(Cartoonist: Schwadron, Harley; cartoonstock.com)(Sunday, 11 September 2016)

Emerging Markets (EM’s) have been moving higher since February 2016. Before I get into the performance of the Indian Stock Market, the question is how long can EM’s continue to rally.

Does the rally in Emerging Markets have Legs?

While trying to guess market direction in the EM world, one does need to remember that what happens in EM’s is a function of what happens to global stock markets. The decoupling rhetoric is trash. In other words, if world markets change direction so will EM’s.

The outlook for growth in EM’s isn’t great, but it is better than what is expected from the economies of DM countries. The consensus seems to be that the sell-off in EM’s was overdone. In that sense, mean reversion appears to be what is happening. What is the role of macroeconomic factors in the ongoing rally in EM’s? That’s a tough one, and I’ll let it pass. In any case, macroeconomic factors can be interpreted to suit the narrative. I’ll stick to the what we know instead.

In my opinion and from a layman’s perspective, what matters is U.S.Dollar parity vis-a-vis currencies of EM countries. Over the last couple of years, EM underperformance has coincided with unprecedented dollar strength. The dollar has strengthened on the back of expectations of an interest rate hike by the U.S. Federal Reserve. The question is, will the U.S. Dollar strengthen even more if and when the US Federal Reserve decides to increase rates? The answer should determine everything else. If you feel that it will strengthen further, EM’s will suffer. I am in the bullish camp. I think that dollar strength is done with, and EM outperformance will continue, irrespective of rate hikes.

Why is the India Underperforming the Emerging Markets Rally?

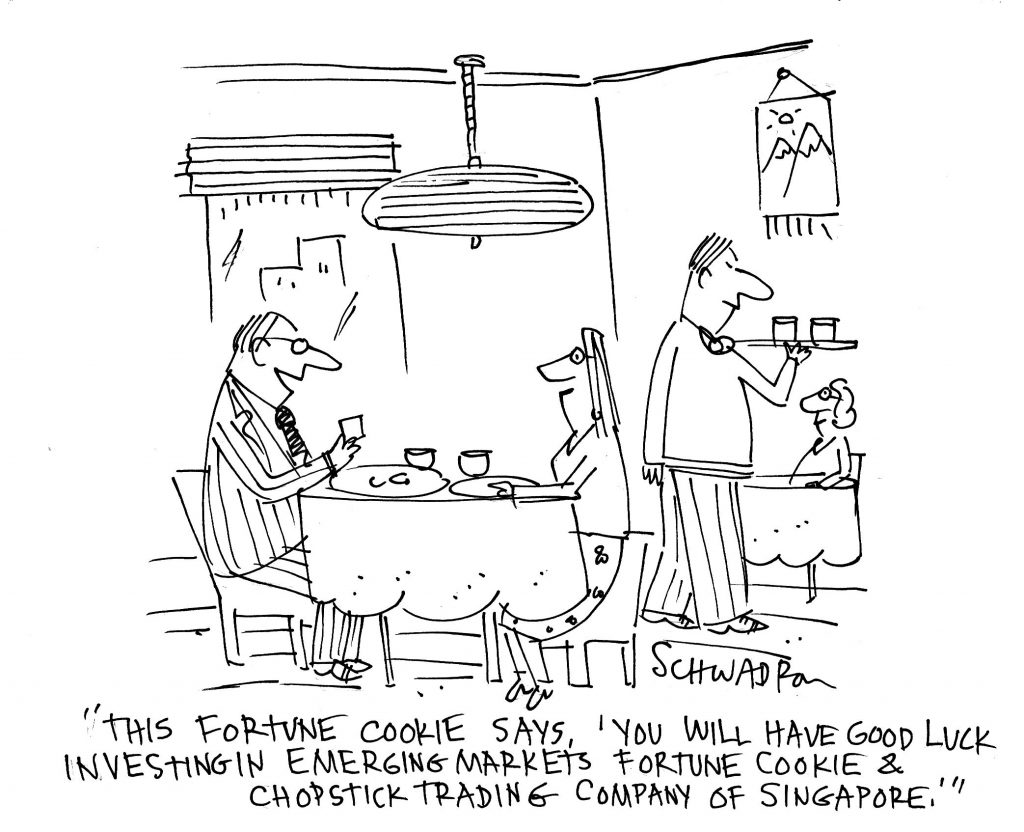

The Indian Stock Market is a subset of the Emerging Markets (EM’s) universe. Many foreign investors prefer the Exchange Traded Funds (ETF) route while investing their money in Emerging Markets. The performance of prominent Emerging Market ETF’s in the year 2016 is shown below:

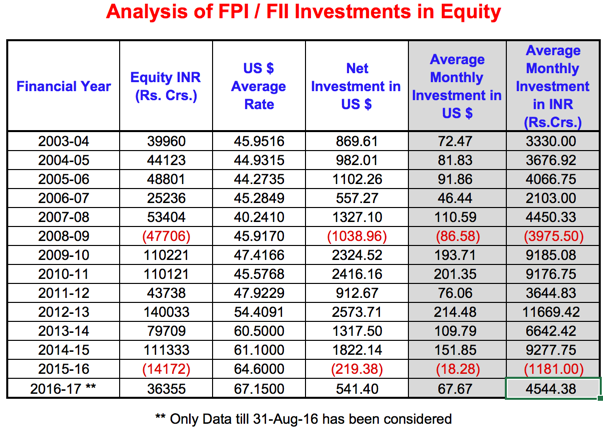

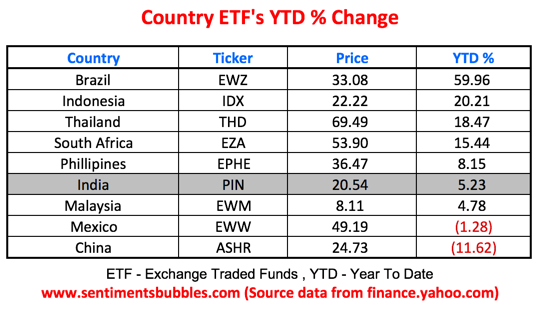

It is apparent that the Indian Stock Market ETF (highlighted above) has underperformed other Emerging market country ETF’s. The flow of funds from Foreign Institutional Investors (FII’s) into Indian markets is the single largest determinant of market direction. Hence, what I have done is to analyse FII investments from a historical perspective and tried to arrive at an educated guess about (a) reasons for the underperformance and (b) the future direction that FII flows are likely to take.

I need to explain what I have done:

- Most market participants have an eye on the FII buy/sell figures that are disseminated daily. I have taken the historical FII buy/sell data, then converted the numbers into U.S.Dollars at the average rates for the various years and derived a monthly figure of FII flows.

- It is apparent that as compared to earlier years, the flow of FII funds into the Indian Stock Market in both U.S.Dollar terms and in INR has been far lower than what it has been in recent years.

- To gauge the impact of lower inflows one needs to look at the numbers in Dollar terms and not in INR (Indian Rupee). That is the only way one can judge FII sentiment towards the Indian Stock Market.

Globally funds chase performance. Each week money is allocated on the basis of what has worked in the immediate past. In that sense, FII fund allocation is a vicious circle. In such a scenario, allocation of funds is made to markets that are delivering the best returns. When it comes to investment philosophy, no money manager wants to be caught investing in Emerging Markets and be told, “they all moved, but you got the wrong one.” The year to date performance of Emerging Markets ETF’s and the flow of FII money into the Indian Stock Market (shown above) captures this investment philosophy.

At the beginning of the year, the consensus was that the Indian Stock Market was the go-to destination for global funds, almost as if the Indian economy were to be a paragon of fiscal rectitude. In the current year, we have had a normal monsoon and the Goods and Services Tax (GST) legislation has been passed. What I am trying to say is that regarding ‘positive triggers,’ we have had our share of the same. Clearly, the FII’s are not impressed. What could be the reason for the apathy?

I could think of many reasons, prominent among them Indian Inflation readings. In a low-inflation world, the Indian economy is an outlier. Inflation again is in the macroeconomic domain, and I wouldn’t want to get into it. According to me, high inflation is not the primary reason for low FII inflows. Could it be valuations then? I don’t think so. Globally valuations have gone for a toss in every sense. Indian equities have historically enjoyed premium valuation metrics due to a host of factors. Hence, I don’t think valuations are constricting FII flows.

In my opinion, there is one singular reason for low FII inflow. If you click on the FPI/FII Investment Details, you will notice that the highest inflows took place in March 2016. Post March 2016 flows into the Equity segment have been lacklustre. In my opinion, low FII inflows is a function of the following:

- In May 2016 the government announced changes in the existing tax treaty with Mauritius. It seems that the changes bring about a fundamental change to the landscape for direct investment in India.

- How important is taxation while taking investment decisions? I think it is pretty important. We all look at returns post-tax, don’t we? You can’t fault the FII’s for behaving exactly as we do! One doesn’t know the tax regimes that exist in other EM’s. Maybe they get a better deal elsewhere.

- To be fair, the amended provisions take effect only from 01 April 2017. However, Indian Tax authorities are known to change legislation retrospectively, and I think the FII’s don’t want to take any chances. In any case, markets are forward-looking and so are FII’s.

Pros and cons of the plans to tax Indian investments coming from Mauritius are something I am not in a position to comment. Suffice to say, Government policy should not be dictated by foreign investors. In any case, what you and I think about the Indian Governments taxation policies doesn’t matter, what the FII’s think does. Its implications for the Indian Stock Market is our concern. I don’t see the proposed changes as bullish.

To conclude, I think we will continue to see ‘decent’ FII inflows, much like the ones we have been witnessing in the recent past. The extraordinary FII inflows of yesteryear are unlikely. I think that the fact that FII’s continue to invest despite taxation issues is positive. The FII’s are likely to be aggressive buyers when valuations are compelling (as they were in March 2016). Till then I suppose the current trend of tepid FII inflow will continue.

Markets Diary

Global markets sold off viciously on Friday, 09 September 2016. The prolonged period of low volatility did breed a sense of complacency. There is no doubt about that. We always want to know why the sell-off took place. Nobody is interested in finding out why markets were going up in the first place. Markets were overheated and sold off, isn’t that what they do all the time? The next question is ‘is this the big one?’ I don’t think so. My reasoning is as follows:

- The fact that this has been a Central Banker sponsored bull run is known. Central Bankers of developed countries have repeatedly announced proposed policy initiatives ahead of schedule. In this way, Central bankers have (inadvertently or otherwise) allowed market participants to front run all policy announcements. In the post-meeting press conference of the European Central Bank (ECB) held on Thursday, 08 September 2016 Mario Draghi (President of the ECB) was reluctant to suggest that more easing lay ahead. There was no ‘whatever it takes’ rhetoric this time. The markets sensed a change in the tone of Mario Draghi’s policy announcement. As a result, bullish positions were liquidated. In other words, the sell-off was a function of “unwinding of front running” than anything else.

- A striking feature of this bull market is that all along it is the retail investor who has been more worried about the global economy than anyone else. There is a lack of euphoria even as markets have climbed higher. Irrational exuberance is nowhere to be seen. The consensus is that Central Bank largesse and the proliferation of negative interest rates are the greatest risks to this bull market. Hence, we continue to be skeptical about global Central Bankers. What if we are wrong? In investing, they say that ‘the greatest risk is the one you didn’t account for.’

PL SEE

http://www.btvi.in/videos/watch/19196/enam-holdings–market-view

OK