Before I get to the post, I need to clarify a couple of things. Over the last three months, I have changed my selection criteria for recommending stocks. While I believe the markets (globally) have entered the ‘euphoria’ phase of the current move, there is no way of knowing how long this period will last and how stretched it will be. Hence, I am loath to timing the market. As we enter another earnings season, an additional cause for caution is the Union Budget. Historically, Union Budgets have been known for Volatility. The immediate question is: will Volatility return, be it either pre-budget / post-budget OR will the market grind higher, irrespective of the Union Budget. The short answer is that I don’t have the foggiest idea.

I do believe that one has to invest in good ideas without getting caught up in our ‘fear of corrections’. There is no harm in waiting for a correction, but nobody can predict the duration of the wait. In the stock market, for the most part, everyone is investing with incomplete information. Waiting for an event or for clarity to emerge is likely to prove costly. In other words, passing on an excellent investing idea just because the market seems to be expensive doesn’t necessarily always work. To illustrate, if the Nifty moves up from the current level of 10680 to 11500 and then corrects by 10 percent, it is almost as good as investing today. Individual stocks will tend to correct more than the benchmark, but there is no way of knowing which ones and by how much they will correct. Hence, what I have done is as follows:

- I am sticking to my policy of buying what is relatively cheap.

- I am trying to pick quality names that are not in the limelight (PSU stocks).

-

Of late, Insider activity is muted. There are no quality names that are being bought. Whatever, insider activity is being reported is in stocks wherein Promoters are not investing – they are trading. Hence, an insider buy is being sold in the short-term. It is egregious Promoter behaviour, but we don’t have to participate, do we? On to the update.

Investing Ideas – 3 of 2018

Background Information

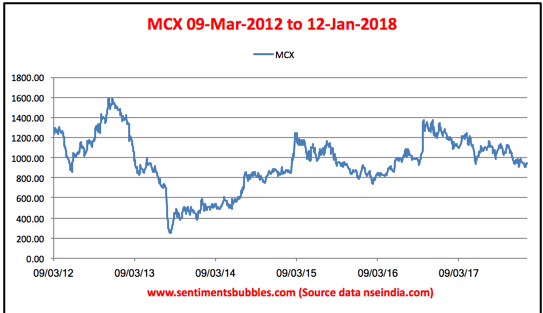

The Multi Commodity Exchange of India Limited (MCX) is a commodities bourse promoted by Financial Technologies India Limited (FTIL). The Initial Public Offering (IPO) of MCX was conducted in March 2012 at a price of Rs. 1032. At that time, it was India’s sole listed stock exchange. The Bombay Stock Exchange IPO’d in 2017, and the National Stock Exchange of India (NSE) is expected to launch its IPO in the current calendar year.

In the calendar year 2013, the erstwhile Forward Markets Commission (now merged with SEBI) passed an order declaring FTIL and its promoter Jignesh Shah unfit to operate any exchange in the country (pursuant to the Rs. 5600 crore payment crisis at the group company, National Spot Exchange of India – NSEL). As a result, in July 2014, FTIL sold 15 percent of its stake in MCX to Kotak Mahindra Bank Limited. Along with other deals involving stake-sales to high net-worth individuals, FTIL has now completely exited MCX.

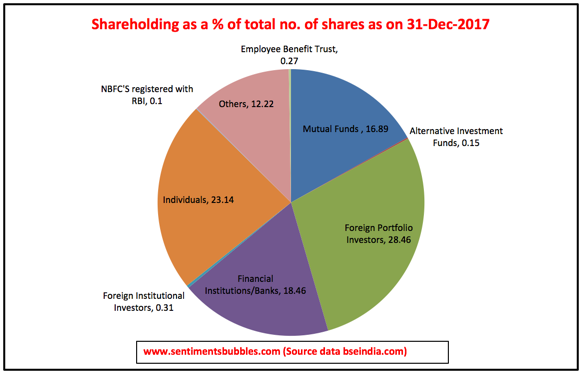

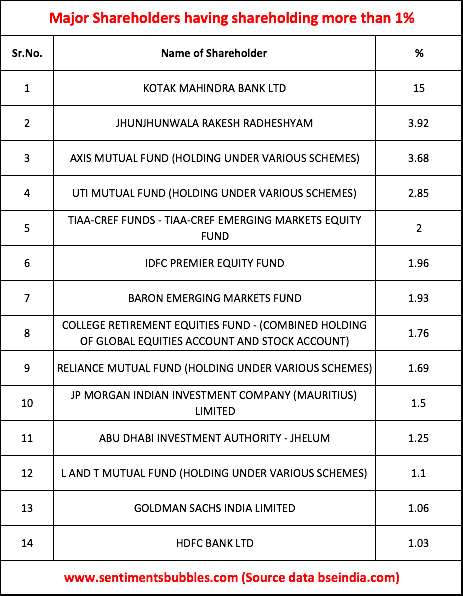

Listed Stocks Exchanges in India have to ensure that the public holds 51 percent of their shareholding at all times. MCX underwent a tumultuous transition in ownership in 2013. Hence, as on date none of the shareholders in MCX are categorized as Promoters. The largest single shareholder in MCX is Kotak Bank; their 15 percent stake in MCX was bought (in July 2014) at a price of Rs. 600 when the prevailing market price was Rs. 783. The Shareholding Structure and the names of the shareholders holding more than one percent of the shares are shown below.

Investment Thesis

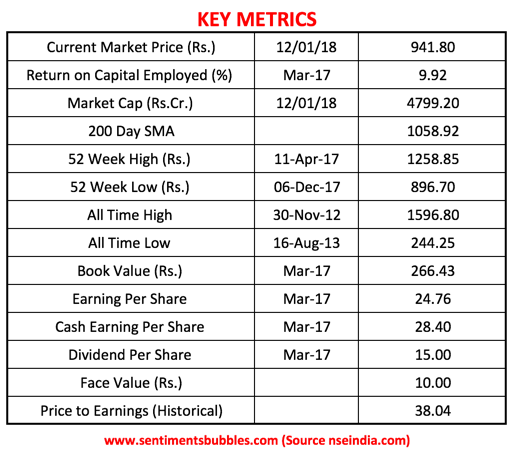

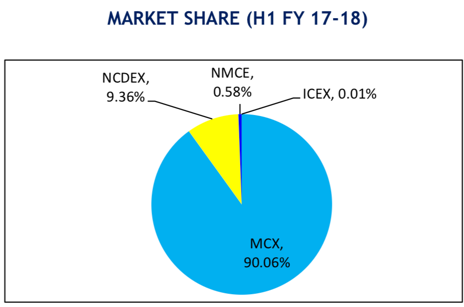

The growth of the global economy is expected to drive the demand for commodities. Commodity derivative volumes are a multiple of the underlying volumes for the physical commodity. In India the volumes traded on the commodity exchanges are comparatively low as on date; the potential does exist for an increase in the volumes. In other words, as Indian Gross Domestic Product (GDP) increases, the volumes are expected to rise. As on date, MCX has a market share of (roughly) ninety percent of the commodities derivatives market in India. The Key Metrics of MCX are shown below:

The year 2017 was one in which the main theme driving stock prices was momentum. Momentum investing works because we as humans want more of whatever has given us joy and profit; at the same time we try and get rid of anything that has inflicted pain and losses. I should hasten to add, momentum works until it stops working! Will momentum investing continue to be the dominant theme in the days ahead? I don’t have an answer to that question. But it might make sense to look at some alternative investing themes. Consider the following:

- Big Mo, as momentum is popularly called, is a direct function of the growth metric. In other words, if a category of stocks is perceived to be growing at a fast clip, momentum follows, and prices skyrocket way beyond intrinsic value – this has been a global feature and has been mirrored in the Indian Stock Market as well. In my opinion, in the excitement over growth (that might never happen), investors have neglected natural resource assets.

- Natural resource assets are the ones that are perceived as inflation resistant and these would include gold, silver, and other commodities. Since the pricing for commodities is dollar-denominated, what matters is inflation in the developed world. So much is written and discussed on how inflation will make a comeback (in the developed world) in the current calendar year. I think most of the commentary is missing the point completely.

- In my opinion, the U.S. 10 year Treasury Yield is the best measure of inflation in the developed world. If yields rise, it would translate into an inflationary global economy and vice-versa. What most commentators seem to be missing is the fact that inflation has already made a comeback – the 10-year yields have almost doubled from their lows. In other words, inflation is something that is already happening, albeit slowly. We don’t have to wait for the U.S. 10 Year Yields to ‘explode’ before making changes in our portfolio allocations. Commodities are one of the best hedges against inflation.

- I am not interested in going into ‘which commodity is the best hedge against inflation’. It’s too difficult to answer that question with any degree of certainty. I think investing in MCX is a safer option.

- The major source of revenue for MCX is in the form of transaction charges that they collect from their members. The transaction charges, in turn, are dependent upon the value of the contract which in turn depends upon the price of the underlying commodities. The global economy is expected to grow at a faster clip than it has in the recent past. Coupled with the fact that inflation readings in the developed world are showing an uptick, it ought to translate into a steady rise in the prices of all commodities. In other words, if commodity prices rise, contract values for traded contracts will rise and so will the transaction charges.

-

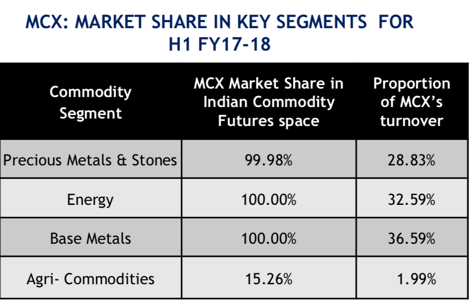

I think that MCX is uniquely positioned to take advantage of an uptick in commodity prices. Take a look at the images below which is extracted from their investor presentation for the September quarter.

What if the inflation argument crumbles and everything stated above is completely wrong or does not play out in the manner expected? I still think MCX is worth investing in. In a nutshell, the long-term thesis for owning MCX can be stated as follows:

- MCX is engaged in the business of facilitating trading in commodities and incidental activities thereto (in India). Warren Buffett likes to own businesses that resemble ‘toll bridges’ In his words: “In an inflationary world, a toll bridge would be a great thing to own because you’ve laid out the capital costs. You built it in old dollars, and you don’t have to keep replacing it.”

- Metaphorically extending the analogy of the ‘toll bridge’ to the business model of MCX is easy. The traffic on the bridge mirrors the volumes on the MCX and the transaction charges mirror the toll. The higher the traffic (volumes), the more the toll (transaction charges) that would be collected.

- In the immediate instance, the dominance of MCX in the commodities segment in India is a given. Investors who want to trade commodities have to use the MCX or they can trade on the National Commodity and Derivatives Exchange (NCDEX). However, MCX is the exchange of choice for the simple reason that in the mind of the investor, it does not make sense to use the alternative.

There are a couple of other positive triggers for recommending MCX. These are:

- All commodities are priced using U.S. Dollars as the base currency. The year 2017 started with the consensus that the Almighty Dollar was likely to strengthen. It proved to be completely wrong. The U.S. Dollar was the weakest global currency of the year, and the weakness continues into the current calendar year as well. To put matters in the correct perspective, the DXY (which is the US Dollar Index) traded at a value of 102.83 on 2nd January 2017. It was trading at 90.97 on 12th January 2018. A weak dollar is a tailwind for global commodity prices.

- The Securities and Exchanges Board of India (SEBI) has issued a consultation paper for allowing the entry of Mutual Funds into the commodity derivatives market. It is expected that move will see fruition by the first quarter of the next financial year. At the same time, in a recent amendment, SEBI has approved the integration of broking activities in Equity and Commodity Derivatives Markets under one single entity. In addition to these changes, SEBI has also permitted the issuance of option contracts on commodity futures. These regulatory actions (put together), will act as a tailwind for the commodities exchanges in India in the years ahead.

-

In 2006 the U.S. based CME Group (Chicago Mercantile Exchange) and MCX entered into a Memorandum Of Understanding (MOU). The MOU enables MCX to settle their rupee-denominated oil and gas contract to CME Group’s NYMEX prices. (NYMEX stands for the New York Mercantile Exchange). MCX runs ‘mirror’ contracts in rupee terms, which are based on the settlement prices for the corresponding NYMEX futures contracts in the US. Rumours about the CME group wanting to take an equity stake in MCX keep getting floated at regular intervals. The rumour mill is not baseless. The reason is that SEBI regulations permit foreign entities (like Exchanges, Depository, Banking & Insurance) to acquire or hold up to 15 percent of the paid-up equity share capital of listed Indian bourses. That also explains why Kotak Bank’s stake is strategically placed at 15 percent. Yet I wouldn’t want to buy MCX for this reason alone.

Conclusion

During the calendar year 2017, the stock price of MCX fell by roughly 28 percent; clearly, we are not chasing momentum when we buy MCX. The reasons for the underperformance are two-fold, (a) lack of growth in the underlying business and (b) contraction of margins. The return on capital and free cash flow metrics for MCX aren’t that great. At the same time, margin requirements in this kind of business ensure that working capital requirements are minimal. MCX is a debt-free, dividend-paying company (with an issued capital of 5,09,98,400 equity shares of the face value of Rs.10 each). In other words, even if MCX were to clock slow but steady growth it wouldn’t matter (in the long-term).

I think that the negatives have been factored into the current market price and the positives are being ignored. The company reports quarterly numbers on 16th January 2018. In the expectations v/s actual matrix, expectations are low. I have no hesitation in recommending MCX as a ‘compelling’ investment at its closing price of Rs. 941.80 on the National Stock Exchange of India (NSE) on Friday, 12 January 2018.