International Paper APPM Limited

The Company produces a range of premium grade writing, printing, copier and industrial papers for domestic and export markets. The well-known cut-size papers of the Company offer a broad range of office documentation and multipurpose papers, from economy to premium grades, ideal for both home and commercial use.

- The Promoter, International Paper, makes renewable and recyclable products. International Paper (USA), established in 1898 is the largest pulp and paper company in the world, with approximately 58,000 employees across 24 countries. International Paper (USA) headquartered in Memphis, Tennessee, USA, bought 75% stake in the business then known as Andhra Pradesh Paper Mills Ltd in 2011 and they now own 75 percent. The Indian company, International Paper APPM Limited, is headquartered in Hyderabad.

- International Paper made an open offer for the shares of APPM in October 2012 @ Rs. 544.20 per share and the deal with the Promoters was at Rs. 523 per share. SEBI asked International Paper to hike the offer price to Rs. 674.93 per share. However, during litigation International Paper prevailed and the open offer went through at Rs. 544.20 per share.

Business Model

The Paper Industry has contracted over the last five years, primarily due to the transition to digital media and the increasing usage of paperless consumption. This has been partially offset by the increase in demand for packaging materials.The business of International Paper APPM Limited and its risk factors and prospects and can be summarized as follows:

- Globally over 400 million tons of pulp, paper, and board are produced. The largest producer countries are United States, China, Japan, and Canada – they make up more than half of the world’s production. The Global Annual Per Capita of the paper and board is about 57 kgs. Fifty-four percent of the paper and board produced globally is used for packaging, the share of writing and printing paper is twenty-seven percent. Roughly fifty percent of the global consumption of paper is in Europe and North America.

- The Paper is manufactured from renewable resources – tree fiber. The wood is treated chemically and processed. Recycled fiber is also being used of late. The Indian paper industry is self-sufficient, and most varieties of paper and paperboard are indigenously manufactured. Some types of specialty paper are imported. The current paper consumption in India is roughly 13 million tons. The per capita usage of paper in India is estimated at barely ten kgs compared with 75 kgs in China, 156 kgs in the European Union, 159 kgs in Korea, Taiwan, Hong Kong, Singapore and Malaysia, 215 kgs in Japan and 221 kgs in North America. The global average is 57 kgs. In other words, India hosts 17 percent of the world’s population and yet accounts for just 3 percent of the world’s production of paper and paperboard.

Risk Factors

- Paper manufacturing is a highly capital intensive, cyclical and low-margin business. Hence, if prices drop then there is a danger of incurring a loss. The Paper Industry is not very environment-friendly. However, International Paper APPM Limited supports farmer welfare programs and champions an eco-friendly environment.

- The main threats and challenges come from the rising cost of raw material – wood. Unfortunately, international Lumber prices have also been increasing, of late. The Paper Industry requires a lot of trees. In India, the available forest land is owned by the government. Corporate farming is not allowed.

- In India, the resources of wood (suitable for paper production) are inadequate. Hence, the cost of wood is much higher as compared to the rest of the world. In the opinion of the management, securing future wood supplies will be the industry’s greatest challenge in the days to come.

Prospects

- The management expects that over the next five years the industry will expand albeit slowly. They expect the increase in demand to come primarily from the developing world. In fact, the developed countries are reeling from the onslaught of cheaper imports from the developing countries.

- The fortunes of the Paper industry are positively correlated to the GDP of any country. It augurs well for the Paper Industry in India. Hence, the parent company is bullish on the prospects for International Paper APPM Limited. They see a change in lifestyle, increasing per capita and the resultant increase in demand for packaging. An ancillary trigger is the expected growth in India’s education sector.IT

- The paper industry in India is categorized into Writing and Printing (W&P), Paperboard and Newsprint segments. Paperboards constitute 43 percent of the demand volume; W&P accounts for approximately 35 percent, Newsprint for 17 percent and specialty papers for 5 percent. The management sees rapid growth in the uncoated W&P segment to the level of 6.4 million MT by the year 2022, as compared to the current level of 4.2 million MT. Paperboard production is expected to increase from the present 5.9 million MT to 7.6 million MT by as early as 2017–18 on account of improved FMCG sales, wider reach of retail, penetration of health care into the rural economy and the sustained demand for packaged products on account of increase in GDP. All in all, consumption in India is expected to touch 20 million MT by 2020 as against the current consumption of 13 million MT.

- Since the management expects the future supply of wood to be the biggest challenge facing the industry, they have an aggressive social farming initiative. In fact, the company is a pioneer in the field of social farming. In the year 2015–16, International Paper APPM Limited could source all its requirement of pulpwood within a radius of 350 km and the majority of the procurement was from the company’s farm forestry initiative. The farm forestry initiative involves developing massive plantations on marginal and degraded farm lands. The company distributes saplings at concessional rates from its nurseries and educates farmers in the best methods to grow them. The Social Farming initiative is implemented via the Rythukosam Smart Card. This is how the card works:

IPAPPM takes one more step ahead towards making the farm forestry model a sustainable one, and it understands that the prerequisite for the same is to have the farmer’s interest protected. Any agricultural produce in the market is subject to the equation of the supply and demand. The farmer’s net return does never get ensured, and unfavorable situation is not uncommon in farmers life. Pulpwood farmers are not any exception. However, IPAPPM takes it as a serious concern and tries to contribute to the sustainability of the model as much as possible from the limited resources it has. It is introducing a scheme called “Rythukosam Smart Card.” This is purely a voluntary scheme. IPAPPM preaches the best practices for pulpwood cultivation that the farmers follow to gain the best yield. The card will be issued to such farmers who follow the prescribed practice in the field. This card will have details of the farmer and his plantations including GPS coordinates recording in the company database. A pre-defined credit policy will be there linked with the number of saplings purchased by the farmer from the IPAPPM CPC and advantage of this credit would come to him during repurchase of sapling IPAPPM CPC in the next cycle for the same GPS coordinate acreage. Later on, when he would bring the wood after a specified period of 3.5 years to IPAPPM for selling, this card would be scanned, and the quantity of wood he brought from his plantation would be recorded. These cards will be linked directly to the bank account of the beneficiary farmer so that the transfer of the monetary benefit (if any) that is to be done can happen directly to the farmers’ account without involving any middlemen. At the same time, the cards won’t cost the farmers anything but following the best practices in the field, for their interest to get the best out of their land in terms of yield.

- The clonal saplings so distributed have started yielding results, and the farmers have reported more than 100 percent improvement in yield per acre of wood produced. The Rythukosam Smart Card initiative enables farmers to have direct access to the company. In this way, the company has cultivated its supply of wood that is sustainable and affordable. In my opinion, this is a very healthy and sustainable competitive advantage for the company – almost a moat.

- The Union Budget 2016, scrapped the customs duty on wood chips used in Paper manufacturing and also reduced the customs duty on certain types of wood pulp.

- International Paper APPM Limited is committed to making sure that the momentum seen in 2015–16 is maintained in the future. Towards this end, systems and processes have been upgraded, and investment in workforce and customer support has been enhanced. The company sees traction in the future on the back of government literacy programs and India’s GDP growth. The management sees an opportunity in the Speciality, Coated, and Tissue Paper Segments. The hit is in the Newsprint Segment since people have stopped reading hard copy.

- It is a fact that a lot of global paper companies have shut down. The reason is that the cost of wood (raw material) is high and demand has been shrinking due to the advent of digital technologies. However, online shopping has also led to the increase of the application for paperboard and boxes, after all, paper surrounds the corrugated boxes. The gradual consolidation of the paper industry means that what we are experiencing now is a shake-out. It is expected to result in better productivity and profitability for International Paper APPM Limited.

Conclusion

- International Paper APPM Limited is uniquely positioned to face the challenges that the industry had to offer. International Paper APPM Limited has over the years improved its competitive strength due to aggressive cost cutting and technological improvements. It is clearly visible in the quarterly results as well.

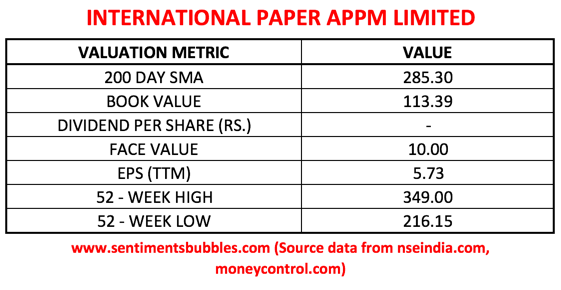

- International Paper APPM Limited is a standalone company, and the face value of the shares is Rs. 10. The Key Valuation Metrics are shown below:

- The Current Market Price (CMP) of International Paper APPM Limited is Rs. 322.20. In other words, we can buy the shares of a Multi-National Company (MNC) at a discount of more than Rs. 200 per share as compared to what the Promoters have invested. I don’t see any reason not to invest.