(Source : Cartoonresource/Shutterstock) The stock market is at an all time high. Is it too late to enter? In my opinion, it’s just late, not too late. Many investors who cashed out feel that it is too late to buy, since they have missed out on the initial blast. In the first place, they decided to cash out because they felt valuations were unjustifiable. Those valuations, which they considered unjustifiable, have been stretched further. It is basically impossible to answer the question […]

HOW YOUR PORTFOLIO CAN BEAT THE NIFTY

Nifty as a benchmark The importance of having a benchmark cannot be understated. Investing is a way of life and your benchmark is an investing lifeline. Its a road map showing you the way. One can also take a detour if and when it is necessary. It lets you know how your portfolio is performing and can help you to stay disciplined. Since having a benchmark is so important, the selection of one is critical. In the Indian context, […]

EARNINGS & MARKETS

How many times have we heard that markets slip on weak earnings? We are already into what is popularly called the earnings season. It is mandatory for Corporate India to report their earnings every quarter. The results, as reported, do bring about a fair bit of volatility in the prices of the respective stocks. How the prices eventually move is more a function of earnings expectations before they are announced. The media run a poll of ‘expectations’. You then have […]

IS THIS THE TOP OF THIS BULL MARKET?

We finally had a meaningful correction in the Nifty last week. The inevitable correction which most investors have been waiting for has thus begun. Since many investors had been left out of a rising market, I presume there must be a sense of relief at the onset of a correction. When the market goes up everybody wants a correction. When it goes down there is the usual post-mortem of the ‘why’. What surprises me is that when a market […]

BUDGET & MARKETS

The Union Budget is to be presented on Thursday, 10th July, 2014. In my student days Nani Palkhiwala used to give a budget speech which was superb. In those days, there was no internet and communication systems were nowhere near what they are today, yet his speech was a massive draw. I wish someone could do something similar today. There is one constant between listening to the budget then and listening to it now and that is the fact that […]

STOCK PICKING – IS THIS A STOCK PICKERS MARKET?

THE ART OF STOCK PICKING A famous quote by Burton Gordon Malkiel “A blindfolded monkey throwing darts at a newspapers financial pages could select a portfolio that would do just as well as one selected by experts” (Malkiel was an American economist and writer most famous for his classic book titled A Random Walk down Wall Street published in 1973). The book was a bestseller and this comparison with primates is well-known in the investment world. William Eckhardt who is […]

MARKET MYTHS

MYTH : MONSOON AND NIFTY RETURNS The last two weeks have seen the market in a sideways move. As usual, the doubting Thomases have started the usual round robin circulation of WhatsApp messages. The media are working overtime on how the effect of El Nino can derail the ongoing stock market rally. The prospect of El Nino does sound depressing. It does prima-facie lead one to conclude that the economic effects will be disastrous and as a corollary the market will crash. […]

THE CONTRARIAN INVESTOR

WHAT IS CONTRARIAN INVESTING? Since the stock market runs on probabilities and not on certainties, one of the successful methods of investing is to be a contrarian investor. It effectively means that one should sell when everyone is buying and buy when everyone is selling. This in a nutshell embodies the theme behind being a contrarian. It is, however, easier said than done since being a contrarian is often compared to the loneliness of a long distance runner. How does an investor […]

CORRECTIONS – APPROXIMATELY RIGHT BUT PRECISELY WRONG

After the sharp run up in the indices in the last 3 months most investors have cashed out and are waiting for a correction to get back into the market. What constitutes a ‘correction’? This is very tricky since in the past I know of many investors who exited in the year 2008 at an index level very near the top and then got so bearish that they never got back in. The general classification of a bull market is […]

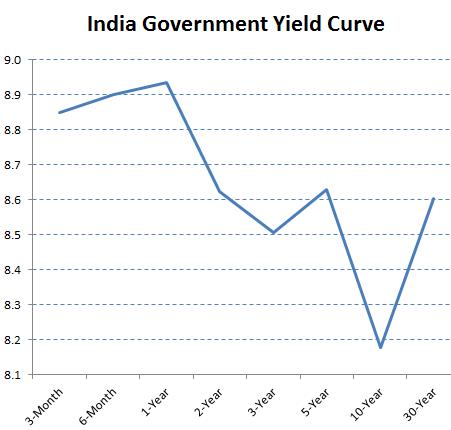

INTEREST RATE CONUNDRUM

I think that with all the euphoria over the new government and which sector is going to outperform, the single most important metric is the Interest Rate scenario. If interest rates start moving down then this will indeed be the mother of all bull markets, so how can one take a call on the interest rate scenario as on today. In simple terms it has to be monitored and one of the tools is the Yield curve. The basis of […]