(Source: www.shutterstock.com/cartoonresource)

Market forecasts are defined as, ‘an attempt to predict the unknowable by measuring the irrelevant’. Forecasts inevitably reflect what is happening rather than what is likely to happen.

How accurate are Market Forecasts?

How many of us take the trouble to verify the accuracy of the forecasts at the end of the year? I had never attempted any such thing and decided to indulge myself.

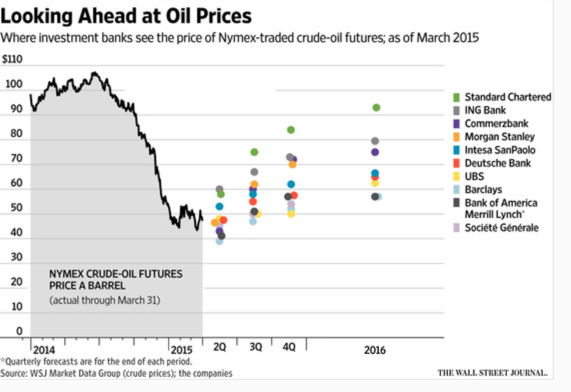

The image below shows the forecasts for WTI (West Texas Intermediate) Oil prices made by the world’s leading investment banks in March 2015. The image shows what forecasters thought the price of oil would be at the end of 2015.

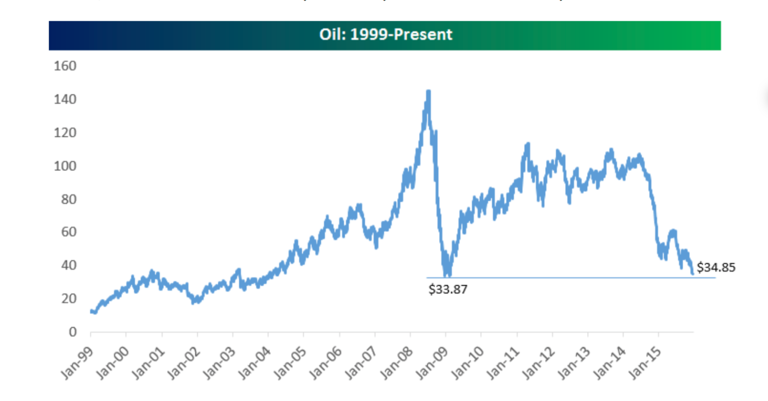

The picture for actual Oil prices as on date looks like this:

(Kind Courtesy: Bespoke Investment Group)

The forecasts shown in the first image were made after crude oil had made a bottom of U.S. $44.03 on March 18, 2015. The price of WTI crude oil at the time the forecasts were made was U.S. $47. In a nutshell, the forecasts implied the following:

- The majority of forecasts for the price of oil at the end of 2015 were concentrated in the region of U.S. $50 to U.S. $70.

- There is not a single forecast for oil below U.S. $40.

- There does seem to be a consensus among the leading investment banks that oil had bottomed out.

I don’t mean to ridicule the forecasters. They all represent formidable financial institutions. These guys obviously understand much more about the ‘oil business’ than I do. However, the fact that all of them collectively succumbed to their human biases is pertinent to the way in which we make investing decisions.

Is it a coincidence that the forecasts for the price of Oil in December 2015 are so close to the then prevailing market price? In a study titled ‘Trapped in here and now – new insights into Financial Market Analyst Behaviour’ by Markus Spiwoks, Zulia Gubaydullina and Oliver Hein, the researchers dealt with this issue of comparing actual results with forecasts. Click here to read. The basis of the study: Interest rates forecasts in bond markets. A perusal of the paper shows that most of the observations made by the researchers apply mutatis mutandis to the stock market. Hence, I think that it is safe to assume that the research conducted is relevant for stock market investing. Very briefly what the research shows is as follows:

- The researchers found that 98.5 percent of forecasts reflected the present rather than the future. In their study, the researchers found that whenever interest rates dropped, analysts adjusted their forecasts downwards. They did the reverse when rates went up. As such, the forecasts showed a correlation with the actual interest rate trends. The authors call it ‘Topically Oriented Trend Adjustment (TOTA)’. They go on to say that this ‘topically oriented trend adjustment’ is not an isolated case. It is, in fact, a common phenomenon in financial market forecasting.

- The paper concludes by saying that if the accuracy of current forecasting techniques is to be improved upon, research must be conducted on the causes of topically oriented trend adjustment.

Since everything depends on oil prices, it is imperative to try to analyse what is happening in the Oil market. Apart from the guys who are still living in a cave, everyone knows that Oil is now hitting new lows, below U.S. $40. The following comes to mind:

- It is pretty clear that the Oil pricing war is, in fact, a battle for global market share of the commodity. There is an obvious attempt at manipulating the supply of Oil. Nobody has an accurate estimate of what is the cost of production of the different manufacturers and drillers. As a result, what started as a political battle has now given way to grave economic overtones. Who blinks first, The United States of America or Saudi Arabia? Is this a manifestation of the economics of ‘disruptive pricing’? Nobody knows, with any degree of certainty. However, common sense suggests that in the long-run, economics ought to triumph over politics.

- What about all the gloomy forecasts made by the International Energy Agency (IEA). I perused all IEA forecasts made from June 2013. I found that the IEA is extremely inconsistent in its prognostications. In fact, I think all their forecasts suffer from the ‘Topically Oriented Trend Adjustment (TOTA)’ discussed above. The failure rate of their ‘forecasts’ is very high. Given their track record, I would prefer to call the copious amounts of IEA rhetoric as ‘TOTA’ rather than a forecast.

- Apart from the IEA, there is a host of agencies that keep issuing forecasts for crude oil prices. There is no reason to believe that such forecasts don’t suffer from ‘TOTA’. Mark Twain, the American author, nailed it when he famously said that a mine is ‘a hole in the ground with a liar standing next to it’!

Forecasts: Historical Analysis

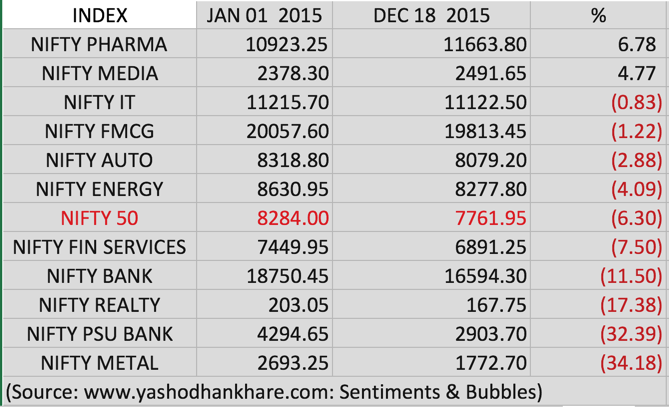

The fact that bull markets have to climb a ‘wall of worry’ is well-known. In 2015, I learnt that the proverbial ‘wall of worry’ is very slippery. What worked in the first quarter suddenly stopped working in the second and so on and so forth – almost like a game of snakes and ladders. The final tally looks like this:

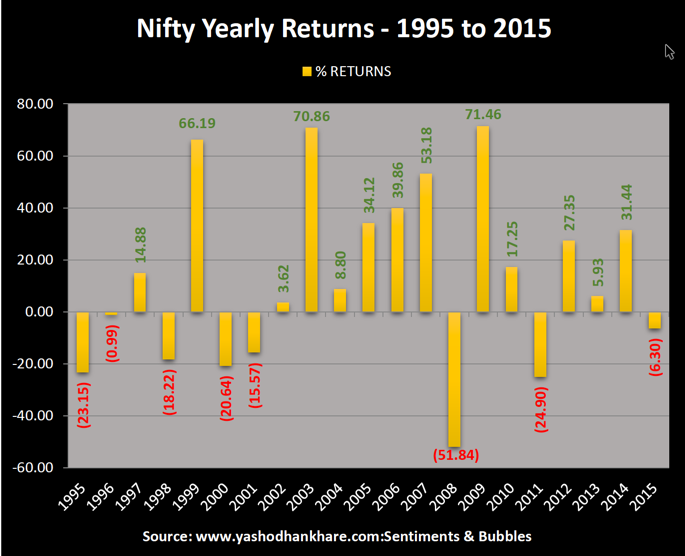

For the year and till date the Nifty is negative. The markets have been bereft of any discernible trend for most of the year. The bull market seems to have taken a pause. What do flat or negative years tell us about the years that follow? To find out, I plotted the data for annual returns from 1995 onwards. This is how it looks:

Market behaviour is a random event and, for the most part, unpredictable. In such a scenario the best one can do is to look at the past and see how random the behaviour has been. The image above does show the following:

-

Two consecutive years with negative years are the exception, not the norm.

- Flat or negative years seem to be invariably followed by years with positive returns. The percentage returns are too random to be able to predict a trend.

Market Forecasts for 2016

Market forecasts for 2016 keep rolling in. In fact, financial forecasting and forecasting chutzpah go hand in hand. It does remind me of Ken Fisher, a prolific writer. In almost all of his books he refers to the market as ‘TGH’, an abbreviation for ‘The Great Humiliator (TGH)’. I couldn’t agree more. If there is one forecast I can confidently make for 2016 it is this; TGH will continue to humiliate the maximum number of investors (and forecasters) for as long as it can and to the largest possible extent. To conclude:

1. Most, if not all forecasts, are useless as investing tools. However, I would be remiss if I were not to link up to a couple of forecasts in a post about forecasting. Hence:

- In 2015, Goldman Sachs got nine out of their ten forecasts correct. On Oil prices too, they were right. Oil has stayed ‘lower for longer’. That does not mean that they will get it right in 2016. Nevertheless, if you want to read a summary of their 2016 forecasts click here.

- The Bank for International Settlements continues to issue warnings about the health of Emerging Market (EM) economies. They see doom and gloom ahead. Click here to read.

- EM’s have got their contrarian ‘magazine cover indicator’. The magazine cover indicator says that a contrarian investor has to be on the lookout for signals that the mob or the crowd has turned bearish on an asset class. The Economist magazine does have a bearish cover on EM’s as an asset class. Click here to read.

2. What about Indian equities as we head into another earnings season? In 2015, the combined weight of ‘expectations and consensus’ proved to be insurmountable. The reduction in the interest rates will have a positive impact on corporate results for the third quarter. Is this priced in? As you keep guessing, do bear in mind the oxymoron; ‘forecasting is difficult, especially when it involves the future’.

A well written article with good observation and study. Making the right predictions (in market) is a Herculean task. Obviously the consistency in predictions becomes impossible. Still the mankind has a natural curiosity to peep into the “so called” expert’s predictions and be happy/repent for his/her own actions/ in-actions!

As an emerging market destination, I believe that India story is intact. Possibly we may see a very good rally selectively in pharma, autos and banking space, going ahead.

True. Yet we have so many analysts giving predictions and forecasts throughout the year. Waste of time, but they have an audience.