Bharti Airtel Limited

Bharti Airtel Limited (BAL) is India’s largest mobile network operator and also the third largest in the World. Unbeknownst to most, Bharti Airtel Limited (BAL) operates in eighteen countries across South Africa, Asia, and the Channel Islands. Airtel is also India’s second most valuable brand. The company has been listed on the bourses since the year 2002.

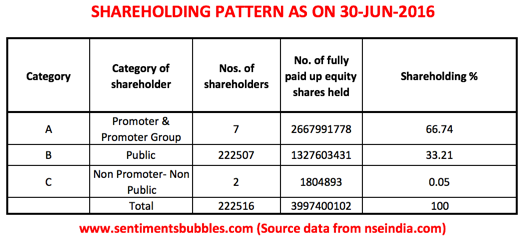

Shareholding Pattern and Key Metrics

Considering the size of its equity, BAL has a very high percentage of Promoter shareholding. Given this, the fact that the Promoters are increasing it, even more, is encouraging.

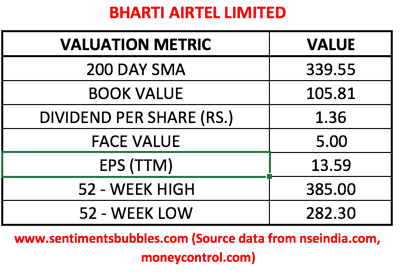

(BHARTIARTL – KEY METRICS)

The threat from Reliance JIO

Currently, BAL has a Revenue Market Share of roughly 31 percent in India. Reliance JIO has announced tariff plans that are proposed from December 31st, 2016 (its commercial launch). The fear is that JIO will erode BAL’s dominant position in India’s cellular market.

The tariff plans range from Rs 149/month for 0.3GB to Rs 4999/month for 75GB. All the plans will offer free unlimited voice call (local and STD) and also free roaming. Other key highlights of the launch strategy are as follows:

• Data will be charged at Rs 50/GB vs. existing tariff of Rs 250/GB

• From September 5, 2016, onwards, JIO’s bouquet of apps, all services will be made available to everyone free until December 31, 2016

• There will be no blackout dates for its customers (i.e. no extra charges during festivities)

• The company plans to cover 90% of India population by Mach 31, 2017.

• It will offer 25% additional data for students with a valid ID card.

What JIO has done in a nutshell is that they have bundled free voice along with data. Will free voice consume data? No clarity as on date, in all probability it would. My interpretation of the above is as follows:

- The real issue with the launch of JIO services is that the pricing metric has moved lower. Will the expected increase in volumes, and jump in data consumption make up for lower tariffs? Only time will tell.

- I think that the JIO effect will sound a death knell for the smaller players in the telecom space. In that sense, the JIO launch will accelerate an industry-wide consolidation in the telecom sector. Any such consolidation will only work in favour of BAL and not against it.

- BAL is well entrenched in the business and JIO is an upstart. The loss in revenue will undoubtedly hit BAL, but not as hard as is perceived. The reason is that the JIO network is not that extensive as on date and will take some time to expand and stabilise. JIO’s plans to cover 90 percent of India’s population by 31 March 2016, sound ambitious, to say the least. In any case, it is very unlikely that existing subscribers of BAL will switch in a hurry. Legacy issues of the erstwhile RCOM are still fresh in the minds of most customers. Most people want to add JIO as an option if their existing service provider fails to match the tariffs. Premium subscribers, in particular, are unlikely to switch immediately.

- The fears of a price war are unfounded. The kind of money that JIO has invested, they need to recoup their costs and then some. In other words, further price cuts can be safely ruled out. In such a scenario, existing incumbents like BAL are likely to gain market share, albeit at a lower price point.

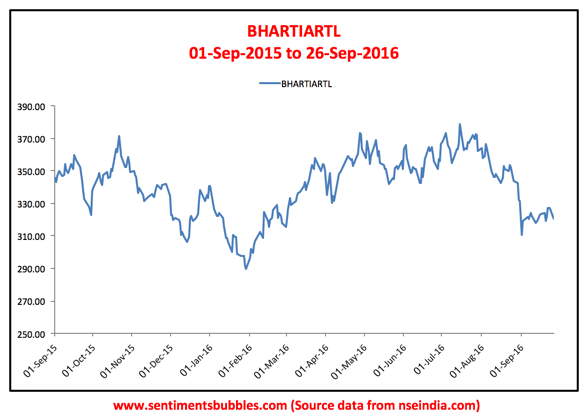

- The market seems to have written off BAL entirely, and the valuation is attractive at current prices. In the image shown below, notice that the price of BAL’s stock had been falling continuously since the beginning of the year in anticipation of the JIO launch. In other words, the current market price of Rs. 314.80 has corrected substantially over the last twelve months. After the launch of JIO services on 05 September 2016, the price dropped further. Since the Promoter group has been buying at these prices, it makes sense to invest along with them.

(BHARTIARTL – THE JIO EFFECT)

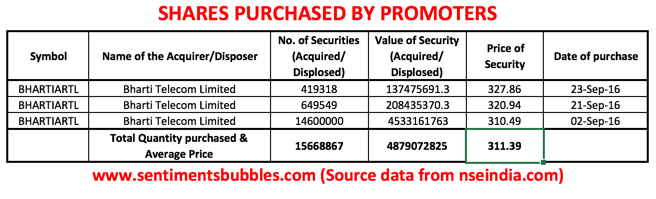

- To be fair, in percentage terms, the shares purchased by the Promoters (as on date and shown below) are hardly 0.40 percent of the paid-up capital of BAL. However, the existing Promoter shareholding is high, to begin with, and secondly, further purchases by the Promoters are not ruled out.

(BHARTIARTL – INSIDER PURCHASES)

- BAL has also issued an Investor Presentation, after the JIO launch.

Investment Rationale

BAL as an investment idea is a contrarian one; it is much against conventional wisdom. I think that one has to take a call on the viability of the business. In my opinion, with the spread of smartphones and the internet, the business viability and BAL’s dominance is beyond doubt. Should one be objective and use the JIO launch as an opportunity to own India’s second most valuable brand at an attractive price OR should one be subjective and skip the opportunity. As long as we are buying a good business at a fair price, I think that it is a risk worth taking. BAL at its closing price of Rs.314.80 on Tuesday, 27 September 2016 is ‘good business at a fair price’ for long-term investors.