(Cartoonist: Aaaron Bacall: Cartoonstock.com)

Historical data does show that reversion to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance. With so much of the stock market’s volatility based on expectations (emotions rather than business economics), what else could we expect?

What is Reversion to the mean?

1. It is commonly said that if we learn enough about security analysis, technical analysis and business cycles, then we have learned enough to make money in equities. We just have to work hard to learn all of these techniques. Yet, time and again, markets prove to all of us, that our collective knowledge of factors that govern world economic events, is not as good we thought it is. Consider the following:

- How many of the worlds economists had predicted in the beginning of 2014, that the price of oil would halve in the current year? You guessed right: none. So much for forecasting business cycles.

- There is then a continuous debate about growth stocks and value stocks, which is better. Actually it does not matter. Since each company and sector goes through a growth cycle and down cycle as it evolves.

- The first rule investors should understand is that what goes up must come down, and what goes down must go up. This in fancy investment world language, is called reversion to the mean. All companies and sectors tend towards average profitability and average growth, in the long run. So no sector can grow exponentially forever. It is the same thing as saying that either good news or bad news, cannot go on for ever. There will be periods when the news flow is good and sentiment is positive and vice versa. That’s how mean reversion works. Investments can’t grow to the sky forever, else everyone would invest in them and never sell.

- The mean is the average of a series of high and low numbers. We often assume that when reversion takes place, the price settles at the mean. In the markets it works differently. The mean is the arithmetical mean, the center point of a swinging pendulum. In the markets when reversion to the mean takes place, prices move from one end of the pendulum to the other end of the pendulum-they don’t stay at the center or the mean. Actually prices spend very little time at the centre. Mean reversion is to investing, what gravity is to physics. It’s pretty even-handed and always will be.

- All of us want to buy low and sell high. Buying undervalued assets and selling overvalued assets is the way to achieve this. In a nutshell, it is an embodiment of the principle of mean reversion. If you are in it for the long haul, looking to re-balance into undervalued assets is one way to increase your long-term results.

- Does growth beget growth or does growth suffer from reversion? The moot question is whether existing growth in a company’s earnings is an assurance that it will continue to grow in the future? Actually, there is no correlation, past behavior does not serve as a guide to future growth. Mean reversion is the common sense answer on why certain investments outperform others.

How does mean reversion work?

This is best illustrated with the following examples:

1. Gold as an asset class has been shunned by most investors in the current year. The U S Federal Reserve briefly began to talk about tapering their bond purchases. This, initially was one of the reasons why so many investors wanted to own the metal in the first place. So, why the apathy, all of a sudden? The fact is that Gold was on an upswing right from 2001 to 2012 – 12 consecutive years (from US$ 200 to US$ 2000). There are many reasons that caused investors to sell gold, but the easiest explanation remains that after 12 years of gains, it was probably due for a reversion to the mean.

2. Economic theory and empirical evidence show that if an industry has low returns on capital, capital then exits that industry, and the returns go up over time. Conversely, businesses with high returns on capital attract competition, and returns get driven down. That’s what you see happening in the oil sector currently.

Why does reversion to the mean work?

1. Human brains are wired to extrapolate, not to think in terms of reversion. We generally take the most recent data points, which is the availability heuristic, and then extrapolate that data, rather than consider reversion to the mean. So stocks tend to be over-priced or under-priced.

2. This does not necessarily mean that we sell what we perceive as expensive. It only means that we don’t buy what you perceive as expensive. Even the legendary Benjamin Graham’s secret was to buy a diversified list of statistically cheap stocks.

3. We do follow this tenet of buying what is cheap in all spheres of our lives. In the stock market we do exactly the opposite. As a pessimistic stock price inevitably influences the appraisal objectivity of most investors, it becomes exceedingly difficult to form a view strongly opposed to the prevailing consensus. Most analysts generally adopt a “this time it’s different” attitude.

When Reversion to the mean may not work

1. Reversion can be stock wise, asset class wise or sector wise. Reversion to the mean should work for everything, right? One approach to investing is to find the under performers just as they are about to cycle back to their average long run potential. Works well in investing, but in life you are often better off staying with the best in class, rather than bottom fishing for the reversion trade.

2. There is an argument that mean reversion is generally reserved for the broader markets, not individual stocks. The problem with ‘buy when there’s blood in the streets’ is that, sometimes, individual stocks don’t comes back from the dead. The company’s businesses may continue to decline. The question of whether a company has entered permanent decline is anything but easy to answer. Virtually all companies appear to be in permanent decline when they hit a rock-bottom market quotation. Hence, it is difficult to time such trades.

4. How do we distinguish between a fallen angel doomed to irrelevance, and one likely to take off again? This is an extremely difficult question. If you answer it correctly, it can be very rewarding. While taking an investment call it may be worthwhile to consider the following :

-

It helps to know why a stock has collapsed. If it is the result of a long-term blow to the business model, as in the case of the internet revolution, then it will indeed be difficult to restore the business to its former glory.

-

However, if the stock collapse resulted from the existence of distressed sellers, a liquidity rather than a solvency issue, or a business going through a cyclical industry trough, the stock price may rebound.

-

Keep a look out for stocks which are returning to the dividend list after a spell of three years or more. A case in point is Arvind Mills Ltd which has quadrupled since it returned to the dividend list.

-

Also, situations where the debt rating of the company is moved a notch higher is one of the best indicators that things are turning around. In such cases there is a high chance of the stock price reverting to its mean.

-

When promoters begin releasing their pledged holdings is a sure sign that times are changing. Such stocks are good picks, depending on how beaten down they are when you invest. This was true for Gujarat Pipavav Port Ltd in the year 2013. This stock has gone up four times.

-

Situations in which a major investor can serve as the value unlocking catalyst. As a result, distressed equities occasionally become targets of funds looking to inject equity capital on preferential terms. This is currently happening in the case of Spice Jet. This is also what Warren Buffet did in 2008.

-

What is the existing insider ownership in the stock. Also, are any insiders currently buying the stock? Has the company conducted a buy back at a price which is higher than the current market price? This is currently true of Jindal Steel & Power Ltd.

-

In case the industry is on the cusp of a major positive inflection point. The challenge is to uncover situations that remain under appreciated or misunderstood. If oil continues to fall, this will be true for all airline stocks.

(Stocks mentioned above are illustrative in nature. They should not be construed as recommendations. I believe that giving practical illustrations helps all of us to relate to the underlying concept. I hope this meaningful ‘disclaimer’ prevents the regulator from going straight down my throat!!)

How to use mean reversion

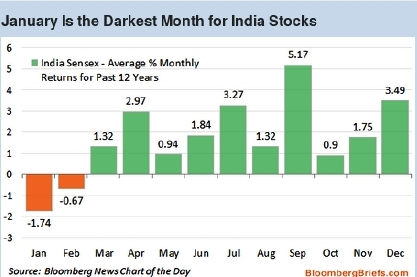

I suppose that is enough of ‘gyan’ on the concept. Time to get down to business and see how it works. Have a look at the graphic below:

“Indian stocks will continue their tradition of performing worst in January out of any month as investors take profit following the best annual performance since 2009, according to Sundaram Asset Management. “Inflows tend to taper in January as sovereign wealth funds, ETFs and hedge funds sell and it won’t be any different this year,” said deputy CEO Sunil Subramaniam. The S&P BSE Sensex has fallen 4.6 percent in December, heading for its worst monthly performance since February 2013, as plunging oil prices and a currency crisis in Russia led to a selloff in emerging markets.” For the full story: NSN NGX7FQ6JTSE8 — Santanu Chakraborty, Bloomberg News

If history is any indicator, we might be heading for a buying opportunity in the next 45 days. With almost all stocks posting handsome gains in the current year, the next year is likely to be more challenging. What I mean is that I have no idea about where the Nifty will go, but there will always be some stocks which outperform. Which ones will they be? Since the idea of obtaining returns better than the benchmark is still alive, what I have done is as follows:

1. I made a list of Nifty stocks which have outperformed the Nifty in each calendar year since 2009. The number of times they have done that is shown in the last column. For example, Asian Paint has out performed the Nifty in each of the last six years (including 2014).

2. What I did next was to study the percentage returns for each of the Nifty stocks from 2009 to 2014 (till date) and tabulated the returns. As a comparison, the returns of the Nifty are also shown. I then assigned ranks, in ascending order, to the stocks which have given the best returns in each year. To download the entire spreadsheet and do your own analysis click here REVERSION-STOCKS FOR 2015 . The following spreadsheets are included in the download:

-

List if Nifty stocks with the percentage annual returns from 2009 till date.

- List of stocks which have out performed the Nifty along with the number of times they have done so.

-

List of stocks which have under performed the Nifty along with the number of times they have done so.

The following conclusions can be easily drawn from the data:

-

Every year roughly 50 percent of the Nifty stocks outperform the Nifty. (The highest is 37 stocks in 2009 and the lowest is 18 in 2013). Almost as a corollary of this, the Nifty gave the highest yearly returns of 71.46 % in 2009 and the lowest returns of 5.93 per cent in 2013. This goes to show the importance of stock selection among the Nifty stocks.

- Private sector banks, defensive stocks and some pharma names seem to outperform the Nifty almost every year.

- Bharti Airtel Ltd has under performed the Nifty in five of the last six years. It basically means that in case you have been holding Bharti Airtel Ltd for the past 6 years, you might have been better of with an index fund or index ETF. This is with the benefit of hindsight. The point is that this sector has been an under performer for five of the last six years. Will there be a reversion to the mean for the telecommunications sector in 2015?

- Dividends are not considered, since the index fund or ETF also gives dividends. So the effect is neutral.

-

The NEW column highlights stocks which were under performers in the immediately preceding year and broke in to the performing list. On an average 40 per cent of the stocks in each year are ‘NEW’.

Conclusion

-

With the advent of algorithmic trading and robot advisory services, it is not that difficult to accept the principle that we too can become a bit mechanical in our trading systems and procedures by buying what is cheap today. In case of those stocks where expectations are low – even a small positive announcement can give the stock price a nice bump. Such a portfolio has low expectations priced in, the odds are in our favor when we begin to invest.

- Lets face it, most of us know very little of the stocks in which we invest. Some of us take calculated gambles, some of us invest blindly. In any case, we don’t really know the whole story. We invariably trust our gut, emotions and some advisor / consultant. When it comes to investing, we are dealing with known unknowns and unknown unknowns. The all important question then boils down to: we preventing ourselves from paying too much for a stock, when you don’t have a clue of its future growth. It is difficult to make predictions about future growth of any stock. Hence the principle of reversion to the mean – buy what is cheap today. Why? Since bad times cannot go on for ever. As in people’s life, this works in markets as well. Of course the assumption we are making is that we are all investing in fundamentally sound companies with good promoters. Hence I have restricted the analysis to the Nifty stocks.

-

The famous English novelist George Orwell has said: ‘Whoever is winning at the moment will always seem to be invincible’. Hence, it all boils down to selecting stocks from the under performing list and then betting on an out performance in 2015. Which stocks will these be in 2015? I have no clue. To try to guess these, I am going to throw darts at the two groups – under performers and out performers. Then select twenty of them, to try to achieve a fair chance of beating the index in the year 2015. What about you?

Actually the best gains have always been when earnings have shown growth/stability and prices have shown reversion to mean..due to factors other than earnings(i.e macro)

it may not make sense to buy stocks with high volatility in earnings..prefer growing earnings/eps/roe..

where price reverting to mean will offer meaningful opportunities ..

I think Vinay bhai gave the answer you wanted. I probably misunderstood the question. Thanks Vinay bhai

pl see the link

https://www.equitymaster.com/5minWrapUp/charts/index.asp?date=12/29/2014&story=1&title=Finance-stocks-weigh-32-in-the-Sensex

oil and gas sector is alo heavily under performing and and under owned and – as if there is no oil and gas thts reqd fr us — there is a blood bath in the stks — if u pick these type of stks cairn /Relaince/ONGC wth 9/12 mnths view u can get 30/40 % returns frm here — actually this is money on table — but as u rightly observed they will come in when oil will go to 80 — — by tht time person like me would exit — reliance gas pricing– political stand off — – THIS TOO SHALL PASS__

Actually oil and gas sector is also due. However most of the companies are government owned which, I feel is a dampener. The best bet is RIL with the ‘jio’ and telecom thrown in. I am sure few will agree. I have yet to find a method to read the balance sheet of RIL. Also the most hayed stock, fits the bill perfectly

Sujaybhai

ys — mean reversion works in Earnings and EBITDA MARGINS – side also— meaning — Bharti’s all time high EBITDA margins were say 42 % in 2008/2009 but – post their acquisition spree and telecom cycle — down turn they would have gone to — 30 % in 2010 & and now they are at 33 % in 2014– so I am nt saying it can go to 42 % — but from a high of 42 to 30 pl chk 62 % retrace — so they can go to 37/38 % frm 33 so thts good on sales of 100000 crs — so additional 5000/6000 rs ebitda can be added in next 4/5 qrtrs — so on 400 crs outstanding shares — ebitda alone can increase per share by 12/13 rs + its growth of 12 % in sales and cash flow and Price to cash flow expansion wth sentiments turning positive —30/40 % upside is nt ruled out mathematically — as per Ramdeobaba’s formula —

U mentioned Guj Pipavav port n Bharti in ur write up

These are the stks which are increasing operating profit in last 4 qrtrs consecutively– but Guj Pipavav TTM pe is 27 n Bharti is at 12.8 — though personally i take cah flow into consideration more than EPS —

but ys Guj Pipavav lot of things happening — bharti is turning around in Africa–

I a siad in mail groth n mean reversion are best combo of triggers — when I said Analyst — recos — if sur short listed stck is consensus of them also — it is triply sure — candidate — if u happen to be on the side of herd wth ur hypothesis in place — there is nothing wrong

I agree. I generally ignore the plethora of analysts appearing on television. If there are others then obviously what you say does help. Yes growth coupled with mean reversion is a wining combination. No doubt about that.

I understand that earnings are more important than trying to predict price.

So , does reversion to mean also work with earnings per share of companies..If so , how?

Your response would be useful.

Actually the current valuations discount future earnings already. The market is already discounting a GDP of 6.5 or thereabouts. The FII favourites are in all likelihood discounting Q4 of FY2015-16, in most of the cases. The herd mentality ensures that what is under performing will no be touched. So if you could predict earnings, so accurately, you are correct. That is a big ‘if’. In so many years of watching earnings and guidance, I have yet to come across any company or analyst with a good ‘prediction’ record. In 2010 nobody could figure out that TATAMOTORS was a Jaguar story. I think it took till early 2013 for them to find out. The people who made the most money in TATAMOTORS are the ones who picked it up at 38 not the ones who bought at 150 when there was an earnings visibility. So if a Nifty stock is going to be ignored for 5 or 6 years, people like me, who are not privy to what the FII’s are doing should safely be doing some common sense investing. The other part of the earnings predictions also should be considered which is that if Asian Paints is going to have fantastic earnings – that is discounted. If Bharti comes out with earnings which are better than expected, then ???? Of course as I have already stated if you have an accurate handle on the future earnings then obviously it makes sense to go along.