(Cartoonist: Doug Pike; cartoonstock.com)(Sunday, 22 May 2016)

How does one select a Mutual Fund Scheme to invest? The current practice is that investors just buy what is sold to them. Surely, that cannot be the best way of benefitting from mutual fund investing.

How to Select a Mutual Fund Scheme?

There are many metrics to consider before one can allocate money to a Mutual Fund Scheme. I have highlighted just two of them.

(A) Does the Manager of the Mutual Fund Scheme eat his or her cooking?

I think it is imperative that a Mutual Fund manager should invest in the scheme that he or she manages. Why? Manager ownership shows conviction in the product that is being sold and adds to accountability. Indirectly, it enhances fund performance. It highlights the fact that the fund manager has got his or her ‘skin in the game’ and that fund managers are willing to put their personal money where their mouth is.

The Securities and Exchange Board of India (SEBI) issued a circular dated 18 March 2016, titled ‘Circular on Mutual Funds‘. Under the sub-heading ‘Enhancing Scheme Related Disclosures’, SEBI now mandates the following:

Further, the following additional disclosures shall be provided in SID of the MF scheme: a. The aggregate investment in the scheme under the following categories:

AMC’s Board of Directors

Concerned scheme’s Fund Manager(s) and

Other key managerial personnel

As is evident from the above, SEBI now wants the Scheme Information Document (SID) to state explicitly the extent of investment made by the fund manager and others in the Mutual Fund Scheme. I think that the SEBI action highlighted above deserves to be applauded. The reasons are:

- Turning the question on its head, why wouldn’t a manager want to own the fund that he or she manages? I can think of only one reason. He or she is financially constrained OR has commitments elsewhere. I’ll treat this as the exception, not the rule. In all other cases, I think fund managers must ‘walk the talk.’

- Manager ownership ensures that the financial fortunes of the unit holder and the fund manager are aligned. They move in lockstep with each other. If the fund manager does something dumb, unitholders may derive solace from the fact that their financial suffering is proportional to that of their fund manager. As a result, fund managers would be forced to use unitholder money just as they would use their own. A commitment by a fund manager in a Mutual Fund Scheme shows that the fund manager shares the trials and tribulations that other unitholders will, and to which the fund manager subjects them, inadvertently or otherwise.

- How much weight should fund manager ownership be given while selecting a Mutual Fund Scheme? There is no fixed desirable percentage. Manager ownership is, in my opinion, one of the important metrics to consider while selecting a Mutual Fund Scheme.

(B) What about recently outperforming Mutual Fund Schemes?

One of the most popular criteria for fund selection is to look at the Mutual Fund Schemes that have recently outperformed. Investors tend to prefer Mutual Fund Schemes that boast of high recent outperformance metrics. A research paper dated 25 February 2016 and authored by Bradford Cornell, Jason Hsu and David Nanigian, is appropriately titled The Harm in Selecting Funds That Have Recently Outperformed.

Interested readers may click on the link and read the entire paper. I’ll just stick to the highlights. The conclusions arrived at in the research paper are:

- Over a three-year period, investment returns of investors who chose funds with poor recent performance were superior to those investors who chose funds with excellent past performance. The difference in the returns between loser funds and winner funds is significant enough to merit consideration.

- In a nutshell, the paper states that ‘the last will be first, and the first will be last’. The paper highlights the fact that Mutual Fund Scheme performance mean reverts over a period of three years. As a result, investing money in recently outperforming Mutual Fund Schemes is not recommended.

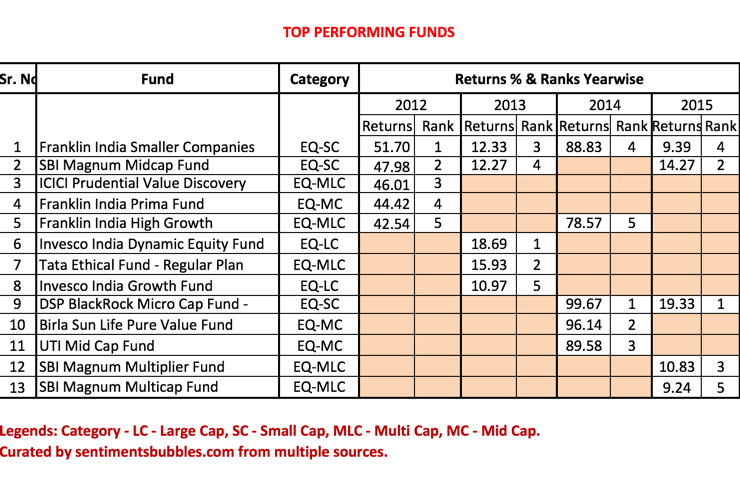

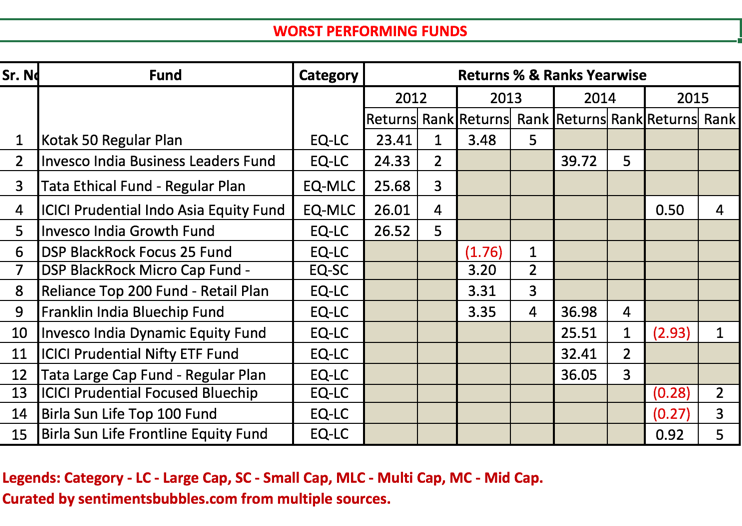

As is my habit, I did an empirical analysis. In the table below, I have ranked the performance of the top five (winner) and bottom five (loser) Mutual Fund Schemes for the calendar years 2012, 2013, 2014 and 2015. The selection criteria is as follows:

- Regular plans for four and five-star rated funds are considered.

- I have merged the different categories like Large Cap, Small Cap, Multi-Cap, etc. The reason is that the name of the fund has little relevance to its components. Since fund management and stock selection is unconstrained, I don’t see the appropriateness of the existing categorisation.

- Needless to say, any change in the selection metric will give an entirely different set of results! Hence, investors may treat the analysis as illustrative and not conclusive.

As part of my working, I expanded the analysis to the top ten performing funds instead of the top five. That spreadsheet is too large to present. However, I think that broadly, what the research paper states is correct.

I should hasten to add that the Mutual Fund Scheme returns shown on different websites and portals vary. At times, the difference is ‘material’. Trying to splice and dice the data is far from easy. The number of permutations and combinations make the task challenging. In such a scenario, I think that the best source for investors is Morningstar India. As more and more investors embrace the Mutual Fund route (and rightly so), I think that Morningstar India is the ‘go to’ source for mutual fund investing in India.

Active v/s Passive Mutual Fund Schemes

The ultimate investment objective is to earn returns that are commensurate with those of the benchmark. Investors have a choice. They may opt for an actively managed Mutual Fund Scheme or a passively managed Mutual Fund Scheme. For the uninitiated, a word on active and passive fund management:

- Actively managed funds are the ones whose composition varies from that of its benchmark. The idea is to outperform – deliver returns that exceed the stated benchmark. Investors who desire to opt for active funds have to be a bit more discerning as compared to their passive counterparts.

- Passively managed funds are those that mimic the benchmark. Returns of passively managed funds trail those of the benchmark that they track. The difference in returns is not material and can safely be ignored. Passively managed funds can never outperform their stated benchmarks. However, consistency of returns is a given. Passive investors need to invest in passive funds that are benchmarked to the Nifty 500 index. The reason is that the Nifty 500 Index covers 94 percent of the free float market capitalisation of stocks listed on the NSE. The Goldman Sachs CNX 500 Fund is tailored in exactly this fashion and fits the bill perfectly. The difference between returns of the Goldman Sachs CNX 500 fund and its stated benchmark are just 0.17 percent on an annualised basis.

While researching the actively managed Mutual Fund Schemes, I realised that there is a dearth of available research. As a result, confusion reigns, and arriving at a definite conclusion as to which Mutual Fund Scheme to select is a daunting task. Consider for a moment that we have roughly 1859 actively managed Mutual Fund Schemes under the ‘Growth’ category. (Growth would mean pure equity schemes). As compared to this, there are just 1500 actively traded stocks on the National Stock Exchange of India (NSE). In other words, trying to find an actively managed Mutual Fund Scheme that is likely to beat the benchmark, is like finding a needle in a haystack.

This conundrum that investors face between actively managed and passively managed funds is not new. John C Bogle has addressed it in his seminal book Common Sense on Mutual Funds. I think that this book is a must-read for every mutual fund investor in India. According to him, trying to pick an actively managed Mutual Fund Scheme is a mistake an investor should not make. He preaches the passive format. To paraphrase John C Bogle; “Don’t look for the needle in the haystack. Just buy the haystack!”

I hate mutual funds!