(Cartoonist: Harley Schwadron;Cartoonstock.com)

Last week, most of us were contemplating whether the Fed would surprise. It didn’t. However, the dip in the indices was surprising.

Why we are unable to buy on the dip?

It has been very easy for me to frequently use the words ‘wait for the dip’ in many of my previous posts. Now that the ‘dip’ is well and truly upon us, how many of us are buying? Not many. It is, in fact very difficult to buy the dip. What makes it so difficult to implement something which is so easy to write or suggest? The reason for this behaviour is a psychological bias known as ‘Risk Aversion’.

Risk Aversion and Loss Aversion

I have referred to Daniel Kahneman and Amos Tversky in many of my earlier posts. Their ‘Prospect Theory: an analysis of decision under risk’ published in 1979, is a seminal paper on the science of behavioural economics. I attach great importance to this science since I firmly believe that the stock market game (it is a deadly serious game) is played with the mind and the emotions. In our markets the words ‘risk aversion’ and ‘loss aversion’ are used synonymously. The theory explains them as follows:

1. Risk aversion is: ‘the reluctance of a person to accept a bargain with an uncertain payoff rather than another bargain with a more certain, but possibly lower, expected payoff’. In other words, human beings prefer more certainty to less certainty. The animated two-minute video below shows what is meant by risk aversion:

2. Loss aversion is: ‘the phenomenon whereby the fear of losing something motivates people more than the prospect of gaining something of equal value’. It is a term to describe how risk averse investors behave. The three-minute video below explains loss aversion:

3. Kahneman says that the joy most humans face from financial gains is not proportional to the emotional pain that we suffer when we incur a loss. In fact, the emotional pain that we suffer from losses is twice as powerful as compared to the joy of winning.

4. Loss aversion prevents investors from booking losses. Loss aversion also leads to investors not taking risks even when the risk-reward equation is clearly favourable.

5. There is an interesting paradox to this behaviour. Many times investors who fear losses end up taking greater risks in trying to avoid these losses. Hence, when we are stuck in a trade, we sell out and buy something else or reverse directions. This is riskier than not trading at all. In fact more often than not the best thing to do is to ‘do nothing’.

6. We are currently witnessing an example of classical ‘risk aversion’ in our market. Corrections and dips should we welcomed. Don’t we always want to buy low? If one of the e-commerce guys announces an online sale, we all rush to participate, don’t we? In the stock market, it doesn’t work like that. In fact, it is exactly the opposite. So when a stock market sale is ongoing as it is now, we are frightened. Risk aversion is resulting in loss aversion.

7. This human bias is embedded in all of us. We tend to forget that this is a liquidity-driven bull market. Any arguments about valuations are passé. My view is that as long as Janet Yellen does not walk through the door (which she opened last week) the ‘buy on dip’ trade is on.

8. How can we get rid of this bias? Getting rid of it is impossible. We can try to address it so as to ensure that it does not prevent us from missing opportunities. Briefly:

- Primarily we have to build some conviction into our belief that stocks are indeed a good investment avenue.

-

Secondly one has to stop checking the stock price or do it as infrequently as possible. Looking at the prices does cause an emotional storm which activates a ‘call to action’. This ‘call to action’ then takes you face-to-face with your inherent bias. The likelihood that you will succumb to your bias rises disproportionately. I admit my personal inability to remedy this ‘call to action’ syndrome.

-

Last and not the least, we must have an investment plan, and we must execute it ruthlessly.

Are investors right in not buying the dip?

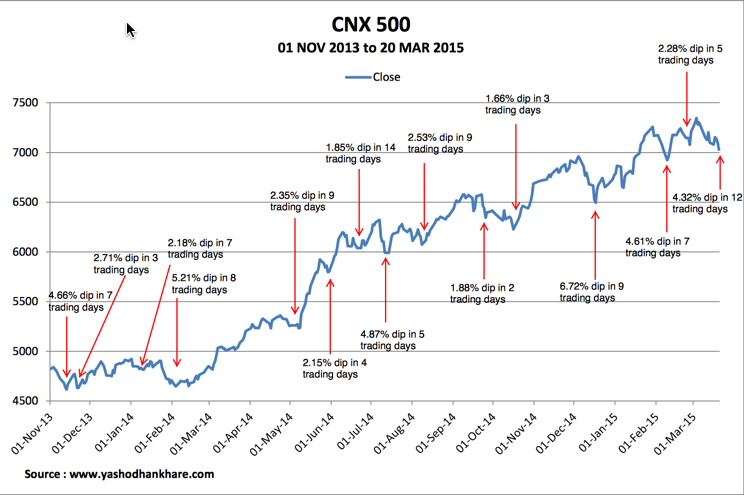

The graph below shows the Nifty from 01 Nov 2013 till date. I have highlighted the dips. All figures are on closing basis.

The following are the inferences I have drawn from the image above:

-

Please remember you are looking at the CNX 500 and not the benchmark. In terms of the free float market capitalisation of stocks listed on the NSE, the CNX Nifty accounts for 67 % and the CNX 500 accounts for 96 %. The CNX 500 effectively provides us with the whole smorgasbord. Hence, it makes sense to look at the CNX 500 and not the CNX Nifty.

-

I have deliberately shown the number of trading days. The slower the dip, the more dangerous. Why? To use a market aphorism ‘false moves come from fast moves’ and the current dip is not a fast move. In terms of number of days, the current fall is the longest. (There is a longer one from 9th June 2014 to 27th June 2014. However, that is more of a sideways move than a dip). Moreover, the magnitude is lower on a higher base. This is a bit worrying. We tend to get a bit complacent with a slowly falling market, thinking it is going sideways. The magnitude of the fall can exacerbate over time. One fine day the market makes up its mind, and we are wrong footed (all-over-again).

-

I don’t subscribe to the percentages mantra for defining corrections. Why is a 10 percent considered to be a stock market correction? Why not 8 or 15 or some such fancy figure like say 9.1789? Beats me.

-

We have seen very few corrections in the current bull run. In terms of percentages, the largest fall thus far of 6.72 % was in the period from 4th December to 17th December, 2014, nine trading days.

Is buying the dip the same as catching a falling knife?

Catching a falling knife is one of the most misused idioms, when talking about falling markets. For the uninitiated, it is a phrase used to suggest that trying to buy a falling knife stock can be hazardous. You can get hurt if you try to catch a falling knife. Similarly, a falling knife stock can lose all its value, hence the phrase. If you are trading and not investing, it is important not to buy something which is falling. However, from an investment point of view:

1. If you are going to wait for the knife to stop falling, you are going to miss the opportunity. If you want a bargain price, then the ‘buy’ has to be done when there is uncertainty. By the time the dust has settled and clarity has emerged the price is not a bargain anymore.

2. That does not mean that one has to catch-all the falling knives prices. As a thumb rule:

-

Within your portfolio, add to your winners. Buy in small quantities. You can never guess the magnitude of a market correction.

-

Don’t look at the benchmark, it does not represent the market. Look at the CNX 500 or better still the Sectoral Index in which you propose to invest or have invested. It gives a better picture and far more clarity of thought.

3. There is no holy grail to investing success. The indices don’t take pit stops like cars do at Formula One. The technical analysis guys, seem to think they do. Unfortunately, they have quite a large following. This is apparent since now-a-days anyone and everyone is fixated on a Nifty ‘level’ or a ‘moving average’.

4. Another popular question, why is the market falling? To know the answer, you first have to find out why it was rising? Solution: these questions don’t have any answers.

5. Some market guru has rightly said: ‘What’s comfortable is rarely profitable’. Effectively a profitable investment that does not begin with extreme discomfort is an oxymoron.

The concepts of risk aversion and loss aversion are well explained. It is empirically true that common investors use to find the price at the lowest when they buy and highest when they sell. Perhaps this creates a lot of confusion and wasting of time in only finding the most appropriate price! Does Apsara become your realty anytime?

From investor’s perspective what one needs to look at is whether he has invest-able money to park for his promising investment. There are many stocks, I believe like Yes Bank which will declare excellent results going ahead. Hidden gems like Marksans Pharma can stand as an excellent long term investment opportunity. ICICI Prudential may be bought through reliable sources before it comes up for listing.

Really speaking, its immaterial where the market is heading if you believe in your stocks….Investor should be more interested where his promising stock is moving! Focused approach like Arjuna can only offer the desired fruits, doesn’t it!!

I think year end considerations, year-end tax planning coupled with our biases leads to investor apathy. In terms of liquidity, to the best of my knowledge there is plenty with Indian investors. However, they have a wide choice of asset classes. In the developed world choices are limited.

Yashodhan

Again, a very insightful post.

Yes, this looks like a good buying opportunity. However, I read from two or three experts that the market may correct by up to 20% in the next month or so.

Regards

Shailesh

I think it is better to buy in small lots. Nobody can predict the market and nobody ever will be able to, there is no doubt about that. My experience is that people who wait for these 10/20 % type of corrections NEVER buy when the market does actually correct. They keep waiting. According to me buying fundamental strong stocks in small lots is the only way.

The data has been sourced from NSE’s website (link 1 and link 2) and starting from 1st January 1999. Ratio related data prior to this period is not available.

So here is the result of the analysis…

The table above clearly shows that if one is investing in markets where PE<12, returns over the next 3, 5 and 7 year periods are astonishing 39%, 29% and 25% every year. That is money doubling almost every 2-3 years!!

On the other end of the spectrum is PE above 24. These are levels which are quite overvalued and returns over the next 3, 5 and 7 year reduces to (-)5.1%, 2.7% and 9.9%.

This shows that if you invest in high PE markets, your chances of low (and even negative) returns increases substantially.

And for your information, we are currently trading at PE closer to 24 😉

Could you elaborate what you are trying to say? I am a little confused.