Firstsource Solutions Limited

Firstsource Solutions Limited (FSL) describes itself as a consumer-focussed, innovation-driven company. The market capitalization is barely 2323 crores. In other words, it is a Small-Cap stock. It is a fact that Small-Cap stocks enjoy a valuation premium. The rider is that it has to be a ‘quality’ Small-Cap. Does FSL fit the bill?

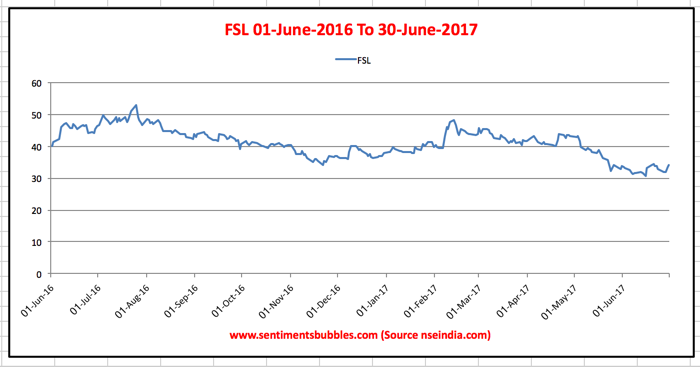

The stock price of FSL has been plummeting, and the stock hit a 52-week (intra-day) low of Rs. 30.35 on 15 June 2017 and a closing low of Rs. 30.55 on the same day. The 52-week high (intra-day) is Rs. 53.65 on 26 July 2016 and the closing high is Rs. 52.85 on 25 July 2016. The 50-day moving average is Rs. 36.07, the 200 day Simple Moving Average is Rs. 39.25. The company has never been on the dividend list.

Valuations

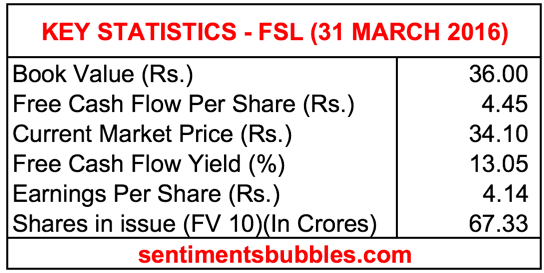

It is apparent from the above that by almost any metric FSL is cheap at the current market price. However, these are historical numbers and markets are forward-looking. There are many who do a hard-core Discounted Cash Flow (DCF) valuation to arrive at a ‘fair value.’ I am a bit wary of DCF valuations since there are too many assumptions that are built-in. The bet that one has to make is whether or not FSL will be a bigger, better and more profitable business ten years from now. The answer to that question ought to decide whether or not you should or should not invest in FSL. In other words, it is necessary to understand the business model and not to look at the valuation in isolation.

Business Outlook

The Information Technology (IT) sector contributes nearly ten percent to India’s Gross Domestic Product (GDP). Currently, the Indian information technology sector is under a cloud (pun intended). The concerns are two-fold: (a) the H1B visa imbroglio in the United States and (b) the advent of Artificial Intelligence (AI) and Robotics These two threats, threaten to deliver a death-knell for India’s sunrise sector.

FSL is a very small player in India’s IT sector. In terms of two threats outlined above, FSL is not threatened by the outcome of the H1B debate since it does not use the visa. Their business model in the United States is that of hiring local Americans. The number of FSL employees who are on an H1B visa in the United States is less than five. However, the threat of automation and AI disrupting the business model of FSL is very real. In fact, Ravi Venkatesani, who is co-chairman of Infosys Limited has written about it very recently. You can read that here: Why this is Indian IT Industry’s Kodak Moment.

The fact of the matter is that India’s IT industry has plucked the ‘low-hanging fruit’ since the last two decades. Indian IT companies will have to re-skill and innovate if they have to grow and survive in the years ahead. At the same time, not all companies will adapt and change. Some might try to succeed; some will fail. Which category does FSL fall in? Have they made or are they attempting to make the necessary changes in their business model is what we are concerned with.

So much is being written about the death of Indian IT that it is difficult to distinguish between opinions and facts. Facts matter, opinions don’t. To get a sense of the facts what I did was to peruse (a) the Annual Report of FSL and (b) the Earnings Call Transcripts for the financial year that ended on 31st March 2017.

You can read these here Q1, Q2, Q3 and Q4

The management says that they are in the process of making a metamorphosis from being a ‘vendor to clients’ to that of being a ‘partner to clients.’ The business model of FSL, from a ‘vertical’ perspective, is Healthcare 38.1%, Telecom and Media 33.4% and BFSI 28%. The Key Takeaways from these reports are:

-

In the last Financial Year (FY), there are two major announcements. These are (a) a ten-year strategic partnership with Sky and (b) ISGN acquisition.

- Sky provides television and broadband internet services, fixed line and mobile telephone services to consumers and businesses in the United Kingdom. FSL is now the preferred partner for their TV and Broadband services. The management is very optimistic and confident that the Sky deal will change the trajectory of FSL as a business over the next ten years. The drawback is that it does increase customer concentration. Sky is described as an aggressive growth-based organization in the United Kingdom. FSL will be investing to the tune of £20 Million over the next three years in the partnership, and the payback is expected to be robust. The Sky partnership is also expected to become a reference point for further business opportunities in the United Kingdom. The full impact of the Sky partnership is expected to be reflected over the ten years beginning with the FY that ends on 31st March 2018.

- ISGN is a Business Process Management (BPM) company to the mortgage industry. ISGN provides customer-centric business process services across the entire mortgage value chain in the United States. The ISGN Solutions website says that’ We measure our performance based on the success we enable for our clients.’ I think this approach has caused more problems for FSL than was envisaged by the management. Initially, the management was optimistic that the ISGN acquisition will be accretive and would contribute 100 to 125 basis points to the earnings. As the year progressed, the optimism has faded, and ISGN business recorded a loss in the fourth quarter of the FY 2017. Something has gone wrong.

- The ISGN Solutions business model is intricately linked to the 10 Year Bond Yields in the United States. These yields have been volatile since the election of President Trump and continued to be so as on date. The volatility in the Bond Yields has hit the volumes in the mortgage refinance market. It has resulted in a loss of Rs. 15 crores in the fourth quarter of 2017. The management does not think that this is an enduring phenomenon. In fact, according to the management: ……most of the impact we are seeing today is because most of the work is in the mortgage origination side which suffers from the way the yield comes, but mortgage servicing is a lot more stable, lot more predictive and most of the businesses we are winning is on the back of selling our Automation- based Mortgage Servicing Solutions and capabilities which we are able to win business from incumbents that today are doing work for a whole bunch of customers. From the Q4 Earnings call: …….In the US, the 10-year yield continue to remain high. Obviously, from where it goes end of Q3, early January it was close to 2.5%, it is closer to 2.3% right now, but we do not see an uptick of volumes as long as the yields are higher than 2.1%. So, on the origination side, we definitely see pressure and origination linked business growth in the mortgage business unit will remain muted if the yields persist or the yields increase. So that explains that this business is going to have a muted quarter but on the back of some of the deals in servicing and translate into revenues, we clearly see growth coming back in fact Q2 onwards.** About the future prospects of ISGN: ….But thesis of our acquisition was to grow the entire servicing business. ISGN was a small company when we acquired it and they were getting excluded from all the servicing deals which minimum deals sizes starts from $5 million to $10 million and because of the size and scale, they were getting excluded but they had the domain capability. But post the Firstsource acquisition those deals are back on the table and very happy to state that we are making significant progress and there could be some big announcements coming in the very near future from that part of the woods.

- The management expects the ISGN business to break-even in Q1 of FY 2018 and will return to profitability from Q2 of FY 2018. According to them, they are de-risking the ISGN business from being a mortgage origination based one to that of an annuity based one. In my opinion, there is a very limited understanding of how this ISGN Solutions business will pan out in the immediate future. What matters is the contribution of the ISGN business to the overall business of FSL. The management quantifies it at roughly six to seven percent of the overall revenue of FSL.

- The Brexit vote in June 2016 has brought about a heightened level of uncertainty and has affected FSL in more ways than one. Firstly, the currency (£) has taken a hit. The Indian Rupee (INR) parity vis-a-vis the Sterling has tumbled from 98 to 78 (roughly), directly affecting the top line of FSL. Secondly, Brexit has affected the ‘deal pipeline’ and some business opportunities that would have seen fruition, have been put on hold. In other words, the ‘sales cycle’ has been elongated. I think with the completion of the election process in the U.K., things will start moving sooner rather than later. The management is cautiously optimistic about the currency parity. They feel that ‘net-net,’ Brexit will be positive for the business prospects of FSL. What that means is that austerity and cost cutting measures might result in an increase in the outsourcing function and a resultant increase in business opportunities – quite the opposite of what we are being made to believe by the media.

-

The management is confident that over the next twelve months, FSL will be debt free and in a position to declare its maiden dividend. At the same time, irrespective of where the IT industry growth rates are, the management expects FSL to be at the top end of these growth rates.

-

FSL is owned by the RP – Sanjiv Goenka Group through their company Spen Liq Private Limited. It has 54.89 percent stake in FSL and is a subsidiary of CESC limited. CESC is being demerged into four entities in the next couple of months. FSL will be a subsidiary of CESC Ventures. In other words, CESC ventures (the holding company of FSL will be separately listed on the bourses. There is no effect on the share count or the ownership stakes. All in all, the demerger of CESC, is a non-event for the business prospects of FSL.

Conclusion

The prospect of disruption of FSL’s business model is real; there is no doubt about that. However, I have reservation about the time frame; how soon will the disruption occur. In my opinion, technological disruption is and will be ongoing; India’s technology companies will have to adapt almost on a continuous basis.

Is the current downturn in the fortunes of India’s IT industry a cyclical downturn (that affects every business) or is it a permanent one that will get worse with each passing day. In my opinion, nobody can tell with any element of surety. In such a situation, I prefer to treat the current negative sentiment towards India’s IT sector as an opportunity. Does FSL have ‘what it takes’ to adapt its workforce in an upward trajectory? Only time will tell. At the current valuations, is it a gamble worth taking? The following might help in making a decision:

- If the worst fears about AI and automation are true, it will be very difficult for the bigger players to adapt. The smaller companies (like FSL) will be better placed and are likely to be nimble-footed.

- Machine Learning is getting smarter, more creative and so are the related algorithms. We have been hearing of self-driving cars, the advent of AI and related technological disruption for over three years now. There are no self-driving cars as on date, semi-autonomous cars are visible, but self-driving ones seem to be light years away. How disruptive will these be over the next ten years? Currently, the market seems to be pricing in the worst-case scenarios.

- There are two Indian outsourcers listed on the Nasdaq; WNS (Holdings) Limited (WNS) and Cognizant Technology Solutions Corporation (CTSH). Their business models are essentially the same as any Indian IT sector stock. Both these stocks are making new 52-week highs. In fact, WNS is very close to its All-Time High. An All Time High is considered to be a very bullish indicator. At the same time, technology stocks on the National Stock Exchange of India (NSE) are making their 52-week lows. It is obvious that the current market prices are lying. Which ones? Those on the Nasdaq or those on the National Stock Exchange of India (NSE)?

- Till date, there has been no decline in the top line of FSL that can be attributed to business conditions. The volatility in the currency parity accounts for the changes in the top line. In the long-term, currency fluctuations wouldn’t matter much.

- Technological disruption would in the normal course result in the creation of jobs albeit with higher skill. The unemployment statistics in the developed world (U.S., U.K. and Europe) show that their economies are at ‘full employment.’ If disruption and job losses were as high as is being feared, then these statistics are questionable. Unless of course, one were to take stand that these economies have only highly skilled workers.

- Is the FSL business model the ‘most vulnerable’ one? I don’t think so. Reason being: their win with the Sky broadcasting network. The exclusivity that FSL now enjoys in its relationship with Sky is the culmination of a relationship that began fourteen years ago. It does go to show that FSL has been delivering and adapting to the changing needs of the broadcaster.

- There is a more than even chance that the opinions of key persons in the IT industry might turn out to be ‘HiPPOs’ – the ‘highest paid person’s opinions.’ HiPPO’s have a tendency to be grounded on biased judgments and gut feelings. They tend not to be based on evidence. * While trying to get the facts about job losses due to automation, one tends to get a muddled picture. Are the reported job losses in the nature of ‘routine’ occurrences or are they something out of the ordinary? One doesn’t know for sure. If the threat of automation is what it is being made out to be, why did FSL make a 52-week high in June 2016? What has changed in the period from June 2016 to June 2017 in the automation world? Practically nothing. In terms of price discovery, there have been two events, Brexit and the U.S. Presidential elections. In other words, sentiment towards India’s IT sector has done a one-eighty over the last twelve months.

- Guidance issued by India’s IT bellwether stock (Infosys) has been muted with a negative bias. It has affected the price earning multiple of India’s IT sector. Is it the job of the management to issue guidance and encourage short-term thinking? I wonder. I suppose the job of any management ought to be to execute and not to set expectations. In any case, Infosys is a large-cap, and FSL is a Small-Cap. The guidance issued by Infosys cannot be used for setting expectations for the sector as a whole. In the stock market, price discovery is a function of actual v/s expectations. At the same time, wrong assumptions would result in wrong expectations and disappointment. The converse is equally true. At the current price of FSL, one is not paying for expectations, and that is a positive.

Have I got it all figured out? The answer is a resounding NO. Is FSL a value trap or a buying opportunity? Time will tell. In the stock market, nobody reaches that stage of nirvana, where he or she can confidently answer this question ahead of time. Stock markets are known to be highly irrational because of the mélange of emotions that lead to price discovery. It is illogical, but investors are most bullish when prices are high and most bearish when prices are low. As an investor, when we buy a stock we expect a return on our investment. To maximize returns, we must buy when Mr. Market offers us the greatest odds – the highest upside potential with the lowest downside risk. I think FSL fits the bill.