(Cartoonist: Doug Pike: Cartoonstock.com) (Anheuser-Busch is the company that manufactures Budweiser beer, and Philip Morris makes Marlboro cigarettes)

Warren Buffet investing gospel has always been – invest in what you know and what you understand. Looking at Indian demographics the CNX FMCG Index will always continue to do well irrespective of economic and political considerations. Is it a sin to invest in this sector?

What is Sin-investing?

To understand that one must know what a vice is. A vice is a weakness of character or behaviour. It is popularly used to describe persons bad habits. So vice investing is profiting from others bad habits. Investing in sin stocks is the act of investing in companies that engage in the business of products that are considered to be vices. Simply put it means investing in stocks of companies whose commercial activity is deemed to be unethical. The world over, sin stocks are the ones whose businesses are those of alcohol, tobacco, gambling and arms. This post is restricted to the alcohol and tobacco industries. These sectors can be very profitable investments, in the long run.

Sin-investing: Is it recession proof?

The short answer is: Yes. Most investors have been lured into buying gold as a hedge against recession. I would stick my neck out and say that stocks of alcohol and tobacco companies are almost recession proof. The reasons are:

-

The products of these types of companies tend to draw a steady stream of customers, irrespective of the economic environment. Hence in the long run they turn out to be sound investments.

-

They have pricing power. In simple terms, you can define it as the ability to raise prices. Any sector that can raise the prices of its products is a safe bet in all markets. The demand for drinking and smoking remains uniform. In fact, when the economic conditions worsen the demand picks up.

-

Alcohol and Tobacco companies have two things that every product should have: brand recall and a loyal set of consumers. Add pricing power to that, and you have a winning combination.

Why is it NOT a Sin to invest in such stocks?

Depending upon each’s moral values and his definition of what is ethical and what is not, one may NOT want to buy these stocks. I don’t think it is a sin to invest in them for the following reasons:

-

The market doesn’t care. The market is focussed singularly on growth and profitability.

-

It does not amount to participation in the vice. By buying a sin stock, you are not giving money to the company to perpetuate the sin. You are trying to share in the profits that the company is bound to make. Buying a stock does not mean you are buying the company’s product.

-

In today’s environment, most investors treat the stock market as a gambling den. The current model of the brokerage business is very akin to that of a racecourse. (I don’t endorse the model, but that doesn’t matter). Incidentally betting and gambling are vices.

-

Is it nice to have a vice? No comments on that, suffice to say that the business is legal.

Sin Investing – Pros

-

Smoking is on the rise in developing countries. This is due to both population expansion and higher disposable incomes. For the Indian investor, there is an added attraction – smoking is in decline in most of the developed world. Hence, the multinational companies are focussed on nations like India who not only have a huge population but whose demographics are favourable. In other words, large number of potential customers are likely to join the legal age.

-

Smoking and drinking are not a very healthy habits. However, from the investment point of view, they have proved to be highly profitable. This is what the historical data shows. Unfortunately, the most appealing investment trait of both these sectors is the addictive nature of their products.

-

High dividend payout, good corporate governance are added attractions. These are value plays. Hence, they are boring. One just has to buy and sit on the investment.

Sin Investing – Risks

As I see it, there is only one risk. That is regulatory. However, the government earns an enormous amount from both these sectors. Hence, the regulatory risk doesn’t always play out the way it is projected to by the media. The risks for the two sectors are:

-

The current government seems to have a bone to pick with the listed tobacco companies. So far, it has failed to affect the stock performance.

-

In the case of the Alcohol shares, the risk of prohibition is very much there.

Looking at the kind of revenue that the government collects from both these industries, the regulatory threats mentioned above have always been present. They are not new. Hence, any dip on account of regulatory pronouncements is a buying opportunity. Historically regulatory excesses have not stopped the growth of their share price and business.

The sin stocks and the CNX FMCG

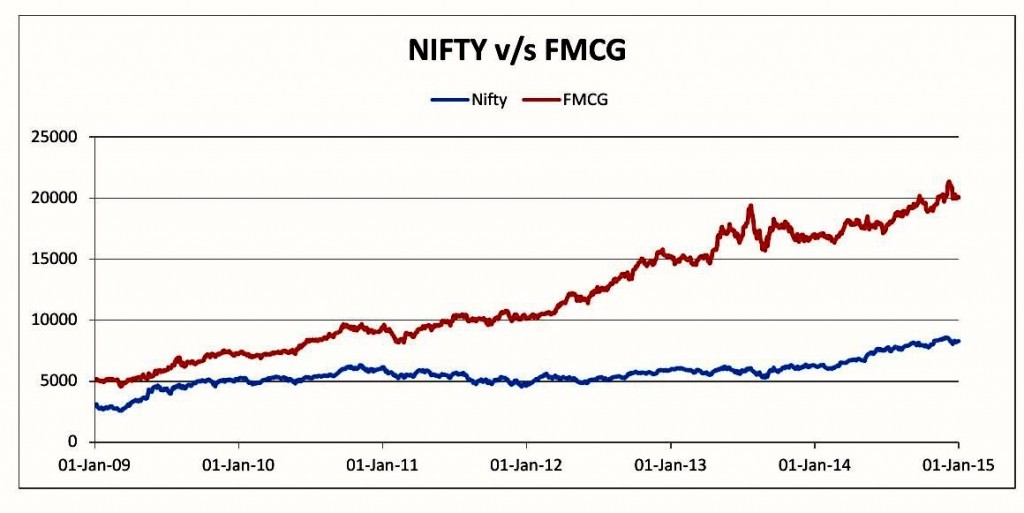

Why am I writing about the CNX FMCG Sectoral index in a post about sin stocks? The reason is simple. Taking into account the index changes (made with effect from 27th March 2015), three sin stocks viz ITC, MCDOWELL-N and UBL will have close to 70 percent weight age in the CNX FMCG. Add the weight age of HINDUNILVR to that, and you arrive at a figure of around 87 percent of the CNX FMCG. Since one cannot trade the CNX FMCG, the only way of participating is by buying these four stocks. Historically, the CNX FMCG has outperformed the CNX NIFTY. The year 2014 is an exception.

I calculated the annualized returns for both the indices for 13 years from 2002 to 2014. I also calculated the annualized returns for the leading stocks in both the alcohol and tobacco sectors for the same period. (The calendar year returns in 2014 are shown by way of comparison). The numbers are shown below:

| SYMBOL | ANNUALIZED RETURN(%) |

RETURN IN THE CALENDAR YEAR 2014 (%) |

| ITC | 24.65 | 14.36 |

| VSTIND | 20.29 | 10.67 |

| GODFRYPHLP | 14.70 | 10.56 |

| MCDOWELL-N | 36.83 | 6.73 |

| UBL | 37.85 | 8.66 |

| CNX NIFTY | 17.69 | 31.44 |

| CNX FMCG | 18.29 | 18.04 |

It is clear from the above that on an annualized basis, the sin stocks and the CNX FMCG Sectoral Index have both, outperformed the CNX NIFTY (except GODFRYPHLP). The reason for the above is that the CNX FMCG has a correlation of less than one with the Nifty. If the CNX NIFTY rises of falls by 1 % the CNX FMCG will rise or fall by less. It also means that, risk reduction of one’s portfolio is possible by diversifying into this sector. Click here to read about Nifty and Sectoral correlation. In the calendar year 2008, when the market crashed, this strategy has proved to be a winning one. Have a look at the numbers below:

| SYMBOL | RETURN IN 2014 (%) | RETURN IN 2008 (%) |

| CNX NIFTY | 31.44 | -51.84 |

| CNX FMCG | 18.04 | -21.42 |

The annual budget always does its bit to provide investors with an opportunity to buy sin stocks. The table below shows the year on year (YOY) returns of the CNX NIFTY vis-a-vis the CNX FMCG from the respective budget dates:

| BUDGET DATE | CNX NIFTY | CNX FMCG | CNX NIFTY YOY RETURNS (%) | CNX FMCG YOY RETURNS (%) |

| 28-Feb-15 | 8901.85 | 21102.35 | 17.63 | 17.23 |

| 10-Jul-14 | 7567.75 | 18000.20 | 32.93 | 23.34 |

| 28-Feb-13 | 5693.05 | 14594.25 | 5.91 | 37.13 |

| 28-Feb-12 | 5375.50 | 10642.75 | 0.79 | 21.91 |

| 28-Feb-11 | 5333.25 | 8730.35 | 8.35 | 26.79 |

| 26-Feb-10 | 4922.30 | 6885.71 | 22.94 | 12.81 |

Sin Investing – the how

Sin investing is not very popular all over the world, neither is it in India. In an ‘I don’t know’ world, where almost every other sector seems to be ‘priced for perfection’, it does make sense to ensure that our portfolios are ‘recession proof’. In India, we do not have any funds that invest exclusively in sin stocks. Hence, one has to invest directly into the respective stocks. One must keep in mind the following:

-

One has to buy gradually and periodically, preferably in small lots, a kind of systematic investment plan. They are boring investments, lots of patience is required. It follows that they are all meant for the long-term – buy and hold.

-

These sin stocks are also prone to sharp down swings. Historically, these have always been buying opportunities. The latest example of this was the post budget volatility in ITC on Saturday, 28th February, 2015.

In which stocks should you invest? You can tailor that to suit your vices. In case you don’t have any, that is a bit unfortunate. Why? To paraphrase Abraham Lincoln, who was the 16th President of the United States: ‘It has been my experience that folks who have no vices have very few virtues’. (Those are his views, not mine!!)

Nice observation indeed. Worth reading as usual! I know many good investors who do confuse on this front and refrain from investing in tobacco and alcohol companies. In my view, investor should be opportunist. Investing in such stock doesn’t mean that you support their evil activities, unless you are consumer! Some even don’t invest in plastic, meat, leather related item producing companies! Some go ahead and do not invest in interest earning companies like banks and financial institutions!!

On the moral grounds, in true spirit, the world over should not invest in Nestle, Pepsi, Coke, Monsanto, DuPont, Syngenta, BASF, Bayer, Dow, BP, Chevron, Walmart, Siemens, Goldman Sach and almost all pharmaceutical companies including Pfizer, Cipla. But, is it sensible?

In current scenario, a prudent investor should invest religiously in United Spirits Ltd, as this is MNC now. There are actually many stocks in FMCG like Colgate, ITC, HLL in MNCs and Emami, Dabar, Godrej Industries in Pure Indian companies which should be considered for stable portfolio.

This has been true for ages. In the outcry system, most brokers refused to underwrite issues that were related to fishing and leather. Things have changed, but it has not been at the investor level. For some reason, it has taken me pretty long to understand that these sectors are despised all over the world. In India, of course, there are plenty of reasons to stay away from investing in these stocks. The gambling stocks too are good bets. We have only DELTACORP as a listed entity in that space. Not worth looking at since there is too much hype due to it being a Rakesh Jhunjhunwala stock.

Hmmm…never thought about alcohol or tobacco to be ‘sins’ in the first place, so I have no inhibitions buying these stock. Frankly, I am taken aback that there might be some people who consider investing in such stocks as ‘sinful’. Oh well, to each his own.

I personally will be rooting for ITC for years to come!

Regards

Shailesh

It was a revelation for me too. If I ask anyone to buy Mcdowell-N, nine out of ten people tell me that they don’t what Mallya is up to OR that they don’t like the alcohol sector, in general. The fact is that Mallya does not control USL anymore. He does have a sizeable holding in UBL, but Heineken runs the company. In fact, they are eager to buy him out. Either it is general investor ignorance or just plain apathy, I am not too sure. I think you should buy all four just to keep things balanced.