(Cartoonist: Chris Wildt: Cartoonstock.com)

What the economy is doing today, tells us very little about what stocks might do tomorrow. Peter Lynch (who has been one of the most successful money managers ever) has said “If you spend 13 minutes a year trying to predict the economy, you have wasted 10 minutes”. In other words, betting on the stock market by analyzing economic indicators is a waste of time.

Economic Indicators and Stock Market Returns

I always thought that upbeat economic indicators led to a booming stock market. The reasons are obvious:

-

The economy impacts corporate earnings. Stock prices generally reflect investor expectations for future corporate earnings, and consequently for future economic growth. Economic growth is the basis of corporate profits and effectively the dividends and corporate benefits that flow there-from. Hence, it seems logical that stock prices should be impacted strongly by economic indicators.

-

As a result, sound economic indicators should help investors make investment decisions. If for instance economic indicators predict an economic recovery then this should signal an appropriate time for investing in stocks.

It seems that economic indicators are not equal to (≠) or have no correlation with stock market returns. In other words, strong economic indicators, do not necessarily mean that we will have a strong stock market. Have a look at the data below:

-

The Greek stock market rose by 30% last year despite a contracting economy. In China stocks were down all year even though the Chinese economy grew by 7%.

- Investing each year in the countries with the highest economic growth over the preceding five years earned an annual return of 18.4%, but investing in the lowest-growth countries returned 25.1%.

-

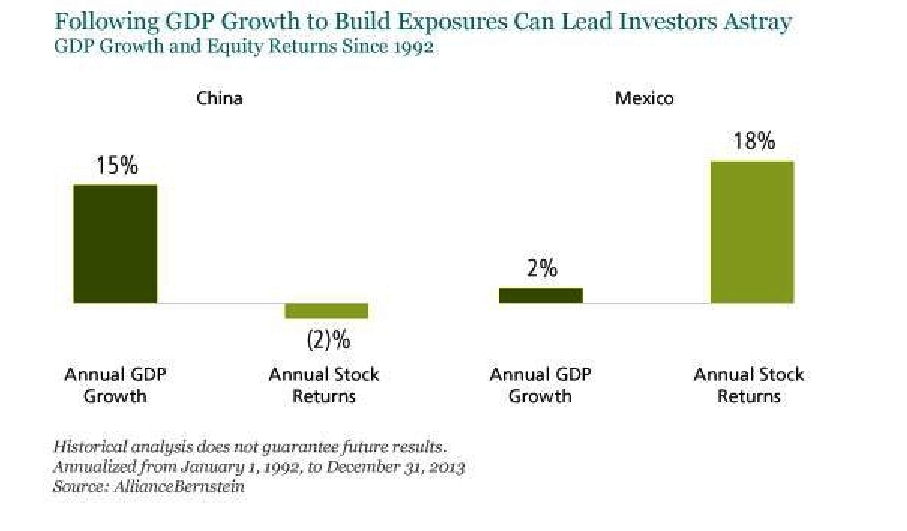

From 1990 onward the Chinese economy grew 20 fold over the next 20 years. The Mexican economy grew in low single digits over the same period. Have a look at the how their stock markets behaved:

Economic Indicators and stock market returns are out of sync with each other

It has been proved beyond doubt that there is practically no correlation between economic indicators and the performance of the stock market. Why?

- The stock markets have already priced in expectations for what the economy will or won’t do, so it is a waste of time following economic indicators. Those who invest based on economic indicators would always be late to the game.

- Now a days we have a lot of debate on whether an economy is in the expansion mode or recessionary mode. The government agencies which pronounce an economy to be in recession or otherwise, are of no use for timing trades. Their predictions come last when everybody knows the obvious. Effectively, no buy or sell decisions can be made on their basis. In short, waiting for government controlled economic bureau to announce data, and then use the same as an indicator of the stock market direction, is a waste of time. The economic indicators, when announced, are far too late to be of any use in timing the market. Moreover the data is revised and no one pays attention to the revisions. The accuracy of the data is thus a matter of debate.

- I find a lot of investors are interested in the ‘why’ of the market. They want to know why the market went up or down in a particular session. This yearning for a narrative is deeply ingrained in all of us. The media help us to hunt for a reason. Having found a reason we then base our investment decisions on it. This is one of the worst methods of investing that one can follow.

- Why is there a disconnect between economic indicators and stock market returns? Growth countries are like growth stocks. Their potential is recognized well in advance, and the price of their equities is bid up to stratospheric levels. By the time economic indicators start looking bullish, it is already too late for us to invest. The chase for returns ensures that investors pile into the stock markets of high-growth countries, until they become overvalued. This herd-like behavior makes their subsequent returns disappointing.

- Historical evidence shows that markets with the high dividend yields (translating in to low equity prices) returned 31% a year, compared with 10% a year for low-yielding markets.

- The stock market does not precisely represent a country’s economy. It excludes non-quoted companies, and includes the foreign subsidiaries of domestic businesses. Hence the stock prices do not necessarily reflect domestic economic growth. A classic analogy is that of Tata Motors. The current price, it seems, only values the domestic business at around Rs. 50. The rest of the price is the Jaguar valuation. Sounds odd, but that is the way it is. Hence, even though domestic economic indicators are far from bullish for Tata Motors, the stock continues to outperform.

- In emerging markets the fastest-growing companies are often in sectors which are not represented in the indices. Thus the stock market does not take these in to account. A case in point, especially in India are the agricultural commodities which are poorly represented in our indices (except the Sugar and Rice industry stocks).

-

Markets are forward-looking. The economic indicators are based on historical data. They are not predictive of the future. In markets we are all looking instead, for lead indicators of future stock performance.

Does the economy precede the stock market or vice-versa

It has been shown that the effect of business cycles on the valuation of equities is also affected by demand and supply, interest rates and risk factors. Hence the conclusion, that it is not worth spending time forecasting business cycles. Historically it has been shown that

- Stock markets are better at predicting recoveries in business cycles. They have been shown to move upwards, on an average, four to six months before business cycle troughs.

- On the downside, as per the historical evidence, and on an average, stock market peaks occur 5.4 months before the peak in the business cycle.

- By the time the economy has reached the end of the recession, markets have already risen 25 % on an average.

-

The stock market it seems provides useful information about the future development of the economy, not the other way around. Even the Leading Economic Indicators (click here LEI), which look at ten indicators, use the performance of the stock market as one for predicting the direction of the economy.

The Indian Scenario

Many of us are surprised with the behavior of the Nifty in the current year. The economic indicators have not been very exciting. The market has ignored the economic reality as many of us would argue. The table below shows that the economy and the market are two different animals. Have a look at the disconnect:

| YEAR | GDP | YEAR | NIFTY RETURNS |

| 1995-96 | 7.29 | 1995-96 | -2.00 |

| 1996-97 | 7.97 | 1996-97 | -2.66 |

| 1997-98 | 4.30 | 1997-98 | 15.13 |

| 1998-99 | 6.68 | 1998-99 | -6.26 |

| 1999-00 | 8.00 | 1999-00 | 43.73 |

| 2000-01 | 4.15 | 2000-01 | -25.19 |

| 2001-02 | 5.39 | 2001-02 | -0.75 |

| 2002-03 | 3.88 | 2002-03 | -14.11 |

| 2003-04 | 7.97 | 2003-04 | 80.02 |

| 2004-05 | 7.05 | 2004-05 | 11.87 |

| 2005-06 | 9.48 | 2005-06 | 64.56 |

| 2006-07 | 9.57 | 2006-07 | 10.03 |

| 2007-08 | 9.32 | 2007-08 | 30.30 |

| 2008-09 | 6.72 | 2008-09 | -36.26 |

| 2009-10 | 8.59 | 2009-10 | 71.52 |

| 2010-11 | 8.91 | 2010-11 | 10.27 |

| 2011-12 | 6.69 | 2011-12 | -9.11 |

| 2012-13 | 4.47 | 2012-13 | 6.86 |

| 2013-14 | 4.74 | 2013-14 | 10.75 |

If Economic indicators do not work, what does

We are all trained look for narratives. That is what the financial news industry provides us with. The economic indicators announcements are a staple of business television and the media. In fact I have been guilty of postponing investment decisions when an economic forecast is due. I prefer to wait for the economic indicators to be announced. In 1994 Warren Buffet has said that “If Fed Chairman Alan Greenspan were to whisper to me what his monetary policy was going to be over the next two years, it wouldn’t change one thing I do”. Consider the following:

1. Markets are far messier than is commonly believed. Even if investors could predict what, say, interest rates might do in the future, knowing how markets will react is another story. Interest rates might jump because inflation is rising, which is generally bad for stocks. Or they could jump because real economic growth is increasing, which markets might like.

2. In the markets the two most important metrics for estimating future stock returns are

- Valuations: The prices of stocks relative to what they are actually worth. Also valuations with respect to expected earnings. The higher the valuations are today, the lower the future returns, unless earnings catch up. The converse is also true.

- Investor sentiment: The biggest drivers of future stock returns are changes in investor sentiment. These are impossible to quantify today. To know what stocks will do in the future, we have to know how optimistic or pessimistic investors will then be. This is far from easy. since it involves predicting human emotions which can change on a dime.

3. However, the market still reacts quite powerfully to announcements of economic indicators which are made periodically. Over the last couple of years most investors must have noticed that these market reactions are ephemeral in nature. The worst thing for an investor to do would be to follow the prevailing sentiment about economic activity. This will invariably lead investors to buy at high prices when sentiment is good and everyone is optimistic, and sell on the corrections.

4. If stocks are under valued and the investor sentiment turns positive, the market is bound to give handsome returns.It is pertinent to note that both of the above must exist at the same time. This has been the story of the Indian stock market in the period from November 2013 and till date. Both the metrics mentioned above co-existed. From now on the economic indicators are expected to improve. How long will that take? Will the market do an encore in 2015? Just remember that looking at GDP data and related mumbo-jumbo won’t help you to arrive at a conclusion.

Thanks

Very nice, and thought provoking article. Answers a lot of questions I had regarding the behaviour of the stock market.

Shailesh