I think the image above correctly describes the ethos in the minds of the Indian Mutual Fund Investor. Practically everyone now uses a Systematic Investment Plan (SIP) for investing in the Indian Stock Market.

A Systematic Investment Plan (SIP) as an investing strategy has stood the test of time, and its efficacy is beyond doubt. However, I wish to highlight the fact that the asset class that is chosen is far more important than the strategy. It is the underlying asset class that is critical to the returns process. If the underlying asset class fails to deliver, the method used wouldn’t matter. Among asset classes, investors have a choice; they can either invest in an Actively Managed Fund, or they can invest in an Index Fund. I’ll come to the Active v/s Index Fund debate in just a bit. First, let’s take a look at what the returns from a SIP in an Index Fund would look like. It is shown below:

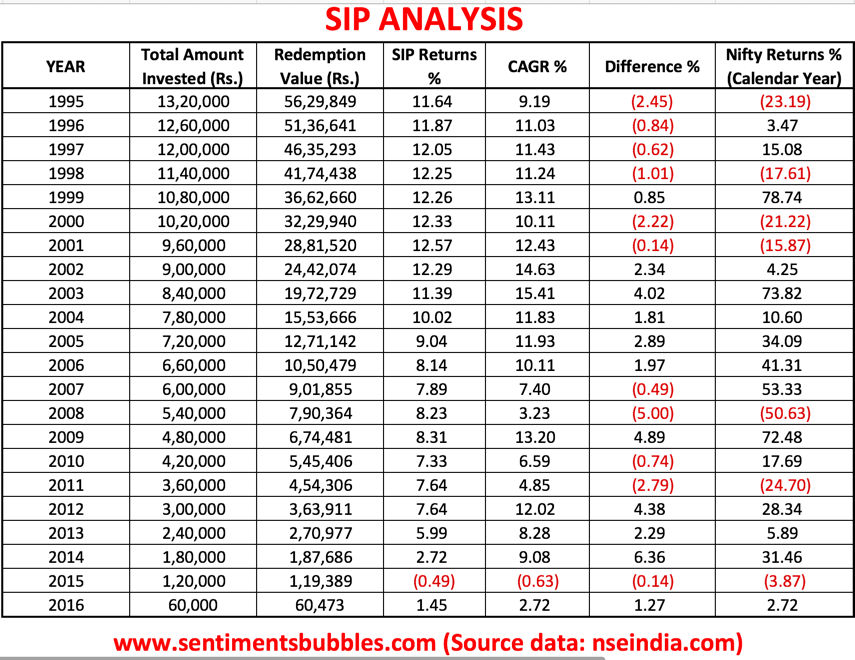

What I did was to compute the returns from a Systematic Investment Plan (SIP) of Rs. 5000 per month using the Nifty 50 (Index Fund). The period considered is from 01 January 1995 till 01 January 2017. For the sake of the calculation, I have assumed that the monthly contribution is Rs 5000. While trying to make sense of the number above, the following might help:

- In the first column, I have shown the calendar year. The second column shows the total amount invested over the entire SIP period. The third column shows the terminal or redemption value of the SIP.

- For example, in the first row, since Rs. 5000 is invested on 01 January 1995 and every month after that. The total amount so invested would be Rs. 13,20,000 (5000 x 264 months). When the SIP is terminated on 01 January 2017, the redemption value would be Rs. 56,29,849.

- If an investor had started the SIP on 01 January 1996, the total amount invested would be Rs. 12,60,000 and the redemption value would be Rs. 51,36,641. It is shown in the second row. The rest of the rows follow the same pattern.

- The fourth column shows the SIP returns. The SIP under consideration has a monthly rest. I have factored this into my calculations. (I have used the XIRR function in Excel to arrive at these numbers. You can call it the internal rate of return). So our hypothetical investor who starts a SIP on 01 January 1995 and terminates it on 1 January 2017, would have compounded his money at 11.64 percent per annum over twenty-two years. Similarly for the other rows.

- The fifth column shows the Compounded Annual Growth Rate (CAGR) of the Nifty from each year till date. While calculating the CAGR, I have assumed that a lump sum of Rs. 13,20,000 is invested on 01 January 1995 and redeemed on 1 January 2017. In such a scenario, the investor would have compounded his money at 9.19 percent per annum. I am aware that practically nobody invests in such a manner. I am using the column as a comparison metric – to gain some perspective.

- The sixth column shows the difference between a SIP investor and a lump sum investor. In the first row, investing in a SIP on 01 January 1995 turned out to be profitable as compared to investing a lump sum. The excess returns were 2.45 percent over the entire period of the investment. Similarly for all the other rows.

- The seventh column shows calendar year returns of the Nifty for each year from 1995 till 2016. Any comparison between CAGR returns, Calendar Year returns and SIP returns is not justified since the periodicity and mode of investment differ materially. These two columns (sixth and seventh) might be useful for those of you who want to try to time the market.

From the table above it is easy to infer that:

- If you are looking for a date to start a SIP, it is clear that the starting date doesn’t matter. If I were to change the dates from the first day of the month to the fifteenth day of the month, returns would vary. In the ultimate analysis, it wouldn’t matter.

- What does matter is the period? SIP’s are a long-term commitment. An investor who started a SIP at the top of the last bull market (January 2008) and held on, still ended up compounding his money at 8.23 percent. In other words, trying to use valuation as a timing tool is practically useless. Just shows the random nature of the stock market and the benefit of ‘staying the course.’

- In reality, investor returns would be a shade lower since the Index fund would have an Expense Ratio and a Tracking Error. Effectively, an Index Fund investor would earn roughly half a percent less than what is shown above.

Active Funds v/s Index Funds

This post is not an attempt on my part to denigrate Active Fund Management. Just because an ideology (Active Funds) has been disingenuously used, it doesn’t mean that it should be dismissed altogether. However, in the Indian Stock Market, very few invest in an Index Fund. In fact, many investors are unaware of the fact that they can invest in an Index Fund. I find both of these facts to be shocking. There are many myths about Index Investing. I have tried to debunk these myths. My thoughts:

- The foremost criticism against investing in an Index Fund is that an Actively Managed Fund delivers superior returns as compared to an Index fund. The reason is that Active Funds have outperformed Index Funds in the recent past. The reality is a bit nuanced. An analysis of the historical data (like the one shown in the table above) in the case of Active Funds cannot be done for the simple reason that Active Funds haven’t been around for that long. There are very few funds that have been in existence for more than ten years. In other words, there is a clear paucity of available data. In such a scenario, is it fair to pass judgment?

- There is no denying the fact that some of the popular Active Funds have generated ‘Alpha’ in the recent past. How can one be so sure that they will continue to do so in the future? Alpha is defined as the excess returns of the fund relative to the benchmark. Is “Alpha’ shrinking? Ambit Capital Private Limited is one of the leading research-oriented intermediaries in India. They think that Alpha in the Indian Stock Market is indeed shrinking. Click The Alpha Squeeze in Indian Large Caps to read their report.

- In a broad sense, investing in stocks is a function of two factors: skill and luck. In the stock market luck has a greater role to play than skill. Lady Fortuna is something that we have no control over. Let us concentrate on skill instead.

- Benjamin Graham has famously said that in the short-term the stock market acts like a voting machine and in the long-term like a weighing machine. Why does the stock market act like a voting machine in the short-term? The reason is that the opinions of the participants (about the economy, currency, company) keep changing very fast resulting in volatility. Predicting short-term direction consistently and correctly is impossible. In the long-term, better sense prevails.

- The random nature of the stock market returns ensures that in the short-term luck plays a far greater role than skill. However, in the long-term, it is the skill that matters more than luck. Since SIP’s are a long-term commitment, investing in an Active Fund translates into a bet on the skill of the Fund Manager. I have no doubt in my mind that many active managers in the Indian Stock Market are extremely skilled and competent. The problem is that we don’t know who they are and which funds they run. A long-term SIP investor in an Index Fund doesn’t have to bother about the skill of the manager or the volatility in the Index; for him or her, ignorance is bliss. It really is!

- The fact that an Index Fund is a diversified Active Fund seems to be lost on investors. An Index Fund is just less Active as I have highlighted here. An Index Fund does not have a money manager. In fact, there is no managing that has to be done. Ergo, Index Funds cost less than Active Funds.

Conclusion

The fact remains that the performance of an Active Fund depends almost entirely upon the skill of the money manager. How many of us have bothered to find out who that person is? How many of us have read the prospectus of the fund we are going to invest in and tried to analyze the skills of the Fund Manager? Very few of us do that. It does appear to me that in the current scenario, investing in a SIP with an Active Fund is an act of faith, a leap in the dark. Happy investing.

I believe any kind of funds are for people who have money but no time. Personally, I do not touch any fund with a barge pole. If you spend some quality time and use common sense, you can invest directly and get good returns from the stock markets. At least, that is my personal opinion.

You have a choice. However, the majority of the investors are using the SIP mode.

In actively traded funds — if u r going thru distributor u pay additonal charges — advisory fees or higher brok which will add to ur TER and trail commission of 0.5 %

Thnks IDFC is one of the lowest cost fund house and my entire MF exposure is in Ultra Short term fund and ELSS of IDFC MF thnks

Correct, lower the cost the better, I suppose. It seems fees matter more than the asset, according to this book: Global Asset Allocation: A survey of the Worlds Top Asset Allocation Strategies by Meb Faber

Very nice post! Hypothetically, if you compare present value of investment (in SIP and lump sum investment of 13.20 lakhs in above example), PV of 13.20 lakhs will be higher than PV of SIP. I understand you have not considered PV to avoid complexity of calculation in the above example but if we consider PVs, returns of SIP will be even better.

Got that. Took a while to understand what you were saying, but yes, considering PV, SIP is even better. thanks for pointing that out. I probably missed that.

ETF is very mundane and non glamorous product — U wont be called in for Star Fund Manager’s conference calls — or meetings of Prashant Jain or Mdhu Kela ( in fact u dont need the stars to manage ur investment which actually removes thrill — Ecstasy thts on table from actively managed funds stable leave alone the wild west life of direct equity investors — ???

I agree, very boring. And yes, no invites for conferences and everything else. But I always thought that investors were interested in returns. For excitement, there are better options. Come to think of it, now that you mention it, directly investing is pretty exciting.

HNIs ( 10 cr + ) investible amount category are not after returns they are cocktail party investors !! they do it for moving and being seen in right circles and are willing to forego returns for the same —

Forget HNI’s they have more money coming in the pipeline, so it doesn’t matter!

There are 3/4 other inputs which may be taken into consideration.

One ratio of is expense ratio ETFs may have .02-03% TER and Active funds may have 2.25-2.3 %

this part compounded over 21 years will be huge — if compared to successful MF schemes say Reliance growth — In addition to this advisory fees are additional say 0.5 % of trail and 0.5 % of advisory ?? ??

Second is dividend pay out by ETFs — if same is reinvested in ETF immediately – the return will be accretive

Third — The simplicity of ETFs works against them as people have strong belief tht simple things can not be effective or efficient than complex products — the monitoring — advisory expenses — hassles —

Fourth may be benchmarking ETFs with fixed income products with Tax implications — ??

Index Funds are different and Index Fund ETF’s are a different product. I think that everything that you pointed out about ETF’s is correct. ETF’s have a problem, they are traded on the exchanges and if one adds the brokerage and spread, they prove to be costlier than pure Index Funds. You can see the link for pure Index here (https://www.fundsindia.com/products/mutual-fund/category/Equity-Index-funds?ccode=13). Notice that the TER is .25 percent for IDFC and then slightly higher for the others. Reliance takes the case, I wonder why their TER (Total Expense Ratio) is .85? That is a prohibitively high percentage. Apart from the .25 percent for IDFC, the investor bears no cost, I am sure about that. In other words, he or she owns the market and pays an Expense Ratio of .25 percent and a small Tracking Error. In my opinion, it doesn’t get any better than this. For Active Funds, Expense Ratios are in the region of 2.25 to 2.40 percent. So 2.25 percent on a 100 crore AUM and 2.25 percent on a 1000 crore AUM – doesn’t make any sense. Unfortunately, that is the way it is!