The obsession of the investing community with benchmarks has increased their importance. The Nifty 50 Index, disseminated by the National Stock Exchange of India (NSE) is the most popularly used benchmark for the Indian Stock Market.

Nifty as a Benchmark

The Nifty 50 benchmark index represents 65 percent of the float-adjusted market capitalisation of stocks that are traded on the National Stock Exchange of India (NSE). I think it is necessary to pay attention to index construction and maintenance for the following reasons:

- The rise of benchmarking has ensured that indices have become very powerful and a force to reckon with for almost all investors and money managers alike. Indices enable us to understand what drives returns in the stock market.

- With benchmarking being what it is, modifications in the benchmark inadvertently influence the flow of funds into specific stocks. Benchmarks are now far more robust than they used to be, they don’t just track markets, they lead them.

Benchmark composition does influence market prices. As a result, money managers don’t own a stock, they are either ‘overweight’ or ‘underweight’, as compared to the index to which they are benchmarked.

Nifty 50: Construction and Maintenance

Apart from being the most widely used benchmark, the Nifty 50 also forms the basis of India’s Index based derivative market. Hence it is critically important as a barometer of the Indian Stock Market. I did a deep dive into the methodology used for the construction of the Nifty 50 benchmark index. I’ll skip all the technical mumbo-jumbo. What we as investors need to know is stated below:

1. The base date for the Nifty 50 Index is 3rd November 1995, and the base value is set at 1000.

2. The selection of any stock for inclusion in the Nifty 50 benchmark index is based on the liquidity of the security in question.

3. The float-adjusted market capitalisation of stocks that meet the liquidity criteria is considered to filter available stocks. What do the words float-adjusted market capitalisation mean and what are the repercussions of such a methodology?

- Market value weights the Nifty, and the largest companies receive the greatest weight.

- Since indices are weighted by market capitalisation, the higher the market capitalisation, the more the number of investors and indexers that are attracted to it.

- The float adjustment mechanism works in such a way that, the higher the Promoter shareholding, the lower the weight in the index computation.

4. All listed securities are considered as eligible for the above process.

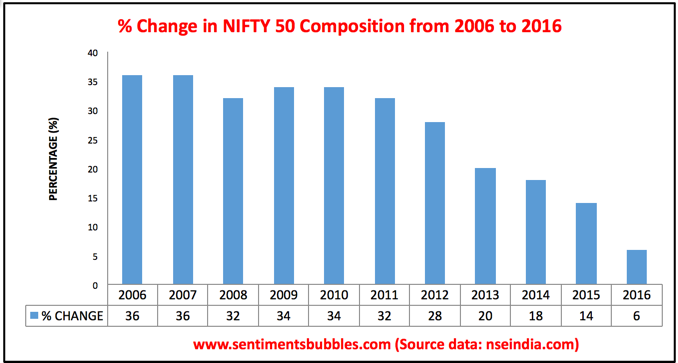

Index Review’s and Changes

The Nifty 50 index is reviewed semi-annually, and modifications are made in the index composition no more than twice a year. Most of us pay scant attention to the review process and the inclusions and exclusions that are made in the index. The image shows the effects of these changes.

This is what I have done:

- I have started off with the Nifty composition as on 01 January 2006. I have then adjusted this for the changes that are made in each calendar year.

- In this way, I have arrived at a Nifty composition for each calendar year from 2006 till date.

- I have then compared the Nifty compositions for each of the prior years with the Nifty composition as on 01 January 2017.

- The percentage change in the Nifty historical composition as compared to the Nifty composition as on 01 January 2017 is shown in the image above. For example, the Nifty as on 31 December 2006 has changed by thirty-six percent as compared with the current Nifty.

- Over time the changes are massive. In other words, the older the comparison metric, the more ‘material’ is the effect of the change.

So What?

It is apparent that the Nifty 50 is a moving target when used for benchmarking. Unfortunately, all global benchmarks suffer from this inherent flaw, and it is not the Nifty 50 alone. It does not mean the Nifty 50 is a flawed reference point. Benchmarks are man-made, they don’t form part of the scriptures. At the same time, the obsession with benchmarks is here to stay. We as investors can tweak the manner in which we use benchmarks. The following might help:

- For those who chose to invest in an Index Fund (passive investing strategy), it would be safe to say that there is no such thing as passive investing in its purest form. I would prefer to call index investing as less active, rather than passive. Should it matter? Not really, since the goal of an index investing strategy is to be the market; that doesn’t change. The fact that the Nifty 50 is a moving target has no effect on the long-term returns from an Index Fund.

- For the money manager, benchmarks are of paramount importance since they have to beat the benchmark to earn their keep. Just because the money managers have lashed themselves to the mast of stock market indices and benchmarks, does it mean that a do-it-yourself (DIY) investor also has to do the same? For the DIY investor, benchmarking serves no useful purpose.

-

Inclusions and exclusions in the benchmark composition are primarily based on the market capitalisation of the stocks. Inadvertently, stocks are added when their prices have reached an all-time high and removed when they hit major bottoms. Such modifications have a significant effect on the prices of the stocks that are so included or excluded. Both of the stocks shown in the image below were included/omitted with effect from 01 April 2016. How much of these price movements are related to business performance and how much of it is related to benchmark construction? Keep guessing!

- A benchmark is defined as: ‘a standard used as a point of reference against which things may be compared’. All comparisons with the performance of the Nifty 50 over periods exceeding ten years ought to be adjusted for changes in composition. I haven’t seen any such ‘adjusted comparisons’. Effectively, Nifty 50 as a moving target only helps those who wish to ‘lie with statistics’. Is there a way out? I think all comparisons must be made with the Nifty 500 Index. The Nifty 500 suffers from the same flaws as the Nifty 50, but the fact that it represents ninety-four percent of the float-adjusted market capitalisation of stocks that are traded on the National Stock Exchange of India (NSE) makes a world of difference.

Conclusion

Global markets have rallied. It seems that all of a sudden, the Japanese economy is reviving (thanks to Yen weakness), China has avoided a hard landing and the United States is the new China. What about the effects of demonetization on the Indian economy? It seems that there aren’t any. Just another case of the narrative transforming the insignificant into the significant. Goes to prove that, nobody knows anything.

The Union Budget will be presented in the next couple of days. In my opinion, the Union Budget is one massive exercise in forecasting. As with most forecasts, the budgetary announcements result in a lot of sound and fury, signifying nothing.