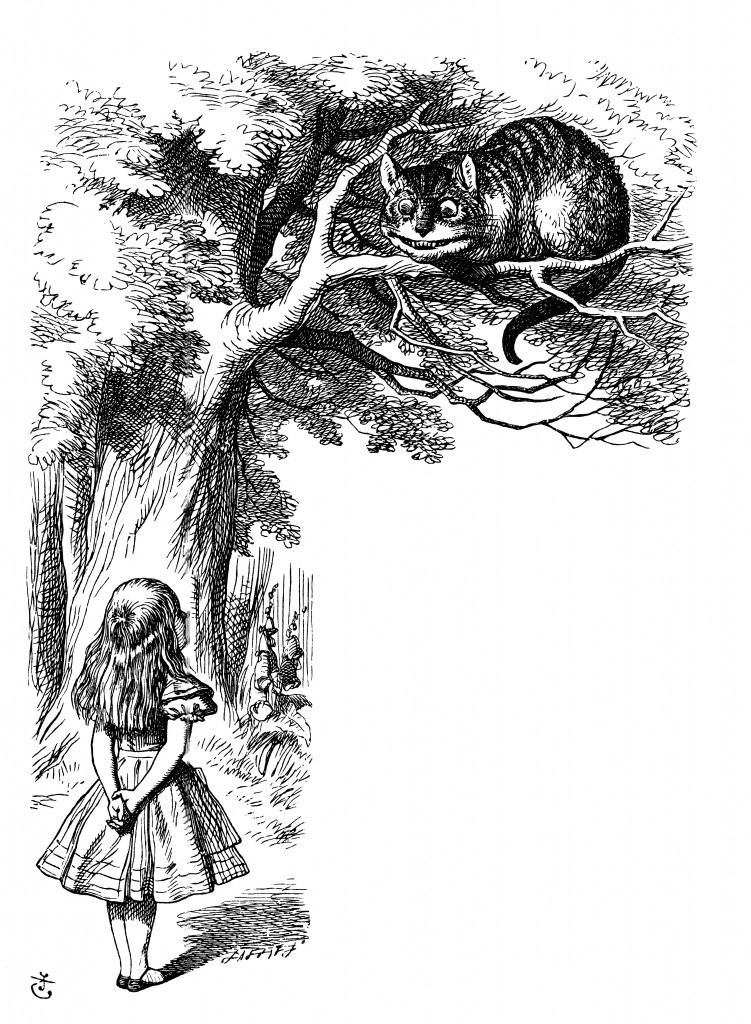

Alice in Wonderland – Alice Meets the Cheshire Cat

(Illustration by Sir John Tenniel under license from Cartoonstock.com)

And, for a Monday morning, a few stray thoughts and a few general observations and a few points of view ( all my own work):

Like I have been reading Alice’s Adventures in Wonderland. The book is written by Charles Lutwidge Dodgson in 1865 using the pseudonym ‘Lewis Carroll’. In the book Alice, a seven-year-old English girl, has a dream. In her dream, she falls into a rabbit hole (burrow). In the burrow, she finds herself in a wonderland populated by anthropomorphic creatures like the Cheshire Cat (which is a vanishing cat), the White Rabbit, etc. And that I have been reading the book ‘between the lines’ for composing this post.

Like there have been many re-imaginings of Alice’s Wonderland over the last many years. And that I am presenting one that is relevant to our current predicament.

Like ‘going down a rabbit hole’ (burrow), is a metaphor for an entry into the unknown. And that the world economy too, just like Alice, has fallen into a burrow.

Like the world’s central bankers, just like Alice, are suffering from specious delusions. In her dream, Alice asks the Cheshire Cat for directions, without knowing what directions she needs. And that the following dialogue between Alice and the Cheshire Cat shows that the world’s central bankers seem to be behaving exactly like Alice.

Alice: `Would you tell me, please, which way I ought to go from here?’

`That depends a good deal on where you want to get to,’ said the Cat.

`I don’t much care where–‘ said Alice.

`Then it doesn’t matter which way you go,’ said the Cat.

`–so long as I get SOMEWHERE,’ Alice added as an explanation.

`Oh, you’re sure to do that,’ said the Cat, `if you only walk long enough.'”

Like I don’t know about you, but I have started feeling that we are now living in Alice’s mythical wonderland. The ‘bad news is good news’ syndrome has been happening a bit too regularly in our markets. And that all of us have begun to think, just like Alice, that very few things are impossible.

Like all of us have been drinking excessively from a bottle called ‘liquidity’. And that fund liquidity and stock liquidity are two separate and distinctly different things.

Like currency-volatility has historically been associated with a global financial crisis. The current currency-volatility is, it seems, in the absence of a global financial crisis. And again just like Alice, nobody seems to care anymore.

Like in the book, when Alice finds herself in trouble, the otherwise invisible Cheshire Cat appears in the sky and talks to Alice. It then disappears completely. That is so much like the world’s central bankers who seem to appear out of nowhere to provide ‘stimulus’ to their economies markets. And that last week the modern version of the Cheshire Cat was sighted mockingly smiling at bears in the Asian subcontinent.

Like there is a consensus among analysts that the Chinese stock market is in bubble territory. These are the same guys who were predicting a ‘hard landing’ for the Chinese economy. And that analysts are now predicting a ‘crash landing’ instead of a ‘hard one’.

Like I don’t understand anything about hard landings, but the fact is that the Chinese stock market has simply ‘taken off’ (instead of landing). The Chinese stock market is up an astounding 90 percent in the last twelve months! That is in spite of a slowdown on almost all economic metrics. And that we in India, do have a lot of catching up to do.

Like with respect to the interest rate hike the Federal Reserve has been shouting ‘it’s coming, it’s coming’ since the taper tantrum in 2013. The Federal Reserve must, for the sake of the markets, ‘say what they mean’. That is not the same thing as ‘mean what they say’. And that the question before the Fed is not when, but how to increase rates.

Like what’s his name Bernanke has taken to blogging. You can read his blog by clicking here. It is expected to be the most widely read and followed blog of 2015. And that now that he is no more part of the Fed, he has stopped talking about ‘growth’ and has begun writing about things like ‘secular stagnation’.

Like temperatures are not the only thing that went below zero in the developed world last month. The inflation readings too did the same. And now that we have got used to negative interest rates, we might as well get used to inflation below zero.

Like in our country when Manmohan Singh was PM we were blaming everything on the poor guy. Now that Narendra Modi is the PM we don’t know whom to blame. Historically, our capital markets have always given stellar returns, in spite of our politicians and not because of them. And that there is nothing to suggest that this is about to change.

Like Rajan holding interest rates was expected. Are interest rates the anathema of the Indian Economy? We have all been thinking on those lines. The International Monetary Fund in a working paper titled ‘Disentangling India’s Investment Slowdown’ does not think so. The report states that interest rates are not as closely linked to the growth cycle, as is the perception. And that you can Click here to read the report in full.

Like after delivering two rate cuts the RBI Governor has now put the onus on the banks. To use golfing terminology, Rajan has hit the golf ball a long way. And now he will take his own sweet time to walk across and see where the ball has landed before he makes any further cuts.

Like in the QE driven world, active managers have performed miserably. The reason is that all stocks have risen in unison. The dispersion of stock returns – the extent to which returns vary from one stock to another has fallen to alarmingly low levels. In the investing world, the lower the dispersion, the harder it is to choose winners. And that as long as dispersion remains at abysmally low levels, it will be extremely difficult to pick winners in 2015.

Like in the run up to the earnings season, market expectations have always been downright bearish. After the season concludes, the market starts going up on the justification that results were better than expectations. And that whatever I see as wrong with this market, it isn’t related to earnings.

Like Shell’s £55 billion dollar bid for BG last week ranks as the ninth biggest mega deal of all time. And that mega deals always happen when world markets are trading at crazy multiples.

And this final point of view:

Like for those of you who have managed to preserve their sanity and stay away from this mad market, there is a word of advice in the book.

“But I don’t want to go among mad people,” Alice remarked.

“Oh, you can’t help that,” said the Cat: “we’re all mad here. I’m mad. You’re mad.”

“How do you know I’m mad?” said Alice.

“You must be,” said the Cat, “or you wouldn’t have come here.”

And that this mad market will continue to trend higher till these folk, who are clinging on to their sanity, run out of another virtue called patience.

Extreme thinking!

Brilliant!

I think this is your best article to date…

And all this while being in the thick of things in tbe Mad Mad World!

BTW

who/where is the Queen of Hearts and the Mad Hatter?

cheers!

Thanks, Jayant. Queen of hearts – rather stay away from her, lest she chops my head off! Mad Hatter – aren’t we all, in our own way!

like!

Thanks Shailesh