In the investing world, can one be a Do It Yourself (DIY) investor? Of course, why not? All you need is an investing edge.

What is an ‘investing edge’?

In the book titled The Little Book That Still Beats The Market, the authors Joel Greenblatt has hinted at what is meant by an investing edge. In his words:

“Choosing individual stocks without any idea what you’re looking for is like running through a dynamite factory with a burning match. You may live, but you’re still an idiot.”

What he meant was that individual investors need to have an investing edge, before they can commit capital to investing in the stock market. My thoughts on ‘having an investing edge’ are:

- Among the many skills that are required to achieve success in the investing world, the primary skill is the ability to pick winning stocks consistently. There are many other skills that one does need, but if one were to single out just one, it is stock-picking.

- To be a good stock picker, one needs to have an edge. Broadly speaking, one needs to have an either an information edge, an analytical edge or an emotional edge.

- In the pre-Internet age, having information was considered to be an edge. Not anymore. Information is now freely available and disseminated in real-time. Nobody has an information edge anymore; having information is not the ‘secret sauce’ it used to be.

- For being able to maximise one’s analytical edge or emotional edge, one needs to have the ability to factually and objectively analyse the information. Subsequently, one also needs to have the emotional frame of mind to steer clear of the noise and the willingness to evolve with the changes in the marketplace.

- Having an edge is not enough, you need to know how to use the edge. Even if you had advance information or a hot tip, you still don’t know how the market will react. In other words, you must have an edge and be right at the same time.

My point is: the type of edge doesn’t matter; having an edge does. When Charlie Munger says that investing is ‘simple, but not easy’, what he means is that being a successful investor is hard – it’s intended to be. Else, everyone would be a successful investor, and that is clearly not the case in the world today.

The next question is ‘so what’? What is the best way of investing in the Indian Stock Market for the majority of the investors who do not have an investing edge? The Mutual Fund route has been lapped up by most investors, and Mutual Fund Schemes are now widely used as a proxy for investing in the Indian Stock Market.

Mutual Fund Schemes are of two types. The actively managed ones are the ones in which most of us invest. The second category is the passively managed schemes, also known as Index Funds. Most investors end up investing in an actively managed Mutual Fund Scheme. Many have never heard of investing in an Index Fund.

What is an Index Fund?

Index funds replicate the performance of the benchmark index. By investing in an Index fund, an investor is assured of earning returns that are in step with those of the Nifty. Instead of trying to beat the market, you can be with the market. Since Index Funds mirror the index composition, the question of outperforming the Index returns does not arise. In fact, returns trail those of the benchmark index, albeit marginally. This gap in performance is called the Tracking Error. The Tracking Error is pretty narrow, and one can safely ignore it while investing in an Index Fund. At the same time, the idea is to invest in the Index Fund with the lowest tracking error and the lowest Expense Ratio.

In the long-term, financial markets are like a voting machine in which the opinions of all participants about companies, currencies and interest rates are publicly announced. In this way, market prices reflect the consensus of views of the marketplace as a whole. In a way, all of these researched opinions and actions is available for the Index investor at a very low-cost.

In spite of the fact that markets are not efficient at all times, they are still pretty efficient in the long-term. That is why the only term that matters in the investing game is long-term. By investing in an Index Fund, you can be a beneficiary of the long-term efficiency of the financial markets and earn the market average rate of investment returns.

Index Investing: Historical Returns

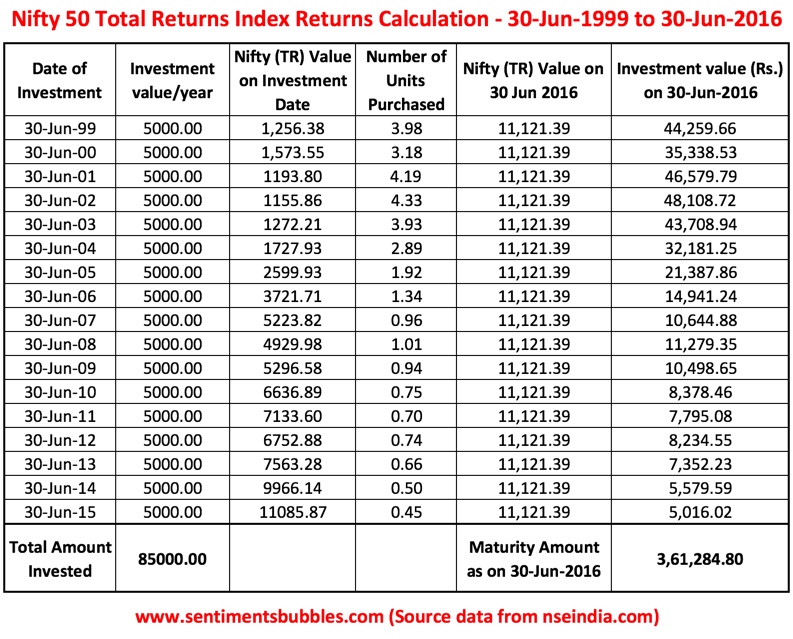

Since investing in an Index Fund would mean making the market average return, the next question is: What are the long-term returns of the Nifty 50? This is shown below:

I have used the Nifty 50 Total Returns (TR) Index for the spreadsheet shown above. The Nifty 50 TR Index is the same as the Nifty 50, just that the index values are adjusted for dividends received from the index constituent stocks. In my opinion, the Nifty TR Index gives a more accurate picture of the long-term investment returns. What I have done is a follows:

- I have assumed that Rs. 5000 is invested in the Nifty 50 TR Index on 30th June 1999. The start date is taken as 30th June 1999, since data before that date is not available for the Nifty 50 (TR) Index.

- On 30th June of every subsequent year, Rs. 5000 is invested for all years till 30th June 2015. In this way, monies are invested for seventeen years. The total number of Nifty 50 (TR) Index units so accumulated is sold on 30th June 2016.

- Over a period of seventeen years, a total of Rs. 85000 is invested and the redemption amount received is Rs. 3,61,285. When you run the numbers, it works out to a return of roughly 14.70 percent per annum. Knock off the Tracking Error and Expense Ratio, and you are left with an investment return of 14 percent per annum over seventeen years. In this way, I concluded that 14 percent is the market average rate of return that one can earn in the Indian Stock Market over the long-term.

When you index invest, you get the average result. Effectively, an investor who used the Index Fund over the last seventeen years has compounded his investment at 14 percent per annum. Not only is a 14 percent tax-free return in a very liquid instrument an excellent return, but it is comparable with any other asset class. You just need the perseverance to stick around and stay the course.

Why isn’t Index Investing Popular?

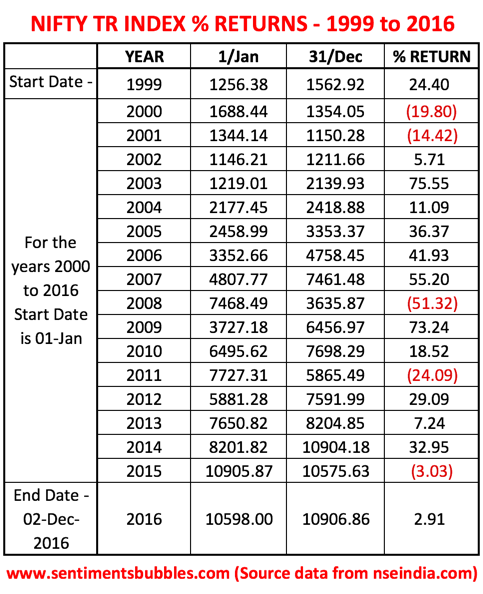

Investing in an Index Fund is the cheapest way of participating in the Indian Stock Market. Despite this, Index Funds are not popular with Indian investors. Why? The reason is that the benchmark Nifty 50 Index has underperformed the market average since 2015 and in the current year (till date). This shown below:

When one looks at returns over the long-term (shown above), you will notice in the image above that returns exceeding the market average have been followed by downward spirals. The converse is equally true. In other words, periods of outperformance lead to underperformance and vice-versa. This feature of long-term movements in the returns metric is known as mean reversion. In my opinion, mean reversion is the most powerful law in financial physics. Looking at the table above, it is axiomatic that the Nifty 50 returns, after spending two years in the wilderness. will revert to the long-term market average in the near future.

Nothing stops an investor from investing in an Index Fund and an actively managed Mutual Fund Scheme at the same time. In my opinion, investing in an actively managed fund via the Mutual Fund route is a crowded trade (as on date), and Index Investing isn’t. Do yourself a favour, invest in an Index Fund.

Thanks for the wonderful article. What would be the difference between the Index Funds mentioned here versus the Goldman Sachs Niftybees that can be invested like shares ?

Thanks, Kshitiz. The Niftybees attracts Brokerage and STT. As a result, the returns are not the same as what I have indicated, they are lower. You need to go through the Mutual Fund Scheme route. You can see the list of available schemes here http://www.fundsindia.com/products/mutual-fund/category/Equity-Index-funds?ccode=13. Select the one with the lowest Expense Ratio.

Yashodhan

Would you advocate any specific Index fund?

You can see the list here http://www.fundsindia.com/products/mutual-fund/category/Equity-Index-funds?ccode=13

The idea is to go for the fund with the lowest Expense Ratio. I prefer IDFC with dividends reinvested.

Thanks, Yashodhan.

Interesting.how to invest in Index Fund – Mat or D mat format?

All Demat