(Cartoonist: Doug Pike: Cartoonstock.com)

On Friday, 13th February 2015 European equities touched seven-year highs, and the S&P 500 closed at an all-time high. The Nifty is within striking distance of its all-time closing high of 8952.35 (29th January, 2015). Is the euphoria justified? Is this an efficient market?

What is the Efficient Market Hypothesis?

1. Eugene Fama is the father of the Efficient Market Hypothesis. The hypothesis says that markets are informally efficient. As a consequence, one cannot consistently achieve returns in excess of the market returns on a ‘risk-adjusted basis’. In 2013, the Nobel committee split the Economic Sciences Nobel prize between Eugene Fama, who propounded the hypothesis and Robert Shiller, who has been one of its worst critics. In a nutshell:

- Fama says ‘it’s the simple statement that security prices fully reflect all available information’. As a consequence, there is no scope for active stock picking.

- Warren Buffet and others who criticize the theory say that the market is a depressive maniac. Its mood swings provide plenty of opportunities. They claim that the efficient market theory is academic and has no relation to the ‘real’ world of investing.

However, there is a consensus that markets are efficient ‘most’ of the time and not ‘all’ the time. In fact, both Warren Buffet and Howard Marks have said that, in the long run, the market does get it right.

2. The legendary Ben Graham was asked this question about Wall Street professionals: Are Wall Street professionals accurate in their near term or long term forecasts of stock market trends? If the answer is no then why is it so? The answer he gave was:

-

Our studies indicate that you have your choice between tossing a coin and taking the consensus of expert opinion, the result is just about the same in each case. The reason for this is that everybody in Wall Street is so smart that their brilliance offsets each other, and whatever they know is reflected in the stock prices. What happens in the future is what they don’t know.

Those economists who are in favour of efficient markets argue that what Benjamin Graham was in fact saying, is what Eugene Fama said many years later.

Is this an ‘efficient’ market?

1. Today most of the developed countries are engaged in a currency war; a ‘competitive devaluation’. They are deliberately weakening their respective currencies to make their exports more attractive. Consequently, investors have to pay if they have to lend money to the government. Why would anyone park money in an instrument where you are sure that you are not going to get even your principal back? It sounds insane, but it’s a fact. We are in an era of negative bond yields. Have a look:

- Finland is seeing negative rates on the ‘initial’ sale of bonds.

-

The Netherlands, Sweden and Austria have negative rates on five-year bonds. Germany and Denmark have negative rates on six-year bonds.

-

Switzerland has negative rates on 13-year bonds. As a result, many corporate bonds in Switzerland have turned negative. Nestle’s four-year euro-denominated bonds are trading at a negative interest rate. So are bonds issued by Shell.

-

On Thursday, 12th February, 2015, Sweden cut its main interest rate into negative territory and also announced bond buying.

-

Short-term bonds issued by France and Slovakia have gone negative.

2. This kind of thing happening in so many countries is surprising. Incidentally, a couple of the countries mentioned above are not part of the Euro. All this has happened after the Swiss National Bank (SNB) removed the floor it had against the Euro, in anticipation of Eurozone Quantitative Easing (QE). Assuming that this is an efficiently priced bond market, the only reasons that someone would park money in an instrument yielding negative interest rates are as follows:

- There is no choice. Many institutions have to invest in bonds. It is the same as state-run banks in India. Also, any alternatives are considered too risky.

- When one expects things to get worse. In such a scenario, if the market expects the rates to go to -2 per cent it makes sense to invest at -.25 per cent. If the yield falls further, the price of the bond moves up, which will then compensate for the negative rate.

- Where the sovereign or currency risk is high, it makes sense to buy negative yielding instruments of ‘safe’ currencies. The way the currency markets have been fluctuating, nobody understands what is in store next. So buying such bonds is a kind of hedge against currency volatility.

- It means that the demand for the bond is higher than the supply. As long as the market expects supply to remain subdued, the yields are expected to continue falling.

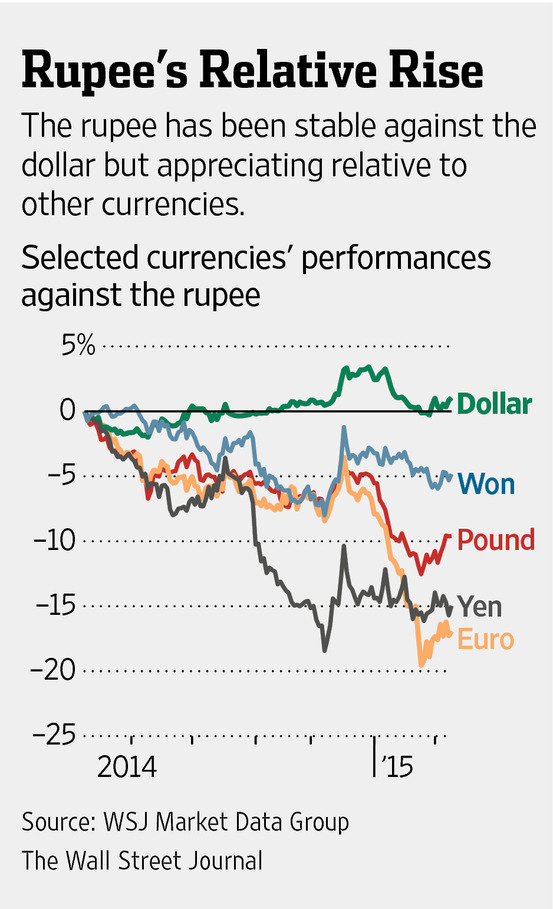

What about the Indian Rupee?

Have a look at the image below:

A strong rupee is helping our imports. We don’t export much, so no one is bothered. The current scenario has the following effects:

- The FII’s are pouring money into Indian debt. It does result in a strong Rupee. Indian debt is attractive in the worldwide ‘search for yield’.

-

The other effect is on equities. The argument is that money chasing stocks will go up. As a result, retail investors are pouring money into the mutual fund equity schemes. The FII’s, on the other hand, don’t seem to be enamoured of Indian equities of late.

Is this ‘efficient’ market pointing to a rate cut in the U S?

1. The European Central Bank (ECB) charges a fee on excess reserves parked with it. The U.S. Federal Reserve pays a nominal interest on excess reserves parked with it. The stand that the U.S. takes is that it is impossible to cut rates any further. What if they cut it to zero or start charging a fee?

2. Less than a year ago, investors were betting the Bank of England would have started raising interest rates by now. On Thursday, Bank of England Governor Mark Carney raised the possibility of cutting them again. It seems tumbling oil prices and currency cross currents are forcing central bankers to change course.

3. Assuming that this is an efficient market, the way European bond yields are currently placed, the market does seem to be expecting a further fall in the yields. This can happen if the Bank of England decides to cut rates.

4. The United Kingdom and the United States are cousins. They do tend to ape each other. If the Governor of the Bank of England is afraid that low inflation will become entrenched, will Janet Yellen be thinking the same? Is this efficient market correctly reading the ‘Yellen Index’? (Yellen Index is the one that blends economic indicators that the Fed will use to arrive at policy decisions – it is a phrase coined by BlackRock – an American multinational investment management corporation). The Fed might just be inclined to cut rates for the following reasons:

- Inflation in the U S is below the Fed’s target for the last 32 months.

-

A rate cut will weaken the dollar. It will help large corporations in the U S.

-

It will result in a spike in the price of oil; this is inflationary and what they want.

What if ….

1. I know the concept of a rate cut in the U S is a bit preposterous. With the assumption that markets are efficient most of the time, they could just be discounting any such occurrence. The way international markets have behaved over the last couple of days and the comments by the Governor of the Bank of England means it is a possibility that cannot be ruled out. So what if it happens?

2. We are in a situation where we are trying to guess how central bankers will behave and how the market will react. In such a scenario, it is difficult to judge whether the current euphoria signals a market excess or the working of an efficient market. Instead of worrying about the ‘what if’ we are clearly left with two choices:

-

Allow the rising prices to have their narcotic effect on our reasoning. This will inevitably result in each of us ratcheting up our risk levels, knowingly or unknowingly. If this is what the majority of investors choose to do you will find demand for low-quality stocks going up.

-

Risk is something over which we have no control. It is not worth one’s time trying to control things over which we have no control. We have already reached a situation where bargains are difficult to find, and valuations are high. If you think that the risk of investing in today’s market is just too high for comfort, the only other thing that can be done is to reduce exposure.

3. Whether or not this is an efficient market, one thing is sure; market irrationality can continue for extended periods of time. Markets always test our patience and our reasoning. Historically most of us (me included) have become typical market victims – popularly referred to as the six-foot-tall man who drowned crossing the stream that was five feet deep on an average.