(Cartoonist: Mike Baldwin: Cartoonstock.com)

Nifty and Oil

For the purposes of this post, I have assumed that U S $ 83 or thereabouts, is the ‘new normal’ for oil prices, and for the INR it is 62. The media reports are full of stories about how the fall in oil prices is a blessing in disguise for India. India’s politicians and central bankers are also happy about the downturn. Lower oil prices help shrink India’s current account deficit. They also ease inflationary pressures. Is this as bullish as is being made out to be? You can take your own call after reading the rest of this post.

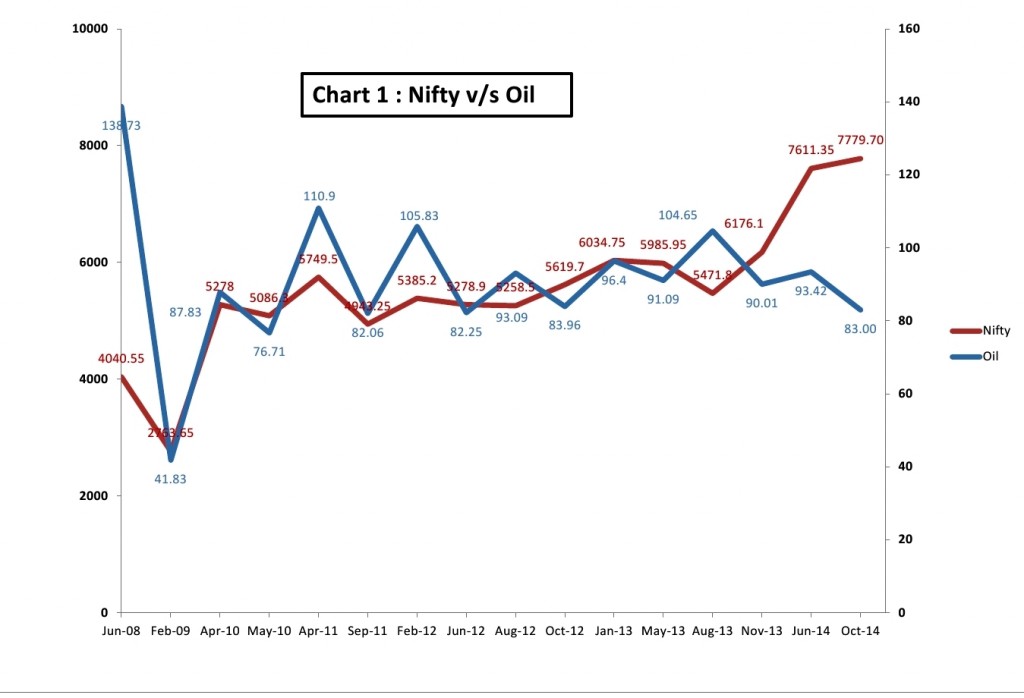

The graph clearly shows that, historically, oil prices and the Nifty are positively correlated. In other words, a drop in oil prices leads to a drop in the Nifty and vice versa. A cursory look at the chart above, shows that the price of oil in June 2014 was US $ 93.42, and the Nifty was 7611.35. On Friday, 17th October, 2014, the Nifty closed at 7779.70 and crude was US $ 83. Have a look at other world markets for the same period:

| DATE | NIFTY | DOW | S&P | NASDAQ | DAX | FTSE |

| 30-Jun-14 | 7611.35 | 16826.60 | 1960.23 | 4458.65 | 9833.07 | 6743.94 |

| 17-Oct-14 | 7779.70 | 16380.41 | 1886.76 | 4258.44 | 8850.27 | 6310.29 |

| % CHANGE | 2.21 | -2.65 | -3.75 | -4.49 | -9.99 | -6.43 |

It does look absurd to me. We are trading higher than June 2014!! Markets are markets and markets are irrational, this is not new. If some one starts saying that we have decoupled, then that is something I have heard so many times in the past, that I know it is absolute bullshit. What I am insinuating is that it is likely that Nifty should come to its June level or lower. This is not technical jargon, neither am I trying to give predictions. I don’t know anything about the either of them. This is simple common sense, that’s all.

Which Sectors in the Nifty will benefit?

Actually falling oil prices signal a slow down in demand from China and Europe. This can hurt exports. It does make things cheaper, if the currency remains stable. In short there will be winners and losers. So, a fall in oil prices can be beneficial to some sectors and bad for others, it cannot be a boon to the economy as a whole.

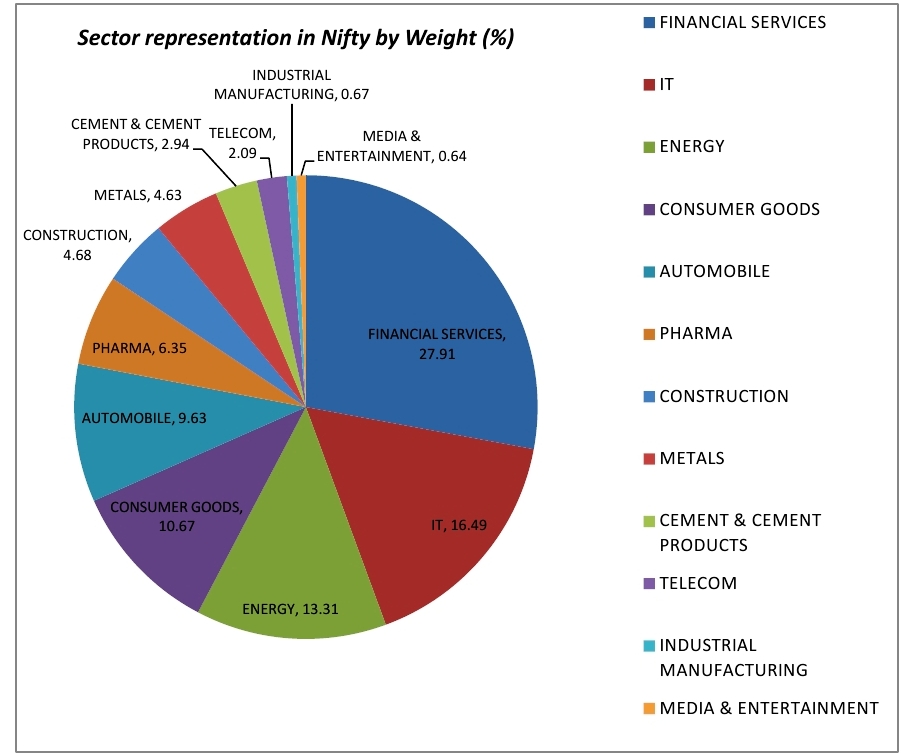

If one looks at the sector wise weight-age of the Nifty shown above, the following conclusions can be drawn:

Financials

27.91 % weight-age is the Financials. For them the oil price is a non event. The main trigger for this sector is the interest rate regime. There is no likelihood of an interest rate cut in the current fiscal. The construction sector with a 4.68 % weight-age is also considered as interest rate sensitive.

Information Technology

16.49 % weight-age is the I.T. sector. The world markets are correcting on fears of a deflationary spiral in Europe, and muted growth in the U.S.A. This does not augur well for this sector. A fall in oil prices is a negative trigger for this sector since it exacerbates growth concerns in the developed world. The developed world, incidentally, accounts for a bulk of the revenues of this sector. Moreover, most stocks in the sector are ‘priced to perfection’.

Metals & Energy

17.94 % is the combined weight-age of Metals and Energy. The commodity cycle has turned downwards. Falling oil prices means integrated energy companies will earn less. However, the oil refining part of the business is likely to do well. Why? The refining business gets more profitable with lower oil prices, since the prices of refined products do not fall as quickly as those of oil. In other words a fall in oil prices leads to an increase in the refining margin of these companies, effectively an increase in their profitability. However, in India this is a government controlled sector, and is threatened by the vagaries of government policy, which is unpredictable. Most of us lack the technical expertise to understand the oil dynamics of the Energy sector. Companies which provide alternative sources of energy (read solar and wind power) are losers. So also providers of drilling equipment for the oil sector.

Pharma

6.35 % is Pharma. This sector is under a cloud due to the U.S. FDA changing their rules and regulations. A fall in input prices due to oil is helpful. This sector is worth watching on declines. For the period from 01st July till 17th October the CNX Pharma index has had an up move of roughly 20 %. After filtering out regulatory concerns (which are stock specific), any dip will be a buying opportunity.

Autos

9.63 % is Automobiles. For the period from 01st July till 17th October the CNX Auto index has had an up move of roughly 8 %. This sector will benefit from lower oil prices due to margin expansion. Lower steel prices will reduce input costs, but what about competition? Will the companies be able to increase margin or will they have to pass on the benefit to the end consumer? This is an unknown. The transportation sector is a related beneficiary of lower oil prices.

Consumer Goods

10.67 % is Consumer goods. For the period from 01st July till 17th October the CNX Fmcg index has had an up move of roughly 8 %. This is the only sector which, to my mind, is a direct beneficiary of a drop in oil prices. Why? A drop in oil has the effect of increasing the disposable incomes of most of us. In the circumstances, consumer discretionary (goods that shoppers can go without buying for a while) and consumer non-discretionary (essentials) are the stocks which are the best bets for investment. Why? Lower oil prices put more money in the hands of the consumer, this will inevitable result in spending, which is directly beneficial to stocks in these sectors. In short the so-called defensive sector is the best bet. Historically, lower oil prices are good for consumer spending.

That takes care of around 90 % of the Nifty composition. This is just a broad outline. The key is that a particular commodity, must account for a substantial percentage of a company’s expenses, for it to have a material impact on the company’s bottom line. The basic benefit is margin expansion, which is difficult for you and me to quantify. It is necessary to link specific commodities to specific companies before one can invest. For you and me, if you buy companies in the so-called defensive sector, you are unlikely to go wrong. You just have to guess what consumers will spend their additional savings on, and then second guess the stock which will benefit. To summarize, 34 % of the Nifty is adversely affected by a fall in oil, 29 % is immune to oil shocks, 11 % is directly benefited and the balance 26 % is very stock specific. So the Nifty cannot run up just because of a fall in oil prices.

Why are lower oil prices bearish for equity markets?

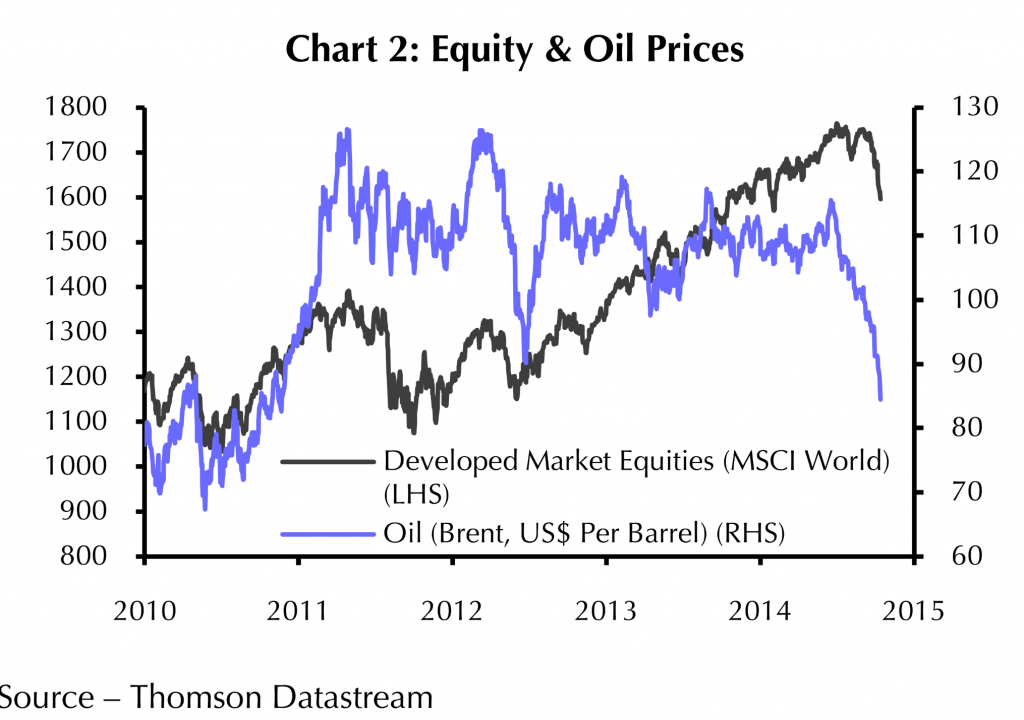

Historically markets and oil rise and fall in unison. It is unlikely to be any different this time. The reasons are as follows:

-

Along with oil, the rest of the commodity pack has got hammered mercilessly. This has resulted in cyclical stocks crashing more than the Nifty. Commodities ranging from corn to copper are near four-year lows. Unfortunately, producers of oil and other commodities were geared for Chinese growth. This is no longer a given, hence these prices have taken a hit. Oil is now quoting at its lowest prices since 2010.

-

The fall in oil prices has had a very unintended consequence. A fall in oil prices results in a fall in inflation all over the world. In India a fall in inflation is welcome, however the rest of the world is staring at deflation. For the uninitiated, inflation is a period of rising prices and deflation is a period of falling prices. In a deflationary environment, goods and services get cheaper over time. Hence, people postpone consumption. This leads to a fall in demand and lower production. Effectively, an economy with modest inflation is preferred to a deflationary environment. Basically too much inflation is a bad thing, so is too little. Why? Too little inflation opens the risk of a general fall in prices, like what has happened in Japan.

-

The developed world is actually staring at deflation. Even if they are not dependent on oil prices to the extent that we are, lower oil prices definitely do not help. In the developed world gasoline prices are dropping, this cannot be considered to be inflationary. Falling oil prices along with dollar strength are expected to put downward pressure on already low inflation in the U.S. This can have the unintended consequence of the Fed having to deal with a deflationary environment. In the U.S. it is expected that the drop in gas prices will result in a drop in inflation to below 1 %. The Feds target is 2 %, so it is effectively, a goodbye to any rate hikes by the Fed.

If’s & But’s

As always nothing in the market is certain. So the following points are worth remembering:

1. How low can oil go?

-

The oil price is a function of demand and supply, hence the price can go anywhere. In economics profits beget competition. The rising price of oil over the last many years has brought a great deal of additional supply to the oil market. The floor of U S $ 80 is expected to hold till November 27th when OPEC (Organisation of Petrol Exporting Countries) will meet for discussing production cuts. In case they do not cut production, this is likely to be breached, and oil may then slide lower. However, no immediate production cuts, in the short-term are expected, since producers are hedged against a fall in price. Of course, falling oil prices would eventually force companies and countries to cut production.

-

Also, if the price of oil breaches the cost of production the slide is bound to be arrested. There is a difference between the fall in oil prices this time as compared to such occurrences in the past. The growing U S oil production has sent a blanket of fresh oil sloshing through world markets. This has changed the dynamics of the oil market. There is a lot of confusion as to the cost of U S oil. The consensus opinion is that the U S oil production is still viable at prices below U S $ 80. However fresh investment in drilling and infrastructure is likely to come to a halt if prices keep dropping. The lower prices are expected to result in a production pull back in North America.

2. What is the break even point for U S oil?

-

Any sustained drop could mean the companies have to scale back development. Analysts have said there could be a natural floor for oil: the price at which U.S. shale producers need to keep their wells flowing profitably. If prices fall below that so-called break-even price, producers could rein in output. The lost supply could then bolster prices.The International Energy Agency (IEA), however, has said that the floor is still considerably lower than today’s prices. According to the agency, only around 4% of U.S. shale-oil projects have break-even prices of more than $80 a barrel. The IEA’s chief economist, Fatih Birol has in an interview he gave last week, said that “there’s not one single drop of oil which cannot be produced for commercial reasons with today’s price”.

3. What if the price of oil suddenly starts to go up?

-

In the past OPEC has cut production. OPEC is a cartel and any production cuts effectively put a floor on the oil price. This time the OPEC is a divided house. The cartel, which is dominated by Saudi Arabia, has refused to cut production. There are a couple of reasons for this. The first one is that Saudi Arabia fears a loss in market share in case it cuts production, and the other cartel members do not follow suit. This has happened in the past. Secondly, Saudi Arabia can afford to lose on its oil sales due to its very large foreign exchange reserves (U S $ 750 billion). The other cartel members are not so lucky. Hence, the Saudi’s prefer to cut the price instead of production. The next OPEC meeting is on November 27th in Vienna. Till then any production cuts can be ruled out. As per the media reports, Saudi Arabia has the capacity to take a hit on its revenues and would be able to sustain US$ 80 to a barrel for a full calendar year.

4. What if QE4 is announced?

-

There is some talk of the U.S. announcing QE4. However, this is just talk and nothing else. At the current moment there is no probability of any such thing happening. The European Central Bank is expected to start asset purchases. This, however, is known for quite some time. Hence, it is discounted in the current market prices.

5. How is the crash in oil price different from the ones we have had earlier?

-

Historically in the period from 2003 to 2008 we had a bull market in commodities which coincided with our bull market. Also we had fast economic growth alongside high commodity prices. How is that? The reason is that demand was strong. Now, things are different. Global demand is falling. This has resulted in a fall in commodity prices. This in itself is deflationary and not good for equity as an asset class.

-

The global oil market has changed in the past few years. When oil prices cratered in the late 1990’s, a long lull in investments followed. By the time the financial crisis erupted in 2008, demand for crude outstripped supply—and oil prices hit a record $145.29 a barrel. This time around, oil prices could rebound if production is cut and the global economy improves. A lot depends on whether producers of U.S. shale or OPEC members curtail production. If the rebound in oil prices is slow, it could hurt large.

Conclusion

Suddenly we find everybody is discussing oil. We have temporarily forgotten about the Middle east crises, Ukraine and Putin, Inflation, Rate cuts, Drought etc. That is why it is said that bull markets have to climb a ‘wall of worry’. The Saudi’s seem to be willing to let the price fall. Maybe it is a challenge to Russia, maybe they are trying to show the U S shale oil producers who is the boss, maybe it is due to Europe or maybe they just have no choice. We will never know for sure. It does look like oil at U S $ 83 or thereabouts is the new normal. Most people seem to be convinced that the fall in oil prices is just too good for the Indian economy, and the best thing that could have happened. I always remind readers that markets are counter intuitive, and when something is too good to be true, it probably is.