(Cartoonist: Doug Pike: Cartoonstock.com)

Pursuant to the Securities and Exchange Board of India (Research Analysts) Regulations, 2014, I was hitherto debarred from making any stock recommendation. Having obtained the required approvals, I am making an ‘attempt’ to provide a stock idea. For the sake of disclosure, I hold no shares of Tata Motors or the DVR. I will also not be acquiring any, till I am out of the regulatory ‘window’.

Why Tata Motors DVR?

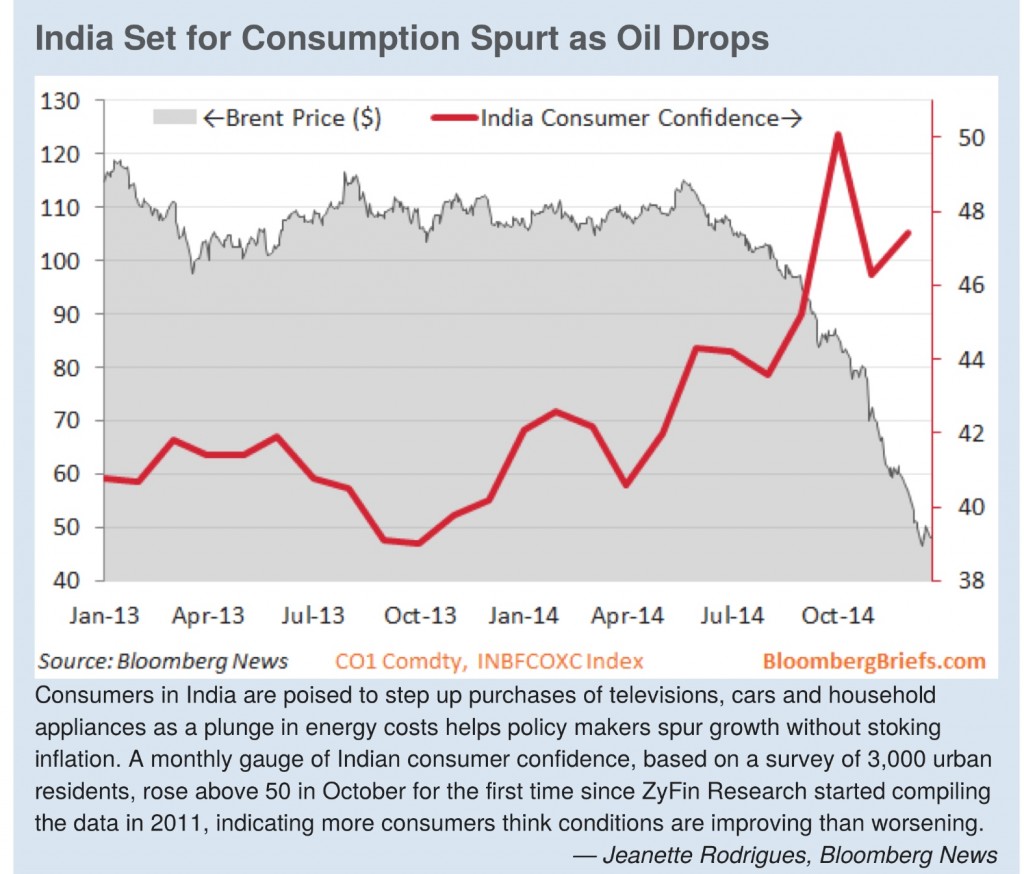

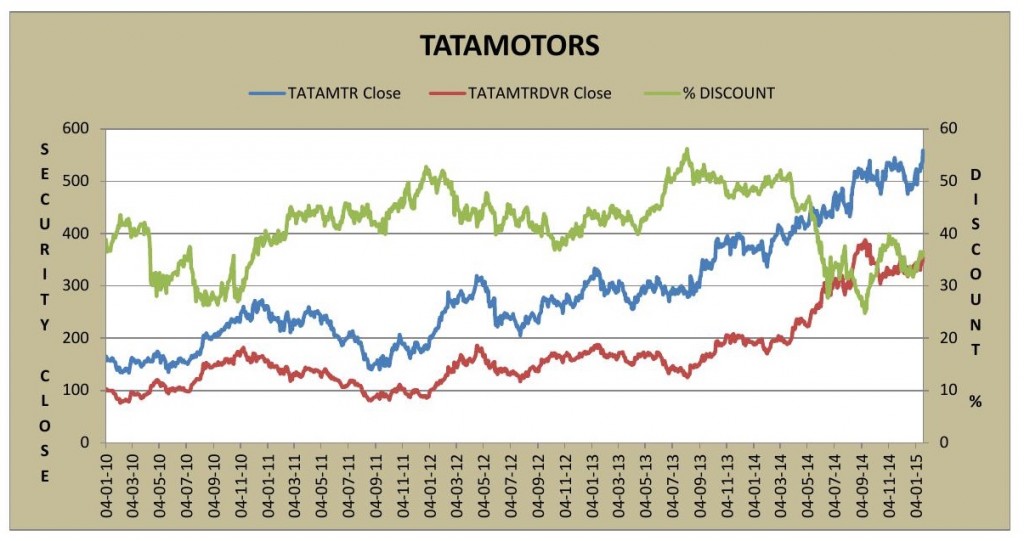

The answer is in the graphic below. Take a look:

The Tata Motors DVR quotes at a discount to the ordinary shares. The discount varies from over 60 percent to a little below 30 percent. I think there is a kernel of an opportunity here.

What are DVR’s?

-

DVR shares – shares with Differential Voting Rights, are ideal for small shareholders as they rarely exercise their voting rights. Most of us buy shares as an investment option. We are least concerned with the voting rights that these shares have.

- The Tata Motor DVR – shares with Differential Voting Rights (DVR), have been listed on Indian bourses since 2009, when Tata Motors took over Jaguar. These shares were issued at Rs. 60 when Tata Motors was quoting at 68.

- The holders of Tata Motors’ DVR shares can cast one vote for every 10 shares held. However, they are entitled to an extra 5% dividend.

The correlation between DVR and ordinary shares is high. They have always quoted at a discount to the ordinary shares. This incidentally, is a worldwide trend. The percentage of discount varies from case to case. Have a look at the graphic below which shows the price of Tata Motors and the Tata Motors DVR from 2010 till 2014. The discount is also shown on the secondary axis.

(Click on the chart to enlarge)

Why do DVR’s quote at a discount?

I happened to read a paper titled ‘The Value of Control: Implications for Control Premia, Minority Discounts and Voting Share Differentials’. It is published by Aswath Damodaran, for the Stern School of Business, in June 2005. There are many things which the paper deals with. I have tried to highlight the relevant issues from the paper – those which deal with voting and non voting shares. The relevant parts are reproduced below:

Shares with Differential Voting Rights – DVR’s

1. Companies which issue non voting shares either pay higher dividends on non-voting shares or give them a prior claim on cash flows.

2. This does complicate the comparison of prices on these shares, since the value of the higher dividends may offset some or all of the value lost from not having voting rights.

3. The shares that carry no, or fewer voting rights, should be worth less than shares that carry more voting power. The difference in price should be a function of the expected value of control.

4. The premium on voting shares should therefore be a function of the probability that there will be a change in management at that firm and the value of changing management.

5. If the primary reason for the voting share premium is the value of control, then the conclusions are as follows:

- The difference between voting and non-voting shares should go to zero if there is no chance of changing management/control.

- In a market where incumbent managers are entrenched, voting shares may not trade at a premium because investors assess no value to control.

- A hostile acquisition in this market or a regulatory change providing protection to non-voting shareholders can increase the expected value of control for all companies and, with it, the voting share premium.

- In summary, then, we would expect the voting share premium to be highest in badly managed firms where voting shares are dispersed among the public. We would expect it to be smallest in well-managed firms and in firms where the voting shares are concentrated in the hands of insiders and management.

- The premium for voting shares reflects at least some of the expected value of control. The relatively large premiums in some markets suggest that the private benefits of control are large in those markets and may very well overwhelm the value of control.

After perusing the contents of the paper I have come to the following conclusions :

- Academically speaking, on the basis of what is stated above, there is no justification for the DVR’s to trade at a discount of 35 percent (which is the current discount). The question of any hostile takeover or management change in the case of Tata Motors does not arise. Hence the ‘value of control’ cannot be expected to be so high.

- Moreover, in the case of Tata Motors, the number of voting shares as a percentage of non-voting shares is large. In case it was the other way around, the voting shares would, justifiably, command a premium. The question of the quality of management in a Tata group company, is in my opinion, irrelevant in India.

- The prime reasons for the discount in the Tata Motor DVR, in my opinion is the higher liquidity in the DVR. When the DVR’s were issued the Promoter shareholding was high at 84 per cent (in the last quarter of 2008). Now it is less than 1 %. A higher percentage of the Tata Motors DVR shares are available to the public (99.49%) and traded. This leads to higher liquidity. In Tata Motors only 56.40 % of the voting shares are traded. Take a look at the shareholding pattern below:

| PERCENTAGE | TATA MOTORS | TATA MOTORS DVR | ||||

| PROMOTER SHAREHOLDING (%) | 43.60 | 0.51 | ||||

| PUBLIC SHAREHOLDING (%) | 56.40 | 99.49 | ||||

What are the chances that the discount on the DVR will shrink?

On March 11, 2014 the U.S. regulator issued a circular titled ‘ S&P Dow Jones Indices Announces Changes in Treatment of Multiple Share Classes in U.S. Indices and Revises Previously Announced Treatment of Google Stock Split’. The circular was issued in anticipation of the listing of Google class C shares, which are similar to the Tata Motor DVR. The circular takes effect in the U.S. from September, 2015. The contents of this circular, in a nutshell are as follows:

- S&P DJI expects to transition the S&P 100, S&P 500, S&P MidCap 400, S&P SmallCap 600, and the S&P TMI/CI to a multiple share class structure effective with the September, 2015 rebalance.

- Under current S&P U.S. Indices methodology, companies that have more than one class of common stock outstanding are represented only once in an index. The stock price is based on one class, usually the most liquid class, and the share count is based on the total shares outstanding. Under the new methodology, all eligible trading lines for a company that meet certain liquidity and materiality thresholds will be included in the index.

- For companies that issue a second publicly traded share class to index share class holders between now and September 2015, multiple class lines will be considered for inclusion if the event is mandatory and the market capitalisation of the distributed class is not considered to be de minimis.

- This change will result in the S&P 500 having more than 500 share lines in the index but the index will continue to have only 500 companies. Each company may have 1 or more lines in the index depending on liquidity and size criteria that will be announced before the change takes effect in September, 2015. The same rule will apply to US constituents in other indices with a specific number of companies.

The above is self-explanatory. Indian regulators ape their counterparts in the U.S. and the U.K. This has been the trend for the last 15 years. There is nothing wrong in following developed markets. In India, among the index constituents, Tata Motors is the only stock which has issued DVR shares. In the event of any such move on the part of the regulator in India, I feel that the discount will narrow to somewhere below 10 %.

What I would do if I were you

Any one who holds Tata Motors might consider switching to the DVR’s. The additional quantity wouldn’t hurt. For those of you who have no holdings of Tata Motors, buy a small quantity of the DVR’s to start with. Subsequently, I can broadly envisage the following four scenarios. What I would do is stated in brackets.

1. The prices of both the DVR’s and the shares continue to increase. The discount remains the same. (Do nothing).

2. The discount increases. (Buy more of the DVR’s).

3. The price of both the instruments falls – discount remaining the same. (Just hold and forget).

4. The discount narrows. (No regrets).

The following points are worth mentioning

a. If you look at the discount graph (shown above) closely, you will notice that the discount has been narrowing since March, 2014. That is the period when the above referred S&P circular has been issued.

b. The current discount in the case of Google, now stands at around 7 percent. The circular becomes applicable, in the U.S. to ‘old DVR issues’ from September, 2015.

c. The FII holding in the DVR as on 30th September, 2014 stands at around 34 percent. I don’t see any reason why something similar would not happen in India, since the FII holding is large.

d. It is a calculated risk. In the event of no regulatory change in India, you will still be left holding on to shares of Tata Motors, albeit DVR’s. I don’t see why they shouldn’t be in anyones portfolio.

e. I draw comfort from the fact that no one understands anything about what is going on. Talking of valuation of stocks has become passé. In such circumstances, I think buying a 100 rupee note for 65 rupees, seems to be one of the safest ways to participate.

Yashodhan

Interesting article. Are there any other companies that have issued DVRs (and are traded on NSE)?

It also seems strange that just because a share has no voting rights, it is listed at a discount of 40% compared to their ‘normal’ share. Am i missing the fine print somewhere?

Regards

Shailesh

I can think of three, Pantaloons, Jain Irrigation and Guj NRE coke. You are not missing any fine print, have a look at the other three. I have no call on any of them.

Fundamental question. I assume you are talking of sovereign risk of the Indian rupee. Looking at the way FII’s are pumping money into Indian debt, I think we should not raise any questions. The other part, is Tata Motors correctly valued in the first place? I would reserve my opinion. According to me the whole market is over valued. But I know from experience that it can stay that way for a long time. The U S markets ran for 4 years in a similar fashion. Then you have two choices. The first is to wait and wait endlessly till the market corrects (whatever that means and by whatever per cent) OR invest gradually and be patient with what one has invested in. I am advocating the latter. So to answer your question, I am taking the Tata Motors price at face value and proceeding to advocate investing in the DVR, albeit gradually. The market and the price of Tata Motors swings a hell of a lot. Just 3 weeks back it was 320, now it is 370. So maybe invest on every dip.

Yashodhan,

Looks very interesting…

I am a value investor. In your opinion, is the 100 Rupee note = 100 Rupees to begin with ? What is the margin of safety ? If the margin of safety brings the value of the 100 Rupee note down to < Rs. 65 to begin with, then it becomes dicey for my philosophy. Unless you categorize this buy as a Special situation.

Your opinion?

Regards

Vinay