Insider Sentiments – 9 of 2017

Maharashtra Seamless Limited

Maharashtra Seamless Limited (MSL) is a leading player in the seamless pipe industry and is part of the D.P.Jindal group. MSL was incorporated on 10 May 1988 and has plant locations in Maharashtra and Rajasthan. The seamless pipes manufactured by MSL result in import substitution and a saving of precious foreign exchange. MSL is a net foreign exchange earner for the country. Apart from catering to the domestic demand MSL also exports to more than twenty-five countries.

Business Prospects & Risk Factors

MSL is a beneficiary of the governments continued focus on infrastructure development. To be specific, the large greenfield projects that are ongoing in the oil and gas sector in India means that MSL’s business prospects are upbeat. The business of the company is dependent upon two factors; (a) the international price of crude oil and (b) cheap Chinese imports. In fact, these are the two risk factors for MSL.

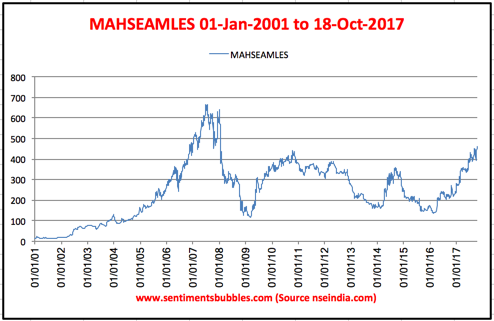

In the year that ended on 31st March 2016, MSL’s profitability suffered on account of fall in the prices of crude and cheap imports from China. Since then there have been two positive triggers for MSL. These are (1) crude prices have stabilized and (2) the National Steel Policy announced by the Government of India, Ministry of Finance, vide notification No. 18/2016 dated 18th May 2016 imposed the long-awaited Anti-Dumping duties on the import of SEAMLESS PIPES & TUBES into India from China.

The prospects of MSL seem to be on a sound footing as long as the Anti-Dumping duty stays in place. There is no reason to believe why that would not be the case. The penetration level of pipelines in oil and gas transportation and other sectors is shallow in India as compared to the global benchmark. It provides a vast scope for growth of the pipe industry in which MSL is well entrenched. Consider the following:

- Through the New Exploration Licensing Policy (NELP) and Hydrocarbon Exploration Policy (HELP), the Central Government is aiming to maximise the domestic exploration of oil and gas to attain self-sufficiency and save on precious foreign exchange.

- It will entail colossal capital expenditure over next few years spearheaded by the public sector behemoths viz., Oil & Natural Gas Commission (ONGC), and Oil India and others, effectively translating into a healthy demand for the OCTG pipes manufactured by MSL.

- Apart from greenfield projects, the Public sector oil marketing companies are also expanding their capacities due to increase in demand. In other words, the replacement demand is also increasing due to the old age of existing refineries. Beside this, existing Refineries also have to comply with Euro VI norms, which will further add to the demand for the Company’s products.

- Ancillary demand for the company’s products also exists from other industry sectors such as Power, Chemicals, Nuclear and other process industries.

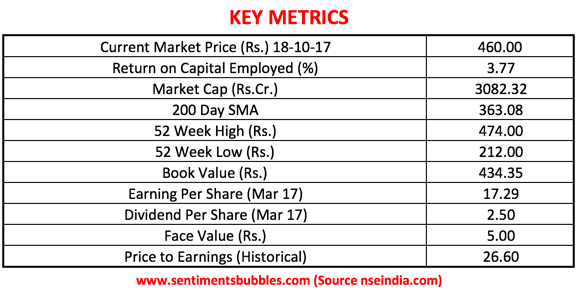

Apart from the above, MSL is also implementing a new solar project in Rajasthan that will reduce their cost of power and ensure that their products remain competitively priced. MSL has a consistent dividend payment history, and the company has stayed ‘cash flow positive’ on a regular basis (even in years when there has been a cyclical downturn). The management appears shareholder oriented; testimony to this is the fact that, in the past, MSL has bought back shares from the open market. (A total of 35,33,796 shares were repurchased from the open market at an average price of Rs. 195.85 during the period from May 2013 and April 2014).

Insider Sentiments

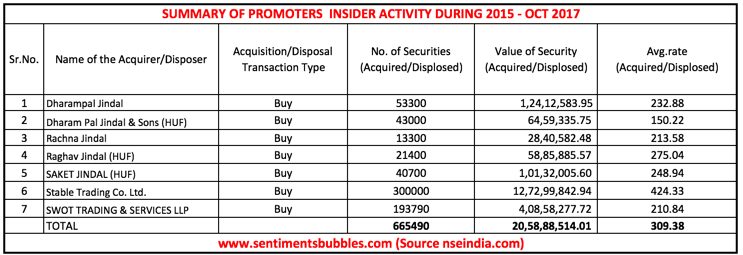

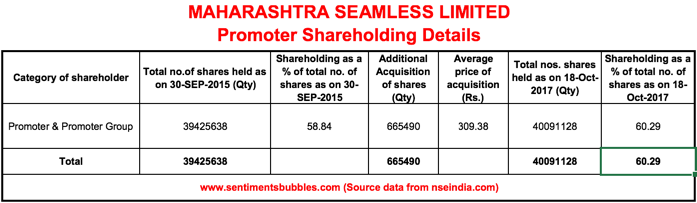

The image below shows data from 2015 till date. A huge block of 300000 shares has been purchased in the current month. The promoters seem to be putting their money where their mouth is and very aggressively so!

Conclusion

As compared to past recommendations, MSL is not a cheap stock. It has pretty much participated in the bull run. Though it is not a commodity stock, MSL will be affected by any downturn in the commodity cycle. The company has a very high book value and very low debt on its balance sheet. MSL is a part of India’s ongoing ‘infrastructure story’. Given the fact that the domestic demand for seamless tubes looks almost ‘sewn up,’ MSL seems to be an attractive buy at its closing price of Rs. 461.10 on the National Stock Exchange of India (NSE) on 19 October 2017.