(Cartoonist: Grizelda; Cartoonstock.com)(Sunday, 28 February 2016)

After a torrid start to the month, global equities bounced back. However, Indian equities did not participate. The reason: Public Sector Banks in particular and the banking sector, in general, proved to be a drag on the benchmark.

Operation Clean-Up in Public Sector Banks

According to guidelines issued by the Reserve Bank of India (RBI), India’s Public Sector Banks (PSB) are in the process of recognizing non-performing loans by the end of March. It has resulted in 12 out of 27 public sector banks reporting losses in their quarterly numbers for December 2015. The fears are as follows:

- The capital of Public Sector Banks has got eroded. How is the Indian government going to cough up the funds that are required to recapitalize the public sector banks?

-

The Indian government has said that the public sector banks need 1.8 trillion rupees of capital infusion by March 2019. Goldman Sachs, the reputed international investment bank disagrees. According to Goldman, the public sector banks require 3.2 trillion rupees of capital, seventy-seven percent more than what the government thinks the banks need.

-

In other words, Goldman is bearish on Indian banks. Goldman feels that Indian banks have 12.3 trillion rupees of stressed loans or 16.5 percent of the total, well above the 11.3 percent banks are willing to admit right now.

-

According to Goldman, bad loans will have a disastrous effect on future earnings of the Public Sector Banks. In their opinion, the clean-up will result in an erosion of four years of State Bank of India‘s earnings, five years of Bank of Baroda‘s earnings, and fourteen years of Punjab National Bank‘s earnings!

Effectively, this is the view of most of the Foreign Institutional Investors (FII’s). FII’s think that India’s Public Sector Banks are a lot more stressed than they had initially thought. In any case, FII’s have always shied away from investing in the Indian Public Sector Banks. What the RBI has done ought to change their outlook. Apparently, this has not happened.

Goldman v/s Rajan

Goldman is one of the best investment banks in the world, if not the very best. I have not read the Goldman research report. I tried to get hold of it; I couldn’t. All of the above information is from media reports. Despite this, it is apparent that Goldman has made a macroeconomic forecast. One doesn’t know the assumptions that Goldman has made while making this forecast. In any macroeconomic analysis, the assumptions make all the difference. Warren Buffet has this to say about macroeconomic forecasting:

“The cemetery for seers has a huge section set aside for macro forecasters. We have in fact made few macro forecasts at Berkshire, and we have seldom seen others make them with sustained success.”

On 11 February 2016 Dr. Raghuram Rajan, Governor of the Reserve Bank of India, gave a speech at the Confederation of Indian Industry’s (CII) first Banking Summit, held in Mumbai.

The transcript of the speech is available on the website of the Reserve Bank of India. He has addressed the concerns raised by Goldman. He has also explained the rationale behind the clean-up. Media narratives of what Rajan has said are cherry-picked to fit the underlying story. It is always better to read what he has said, rather than what he is ‘reported to have said.’ In other words, this speech is from the ‘horse’s mouth’. Whatever may be your view of public sector banks in India, I think that this speech is must read. Click here to read.

Investors seem to forget that Raghuram Rajan is a bureaucrat, not a politician. He is addressing the CII, not an election rally. Moreover, this is what he was expected to do. In the end, it is a question of Goldman v/s Rajan. I am tempted to give Rajan the benefit of the doubt.

Is this a buying Opportunity?

A weak financial sector is the bane of any economy. Can the projected growth of the Indian economy be achieved without a commensurate growth in India’s Public Sector Banks? I don’t think that is possible. Hence, I believe that this is a buying opportunity for Public Sector Banks in India. My reasoning is as follows:

1. In the current scenario, the decision whether or not to invest in India’s beleaguered PSB sector would be a function of the following:

-

Can the Asset Quality Review (AQR) and the attendant clean-up of India’s Public Sector Banks be construed as a crisis? For those of you who construe the clean-up as a crisis, you ought to stay away from investing in the banking space altogether.

-

Can the clean-up develop into a crisis at a later stage? This is impossible to prognosticate. I think, most of the analysis is cynicism masquerading as wisdom. In any case, if you subscribe to this view, stay away.

-

Does the clean-up of India’s PSB’s augur well for future growth of the sector? I think it does. According to me, there is no crisis, and I don’t envisage one. Most of the fears articulated by Goldman are in the price. Investing in India’s beleaguered public sector banks is a long-term bet on the Indian economy.

2. For public sector banks in India, things ought to get better, not worse. I think that the worst is behind us and that the sell-off is done. A fall in price, under most circumstances, should lead to higher expected returns. In other words, at current prices, the risk-reward ratio for buying into the Public Sector Banks is favorable.

3. Has negative sentiment from NIRP (Negative Interest Rate Policy) in the developed world affected Goldman’s view of Indian public sector banks? I think it has. Goldman correctly reflects sentiment. Rajan, in his speech, reflects the reality. Investors need to be a bit discerning. Stocks always move on the gap between sentiment and reality. Rajan’s speech enables a reader to discern the gap between sentiment and reality.

4. Currently, the issue of capital adequacy of the public sector banks is hanging like a Damocles sword. I think Rajan’s speech has allayed fears. He has referred to the media reports as ‘scare-mongering.’

5. Historically, it has been shown that markets are wrong at the worst possible time. These have proved to be inflection points in the past. Buying at inflection points can improve long-term returns considerably. However, inflection points are visible only with the benefit of hindsight, not in real-time.

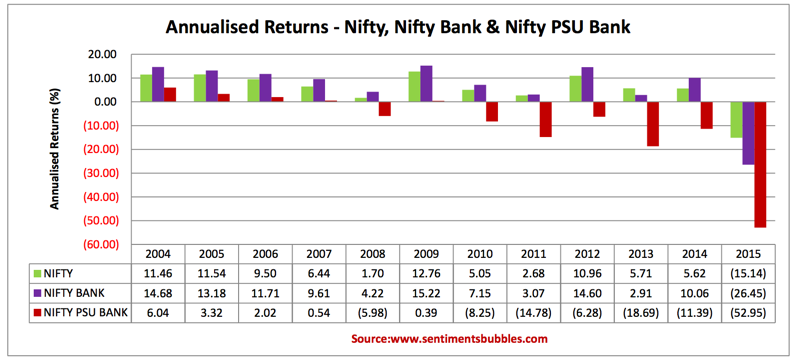

6. Is this Indian PSB’s ‘Lehman moment’? I think it is. Is there blood on the street? In my opinion, plenty of it, some of it are our own! ‘Blood on the Street’ looks like this:

7. Is it the job of a Central Banker to please markets? I don’t think so. Apparently the ‘Rajan Put’ does not exist. I think the last line of his speech, that says the ‘Government and RBI will do what it takes‘ sounds much better than Mario Draghi’s (President of the European Central Bank), ‘whatever it takes‘ rhetoric. Draghi seems arrogant; Rajan pragmatic. If FII’s can cheer Draghi, why not Rajan? My guess is, they will, in due course of time.

8. The question of ‘how to invest’ remains. In my opinion, the cheapest and most efficient way of investing in this sector is to buy the ETF (Exchange Traded Fund). There are two ETF’s

- The first one trades under the symbol PSUBNKBEES on the National Stock Exchange of India (NSE). This ETF mirrors the Nifty PSU Bank Index. It comprises solely of public sector banks. Click here to read the fact sheet.

- The second one trades under the symbol BANKBEES. It comprises of both, public and private sector banks. It is a play on the Indian banking sector as a whole. Click here to read the fact sheet.

What about the Budget?

Will the markets change direction after the Union Budget is presented? Nobody knows. My thoughts:

-

All of us want to buy low and sell high. In reality, we end up buying high and trying to sell even higher. There is a difference. Buy low and sell high would translate to buying when a correction is ongoing. Buying high and selling even higher would mean that we want to buy when the tide has turned, and an uptrend is firmly in place. No trying to catch ‘falling knives’, as they say. Good luck with all of that!

-

Market direction post-budget would be a function of the number of negative surprises in the budget announcements. One thing is for sure, expectations of negative shocks are high. If there are none, it ought to be construed as bullish.

-

Currently, there is a lot of debate about the short-term direction of the market. This dialogue from the movie ‘The Wolf of Wall Street’ is apt (emphasis is mine): “OK, first rule of Wall Street – nobody – and I don’t care if you’re Warren Buffett or Jimmy Buffett – nobody knows if a stock is going up, down or sideways, least of all stockbrokers. But we have to pretend we know.”