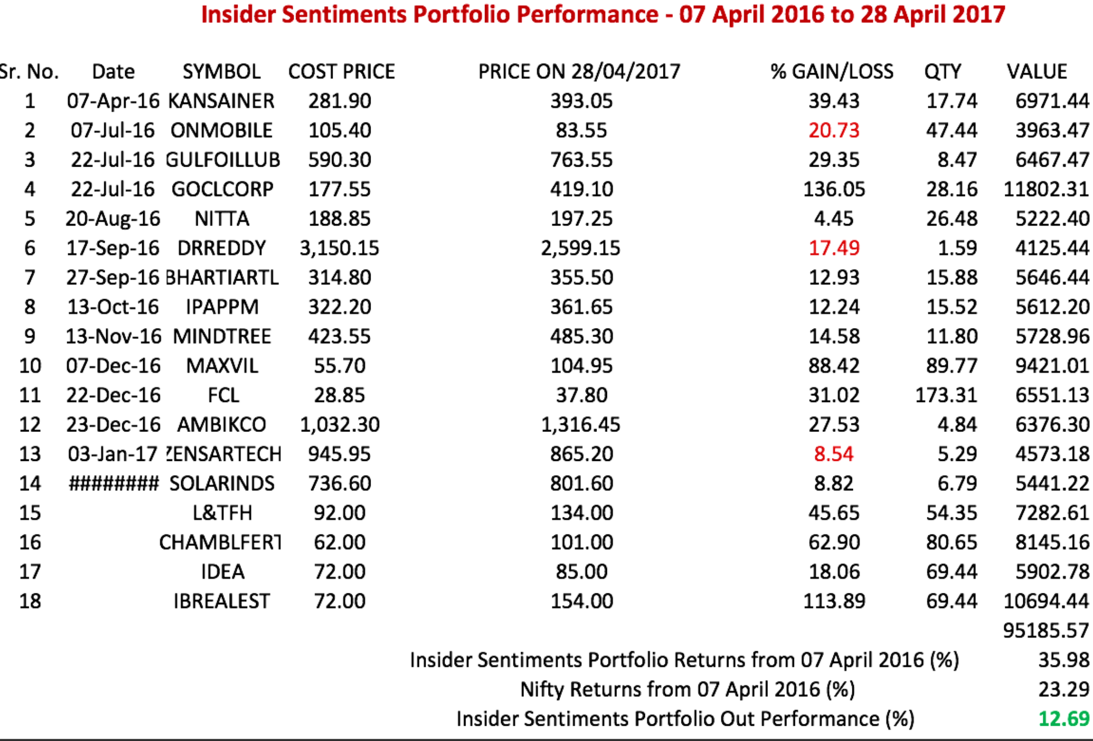

I have already published the Performance Statistics for Insider Sentiments for the last year. While calculating the returns and the outperformance, there is a caveat. Hence, I feel the need to update the statistics. In the image shown below, I have changed nothing. The dates and rates are all the same.

The difference between the image shown above and the one that was published earlier is that L&TFH, CHAMBLFERT, IDEA, and IBREALEST were missing in the earlier post. I need to do some explaining.

Since the last year was the first year for Insider Sentiments, I did dome word of mouth marketing and publicity. As part of the freebies, some recommendations were given away for free and no reports were published for the four stocks mentioned above. I had intentionally omitted these in the Performance Review that was sent last week. The reason I did not publish reports was singular, they were free recommendations, and I didn’t feel the need to post for the free stuff. I now realize that a set of investors who do not trade with Vimal & Sons remained in the dark about these four stocks. As luck would have it, two of the four FREE recommendations doubled from their recommended price. Hence, in the current year, I’ll be taking extra precautions by publishing reports for the free recommendations as well.

Of the recommended stocks, ONMOBILE, DRREDDY, and ZENSARTECH are in the red. Of these, ONMOBILE is a small and niche business; I think it makes sense just to wait. DRREDDY has surprised me the most; I’m waiting for their latest earnings announcement, and I’ll publish an update when necessary. In the case of ZENSARTECH, I wish to update investors as follows:

- The entire Information Technology (IT) sector is under a cloud (pun intended), and IT stocks have severely underperformed the Nifty. I think there is a lot of noise and very few signals in what is being reported by the mass media. Very often, one finds the same story being republished with a tiny change. The reason is that the facts haven’t changed and IT remains a sound business. There is no clarity on the Visa Regime that is likely to get enacted in the United States. If the changes are cosmetic, perceptions will change.

- The fear is the growth rate for IT stocks; what kind of growth will these stocks have in their businesses in the years ahead? In the current scenario, everyone seems to be convinced that IT is dead and that their businesses will not grow. Hence, the argument is that IT stocks should be shunned and ought to command a lower price earning multiple, given that India is a growth economy. I beg to differ. Almost all IT companies have issued guidance that their growth will be in the region of eight to ten percent per annum, which is not bad at all. The entire debate centers around classifying a stock as either a growth stock or a value stock. In my opinion, no such distinction exists. There is no such thing as a growth stock; only phases of low and high growth in every company’s life. The best part is that these phases are invisible in real-time; they can be identified with the benefit of hindsight, not otherwise. In other words, what the street is doing is forecasting outcomes, and we all know how accurate these are likely to be. The Mutual Fund managers, it seems (if the media is to be believed) have sold out of the IT space. I consider that to be bullish as well.

- There are two IT stocks in the Insider Sentiments portfolio. Of these, ZENSARTECH has given negative returns. The latest quarterly results were disappointing, but one-quarter doesn’t make or break a business. ZENSARTECH is a debt free company, and their business model differs from that of the traditional brick and mortar IT company like Infy or TCS. One keeps hearing of the word ‘digital’ and that IT stocks that have a ‘digital business’ would survive the downturn and emerge stronger. Since I am not an IT professional, I’ll link to two recently published articles that shed light on how ZENSARTECH is a digital IT company. These might be useful: Zensar Technologies: On the Digital Highway and We are committed to make Zensar a 100 percent digital company.

- In the period from 28 April to 2 May 2017, the Promoters of ZENSARTECH have bought another 31183 shares at an average price of Rs. 872 per share. According to me, that is bullish, and I think it makes sense to accumulate ZENSARTECH since it is has fallen roughly nine percent from its recommended price.