(Cartoonist: Guy & Rodd; Cartoonstock.com)

India has been dropped from the Fragile Five in the second week of March 2015. Why was India dropped? Are oil prices making us anti-fragile? If it is indeed so, is our anti fragility ephemeral? In this post, I have tried to find answers to these questions.

What is Fragile?

Nassim Nicholas Taleb’s book Anti fragile: How to Live in a World we Don’t Understand contains a very succinct definition of fragility. He describes it as: ‘Anything that has more upside than downside from random events (or shocks) is anti fragile. The reverse is fragile.’

Morgan Stanley’s Fragile Five

The words ‘Fragile Five’ were coined by Morgan Stanley in August 2013 to describe emerging nations in turmoil. The five countries that Morgan Stanley included in this list were India, Turkey, Indonesia, South Africa and Brazil. The term was used to describe emerging nations who were excessively dependent on foreign investments to achieve their growth targets. Recently it dropped India from the Fragile Five and included Mexico instead. What prompted Morgan Stanley to drop India from the list?

Why was India dropped from the Fragile Five?

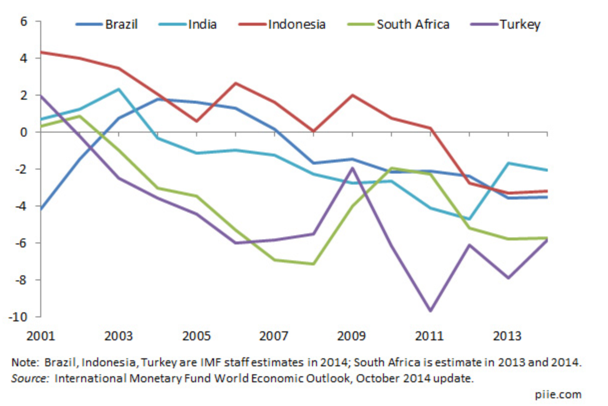

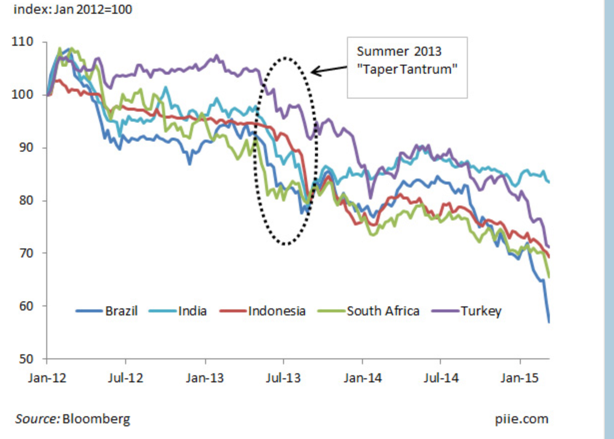

There is an article published by the Peterson Institute for International Economics titled ‘The Taper Tantrum Revisited’. (Click here to read). It analyses how each of the five countries have fared since the taper tantrum. The images shown below are from this report. They speak for themselves; no commentary required. I was surprised with the following:

-

The fact that India was the only country that had learnt its lessons from the taper tantrum was a revelation (for me).

-

The comparative outperformance of India or the gap by which India has outperformed is very large.

Fragile Five: Improvement in Current Account Deficits as percentage of GDP

The report states that Turkey, India and South Africa are all beneficiaries of the plunge in oil prices. However, India is the only country that shows an improvement on this metric.

Fragile Five: Foreign Exchange Reserves

| Convertible foreign currency reserves, millions of U S dollars | |||||

| Country | Jun-13 | Jan-15 | % change | ||

| Brazil | 359,386 | 353,076 | 1.76 | ||

| India | 254,367 | 303,325 | 19.25 | ||

| Turkey | 103,995 | 108,135 | 3.98 | ||

| Indonesia | 91,573 | 107,810 | 17.73 | ||

| South Africa | 39,475 | 39,828 | 0.89 | ||

(Source: International Monetary Fund, Data Template on International Reserves and Foreign Currency Liquidity)

Under this metric India and Indonesia show improvement. India has ten months of import coverage i.e. the foreign exchange reserves are enough to cover ten months of imports at current prices.

Fragile Five: Depreciation of National Currencies to the U S Dollar

Again India is the only country among the Fragile Five which boasts of a stronger currency as compared to what it was at the time of the taper tantrum.

Will oil @ US $ 80 make India fragile?

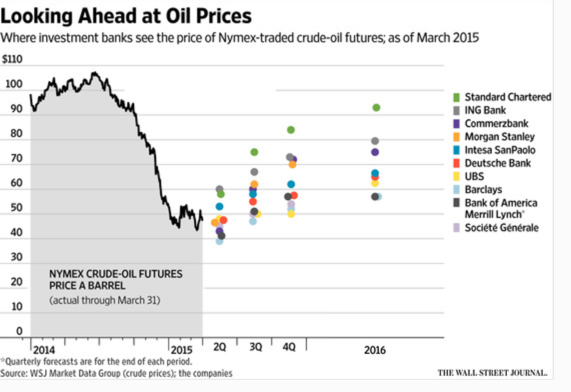

The outperformance of India is due to lower oil prices. What if the ‘oil shock’ of 2014 reverses and we get a ‘reverse oil shock’ in 2015? Where are oil prices headed? I tried to guess, have a look: (All References to oil prices are for West Texas Intermediate – WTI)

The image below shows what the top investment banks in the world are expecting:

If you look at the image, you will find that practically no one is predicting a price below US$ 40. Most of the investment banking firms are predicting between US$ 50 and US$ 90. Oil is currently a shade below US$ 50. A report by UBS Global Research is titled: ‘What if oil price now climbs to $80/bbl?’ (Click here to read). This report comes to the conclusion that, on the basis of statistical analysis, there is a 25 % chance that oil will hit US$ 80 in the calendar year 2015. The fact that practically nobody is predicting a lower price means that the consensus opinion is that oil has bottomed out. Why are there practically no predictions below US$ 40? According to me, the reason that we have no predictions below US $40 is probably because the recent bottom was US$ 44.03 on March 18, 2015. All predictions shown above have automatically got anchored to this most recent bottom. I think it shows the anchoring bias among all of us. I have written about the anchoring bias in one of my earlier posts. Click here to read that post.

Why oil may continue to fall.

The image ‘Looking ahead at oil prices’ shown above, shows the estimates of investment bankers. They are the best brains in the investment banking business. They do have their reasons for giving estimates. However, they are not immune from human biases. Hence, they may be wrong. I tried to look at the whole ‘oil shock’ dispassionately. These are my thoughts:

- It has not been ordained in the Holy Scriptures that ‘Oil shalt trade above US$ 50 or US$ 60 or whatever’. Oil is a commodity and has to obey the demand-supply curve. If supply exceeds demand, prices have to fall. This is common sense. The price of oil can go ‘anywhere’ as long as supply exceeds demand.

-

The Saudi’s pretty much control world oil supply. It is very clear by now that the Saudi’s have refused to tinker with oil production. This has, in no small measure, ensured that the supply side remains stable. In fact Iranian oil (if at all) will increase supply.

-

My argument is simple; Oil prices cannot move up unless and until someone tinkers with the supply, or there is a disproportionately high rise in demand. The Saudi’s are the only one who can tinker with the supply side . Unless they do this, oil will continue to remain range bound with a downward bias. On the other hand, demand is stagnant. If media reports are to be believed, demand for oil is falling.

-

Despite whatever technical analysis and chart patterns may say, I do believe that: rising markets have no resistance and falling markets have no support. It is easier to read and understand Newtonian laws of motion than it is to make sense of charting patterns. Financial physics does not always agree with Newtonian laws of motion, but this time it just might.

What to do?

The behaviour of the market in the last year and a half has not shown any fragility. India along with China has been one of the best performing global markets. At current valuations, will India will continue to be the toast of the emerging world? My guess is, it would. This is what I expect:

- I keep saying that FII funds follow performance and not value. It follows that FII induced ‘liquidity’ will continue. This time with a difference, we might get more. Because in the event of a liquidity threat, we will be perceived as being better off (compared to the newly composed ‘fragile five’).

-

The argument whether we will continue to remain anti-fragile boils down to the price of oil. If oil prices do crater and head towards ‘ground zero’, we as consumers do stand to benefit. Our portfolios are likely to suffer collateral damage in the process.

-

The elephant in the room is not interest rates, but oil prices. There is no doubt in my mind that oil prices and not interest rates will hog financial headlines in the remainder of 2015. The media and the fund management universe has been tom-tomming that falling oil prices are the best thing ever that could have happened for the Indian economy (after Narendra Modi). Unfortunately, there is nothing to suggest that this is the correct interpretation. Falling oil prices are deflationary.

-

If oil continues to fall, we might have the ‘mother of all corrections’ in what is being popularly called the ‘mother of all Indian bull markets’. Hungry FII’s will undoubtedly ‘buy every dip’. What about us? For us, stock and sector selection would, at the same time, be critical and difficult. My suggestion is to pick an active manager or better still start throwing darts! That is what I am going to do!

Yashodhan

Again, a well written article.

My question is slightly different. I have been a follower of ONGC for a long time now.

Do you think investing in ONGC now is a good option with a time horizon of about 8 to 10 years?

Regards

Shailesh

I have never tracked ONGC. I think instead of ONGC, OIL INDIA LTD, CMP 459 is a better bet. All these companies have the same problem – the government decides the price of the finished product. The government is not known to take decisions in the interest of shareholders. They always end up acting in ‘larger public interests’ and the shareholders can go for a toss. Difficult to predict 8 to 10 years but I prefer OIL to ONGC.