(Cartoonist : Farris, Joseph : Cartoonstock.com)

For this weeks blog post, I delved into the fascinating world of Currency Markets. The most succinct way of presenting a very intriguing topic, I thought, would be to pen a list of Frequently Asked Questions ((FAQ) on the U S Dollar Index (DXY).

FAQ on DXY

1. What are Foreign Exchange (Forex) or currency markets?

The Forex markets are huge. Every day, more currency and currency instruments trade hands, than all the world stocks and bonds combined. The unique feature of these markets is the hegemony of the U.S. Dollar. The U.S. Dollar Index (DXY) is a measure of the value of the U.S.Dollar.

2. What is the Dollar Index?

- The dollar index is a measure of the value of the United States Dollar relative to a basket of currencies. The six currencies which are used to arrive at the index are Euro, Japanese Yen, Pound Sterling, Canadian Dollar, Swedish Krona and Swiss Franc. The dollar index (DXY) is said to go up, when the U.S. dollar gains strength vis-a-vis the other six currencies. The most important factors driving exchange rates, is differences in interest rates between countries.

- The dollar Index is in a bull market of its own. Historically dollar bull markets last years, with an average gain of 30 %. The dollar index is trading above 85 for the first time since 2010. The dollar index has now risen for 12 weeks in a row. This is the longest streak in the 41 year history of the index.

-

The dollar index peaked at 121 in mid 2000. From a level of 120 in early 2002 the dollar index started falling. It hit a low of 70 in 2008, a drop of 40 % in six years. Effectively, this dollar index bull run, which started from 2008, is now 6 years old, and has moved 21 % from its low.

3. Why is the DXY so important?

The dollar index has attracted the attention of market pundits, because of the following reasons:

- The index has moved up from around 81 levels seen on July 25, 2014 to the current 86 level. This implies an upward move of roughly 6 %. This is considered to be huge in Forex markets. This, incidentally, is a four-year high for the dollar index. Prior to this move, the index was more or less stable at 80 levels. To put matters in the right perspective, the dollar index is now higher than it was at the height of the taper tantrum last year, which was 84.69.

- Actually the dollar index has traded sideways in a band from 79 to 84 for the period from November 2011 to August 2014. The fact that it has broken this range is significant. The upside target is said to be 89.

-

We are now living in a bipolar world. On the one hand we have an improving U.S. economy, and a Federal Reserve contemplating interest rate hikes. On the other, we have a deteriorating European economy, and European Central Bank contemplating what else it can do to beat back a deflationary downturn. This means that a global asset allocation shift is underway. This will result in increased volatility in financial markets. In India, we are caught between the two.

4. How does it affect the Indian Rupee (INR)?

- The dollar index has had a resultant effect on the Indian Rupee, which was around 60 on 25 July 2014, and is now currently trading at around 62. The dollar strength has begun to unnerve equity markets.

-

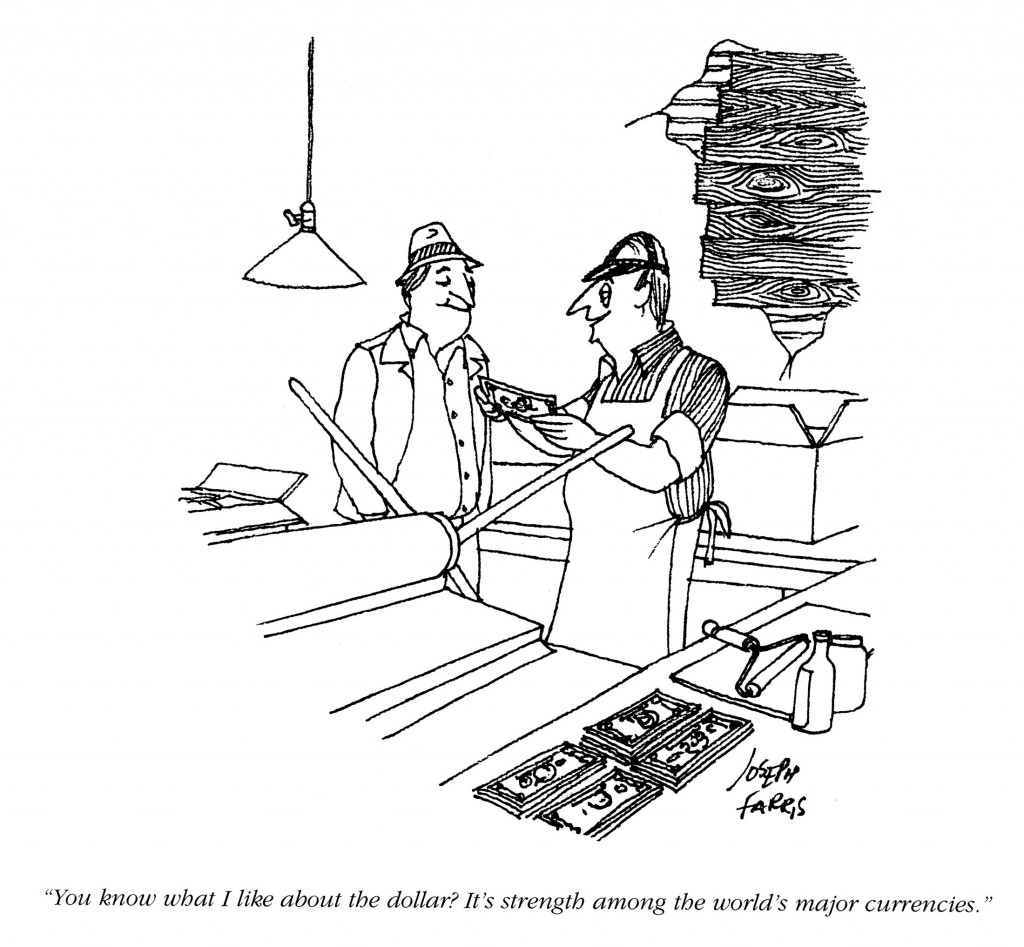

The following image shows the movement of the dollar index vis-a-vis other world currencies. (USDKRW is the Korean Won, USDIDR is the Indonesian Rupiah and USDMYR is the Malaysian ringgit)

(Source : Mecklai Financial)

-

It is clear that the USD-INR pair (U S Dollar-Indian Rupee) has been one of the strongest currencies in the wake of the dollar onslaught. It has depreciated by only 3 %, which is the least among the currencies shown above. There is practically no difference between the INR-Dollar parity as on 01st January 2014, and what it is today.

5. What explains the strength of the INR?

There are four primary reasons for the ‘relative strength’ of the INR:

- The first is the fall in the price of Crude oil, this has cushioned a fall in the INR.

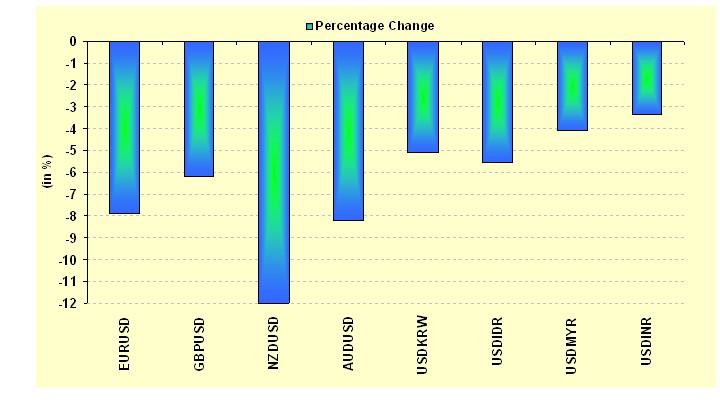

- The second is the huge improvement in the Current Account Deficit, as can be seen from the graphic below.

- India is the best performing nation among the BRIC pack. I have written in the past about this, you can read it here. This is mainly due to very strong FII inflows.

- The recent rating upgrade has definitely helped .

(Source : The Wall Street Journal)

6. What is ‘carry trade’?

This is a mechanism, whereby, investors borrow in a low-interest currency (U.S. Dollar), to invest in the higher yielding domestic debt of emerging markets (India). The expected rate hikes in the U.S. are supposed to result in a reversal of these ‘carry trades’. This is popularly called the ‘unwinding of the carry trade’. When investors decide that their losses in the foreign exchange market eclipse their gains from the interest rate differential, they cut and run. If this is done in unison by a large number of market participants, it exacerbates an already delicate situation. The following points are worth remembering:

- Many emerging economies, including India, rely on carry trade inflows to finance current account deficits.

- The media has been rife about the effects of ‘unwinding of the carry trade’. I beg to differ. Historically, any dollar strength has been met with an interest rate cut by the Fed in the U.S. With interest rates already close to zero, there is a question as to what is left, for the Fed to cut. There used to be a continuous debate that due to QE the Fed has run out of tools to combat the next crisis. Is the strengthening of the U S Dollar the beginning of a crisis for the Fed? How will it react? I think, with the dollar strengthening, the prospect of rate increases can be ruled out for now. As a result, there will be no unwinding (or relatively less) of carry trades, which explains the strength in the INR.

- However, it has to be remembered that the stress on ‘carry trade’ mechanism is growing. Even if there is no unwinding, fresh positions are definitely not being built up. These were aiding the FII flow into Indian debt. They influence the exchange rate, which in turn affects equity markets (which is what we are concerned with).

7. Is a rise in the Dollar Index (DXY) a precursor to a fall in the Nifty?

I read an article in the media, about how a rise in the dollar index spells trouble for the Indian Equity markets. You can see the article here. The article goes on to say that the Nifty and the dollar index are negatively correlated. This means, that as the dollar index goes up the Nifty goes down. The graph shown therein is reproduced below:

(Source : Moneycontrol)

The graph shown above, however, does not show a negative correlation. In fact, negative correlation is seen only in the period up to 2009. From 2010 onward, there is a positive correlation. In other words, this is not a fool-proof method for forecasting Nifty levels. A spike in the dollar index does not, necessarily, translate in to a fall in the Nifty. It can be seen from the graph above, that in recent times both have been positively correlated.

8. Is it a coincidence that the dollar strength, and the end of QE are occurring at the same time?

The last time QE ended, stocks have tended to correct within a month thereof. There was hardly any gap between end of QE 1 and the start of QE 2. Hence there is no point looking at that period. QE 2 ended in June 2011 and QE 3 began in September 2012. In this period, the high and low of the Nifty, DXY and the INR were as follows:

| HIGH | DATE | LOW | DATE | |

| NIFTY | 5728.95 | 7-Jul-11 | 4544.20 | 20-Dec-11 |

| DXY | 84.14 | 24-Jul-12 | 73.53 | 7-Jun-11 |

| INR | 57.09 | 27-Jun-12 | 44.00 | 27-Jul-11 |

The above data shows that the end of QE 2 did result in the following:

- An intermediate high on the Nifty.

- An intermediate low on the DXY.

- An intermediate high on the INR.

The INR weakened as soon as QE 2 ended. However, in India, the end of QE 2 coincided with the ‘3G scam’. Hence, I would not draw too many inferences from this. However, there is bound to be pain for all markets, since a seamless transition from QE 3 is unlikely.

9. How is the Dollar Index related to the price of commodities?

- Since currency is a relative game, to buy dollars people must sell something else, say the Euro or the Yen. The two most important factors which decide which currency is bought and sold, are the strength of the economy and the direction of its interest rates. On a relative basis, in the developed world, the U.S. is perceived as one of the best performing economies. Hence, from a currency viewpoint, there is a lack of opportunity outside the dollar.

- As the dollar strengthens, prices of commodities are falling across the board. The reason is that most commodities are priced in dollars. Effectively, a stronger dollar, lowers commodity prices. The dollar index and the price of crude oil are inversely correlated. A rise in the dollar index, leads to a fall in crude prices. I have written about it earlier. Actually, the weakness in commodity prices indicates a dis-inflationary trend, which ought to be disquieting to equity markets.

- A fall in crude prices, is widely perceived to be a positive factor for the Indian economy. However, I should hasten to add that it is expected to cushion the INR to the extent of 2 or 3 rupees only. Moreover, all bull markets have coincided with a rise in crude prices. In other words, crude prices and the Nifty are positively correlated. The reasoning is simple, if crude prices fall, it shows a fall in demand, thereby a deceleration in industrial activity, and effectively in the economy.

10. Is the ‘Dollar Tantrum’ similar to the ‘Fed Taper’?

A stronger dollar would equate to further capital outflows, placing further pressure on already vulnerable economies. A combination of dollar strength, delayed Fed rate hikes and weak commodity prices, are expected to be easier for emerging economies like India to handle. The relative out performance of the INR, effectively means, that after this whole dollar tantrum is played out, the Indian market is likely to rebound the most.

11. How long can the INR resilience last?

- The weakening commodity prices does help in a situation like this. The debate effectively shifts to the domestic economies of the emerging market countries. The performance of the Indian economy will be closely watched by all market participants. Any perceived weakness in the economy will invite aggressive FII selling. Why? It then becomes a combination of a strong dollar and weak fundamentals. This spells disaster, and is self-fulfilling, meaning it is a vicious circle where one feeds on the other.

- In each of the last six years, the average range of the Rupee has been nearly 10 rupees. Historically, the bulk of the Rupee volatility is driven by local considerations viz. inflation, the current account deficit (CAD) and political stagnation. All three of them were major factors in the past. However, now we have falling inflation, comfortable CAD and a stable government. This translates into a sweet spot for India as a whole.

12. What to do?

- There are just too many unknown unknowns in financial markets at any given point in time. This makes forecasting very difficult and tricky. There is no denying the fact that, the strength of the U S Dollar will be a determining factor in U.S. monetary policy in the immediate future.

-

I think, while investors remain focused on the dollar index, attendant global cues and FII flows, they are ignoring the realities at home. Any under performance / correction in India equities, would automatically be blamed on a ‘dollar tantrum’. I would beg to differ. In the longer term, currencies don’t matter for much. I think investors need to focus on the Indian economy. If the Indian economy spirals upwards, the dollar index would not matter. In the aftermath of the dollar tantrum, if the Indian equity market fails to deliver out-sized returns, I would use the popular cliché and say ‘It’s the economy, stupid’.

Most of the recent moves in the USD are actually driven by the situation in the Eurozone and in Japan. FX is the classic long/short or pair trade – you buy or sell the USD against the EUR , as opposed to equities where you buy/sell a stock against cash ( whether USD or INR ) . The ECB and BoJs actions have led to a debasement of the Euro and the Yen respectively whereas the Fed is looking at a gradual removal of accomodation and possible rate hikes , and it’s this divergence in interest rate paths that is driving FX pairs . 70% + of the DXY is the European bloc ( EUR/GBP/CHF/SEK ) and so the DXY being at multi year highs is a mere summary of what is happening in the underlying pairs like EUR/USD and USD/JPY. Subtle difference , but it’s other currency weakness which leads to USD strength , not the other way round .

True. Hence, the dollar is the cleanest of the dirty shirts!!

I do not have an answer to ‘who owns the Fed’. According to me it is the parallel of the RBI.

As per my info, the USD is not a currency owned by the country, ie USA govt.

It is owned by Federal Reserve which an independant entity.

Nobody at a common mans level knows…. Who owns the Fed.

Can you throw some light on it, so that while studying the topic one can clearly know why the dollar never falls beyond a point.

All the power entres of the world collective own the Fed ( both directly and or indirectly).

Hence….., anyways, am in a hurry to rush to off. Will opine in depth later.

Pls tell your thoughts till then