(Cartoonist: Mike Flanagan: Cartoonstock.com)

The term liquidity trap is commonly used in economics. I had forgotten about the concept completely, mainly due to my obsession with the markets. The abundance of liquidity in the markets, forced me go back to my economics text books to study what I recollected of the ‘liquidity trap’.

What is a Liquidity trap?

According to the Keynesian theory, a liquidity trap means that bond yields fall to such a low-level that they show that the risk of future capital loss is more than the prospective return. This has actually happened in the case of bonds from developed countries, like Germany and the USA.

The modern definition of a liquidity trap has four characteristics:

-

Short term rates are close to zero, which they are.

- Bond Yields should be at the lower end of the risk return equation and they should remain there. This is also true in the current scenario.

- There should be declining inflation. This is what the European Central Bank (ECB) and the Bank of Japan are fighting.

-

In a liquidity trap people want to hold money instead of bonds. That is not the case today

Today people are desperate to get their hands on bonds. In a liquidity trap, as Keynes says, “almost everyone prefers cash to holding a debt”. Hence, a liquidity trap is when there is a panic across financial markets, people rush to cash, and no matter how much cash the central bank issues, the demand for financial assets remains depressed. The developed world is not there as yet. They are definitely in a ‘low interest rate’ trap, which can lead to a liquidity trap.

Liquidity & the Stockholm Syndrome

As per Wikipedia, Stockholm Syndrome or capture bonding, is the psychological phenomenon, in which hostages express empathy and sympathy, and have positive feelings towards their captors, sometimes to the point of defending and identifying with them. It is used to describe a traumatic bonding, which does not require a hostage scenario, but which describes strong emotional ties that develop between two persons where one person intermittently harasses, beats, threatens, abuses or intimidates the other. The basis of the Stockholm Syndrome is that when the victim believes the same values as the aggressor they cease to be perceived as a threat.

Consider the following:

-

Quantitative Easing (QE), which was announced as a means of reviving the economy and fighting deflation, has in fact been deflationary. It has had a reverse effect. When QE was announced there was unanimity among all economists that it will lead to inflation. The prediction was that QE would stimulate bank lending and motivate consumers to move from a hoarding mindset to a spending mindset. The exact opposite has happened. The consumers decided to hoard cash out of fear that there would be no economic expansion.

- Still we have countless commentators saying that QE was a success. The jury is out on that. With the benefit of hindsight, it is clear that the only positive effect that QE had, has been on stock prices. So now central bankers are so scared of a fall in stock prices, that they continue to infuse liquidity in to the system. Stock prices now have a vice-like grip over the worlds central bankers. In fact, in Japan they are trying to shore up stock prices. This is what they have clearly stated!!

- We have the European Central Bank (ECB) and The Bank of Japan trying to ‘create’ inflation by using a modified form of QE. The fact remains, that despite the apparent lack of success that QE had in ‘creating’ inflation, the Japanese and the Europeans are still hell-bent on trying it.

-

The moment QE was stopped the Japanese Central Bank stepped in. All the central bankers of the world want to infuse liquidity, depreciate their currencies and promote exports. Effectively Central bankers the world over are now practically held to ransom by the stock market. In fact, there is talk of QE4 being announced sometime next year. Effectively, central bankers have been struck by the Stockholm syndrome, albeit a modified version. The victim and the aggressor are the central bankers and the worlds money managers, with their roles (as victims and aggressors) being randomly interchanged.

Liquidity – Effects

Liquidity has made life easy for money managers. It does allow money managers and their clients to profit with little effort. Liquidity has run up the price of stocks and bonds mostly in straight-line fashion. It has taken volatility out of the marketplace. Liquidity also ensures shorter corrections. Have a look at how it plays out:

-

If the data is weak, liquidity ensures that the markets go up. Why? Because ‘it is darkest before dawn’ and things can only get better from here. It is interpreted to mean that the central bankers will pump in more liquidity. Poor data is quickly blamed on ‘base effect’ or it is ‘above expectations’ or ‘discounted’.

- If the data is good, then obviously there is enough liquidity ‘waiting in the sidelines’, so buy more. Effectively buy on the uptick and buy more on the down tick.

- Hence, good news and bad news, are both bought in to, almost as if these two things were entirely interchangeable.

- The old maxim of buy on rumour and sell on news is now re-written as ‘buy on rumour, and buy some more on news.’

- ‘Profit booking’ – never heard about it. Also, what if one books profit and the stock zooms? What is the money manager supposed to buy with the liquidity? Sit on cash – old-fashioned!! It is, indeed, very difficult to sit on cash when everyone around you is making money.

- In India, if the Rupee strengthens, buy the banks, sell the software stocks. If it weakens, leave old positions as they are, now add software and hold banks. If it strengthens again, buy the banks, leave the software longs as they are. The liquidity syndrome ensures that new all time highs will occur in a week (maximum).

-

In markets one has always read about how people are afraid to buy. This must be the first time that people are afraid to sell. I always knew that markets were irrational. This is a new all time high for ‘irrationality’. But then Keynes said that ‘Markets can remain irrational longer than you can remain solvent’.

This is not a joke or an exaggeration, it is what is playing out in the markets. If one reads the above a second time, it is actually very easy to implement!!

Liquidity – Risks

You can say that liquidity, that has hitherto been taken for granted, is actually an illusion. Why? I think the market has largely ignored comments made by Mark Carney last week. The main reason as espoused by Mark Carney, Governor of The Bank of England are as follows:

“We know that almost half of the $ 70 trillion in managed assets globally are in funds that offer their investors redemption at short notice. At the same time funds are investing increasingly in higher yielding, less liquid assets. One example of this has been the exponential growth in ‘liquid alternatives’ , giving mutual fund investors access to hedge fund like strategies. The compression of liquidity risk premia suggests that investors are assuming that any future withdrawals from funds will be conducted in an environment of continuous market liquidity and that the value of their fund holdings will not fall substantially when they exit. The risks to that assumption are only in one direction.”

Effectively what he is saying is:

-

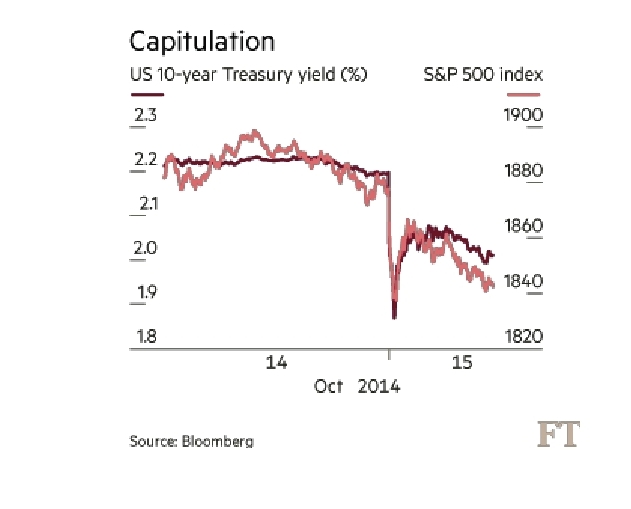

Liquidity has become scarce in secondary fixed income markets. This, in fact, is what happened in the U.S. debt market in October. The graphic below shows what happened in a matter of minutes. It was dubbed as a ‘flash crash’. The resultant ripple effect on the equity market was a swift 10 % correction, before we had central bankers getting in to the act, all over again. How long will this continue to happen?

- He further revealed that it now takes seven times as long for investors to liquidate bond portfolios, than it used to take in 2008. The reason is that in 2008, banks and brokers held such large inventories of bonds and other assets that they were happy to act as market makers. In other words, they were ready to buy and sell when investors wanted to trade. Since 2008 banks have slashed their inventories between 30 and 80 per cent (depending on the asset class) to meet stricter regulation. To put it in simple jargon, in the event of an exigency, the ‘exit’ is crowded.

- It seems, the exit is likely to get crowded only if the U S starts raising interest rates. This, the markets feel is unlikely to happen in the near future. Hence, the continued up tick in prices. International bankers are focusing on measures to ameliorate the liquidity risk. They are pushing for more transparency in the bond markets, and for more activity on electronic exchanges. This it seems will make exits easier.

-

There is a difference between the liquidity that the BOE governor is talking about, and the liquidity in the market. What he is highlighting, is the fact that the fund liquidity has not percolated to stock / bond liquidity. There is a difference between monetary liquidity which is abundant, and stock or bond liquidity which is scarce.

Liquidity : The Indian Scenario

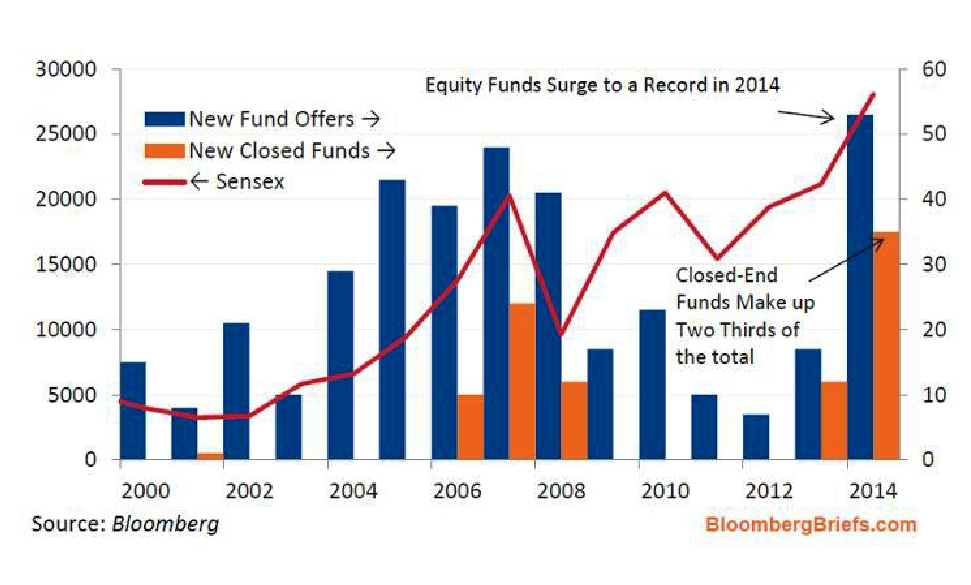

As the index trends higher, we have had a record number of closings at all time highs. I always thought that new all time highs would cause investors to become more circumspect and withdraw, waiting for a correction. I was wrong as the graphic below suggests:

“Indian investors are so confident in Prime Minister Narendra Modi’s plans to boost growth that two-thirds of record equity fund offerings will be locked for at least three years. Fifty three equity funds started up this year, according to the Association of Mutual Funds of India. The portion in so-called closed-end funds rose to 66 percent, the most since at least 2000. The funds bind assets for a minimum three years.” – Bloomberg

There is an explanation for the above phenomenon:

- Going back to the Morningstar conference, one of India’s leading fund managers said that in Indian equity markets, in this bull run, the returns are front loaded. This means that investors will earn the maximum returns in the first two or three years of this government. Later on, it seems, the returns will not be that high. How is he making these predictions when India is dependent on global liquidity and global events? He went on to say that India is now decoupled from the world and that ‘this time it’s different’. I think this is more of marketing chutzpah, than any thing else.

-

There is a dichotomy here. I think Indian investors confidence in the government has got a bit ahead of themselves. The expectations are sky-high and going higher with each passing day. How else can one explain the fact that Indian investors are behaving differently, than their international counterparts. If Mark Carney says that “almost half of the $ 70 trillion in managed assets globally are in funds that offer their investors redemption at short notice” and we take this at face value. On the contrary, in India, two-thirds of equity fund offerings will be locked for at least three years. That is what the graphic above shows. Either the data points are wrong, or Indian investors are sold on the ‘front loaded returns’ story.

Conclusion

Since there is such a gush of liquidity does it automatically mean that ‘this time it’s different’ and markets will continue to trend higher? Actually it is different every time. However, the end result is the same.

- In India we are taking the liquidity for granted. It has led to complacency. What happens if the liquidity dries up? It won’t be a pretty picture, that is for sure. The U S federal reserve is now dropping hints that the liquidity that has been taken for granted, may be reined in. They are hints, nothing more than that. The street has seen through them. The Fed rate is not expected to go anywhere in the near future.

-

There is no doubt in my mind that we are in the middle of a liquidity bubble. The legendary hedge fund manager George Soros once remarked that “Stock market bubbles don’t grow out of thin air. They have a solid basis in reality — but reality as distorted by a misconception.”

-

The ‘liquidity syndrome’ is not a new paradigm that could persist forever. I am sure it will suck in the maximum amount of people, taking the largest amount of risk, just at the point where it will come it an ignominious end. How long will it take for reality to catch up with the ‘liquidity’ misconception, your guess is as good as mine!!

Actually, I too am bullish on the prospects of the government delivering. However, the world over markets seem to be going up in a straight line. I don’t buy ‘this time its different’ line of thought. Prices have to be stock specific and performance based at some point. After the initial euphoria in May-June, sanity does not seem to have returned. I think the P/E of the Indian market vis-a-vis historical P/E is not what is driving this up move. The P/E is better in hindsight since when the markets get irrational the P/E gets stretched, till where no one knows or rather will know only in hindsight. I think comparison with China is a tad optimistic, at least at this stage. Maybe after 5 years if everything goes well. The FII funds always want a story to cook and India is the best one on the horizon, currently. Actually the media plays a big part in influencing our thought process. The government is making all the right noises. We are now discounting close to 7 % GDP growth, so I think when we are growing at 5 % currently, we need to take it easy till more clarity emerges on the ‘reforms’ front. The current euphoria is liquidity driven more than any thing else.

Informative reading.

Do you think, the long term structure of the markets should be higher (and higher) based on at least two crucial information points.

1. The PE of the Indian markets vis-a-vis historical bubble territory PEs

2. The way I see it, the country was perhaps at rock bottom for everything before this government. If the government does indeed deliver on most of its promises, wouldn’t earnings of companies (led by demographics, increased earning power and consumption) actually see inflation adjusted long term double digit growth, like China saw for over two decades ?

If so, would the scenario be “different this time” ?

Thoughts??

Regards

Vinay