In the past few days i have been asked by various investors as to my Nifty and Sensex targets for the next 5 years now that we have a new government at the centre. I for one am at a loss to answer that since there is no accurate way of forecasting the future. The whole financial media juggernaut has gone to town giving year-end targets and recommendations. Investing is not about going to a soothsayer (adviser) who can accurately […]

NAMO NAMAH

WILL THE MARKET BECOME A VICTIM OF IT’S OWN EXPECTATIONS? To me the biggest surprise of the election verdict was that not a single analyst or political commentator predicted that there will be a problem about forming the opposition party, most were busy cobbling up numbers of how the government is going to be formed and now we are trying to figure out how the opposition party and its leader are going to be selected. The verdict reflects the widespread […]

EXPECT THE UNEXPECTED

If there is one thing about markets which is certain it is the uncertainty of price discovery especially when we are on the threshold of a make or break event in India. I do not remember a single election in history where so much was at stake for the Indian business community as in this one. Bull markets like the current one generally climb the ‘wall of worry’. Markets generally discount all known phenomena and what we all know is […]

SELL IN MAY AND GO AWAY ????

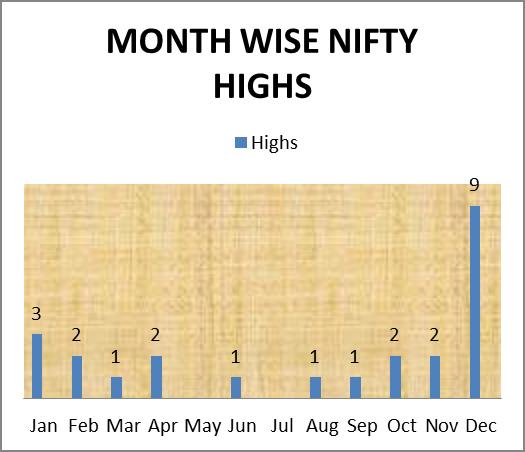

Every year this catchy phrase of sell in May and go away has become a media favorite. This is an American saying and the complete version is ”Sell in May and go away. Stay away till St. Leger’s Day”, and it effectively means that there is no point owning stocks in the (American) summer. Incidentally St Leger’s day is in September. In the Indian scenario the media has adopted it very quickly and has been extensively used in the month […]

2009 v/s 2014

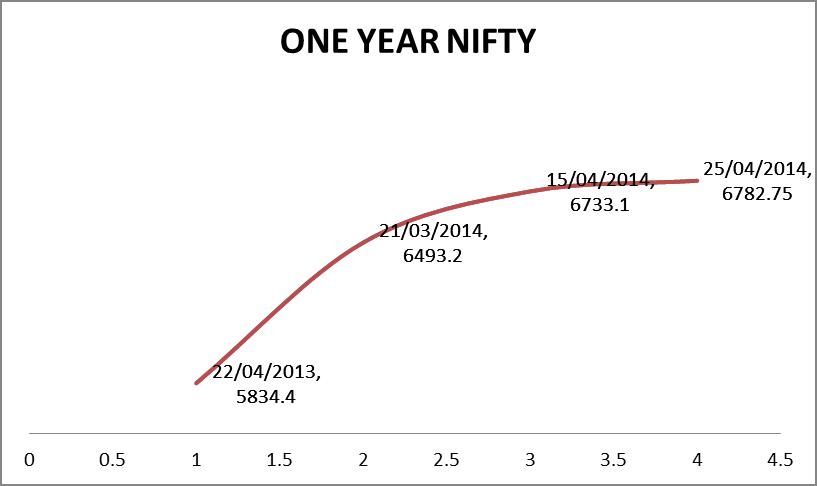

As we approach the end of the voting and get closer to the announcement of the results i am just wondering what to expect from the market, volatility is a given and i thought it would be in the fitness of things to delve into the past elections and see if any inferences can be drawn therefrom. The reason for looking backwards is logical since the stock market is basically cyclical in nature and the cycles tend to repeat since […]

INVESTING METHODOLOGY

Investing in stocks is made to look easy by the media and is unfortunately sold as a day at the races. There have been and always will be suckers who think that investing is easy. Charlie Munger (partner of Warren Buffet) says that investing is simple but not easy. In fact if one is not careful, investing in the stock market is like going through a revolving door. There cannot be any fixed methodology for investing in stocks and each […]

THE MODI SARKAR STORY

In the last couple of months as the build up to the election has started the noise around the likelihood of a stable BJP government with Narendra Modi as the Prime Minister has grown exponentially. In December there were many doubting Thomases and the most optimistic of them put the BJP tally at 230. In the recent past the numbers have crossed 300 and the die-hard optimists are predicting 375. What is with all these stories? In the stock market […]