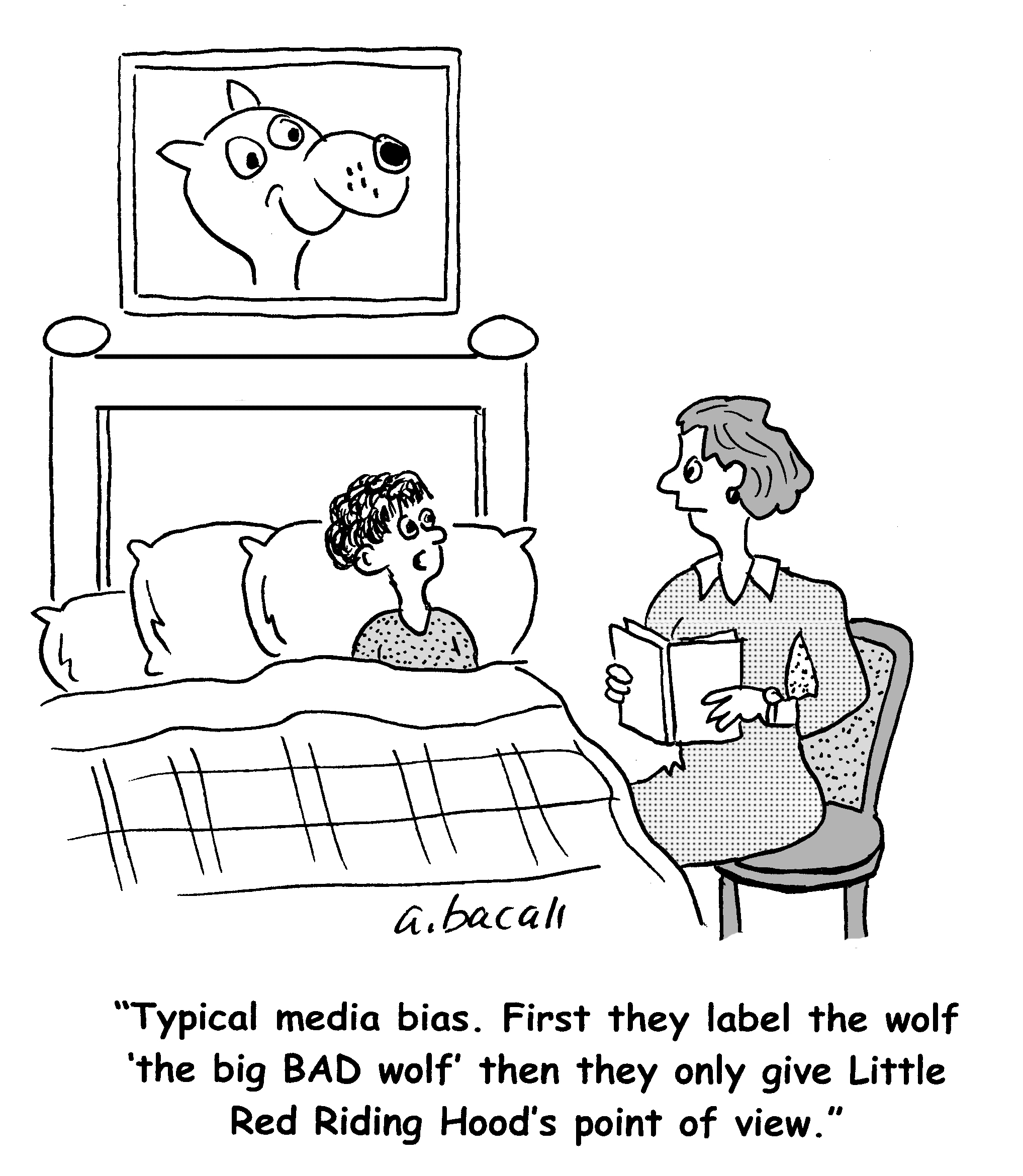

(Cartoonist: Aaaron Bacall: Cartoonstock.com) It is common knowledge that most of us make our buy and sell decisions based on sentiments, fads and on other psychological biases. This is true not only for us, but also in the case of money managers, and other professionals in the investing arena. In this post, when I refer to investors, it means the whole universe, you, me and the professionals. Why the bias? In today’s perennial connected world, our biases result […]