(Cartoonist: David Brown; cartoonstock.com) (Sunday, 17 July 2016)

An RBI interest rate cut is always considered as bullish. It is a signal that inflation readings are favourable, and the economy is moving in the right direction.

The 10 Year GOI Bond

The 10 Year Government of India Bond (10 Year GOI) is a sovereign Bond issued by the Indian Government, denominated in Indian Rupees (INR) and represents government debt. Sovereign Bonds are those that are issued by governments. Just as in equity, the Sovereign Bond market is split in two – sovereign bonds issued by countries forming part of the Developed Markets (DM) and those issued by countries forming part of the Emerging Markets (EM). Needless to say, we are concerned with the EM variety.

It so happens that in the aftermath of the Brexit vote, the yield on the 10 Year Government of India Bond has been dipping precipitously. In fact, yields hit three-year lows last week. In such a scenario, I have tried to (a) make an educated guess of the probability of an interest rate cut and (b) tried to arrive at a conclusion as to the best way to profit from the same.

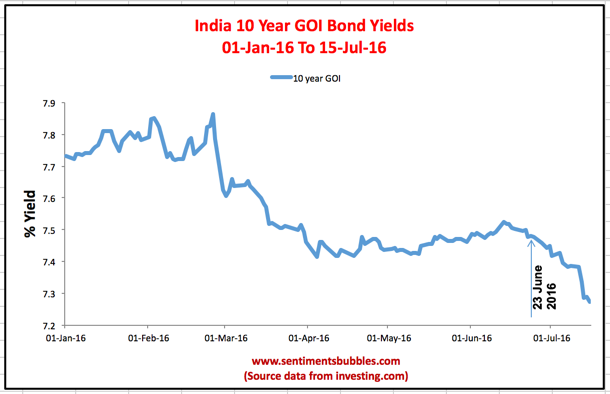

The falling yield on the 10 Year GOI is shown in the image below. The sharp drop in the yield – Post Brexit, has been highlighted. For the uninitiated; as the demand for the 10 Year GOI goes up, the yield goes down. In other words, falling yields on the 10 Year GOI represent rising demand for the same.

For all practical purposes, the 10 Year GOI represents the Indian debt market. Why is demand for the 10 Year GOI rising and what does it mean for the layman investor? The following points merit consideration:

- QE (Quantitative Easing) involves buying of government securities aka sovereign bonds. Even though the U.S. Federal Reserve has ended its QE program, the European Central Bank (ECB) and the Bank of Japan (BOJ), have their versions of QE in full swing. These two are expected to step up their asset purchases (QE) in the coming months, and the Bank of England is supposed to join them. Hence, the global demand for sovereign bonds is at its highest ever.

- Traditionally sovereign bond instruments are bought by long-term investors like pension funds and insurance companies. As on date, these two buyers are joined by two more; global central banks via QE and speculators in the bond market. As a result, demand outstrips supply. The amount of excess demand is unquantifiable.

- The demand so generated has driven up the sovereign bond prices and driven down bond yields, in many cases into negative territory. The demand for sovereign bonds is so high, that Fitch (the rating agency) estimates that nearly $10 trillion of government debt worldwide now yields negative returns. In other words, there is very little, in terms of DM sovereign bonds, left to buy.

- As a result, of the above global pension funds and insurance companies are left with no alternative but to buy Sovereign Bonds issued by countries forming part of the EM’s. Effectively, the global search for yield has now reached the shores of EM’s. Globally, this scenario is being described as TINA – There Is No Alternative. The buyers of sovereign bonds are beyond caring which country the bonds are issued by, as long as it has a positive carry, they’re game.

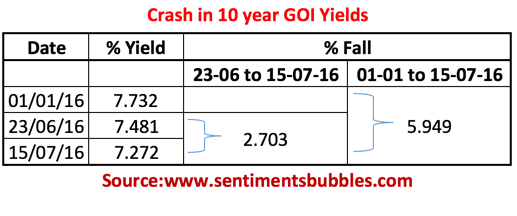

- The 10 Year GOI yield has dropped by forty-five percent (as compared to the yield on 01 January 2016) in just 15 trading sessions post-Brexit. This sudden drop is highly abnormal and is a function of the increased demand for the 10 Year GOI. Take a look at the image below to get a feel for the magnitude of the drop in 10 Year GOI Yields.

All-in-all, the 10 Year GOI is now a much sought after instrument. In the ordinary course, the 10 Year GOI yield tends to drop in response to rate cuts by the Reserve Bank of India (RBI). In the immediate instance, they are falling sans a rate cut, for the reasons enumerated above. It sets up a fascinating scenario in the Indian Bond Market. Instead of trying to use fancy words like ‘yield curve’, I’ll try to put it in the most simplistic terms. So, here goes:

- We are concerned with two rates, the short-term rate of interest and the long-term rate of interest. The RBI Repo Rate is the rate at which the RBI lends money to commercial banks in the short-term and represents the short-term interest rate. The 10 Year GOI (shown above) accounts for the long-term rate of interest.

- Currently, the RBI Repo Rate stands at 6.50 percent. The long-term interest rate represented by the 10 Year GOI closed at 7.272 percent on 15 July 2016. What the bank rate watchers are monitoring is the gap (spread) between the 10 Year GOI (7.272 %) and the RBI Repo Rate (6.50 %). This gap has been shrinking rapidly in the post-Brexit period.

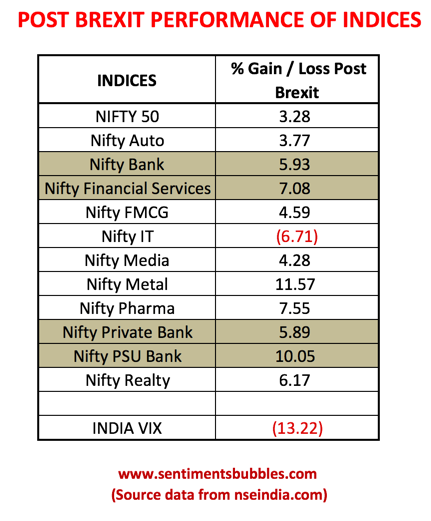

- Market participants consider the likelihood of any let-up in the demand for the 10 Year GOI as remote. Hence, there is a very high probability that this gap will continue to shrink. What happens when the long-term rate (7.272 %) starts dipping below the short-term rate (6.50 %)? That is in the macroeconomic domain. As a result, I’ll skip the interpretation. What the market is pointing at, is the fact the RBI will pre-empt any such possibility by cutting the Repo Rate from 6.50 percent. I am inclined to agree with this interpretation. That is why you have a post-Brexit benchmark scoreboard that looks like this:

From the image above, it is apparent that the financials are on a tear post-Brexit. It seems that bond market denizens are making fresh allocations to EM debt since (a) Brexit is not an ‘EM event’ and (b) because of the TINA predicament that global pension funds and insurance companies find themselves. Whichever way you look at it, Brexit is a net positive for EM debt and currency.

Investment Options

For the Indian Retail Investor, there are two ways to trade this; (a) try and pick up stocks in sectors that are seen as direct beneficiaries of the expected rate cut OR (b) Invest in Fixed Income products.

In the case of option (a) above, I have highlighted the sectors in the ‘Performance Table’. A word of caution is warranted. The entire financials pack is likely to move in tandem with the yield on the 10 Year GOI. The yields, in turn, are a function of the global flow of funds into bond instruments which depend on the whims of global Central Bankers. In other words, Volatility is a given.

I always write about stocks. For a change, this time, I prefer to highlight opportunities in (b) above. It is clearly the less exciting of the two options and less discussed. All the more reason why I have chosen to highlight the same.

Fixed Income Investing on the NSE

Over the short-term, returns from fixed income investing (aka bond investing) is a function of two things; (a) the coupon rate on the instrument and the capital appreciation in the price of the fixed income instrument (bond).

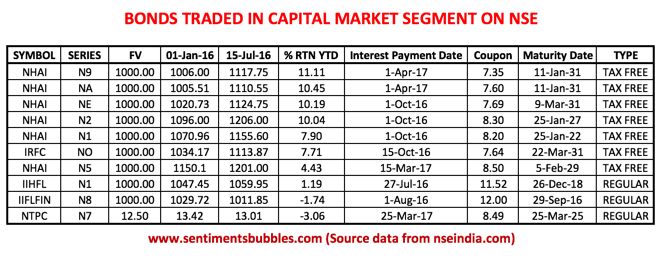

Bonds traded in CM shows the smorgasbord of fixed income instruments traded on the National Stock Exchange (NSE). The top ten fixed income securities selected by traded volume and sorted on percentage returns are shown in the table below:

At the outset, the table above is representative and not exhaustive. It has to be used as a starting point and not as an end in itself. With that out-of-the-way, a couple of pointers would be in order:

- In the table above, the column titled ‘% RTN YTD’ represents that gain in the price of the instrument (capital appreciation) in the current calendar year. The Total Return (TR) for a fixed income investor is the sum of the capital appreciation and the coupon rate. Due to differing maturity dates, I have not calculated the TR in the table above. However, I wish to highlight the fact that (in most cases), the TR in the fixed income universe, comfortably exceeds the return provided by the equity benchmark (aka Nifty) in the current year. It has been so in the year 2015 as well.

- The fact of the matter is that extended versions of global QE have resulted in an inverted market structure. In the new paradigm, fixed income instruments are being bought for capital appreciation, not for their coupon rate.

Conclusion: ‘Nobody knows Nothing!’

The one minute video shown below is worth sharing:

Since ‘nobody knows nothing’ is so true, I have chosen to ignore mundane things like oil prices, inflation, and exit strategies from global QE, while writing this post. Nobody is interested in these as on date, and nobody has the answers. The aphorism ‘Don’t confuse brains with a bull market’ is an apt way to describe the proceedings.

Yashodhan

Are you saying that we should buy bonds?

Regards

Shailesh

Actually Yes, looking at the Volatility it is the safer of the two options.