(Cartoonist: Mike Baldwin: Cartoonstock.com)

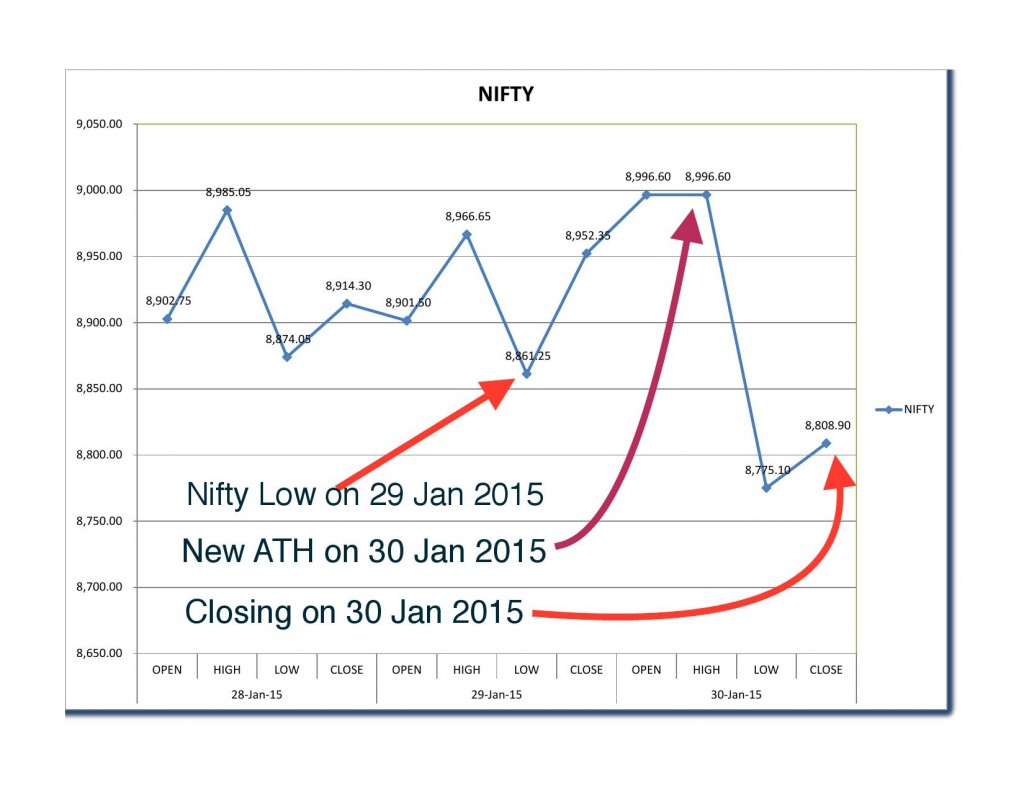

On the last day of the January, the sell off in the markets resulted in what Jesse Livermore (the great bear of Wall Street) used to call a ‘reversal’. It means any stock or index that makes a new all-time high (ATH) and then closes below the lowest level of the previous day, on a larger volume. All of this happened on Friday, 30th January, 2015. Have a look at the image below:

In the past, this was referred to as a trend reversal. It used to signify a sideways or a downward trend. In today’s world, what does it signify? The answer is ‘I don’t know’.

What is the ‘I don’t know’ effect’?

Many a time we are asked a question the answer to which is unknown to us. The fear of admitting and saying ‘I don’t know’ is a bit uncommon. People posture as if they know something. The hilarious four-minute video below shows this in ample proportion:

The funny thing I find about the above TV show is that the host Jimmy Kimmel continues to do this repeatedly. He has a show called Jimmy Kimmel Live that has got a Lie Witness News feature. I have no clue about how popular the show is, but one thing is sure, people seem to fall for his fictitious questions repeatedly. I thought that it must be a rigged show and that people on it are part of the casting crew. I changed my opinion after watching a number of his shows. The people asked are different in each episode – they are picked at random. I came to the conclusion that there is something that the Lie Witness News feature can teach all of us.

The Dunning-Kruger (I don’t know) effect

It seems that this behavioural bias is called the Dunning-Kruger Effect. What this effect says is that people cannot recognise just how incompetent they are in certain areas of life. As a result, most people are unwilling to utter the words ‘I don’t know’. They prefer to pretend to know the answer.

In a nutshell, the Dunning-Kruger effect says the following:

-

Incompetent people seem to have an inappropriate confidence. Most people fail to recognise the frequency and scope of their ignorance.

- We are all poor performers at one thing or another; we fail to see the flaws in our thinking or the answers we lack.

- People who don’t know much about a given set of skills, tend to overestimate their prowess and performance.

- People who went bankrupt in 2008, when surveyed about financial literacy, behaved and answered as if they were full of knowledge.

- This problem of unrecognised ignorance hits almost all of us. It leads to most us being misinformed.

- All of us fancy ourselves as pattern recognizers. We have a creative genius for storytelling. When you combine this with our ignorance, it does lead to incorrect decision-making.

- Education produces an illusory confidence in most people. So it’s very easy to find the mistakes that other people make, but very difficult to see those same errors in our actions.

Earnings Guidance and the ‘I don’t know’ effect

If you look at the video closely, you will notice two things:

a. The face of the interviewer is not shown and

b. The facial expressions of the people being interviewed reveal a lot more than what they are saying.

The host also gives the statistics, that 50 % of the people interviewed gave fictitious answers to false questions. Since it is earnings season, I drew a parallel to the two kinds of communication we are used to.

- One is the conference calls. These calls are now routine. The analyst community all gather on their telephone devices, headphones and ask the management questions on the quarterly results. I do end up listening to some of the conference calls. Not all, but those companies that I am tracking. I have never found anyone answering ‘I don’t know’ at any of these conference calls. In times to come; I hope we will have live shows where the faces of the company executives are clearly visible. It can add to the analysis in a big way. In the current scenario, it is impossible to detect deception since the facial expressions are not visible.

- The second is the interviews on the television. Either there is a voice from a remote location or if it is on television, the interruptions are so frequent that it is impossible to get a complete answer. Add to the fact that the people who matter, do not appear on television.

- All in all, the guidance and analyst presentations are a mess. It is the second type of experts, who appear on the media channels, that are highly dangerous. I seldom listen to any of them, but many investors do. They pretend to be the most knowledgeable. Most of the discussion sounds something like this: “on one hand . . . But, on the other hand”. It is pretty clear that the expert has no idea of what’s going on. Why then, is it so difficult for these experts to say three little words: ‘I don’t know’? In the current scenario, I think ‘I don’t know’ would be a better answer than most. That is, unfortunately, an answer you seldom get to hear or read.

What to do?

In the markets now-a-days, there are experts, and then there is everybody else (like you and me). I find it most amusing when all the experts who appear on television, opine about the world economy, inflation and Indian stocks relative to the world. Apart from a handful of people (none of whom make an appearance), I do not think anyone has a clue of what is going on. Consider the following:

1. The world economy is a matter of much discussion and debate. Most of the developed countries have been stimulated by monetary easing. The central banks of most of the countries in the developed world are trying to weaken their currencies. It does it make for an intricate situation. There is no historical precedent.

2. The following questions all have ‘I don’t know’ answers. In India, there is only one person who can voice an opinion on them. (You guessed it, the honourable Raghuram Rajan).

- What is going to happen when the U.S. Federal Reserve starts raising interest rates?

- Price of Crude oil in December 2015?

- The currency market and how Indian companies will be affected?

- The interest rate scenario in India and the U.S.?

- Global growth?

The rest of us are in an ‘I don’t know’ world. We are all guessing. Some of us will be right, some will be wrong. Even a broken clock shows the correct time twice in a day! For money managers operating in an ‘I don’t know’ world, their job isn’t going to be easy. With so much uncertainty, it is indeed difficult to construct a portfolio. To summarise, the legendary Mark Twain has said: ‘It is not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so’. By the way there is a controversy over who said this, Mark Twain or Josh Billings, the answer is ‘I don’t know’ !!!!