(Source : Cartoonresource/Shutterstock)

Why is this market devoid of a correction? Is it a phenomenon of ‘this time it’s different’ (the four most dangerous words in the stock market). The Nifty closed at a 8086.85 on Friday, 05 Sep,2014. The speed and momentum have taken most market participants by surprise (including me). The technical analysts, fundamental analysts and economists are in the same category as the retail investor. I proceeded to analyse the reasons for this, and came up with the following plausible explanations. In my opinion the reasons, in the order of priority, are as follows:

Change in investor behaviour

The corrections in the market have become shallower as the index has tended to trend higher. At the same time, when there is a sell off, we regularly see the market recovering very quickly. In the past, sell off’s took months, not any more. I think there is a change in investor behaviour. Consider the following :

-

The retail brokerages are not as excited as they were in the period 2003 to 2008. Why? I used to think that there is a shift towards on-line trading. I have, since, corrected my opinion. A lot of money has moved into wealth management accounts under various portfolio management schemes. This money used to be directly invested in the market in the past. Now the money is in the hands of more mature wealth managers. They tend not to sell on the drop of a hat. Hence the avalanche of selling orders does not materialise. In earlier bull markets, the leveraged positions were massive, not this time. Everyone is scared of using leverage, lest there is a crash.

- The Assets managed by portfolio managers on Dec 2010 has tripled as on July 2014. This is what the SEBI data says. You can see it here. The Portfolio Management Schemes (PMS) generally charge a fee of 2 % per annum. Over and above this, there is a return based fee of 20 % of the returns generated. This is generally called a 2×20 fee structure. Hence, there is flow of money from the retail brokerages to 2×20 schemes. In other words, incomes are fee based and not brokerage based. In the PMS world, the more the client earns, higher are the fees earned. The interests of the money manager and the client are aligned (what a change!!). Since the focus has changed from brokerage to fees, this, indirectly has a huge impact on the way money is managed, and effectively on stock market volatility. More and more money is being driven towards fee based accounts. Hence churning of portfolios is restricted. So people don’t end up selling as often as they used to.

- Not only has the investor behaviour changed, so has that of the money managers. Since more money has moved to ‘managed accounts’ the market has become shallow. This explains why good news and bad news both tend to get bought into, almost as if the implications are the same. The poor churning and turnover of portfolios translates into poor retail volumes on exchanges. In past bull runs, retail investors sold and FII’s bought. Not this time. This time the FII’s are up against Indian money managers. They will have to up the ante if they want to buy. As a result, the days of FII’s having a free lunch in the Indian stock market are over!! It is a sign of a maturing stock market, where making money will become increasing difficult. This change in investor behaviour, is one of the primary reason for the resilience of the stock market.

-

I am not saying that this can go on forever. It is not happening as on date. I shudder to think what will happen if all the Indian money managers and FII’s get bearish at the same time. The bull market is not yet 1-year-old. There is bound to be a portfolio churn to lock in long-term gains as and when they occur. This, in my opinion, should start from November onward.

ETF Inflow

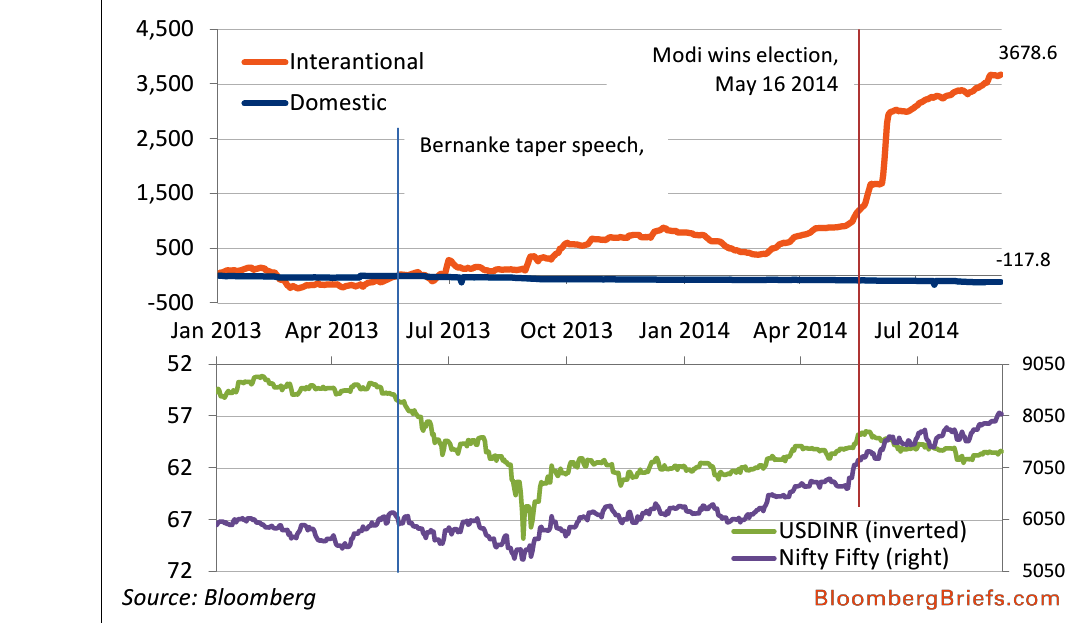

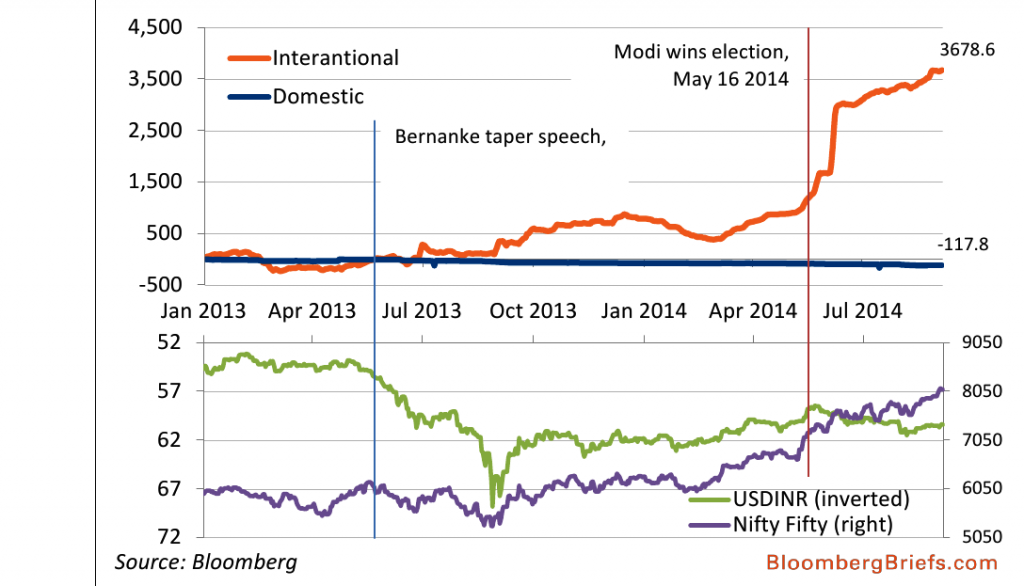

Since the market is FII driven, one of the most popular methods used by foreign investors to diversify their holdings, is to invest in country specific Exchange Traded Funds (ETF’s). The graphic below shows the sharp increase in the ETF inflow in to India specific ETF’s listed in the U.S., and the Nifty move in comparison.

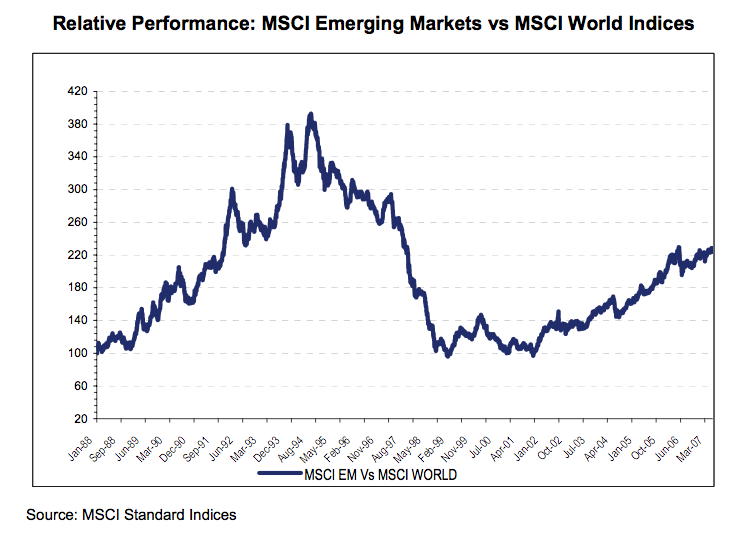

The inflow into India specific ETF’s can be used as a predictive tool. Why and how? In the beginning of 2014, ETF’s withdrew money for 16 consecutive weeks right till February. In effect, the total amount withdrawn, was more than the total inflow in the whole of 2013. In terms of amounts, the total amount withdrawn from EM funds as on February 8, 2014 stood at $ 18.6 billion, compared to $ 15.2 billion outflow in the whole of 2013. The past record for such withdrawals was in 2002, which was 14 weeks. Do you want to know what happened in 2002? The EM space went on to smash the MSCI world index consecutively for the next four years. The chart below shows this.

The following conclusions can be drawn from the above:

-

The Nifty closed at 6301.65 on 01 Jan 2014. As a result of the above mentioned ETF selling, it closed at 6001.10 on 13 Feb, 2014. After the initial withdrawals in the beginning of the year, the trend has reversed and there has been a flood of inflows. This change of mood is unpredictable. The FII community controls the market. The ETF mechanism is one of the tools they use.

- In today’s scenario ETF’s are the most preferred method of investing in a country. Why? It is very easy for FII’s to enter and exit from these ETF’s. These country specific ETF’s are listed in the U.S. The inflows translate in to unit creations and are invested in the underlying stocks, as per the weight-age disclosed in the respective offer documents.

- The entire FII inflow is not through ETF’s. However, since the ‘herd’ mentality is so common, you generally have FII’s buying in unison and selling in unison.The FII flows, apart from ETF’s, are almost impossible to track. They are routed via Mauritius, sub accounts and the works. Despite all the transparency in our markets, this one feature remains shrouded in secrecy. Also the daily buying and selling figures of FII and domestic institutions (DII’s) continue to be perplexing. You routinely have FII’s buying and DII’ selling, How, I have no clue.

- These ETF’s, have, inadvertently created a boom and bust cycle for Emerging Market (EM) equities. There is a debate in the developed world whether this is the best method of investing in EM equities. The fact remains, that it is the most preferred route. There is nothing to suggest that this is about to change. They are preferred since they are traded throughout the day. The cost of entry and exit is affordable. It is easy to switch asset classes when you invest through ETF’s.

-

In the U.S. you have an ETF for almost anything and everything. There is a marked preference to ETF investing due to their transparency and liquidity. Most money managers in the FII world treat EM equities as an opportunistic asset class, so quick entry and quick exit is a priority. They naturally prefer the ETF route.

-

Interested readers may click here to read about the top 10 India specific ETF’s listed in the U.S. The top 10 holdings can also be studied to find out which stocks are the commonly held. (The ticker symbols for the top ten India specific ETF’s are EPI, INDA, SCIF, PIN, INDY, INXX, SCIN, SMIN, INCO, INDL).

The future of BRIC nations (Jim O Neill)

Jim O Neill (who coined the acronym BRIC-Brazil, Russia, India, China) was asked whether the BRIC rise is over, due to the slide in growth rates. The salient points made by him in a guest post, published in The Financial Times on Sep 2, 2014 are as follows:

-

With the setting up of a BRIC bank, the BRIC acronym is here to stay. In fact, with the establishment of a bank, their influence is likely to rise.

- Brazil and China grew due to rise in commodity prices, China is hobbled by its own challenges and all that is left is India. If it were not for the election of Narendra Modi, there is nothing to be optimistic about in India.

- The challenges in Russia and Brazil are not comforting. That leaves only India, where there is a strong possibility of big policy improvements. India is likely to grow at a rate of 7.5 % in the second half of the decade, possibly faster than China.

I would not ignore his views, and I do not think the FII’s do either. It explains the very high FII interest in the India. After reading his views, I almost got the impression that for FII’s, India is the destination of choice, among the BRIC pack. It almost seems as though, in so far as the BRIC pack is concerned, they have no alternative.

Conclusion

The U.S. market has not had a 10 % correction for more than 2 years. The commentary is that it is because of their monetary policy. It may be so partly, but that does not explain the absolute dearth of corrections. Money is moving out of the U.S. market and is finding its way in to EM. India has been the hottest EM thus far. I have said it before, and I am saying it again, flows follow performance, not value. Each week, money is allocated on the basis of whatever has worked best in the previous week. I am not saying that ‘this time is different’. All I am saying is that there is a new paradigm. The retail investor is least bothered about the happenings in the stock market. He just does not give a s**t. He is still happy with the tangible assets which he owns. The intangibles can go to hell!!

Thanks, Shailesh

Very good analysis your blogs are awaited keep it up