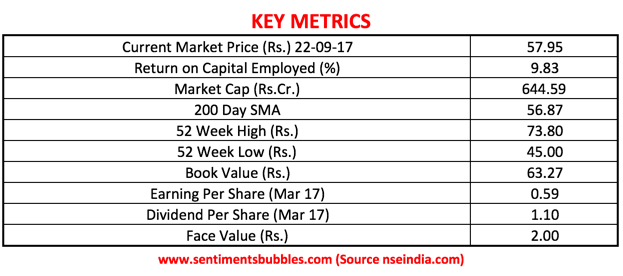

Elecon Engineering Company Limited is a Small-Cap engaged in the business of manufacture of Industrial Machinery. Elecon is involved in the manufacture of Industrial Gears, Power Transmission and labor-less Material Handling Equipment. It provides support to growth sectors such as fertilizer, cement, coal, power generation, mining, chemical, steel, port-mechanization, minerals & metals. It is listed on the National Stock Exchange of India (NSE)(ELECON) and the Bombay Stock Exchange (505700). The Key Metrics are shown below.

Historical Background

Elecon Group was established in 1951 in Goregaon, Mumbai by Ishwarbhai B. Patel. The Company’s early focus was on Engineering, Procurement and Construction projects in India. In May 1960, the Company moved to its current location in Vallabh Vidyanagar, Gujarat. Elecon has an experience of more than five decades and has successfully consolidated its position as Asia’s largest gear manufacturer. Elecon has a significant presence in India as well as abroad. The company was the pioneer in introducing the modular design concept, case hardened and ground gear technology in India. The Company has a proven track record in developing and manufacturing worm gears; parallel shaft and right angle shaft; helical and spiral level helical gears; fluid equipped and flexible couplings, as well as planetary gearboxes.

Elecon has a significant presence in India as well as abroad. Elecon business comes from two segments, Material Handling Equipment (MHE) and Transmission Equipment (Gears). As on date, the Gears business contributes roughly sixty-two percent of the top line and the MHE business the balance thirty-eight percent. To summarise, the fortunes of Elecon are closely linked to the infrastructure story.

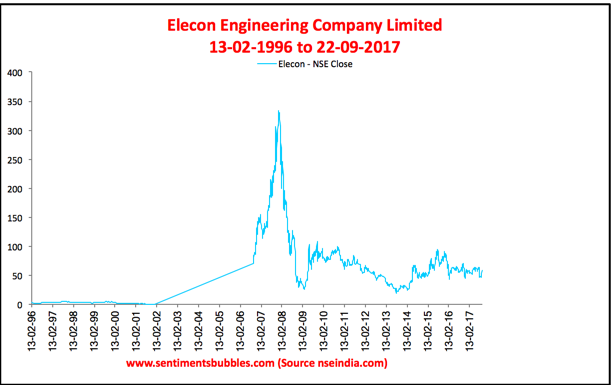

Elecon’s business performance over the recent past has been nothing to write about. Despite the ongoing bull run in the Indian Stock Market, Elecon’s stock price has been languishing. The stock price has gone nowhere over the last three years.That is apparent from the image below:

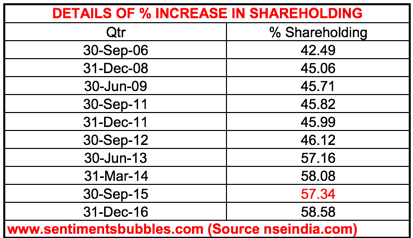

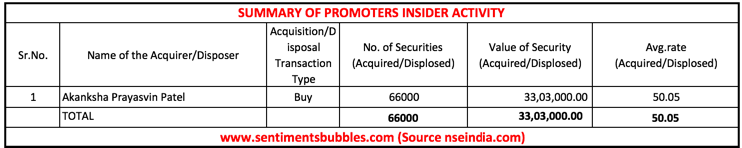

However, markets are forward-looking and so should investors be. The management sounds bullish in their comments, and they are backing it up by putting their money where their mouth is. It is apparent from the image below. The insider purchases have been nominal thus far. However, there may be more to come, who knows? (Promoter shareholding has been increasing progressively over the years).

Investment Thesis

Without getting into the macroeconomics of the Indian Economy and the ‘India Story,’ one thing is sure; the need for infrastructure is enormous and it will take decades (or longer) for the India as a country to be able to boast of an infrastructure comparable with that of China. There is a huge dichotomy in the ‘India Story’ commentary. To state it bluntly, any comparison with China is dumb, simply because the infrastructure is just not comparable. In other words, the need for infrastructure is real and Elecon is bound to be a beneficiary. The management sounds optimistic about the prospects. What then explains the fact that the stock price has been languishing? My thoughts:

- Market sentiment has been skewed decisively in favor of Automobile, Real Estate and Banking sectors in this bull run. These are considered as the growth areas, and the current bull run has been all about growth stocks. Momentum is what is driving individual stock prices. Almost always, the momentum is based on a growth story. However, chasing growth stocks at any price is risky. If the projected growth does not materialize, the stock price will fall, and investor capital will contract. Why swing for the fences?

- One of the best performing sectors in the current year has been the Real Estate Sector. Why have pure-play real estate stocks (land banks etc.) been such outperformers? The narrative is two-fold: (a) the post-demonetisation Indian economy is one which will move from being a predominantly black money one to one that is less black and (b) the implementation of the Goods and Service Tax (GST) will ensure that many businesses that were hitherto outside the tax net would now be included. The combined effect of these two factors would ensure that over the period of the next five years, the Indian economy would no longer be classified as a black money economy. I should hasten to add that these are not my views, this is the story that is driving these stocks.

- Without getting into the merits of the story, two things are apparent, and these are (a) the acceptance of credit cards has shot up dramatically and (b) GST has meant a massive increase in business for practicing Chartered Accountants (which means that the tax net is widening). Both of these are undeniable. Hence, I am inclined to believe that there is a kernel of truth in the story outlined above. I have a problem with the extrapolation. I think that most of the stocks that have shot up on the basis of the ‘story’ are simply exorbitantly priced and hence not investable at their current prices.

- Stock valuations and definitions of what is expensive and what is cheap is very subjective. The most popular methods are doing discounted cash flows (DCF) of projected future earnings and then arriving at an investment rationale. I think this is a risky methodology simple because there are too many assumptions that one has to make. Moreover, doing DCF’s means forecasting, and I am loathed to forecast. I prefer to keep things simple. I think it is better to look at the data that we have with us in real-time instead.

- In my opinion, the rational thing to do would be to buy a stock that is likely to benefit from the black to a less black story of the Indian economy and is relatively cheap. I think ELECON fits the bill perfectly.

- The management commentary has highlighted the growth in exports, and they expect the momentum to pick up shortly. Since the business model is spread across various sectors and geographies, I think that earnings growth for ELECON is dependable and the company even pays a dividend. The stock is pretty cheap, and that matters.

Elecon’s equity capital of 22.44 crores comprises of 112,199,965 shares of the face value of Rs. 2 each. All in all, ELECON is a GARP stock – Growth at a Reasonable Price. Hence, I think it is a safe bet at its current market price of Rs. 57.95 on the National Stock Exchange of India (NSE).