(Cartoonist: Brad McMillan: Cartoonstock.com)

A lot of people do invest on the basis of the idiom that ‘great things come in small packages’. The relation between size and returns is significant for several reasons. The most important one is that it forms the cornerstone for mutual fund classification. With the increasing participation of the retail investor in the mutual fund space, it is indeed imperative to understand the stock rating and returns equation. Is there really a ‘returns’ advantage in owning small cap stocks?

What is a Small Cap

The NSE has got a CNX Small Cap index. There will be many investors who own small caps that do not form part of this index. They may be small caps in nature, but for one reason or another they do not qualify for inclusion within these top 100. Click here to see the ‘selection criteria’ used by the NSE. I am talking about small caps in general in this post; the reference point is the CNX Small Cap Index.

What is the ‘Small Cap’ premium?

Valuation premium is the higher price earning multiple, which small caps command. In normal market conditions, it is six basis points. Small caps always enjoy a premium as compared to large caps.

Why do Small caps command a premium?

In our market, currently, there is a clear incentive for small caps. The justification for this according to the research gurus is as follows:

-

The premium argument stems from the fact that there is less information available about these stocks. Hence, they carry a higher risk. It seems this increased risk entitles them to a valuation premium.

-

Small cap stocks suffer from lower liquidity. Hence, they command a ‘liquidity premium’. Liquidity or lack of it in small-cap stocks is the ease with they can be bought and sold. In today’s investing environment investors want to get in and out of positions quickly. In the event of a crisis, it is much easier to enter and exit the large caps than the small cap stocks. The extent to which this liquidity affects the price of an asset is called the liquidity premium.

-

In the case of stocks that are highly liquid, it seems that investors are willing to accept a lower price since they can sell almost any time. This lower price for large caps translates into a premium for the small caps. The existence of the small cap valuation premium does not mean that small cap stocks will outperform large caps every year.

Small Caps – Pros and Cons

In the case of small caps, it ‘s tricky to pull out pros and cons since one leads to the other and vice versa. It ‘s hard to decide which is the cause and which is the effect. In some cases, the cause and effect may interchange places and sometimes both may be the cause and effect at the same time. Eg the more money you make, the more stock you buy and the more stock you buy, the more money you make. One has produced the other. (This has been the story of this bull market thus far). Each of the things stated below are both pros and cons, depending upon the state of the market and the price point that is being used as a reference.

1. First of all small caps are not covered as extensively on the research front by professional investors. Many institutional research outfits do not allocate capital to small cap stocks. If someone just starts buying the price tends to jump. The reverse is equally true. Hence, a single large buyer or seller can create an impact on the price. It is easier for one or multiple large players to cartelize such stocks.

2. Small cap stocks are more sheltered than their large cap peers from global economic worries. Most of them don’t have a global presence, they are domestic plays. There is a consensus about the India growth story and also an agreement about lack of growth in the rest of the world. That is the only reason they are quoting, where they are today.

3. There have been periods where small cap stocks have given phenomenal returns and also long durations where they have not delivered any return. For instance during the technology boom small stocks were mostly ignored. After the dot-com bubble burst, these small cap stocks did produce better returns.

Are Small Caps overheated?

1. Among the ‘broad market indices’ published by the NSE, the small cap index is the second best performing index of 2014. However in January 2015 and till date it has lagged all other broad market indices. Have a look at the table below:

| INDICES | % Returns in 2014 | 1/Jan/15 | 6/Feb/15 | % Returns in 2015 |

| CNX NIFTY | 31.44 | 8284.00 | 8661.05 | 4.55 |

| JUNIOR NIFTY | 43.82 | 18734.85 | 19081.60 | 1.85 |

| CNX MIDCAP | 55.09 | 12618.30 | 12744.90 | 1.00 |

| CNX SMALLCAP | 52.33 | 5339.10 | 5383.00 | 0.82 |

2. Have a look at the price to earnings, price to book value and dividend yield for the broad market indices of the NSE:

| INDICES | Price to Earnings | Price to Book Value | Dividend Yield |

| 6/Feb/15 | 6/Feb/15 | 6/Feb/15 | |

| CNX NIFTY | 22.44 | 3.65 | 1.22 |

| JUNIOR NIFTY | 21.12 | 2.89 | 1.00 |

| CNX MIDCAP | 20.46 | 2.46 | 1.53 |

| CNX SMALLCAP | 34.94 | 1.43 | 1.56 |

3. There does appear to be some froth in the small-cap valuations. The small cap index quotes at a premium to the benchmark. Even after factoring the ‘small cap premium’ this index seems to be over priced.

In 2015 will small = beautiful or ugly?

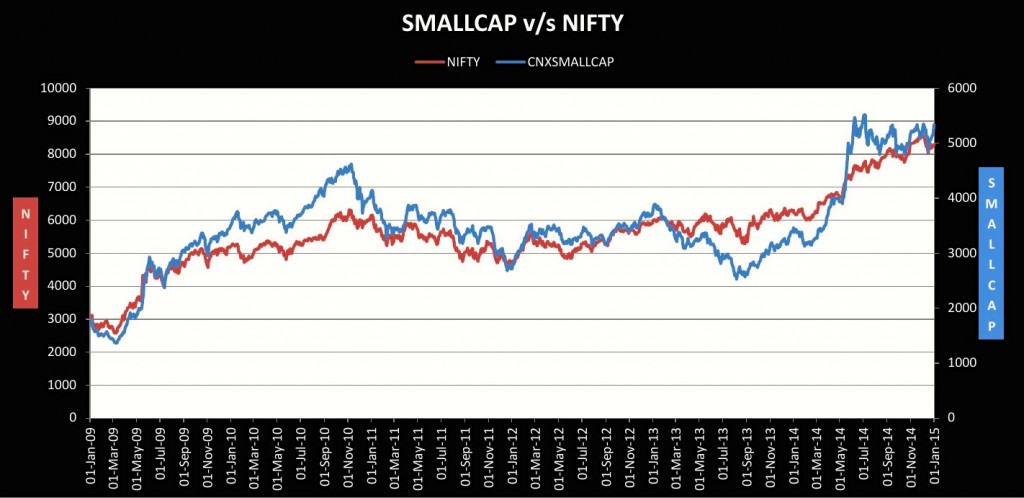

1. It is naive for investors to assume that just by investing in small cap stocks they will automatically earn excess returns. Have a look at the image below:

(Click to Enlarge)

The returns equation over the longer term does not show that one is better than the other. However, the average holding period of a stock having come down in recent times, this choice of investing in small or large cap has become rather important.

2. Towards the start of any bull market, the small caps tend to outperform. I think that phase of the market is over. As they say, the easy money has been made.

3. Smaller also spells riskier. In times of uncertainty, large caps are favoured. As compared to small caps, the large cap stocks have more robust business models.

4. The calendar year has begun with the small cap index quoting at an abnormal premium to the benchmark. Irrespective of what the market does in 2015 and where it goes, this premium is likely to shrink. Which way? Just remember that: ‘Small’ doesn’t beat ‘all’ at all times!!

Thanks.

Good insight into Small caps!

Shailesh