And, for a Monday morning, a few stray thoughts and a few general observations and a few points of view:

Like the Indian Stock Market has been in a tailspin since the demonetisation of high-value currency notes was announced by the Prime Minister on the 8th of November 2016. Bulls got punched in the mouth twice, once as a result of the demonetisation and again as Emerging Markets (EM’s) cratered in response to Donald Trump election as the next President of the United States of America. And that when one gets punched in the mouth twice in quick succession, it hurts.

Like the fact remains that there is no certainty when investing in stocks. We can only look at the past and try and draw correlations. I decided to search for precedents to the demonetisation move and found that something similar had taken place in the year 1978. However, our stock market was in the Stone Age in those days. In terms of size, it seems that the current move has no precedents – globally. And since the scale of the demonetisation is unprecedented, it means that there is no there-there.

Like, in my opinion, it is extremely hazardous to voice an opinion on something that has no precedents. We already have a surfeit of noise on what demonetisation means for the future of the Indian economy. Most commentators seem to be mixing politics, the stock market, and the economy. Not only is that a toxic mix, I think it is entirely avoidable. Moreover, voicing views on demonetisation involve making a macroeconomic forecast. And that I am reluctant to prognosticating anything that can be interpreted as a macroeconomic forecast.

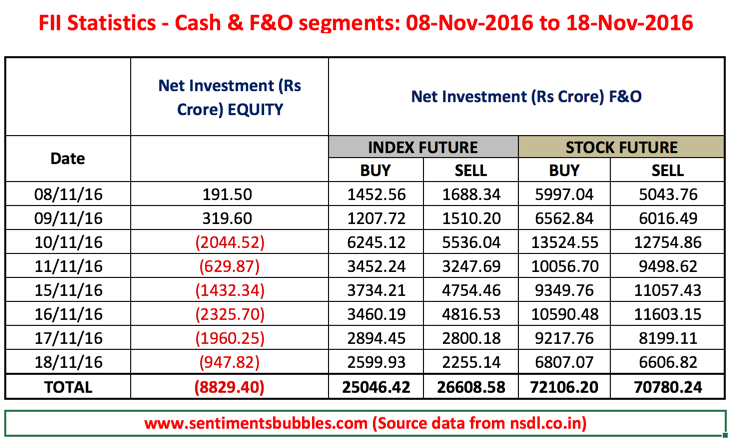

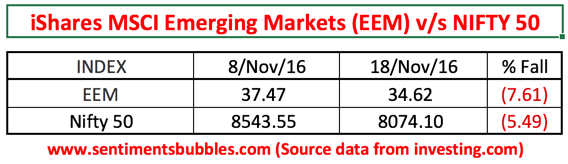

Like Foreign Institutional Investors (FII’s) voted with their feet, driving the benchmark Nifty 50 Index down from 8543.55 on 08 November 2016 to 8074.10 on 18 November 2016. And that since FII money runs the Indian Stock Market, what they think of the demonetisation move is all that matters.

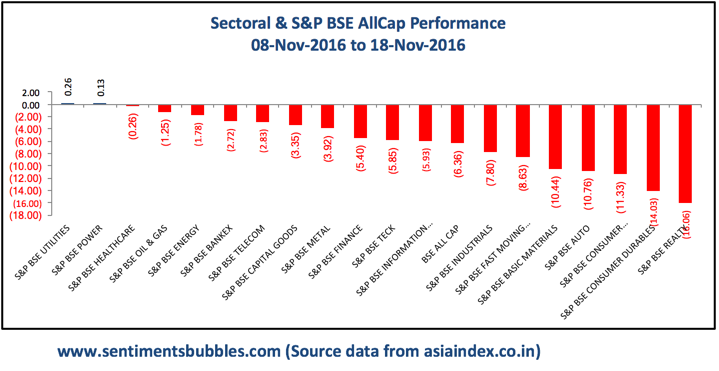

Like I am trying to find a reason for the FII selling; was it due to the demonetisation or was it due to something else? The demonetisation move was announced on 08th November 2016 after markets closed. FII’s started selling on 10th November 2016 and not before that. In fact, they were buyers on 09th November 2016. And that the selling was across the board (indiscriminate) and there was no place to hide.

Like Developed Markets (DM’s) recovered smartly after Donald Trump nomination as the 45th President of the United States. At the same time, Emerging Markets (EM’s) went into a tailspin. It seems that Donald Trump’s Presidency will lead to higher growth and higher inflation (reflation) in the developed world. And that the reflation trade is being referred to as Trumpflation.

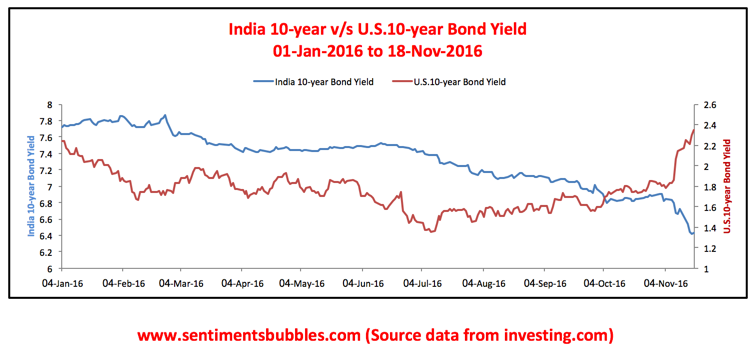

Like expectations of a global tightening of monetary policy soared almost overnight. Nobody is talking about easing and negative rates anymore. Trumpflation rattled bond markets and led to a massive spike in global bond yields. The yields on the ten-year India Government Bond bucked the global trend and continued to head south. And the fact that Indian Bond Yields diverged from the global trend is bullish.

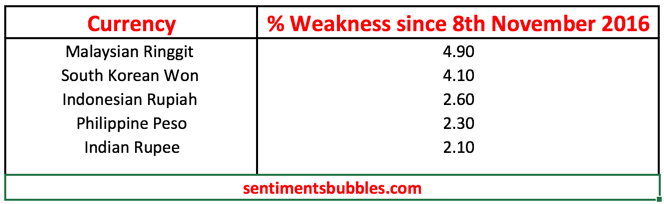

Like the impact of Trumpflation was felt in the currency markets as well. Asian currencies were weak across the board. And that the J.P.Morgan Emerging Markets FX Index nosedived.

(Image Courtesy ft.com)

Like what changed almost overnight was perceptions about the global economy and nothing else. It resulted in an almost simultaneous realignment in world currency, equity and bond markets. Asian currencies, in particular, took it on the chin. And that in relative terms, the Indian Rupee (INR) has been the strongest Asian currency in this latest Trump Tantrum.

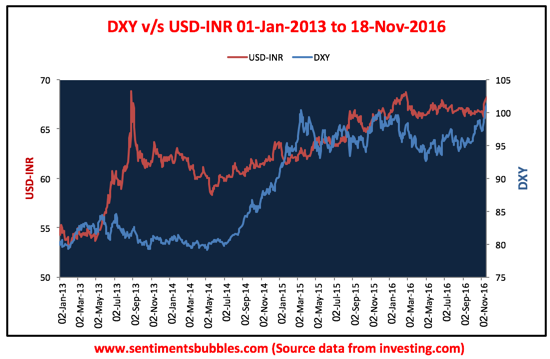

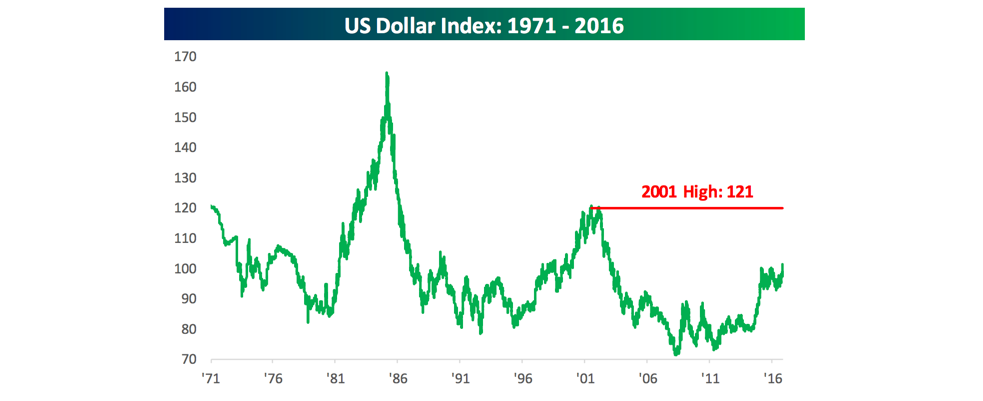

Like the hegemony of the U.S, Dollar in currency markets is a given. As a result, currency parity is always expressed in comparison with the Dollar Index (DXY). When the DXY moves up (strengthens), the INR weakens. When the INR weakens, Indian Equities almost invariably trend lower. The DXY has been making new highs on virtually every trading day of the last week. It has pushed the U.S. Dollar Index (DXY) to a fourteen year high. In my opinion, the INR has held up pretty well; it has yet to breach its All-Time Low of 68.85 (28 August 2013). And that historically currency tantrums have been one of the best buying opportunities for Indian Equity investors.

Like the iShares MSCI Emerging Markets Exchange-traded fund (EEM), has fallen 7.61 percent since the results of the U.S. Presidential Election. The Indian Stock Market has outperformed the EEM since 8th November 2016 and till date. The fact of the matter is that money has moved from EM’s in Asia into Japanese equities. And that the shift in favour of Japanese Equities as against Asian equities is in no way correlated with the demonetisation of high-value currency in India.

Like the fact that the Indian fixed income market represented by the ten-year India Government Bond Yield, has diverged is a clear indication that the markets expect interest rates in India to trend lower in the intermediate term. And that India is the only Emerging Market where interest rates are projected to trend lower in the days to come.

Like It is pretty apparent from all of the above that the meltdown in Indian Equities over the last fortnight has been more a function of a sell-off in Emerging Markets than anything to do with the demonetisation of currency notes. In fact, the demonetisation has been a blessing in disguise for Indian Equities. And that, things would have been a lot worse had it not been for the demonetisation.

Like that still leaves us with questions as to what to expect in the immediate term. In my opinion, all eyes are on the U.S. Dollar Index (DXY). The DXY is currently trading a shade above 101 and is at a fourteen year high. It seems that higher interest rates in the US will attract foreign capital to the United States. In anticipation of such moves, the DXY has gained strength and is expected to move higher. If that happens, the INR will crater, and Indian Equities will crumble. The threat is very real. But such moves in currency markets or in any market for that matter, don’t happen overnight. Almost always, markets tend to pullback before moving higher. The dollar index is expected to correct and that ought to bring about a relief rally in Emerging Markets. And that since Sentiments & Bubbles is a blog about the Indian Stock Market, my views may be biased.

Like we as investors should stop being obsessive about the effects of demonetisation. In spite of the fact that human beings are not known for their forecasting skills, a multitude of opinions on the consequences of demonetisation has already been expressed. In all of these, there is unanimity on the fact that the demonetisation will be deflationary and that it will slow India’s economic growth. I firmly believe that ‘nobody knows anything.’ And that investing is very counter-intuitive; things on which everyone agrees often turn out to be wrong.

Like a lot is said about markets not liking uncertainty and how markets tend to move sideways or lower whenever things are uncertain. To be fair, I too have subscribed to this view in the past. I have since revisited this thesis. When are things certain in markets? Almost never. In spite of this, we find this uncertainty angle being peddled and in my opinion, its blasphemy. And for all those of you who are waiting to invest when things get more certain, I have a final thought: Are you feeling more certain than you were a fortnight back?

As a remember your financial philosophy from early days in shree investments when you travelled Mumbai Pune and I stamped the share transfer forms; you always insisted on bank transactions and never really supported cash transactions. However from the above article I don’t get a sense that this move has really enthused you… though the above article is more independent and not a take on the demonetization. I would still like to know your take.. in short will it be good for Indian economy ….?

You are right; I was always against cash. The current move by the government doesn’t address the underlying problem; the reason is that it can’t. No one can change morals; if the population is keen on generating unaccounted currency, that is what will eventually happen. Unaccounted money is a worldwide problem, not unique to India. We have never purged it in this manner. Hence, the commotion and noise. I don’t think it is as big a deal as it is being made out to be. An Indian citizen can EFFORTLESSLY and SEAMLESSLY switch to plastic in a matter of hours. If there is a will, there is a way!And yes if people do switch to plastic it will be GREAT, not GOOD for the Indian economy.

In my opinion, implementation is the the key. In a college practical exam the student whose experimental data matches the best with theoretical data gets the highest marks. Here it is pretty much clear that the RBI hasn’t done its home work well when it comes to actual implementation. This will cause the overall effect of this project to be a negative. To make matters worse trumpflation will not help developing economies either.

Also it will kill small scale industry in the short run and people will lose jobs. All this talk of money coming into the RBI and then lending it to create new jobs if it happens, in reality will be a zero sum as the people who lost jobs in the first place will get these.

This off course doesn’t target the big fish and all it does is destroys short term stocks of black which were waiting on launch pads to be converted to white. It looks like it has been more a case of carpet bombing than surgical strike which it was made out to be. Pardon me for using the military lingo but it seems that is in nowadays and the best way to drive home one should point.

However in the distant future as money has no color and no race the share market would have anyways gone north irrespective of this move.

Implementation is the key – correct, but I think it is early days to jump to conclusions. How things pan out after bank withdrawals freely are permitted from 01 January 2017, ought to decide what happens. I like the military lingo! The stock market is irrational; nobody has ever made any sense out of short-term movements. Everyone (I included) is reacting to the price action. In other words, all this analysis is an after-thought, that’s always the case.

I am not qualified to make any comments on such a complicated issue. All I know or feel is that all this exercise is not worth it in terms of cost/benefit ratio. As of now costs seem to far outweigh the benefits.

You are not alone when you say that it is a complicated issue. The difference is that other are not as candid. Once the FII’s start buying no one will talk about demonetisation for a long time to come.

I would imagine over all long term effect of demonetization would be good for Indian equity markets., if Indian psyche would be deflected from real estate and gold, however, traditionally, as far as I know black market money finds its way to “opaque Ponzi schemes” such as real estate and god jewelry business. World wide people are trying to lower the taxes as much as possible to stimulate the economy, in reality a black market is essentially “0 tax,” which should be great to economy in theory, but in reality now demonetization message is clear………………………………..hand over the loot of efficient, creative, hardworking (but dishonest) black marketers to the inefficient corrupt government and its burearocrats in bribes, fees, licenses, registration fees, octroi, local taxes, income tax, estate duty, etc., and to reward lucrative govt., contracts to cronies, hire redundant non productive work force, and buy expensive useless military toys…etc.

True. Nobody can improve morality. The fact remains that the human mind is ingenious and people will find ways to circumvent the system. But in the long-term, as more and more of the population becomes tax compliant the benefits are obvious. Yes, the participation in Indian Equities ought to go up in the days to come, there is no other avenue.