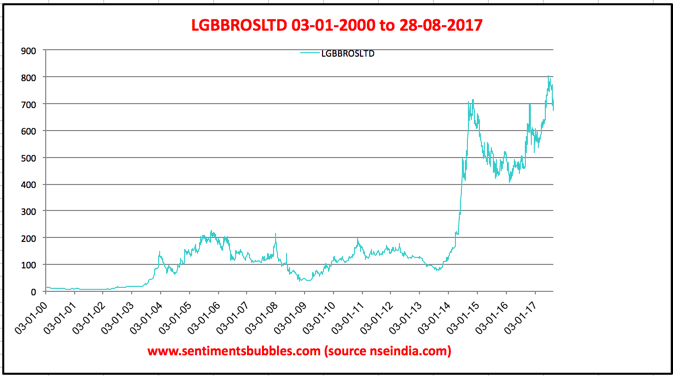

LG Balakrishnan & Bros Ltd

L.G.Balakrishnan & Bros Limited (LGB) was founded in 1937 as a transport Company and has evolved today into a major manufacturer of chains, sprockets and metal formed parts for automotive applications. LGB has its corporate office in Coimbatore in the state of Tamil Nadu. It has five plants that manufacture drive chains, machined and precision equipment and rolled steel products. LGB is the premier manufacturer of automotive chains under the familiar brand name ‘ROLON’.

Business Highlights, Prospects and Risk Factors

LGB is focussed on the two wheeler industry in India. Things have been looking up for two-wheeler manufacturers in the recent past. Not only is the management confident that the trend will continue, they feel that any downward trend in two-wheeler sales will be temporary or short-lived. Over the last four years, LGB has invested roughly Rs. 285 crores on upgrading facilities and expanding capacities. The reason for the optimism of the management is that it seems only twenty-five percent of our population have personal mobility, as on date. With rising GDP, the demand for two-wheelers is expected to remain robust. The company sites the power situation and exchange rate volatility as risks to their outlook.

As a company focused on innovation, LGB places a strong emphasis on Research & Development (R&D). Its R&D facility is equipped with state-of-the-art equipment for the testing of raw materials and finished products. The company has 17 chain manufacturing plants, all ISO 9001 certified by Underwriters Laboratories Inc., USA. Hence it is not surprising that about 10% of LGB’s products are being exported to the USA, European countries, Australia, New Zealand, South Africa, Japan, Far & Middle East countries.

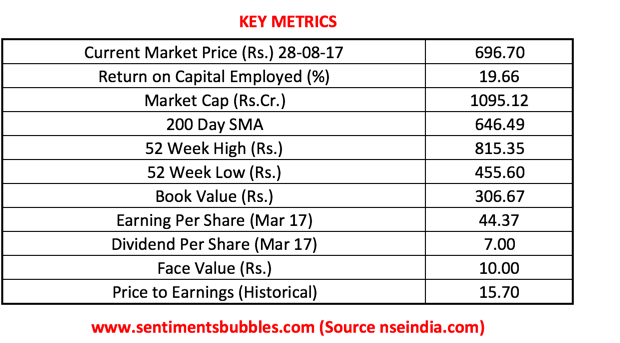

Key Metrics

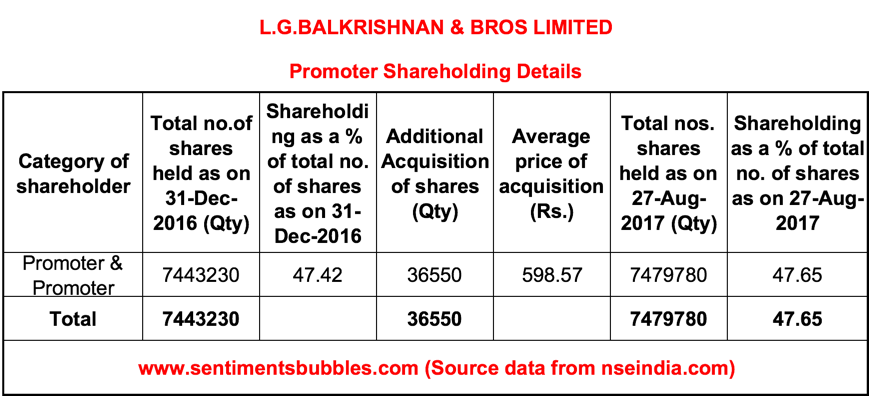

LGB boasts of a very robust Balance Sheet with little debt and high levels of cash flow generation. The details of the Promoter buying in the recent past are shown below:

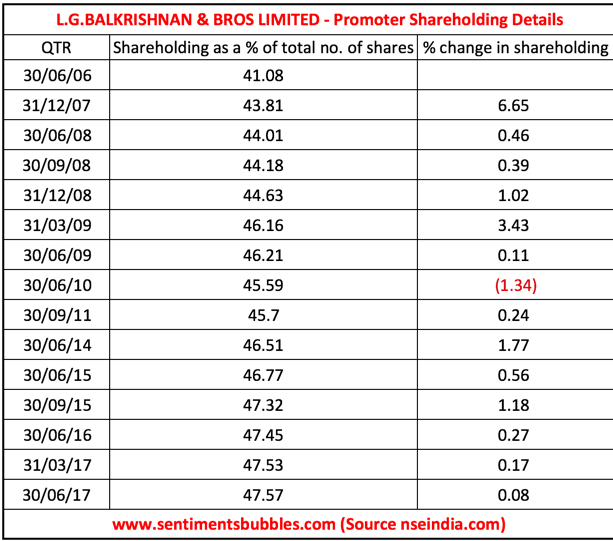

The Promoters have been steadily increasing their stake in the company over the past several years. That is evident from the table shown below:

Conclusion

The Promoters of the company are buying the stock at a steady clip and don’t seem to be any hurry whatsoever. Today, LGB is the No. 1 OEM supplier of Drive Chains with 70% market share, around 50% of the Replacement market. The market share is surprisingly high in both the segments, especially considering the fact that LGB is an auto ancillary business. Investing in LGB is what is popularly called side-car investing – the car or the mother-ship is the two-wheeler manufacturer to whom LGB supplies. Hence, LGB trades at a subdued multiple and justifiably so. The strength of the Balance Sheet and LGB’s dominant (almost monopolistic) position in its product category are huge positives. I think LGBBROSLTD at its closing price of Rs. 696.70 is a safe bet in the current market conditions. Timing a purchase is more of luck than skill. However, as long as one is investing in a good business, (with a long-term perspective), the timing wouldn’t matter.