(Cartoonist: Bacall, Aaron : Cartoonstock.com) We are back to the earnings season. INFY, the IT bellwether announced numbers on Friday, 10th Oct, 2014. The stock had declined for most of the week on the back of ‘sell’ recommendations by some FII brokers. On Friday it recovered all its weekly losses, and then some. Since the market gave its price a nice bump, I assume the numbers and guidance must have been encouraging. The INFY Price Target How […]

FOREX FALLACIES – THE DOLLAR INDEX (DXY)

(Cartoonist : Farris, Joseph : Cartoonstock.com) For this weeks blog post, I delved into the fascinating world of Currency Markets. The most succinct way of presenting a very intriguing topic, I thought, would be to pen a list of Frequently Asked Questions ((FAQ) on the U S Dollar Index (DXY). FAQ on DXY 1. What are Foreign Exchange (Forex) or currency markets? The Forex markets are huge. Every day, more currency and currency instruments trade hands, than […]

LEI – THE MAGIC INDICATOR

(Source: Cartoonresource/Shutterstock) One of the very valid criticisms about research and stock predictions, is that it is made on the basis of past and historical data. This data cannot be said to be predictive. The Leading Economic Index published by the Conference Board, on a monthly basis, is a futuristic indicator. I have mentioned it, fleetingly, in the past (you can read about it here). The Conference Board Acknowledgements : I wish to thank the Board and their […]

ARE YOU PREPARED FOR A MARKET CORRECTION?

(Source : Cartoonresource/Shutterstock) With the bull market setting new high’s every week, it might seem preposterous to prepare for a correction. However, it does pay to be forewarned since, ‘to be forewarned is to be forearmed’. Historical FII ‘flows’ in Q4. The Indian market is heavily dependent on FII (Foreign Institutional Investor) ‘flows’. Any downturn in the market, has, more often than not, come on the back of FII selling. Is there a trend in the FII ‘flows’? I did a […]

THE ART OF SELLING STOCKS

(Source : Cartoonresource/Shutterstock) There are, broadly, two types of sales. The first one is a specific stock sale and the second one is a sell on the market. The contents of this post should not be construed to mean I am suggesting a sell on the market. Yes, some stocks in my opinion are worthy of being sold. Which ones? Maybe you can use the contents of this post to find out more about that. Selling Is an Art, […]

WHY IS THIS MARKET DEVOID OF A CORRECTION?

(Source : Cartoonresource/Shutterstock) Why is this market devoid of a correction? Is it a phenomenon of ‘this time it’s different’ (the four most dangerous words in the stock market). The Nifty closed at a 8086.85 on Friday, 05 Sep,2014. The speed and momentum have taken most market participants by surprise (including me). The technical analysts, fundamental analysts and economists are in the same category as the retail investor. I proceeded to analyse the reasons for this, and came up […]

THE ‘MAGIC’ FORMULA FOR STOCK SELECTION

(Source : Cartoonresource/Shutterstock) Stock Selection Is there a ‘magic’ formula for selecting stocks? I came across one in a book titled ‘The Little Book That (still) Beats the Market’ . We have all heard of the methods of the legendary investors like Warren Buffet, Charlie Munger, Seth Klarman. How they buy stocks quoting well below their intrinsic values. Concepts like ‘margin of safety’ while buying any stock have been talked about and written about almost everywhere. Also the […]

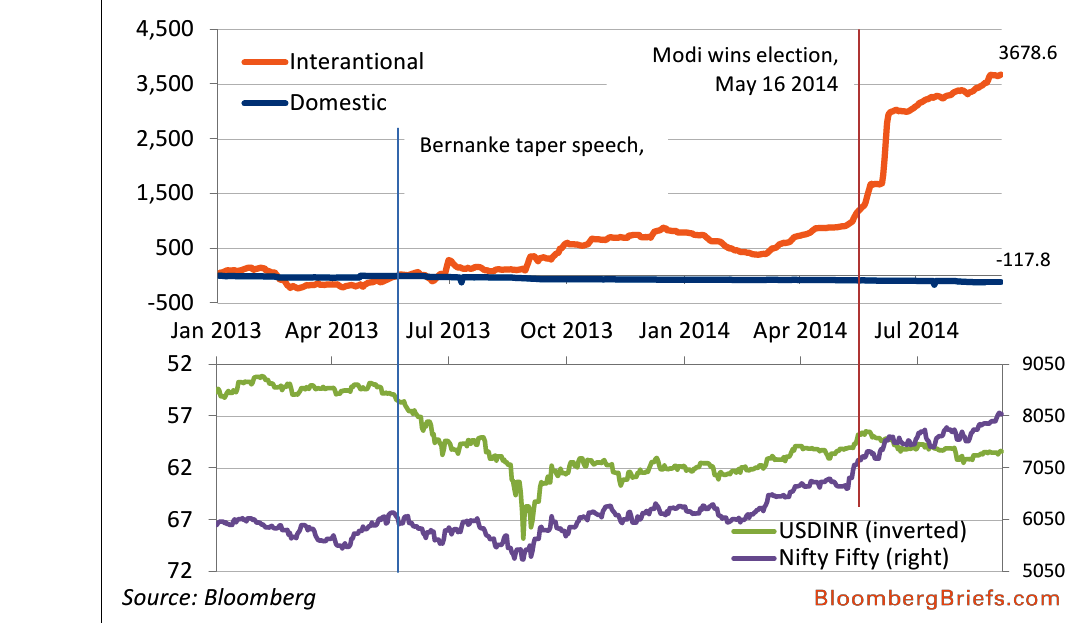

WILL THE FED TAPER DERAIL THIS BULL MARKET?

(Credit:James Patterson,The New Yorker Collection/The Cartoon Bank) FII flows and the bull market I had said in one of my earlier posts that Foreign Institutional Investor (FII) inflows are the single largest determinant of market direction. It follows that flows are dependent upon the U.S. Federal Reserve (Fed). In May 2013 the Fed announced that it will start tapering its Quantitative Easing (QE) program and what happened is history. So what happens when the taper is done with in […]

HOW MANY NEW ALL TIME HIGHS WILL THE NIFTY MAKE?

(Credit : Bernard Schoenbaum The New Yorker Collection/The Cartoon Bank) The Gamblers Fallacy As per Wikipedia “The Gamblers fallacy, is the mistaken belief, that if something happens more frequently than normal during some period, then it will happen less frequently in the future, or that if something happens less frequently than normal during some period, then it will happen more frequently in the future. In situations where what is being observed is truly random, this belief though appealing to the […]

HOW CORRELATED ARE NIFTY STOCKS?

Source : Aaron Bacall The New Yorker Collection/The Cartoon Bank In any portfolio diversification is essential. How does one go about it? As long as an investors portfolio consists of companies whose businesses are not correlated, diversification is possible. The idea behind having a diversified portfolio is primarily to reduce risk. The reason is that, since the businesses are not correlated, when one company is doing well the other is likely to be doing poorly. This correlation ensures […]