out of favor. That sets up the stage for reversion to the mean – the only law in financial physics. All the others are hypothesis or theories, not laws. Why does it tends not to work – conviction, rather a lack of it. You require a hell of a lot of confidence to stay invested when everyone around you is making money. That has been my failing and also that of many others.