How many of us have a strategy while investing? How important is it? I think that having an investment strategy in place is a precursor to the actual investment process and its importance cannot be understated.

Investment Strategy: Why?

In the extremely noisy world of investing products, there are multiple strategies. To be fair, there cannot be any one strategy that fits all. Each of us has to devise or tweak our investing strategy depending upon one’s risk profile and a host of other factors like age, income, time frames and most important of all, our goals. At all times, what is important is having a strategy.

In my opinion, returns from any investment strategy in the Indian Stock Market have to be comparable with two competing asset classes, viz. Real estate and Gold. In the stock market, our portfolio returns are determined by a) what stocks we own and b) how we weight those stocks. ‘Weight’ of a stock is the Rupee value of any one stock in one’s portfolio. Assuming that a model portfolio would consist of twenty names (at the most), what should be the individual Rupee value that an investor should allocate to the twenty different stocks?

Equal Weight as an Investment Strategy

We always want to own more of the stock that rises the most in the shortest possible time. At the same time, we wish we had not bought the losers in the first place. Online portfolio tracking coupled with our myopic mindset accentuates the problem. At all times, most of us tend to compare and contrast how things would have been different if we had bought more of the winning names and not bought the losers. Most of this is hindsight bias. Inadvertently, when ‘we bet small we win’. Is there a way out?

A Do-It-Yourself (DIY) investor who follows an Equal Weight (EW) strategy would end up allocating equally to all the stocks in his or her portfolio. I have highlighted the salient points of an EW strategy herein below. To make things more relevant, the context I have used is that of a Mutual Fund Scheme. Everything that is stated applies to a DIY investor as well. For additional clarity, I have first talked about the strategy that is currently being followed by all Mutual Fund Schemes that are not Equal Weight (EW) and then proceeded to write about an EW strategy. Here goes:

- All Mutual Fund Schemes allocate their corpus among various listed stocks. Stock selection in any Mutual Fund Scheme is preceded by a sector allocation. Sector allocation would primarily be a function of the macroeconomic view that the money manager in question subscribes to. For example, a money manager may be bullish on the Banking sector and bearish on Technology. In such cases, he or she would allocate a bulk of the corpus to Banking stocks (overweight) and a far lesser proportion to the Technology names (underweight). Within individual sectors, the stock allocation would be a function of valuation of the stocks, growth prospects and a host of other things. Needless to say, the Rupee value of individual sectors and the stocks within these sectors would vary; it wouldn’t be equal.

- In the current scenario, the benchmarks used to judge performance are weighted by market capitalisation. What that means, is that the weight of the components within the benchmark is decided by their market value. The higher the market value of the outstanding shares of any one stock, the more the weight it carries in the benchmark composition. Since money managers are obsessed with their benchmarks, it follows that their portfolios too are weighted by market capitalisation. Inadvertently, investors end up owning more of what is going up and less of what is going down.

- Any Mutual Fund Scheme that is Equal Weight is assigned to a benchmark. For eg., the Nifty100 Equal Weight Index is assigned to the Nifty 100 Index. All the stocks in such a scheme would be assigned an Equal Weight (EW), according to their Rupee value. An EW strategy dispenses with a sector and stock allocation. It simply allocates an equal Rupee value to all the names.

- It follows that, if one were to compare two schemes with identical names, one that is weighted by market capitalisation and the other that is Equal Weight, their performance would vary. The reason is that even though the constituents are the same, the characteristics of the two schemes are materially different.

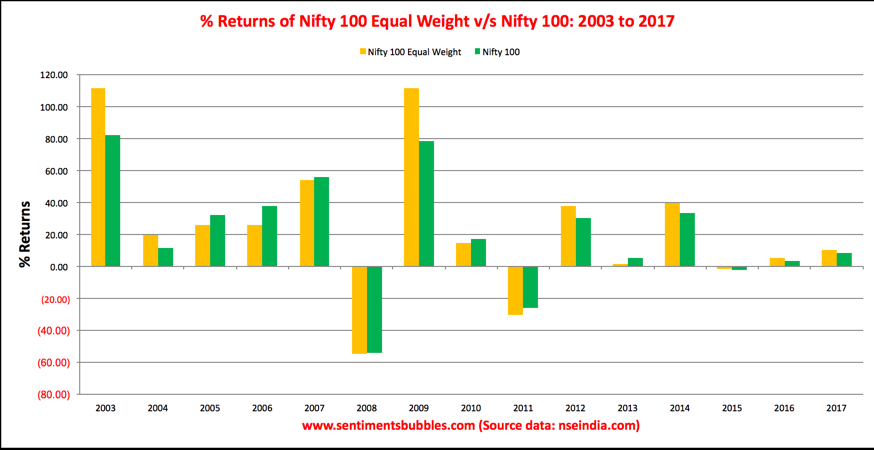

How do returns from an EW strategy compare with those of a market capitalisation strategy?

The Nifty100 Equal Weight Index

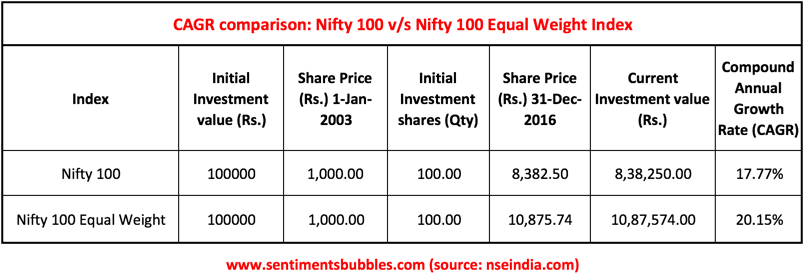

The Nifty100 Equal Weight Index is part of the Strategy Indices that are disseminated by the National Stock Exchange of India (NSE). The Nifty100 Equal Weight Index comprises of the same constituents as Nifty 100 Index (market capitalisation based Index). Both of these have the same base date and starting values. In other words, they are comparable. The comparison is shown below:

To quantify the performance, what I did was to compute the CAGR for both the indices since inception. (CAGR is the acronym for Compound Annual Growth Rate. It is defined as the growth rate over a period exceeding one year. The CAGR rate (expressed in percentage terms and as a yearly constant), gets your initial investment to its ending value. The basis of the CAGR calculation is that each year’s growth is compounded year over year).

The outperformance on the Nifty100 Equal Weight Index is apparent. However, there is a caveat. The following will make things clear:

- Since prices of the various components move at random, it follows that in due course of time the weight of the different components in an EW portfolio would shift. As a result, the EW portfolio has to be rebalanced periodically,

- Rebalancing an EW portfolio would mean selling a portion of those stocks that have gone up and buying more of those that have gone down. In this way, the weight of different components would be restored to their Equal Weight.

- Rebalancing entails transaction costs. Hence, Expense Ratios of any EW scheme would be higher. To minimise transaction costs, rebalancing more than once per year is undesirable.

In reality, the volatility of an EW index is far less than that of a market capitalisation weighted index. At the same time, the extra returns that an investor is likely to earn from an EW strategy come without taking any additional risk. To conclude, there is nothing clever about an Equal Weight strategy. The simplicity is endearing and in the ultimate analysis, an Equal Weight strategy just works.

Yashodhan

I would rather be overweight in stocks I am comfortable with and intend to own for a long time (15 years or more). I personally do not believe the EW strategy suits individual investors.

Broadly two types: concentrated portfolios or diversified ones. Take your pick. Diversified ones have a lower risk. Within these, EW tends to work. In both cases, long-term is the best, as log as you’re buying good names.