(Source: Cartoonresource: Shutterstock)

Demographics is one of the 3D’s in the hurricane of economic growth. The other two are, debt and deficits. How can India be considered to be a country which has a demographic dividend? I have tried to highlight the reasons.

What is demographics?

Demographics is the quantifiable study of a given population. The main themes used are gender, languages, age and ethnicity of the population. With India’s burgeoning population and its diversity on all counts, it is obvious that we are a looked upon as a market with great demographic potential. This potential is mainly from the demand perspective. As investors, we have to guesstimate the kind of demand that can arise in the future, and its durability. The benefits which such a population can provide, are referred to as the ‘demographic dividend’. It follows that India is perceived to have one.

What is the size of the demographic opportunity?

-

The current population is estimated at 1.2 billion. The expected growth is 1 % annually for the next 10 years. This is expected to add 167 million to the population.

- As per the estimates of the World bank, by 2025, 68 % of India’s population will be of working age. People of working age are more productive than those who are not of this age, hence the dividend. This is because an increase in the working age ratio can raise the economic growth. To put matters in the correct perspective, by 2020 the average Indian will only be 29 years old. The comparative ages are, 37 in China and the U S, 45 in Europe and 48 in Japan.

- The demographic dividend will accrue only if the economy is ‘open’. This is very likely to happen. So, a demographic dividend can be realized only if there are incentives in place to exploit the potential which the demographics offer.

- It is expected that a quarter of the projected increase in the global population in the age group 15-64 will occur in India between 2010 and 2040. The global population is expected to grow by about 2.4 billion people. A bulk of this increase will be between the ages of 15-64, the so-called working population. Hence, India is expected to be the largest single positive contributor to the global workforce over the next three decades. That is the size of the opportunity.

- The foreigners are excited, since they feel that India’s demographic dividend will occur just as China’s is ending. This is perceived as a tremendous growth opportunity. The consuming class is expected to grow from under 100 million to 500 million individuals over the next decade. Incidentally, private consumption is 62 % of India’s GDP. This is higher than the Euro zone, Japan and China.

- Also, our savings rate at 40 % is one of the highest. India’s GDP (Gross Domestic Product) is estimated at $ 5400 against the average world GDP which is $ 13031. This is due to low urbanization. The NREGA scheme is to blame, since it has ensured that there is less migration from the rural areas to the urban areas.

-

India’s per capita income, which had taken 4 decades to double by 1991, doubled in the next 15 years. It is likely to double in the next 10 years (these are estimates). Hence, the expected rise in disposable incomes.

Which sectors get the demographic dividend?

We are said to be in the early stage of a demographic dividend period. The consumer demand which can be generated with such large numbers is huge. The obvious winners are:

-

The consumer staples companies. It seems that 65 % of our population lives in the rural areas. Hence, firms which reach in to the so-called rural areas will be beneficiaries. These are Hindustan Unilever, Godrej Consumer, Dabur, Marico, Nestle, Tata Global and ITC (to name a few). With the infrastructure bottlenecks still very much in place, it pays to concentrate on companies which have an existing strong rural network. What we have to look at are companies with a competitive advantage, good brand portfolio and scale. The well entrenched multinational companies are the obvious beneficiaries.

-

India has a very low-level of financial penetration. Only 40 % of the population have bank accounts. So let us not talk about credit cards, housing finance etc. Whatever one does, one has to look at the rural landscape. The hinterland is largely ‘un-banked’. Hence, it is the Micro finance sub sector of the banking space that has the largest growth opportunity.

Demographics – China v/s India

Going back to the last bull run, China and India were supposed to the new economic super powers, with expected growth rates in excess of 8 %. Now we have a modified version which can be summarized as follows:

-

In both the countries growth is likely to be driven by investment and consumption.

- Both China and India are undergoing structural reforms.

- Both countries are benefited by the falling commodity prices.

-

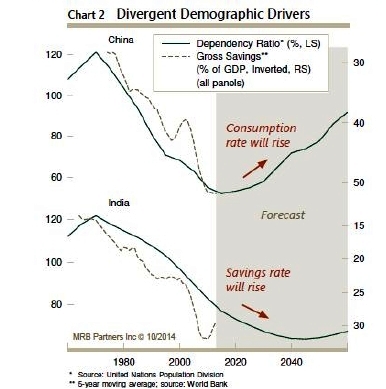

Both countries have a demographic dividend. China is at an inflection point, meaning its savings rate will fall and consumption will rise. India, it seems, is 30 years away from such a situation. Effectively, the old argument that China invests too much and India consumes too much is about to change. China needs more consumption and India needs more investment. In India the savings rate is expected to go up. This is depicted in the graphic below:

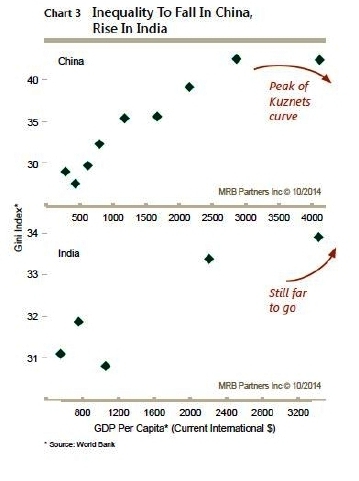

The World bank also states that income inequality will fall in China and rise in India, as can be seen from the graphic below:

It seems that in the case of China the consumption story will be driven by mass market spending. In India it is expected to be driven by luxury goods. This is very attractive for the foreign investors. It implies strong top-line performance for consumer staples and consumer discretionary sectors.

Mind the (Expectations) Gap between Demographics and GDP

I remember an example of the way demographics was extrapolated in the broking business. In the year 2000, when de-materialization of securities started for the first time in India, some one did a study of the population and the number of demat accounts. This ratio was so poor, that it was extrapolated to mean that the best business in India was the broking business. This story was repeated in 2007-08. The rest, as they say , is history. Why were the estimates so incorrect? The reason is that no one bothered to verify what percentage of the population had an investable surplus. In other words, what was the GDP of the sample. The moral of the story is that when optimistic expectations get detached from reality, they create an expectations gap. With this in mind the following points are worth mentioning :

-

There is a centre-state dichotomy in India. India’s GDP has fallen from nearly 9 % to the current 4.7 %. There are, however, many states which have been clocking double-digit growth.

- Apart from these differences, there are different political parties with diverse political ideologies, in the various states and union territories. This adds to the policy paralysis and uniformity that is required for en-cashing India’s demographic dividend. Much of India’s demographic dividend can remain unpaid, unless there is a significant improvement in the underlying infrastructure and ease of doing business. In other words, there can be no demographic dividend unless these issues are addressed.

- There is a huge gap between the GDP of the different states. The richer states have experienced faster per capita GDP growth than the poorer states. In reality the richer states are getting richer thereby increasing this gap.

- What is the reason for this gap between the states? The relative success of some states over others, is a combination of the underlying conditions (how rich or poor the state is) and how easy it is to do business. If the poorer states, with a less friendly business environment, change and make it easier to do business, they stand to benefit the most from favourable demographics.

-

India is not one homogeneous country. It is in fact a country of countries. The states and union territories have very important cultural and linguistic differences. Hence, the states hold the key. In effect we have to look at India on a state by state basis to get a consolidated picture.

Conclusion

It is indeed a paradox, that population, which in the past was India’s bane, is now considered to be its greatest asset. China, it seems, is on the verge of abolishing it’s ‘one child’ program. You can call this the mother of all paradoxes!! That is the way the market has evolved. It is obvious that we are in a sweet spot on the demographic front. However, we have always had this ‘dividend’. It is for this reason that India has attracted only the consumer oriented multinationals over the last so many years. The technology and capital-intensive investments have been low in the past. Slow moving regulatory environment and policy paralysis have ensured that the benefit of demographics has been hitherto limited. For this to translate in to a meaningful demographic dividend the most important things to remember are:

- The ease of doing business. The current regime is known for this. Hence, expectations are high, and rightly so. If all Indian states adopted the best practices we could overtake China.

-

The economy as a whole will benefit from favorable demographics due to the ‘ripple’ effect. However, it is important to remember that the market looks at only long-term demand and its sustainability. Hence, demographics is a long-term story and so is equity investing – what a coincidence!!

- The demographic dividend is actually the strongest reason to invest in Indian equities. The rest is noise. It follows that only those investors who have the belief, patience and the courage of their convictions, will be able to enjoy India’s demographic dividend.

This is quite helpful and knowledgeable post. Good research done.

Thanks