Insider Sentiments – S&P BSE Healthcare

(4 Stocks recommended)

The market bucked the May seasonality. We now have a scenario where the Indian Stock Market has recorded positive monthly returns for all the first five months of the current calendar year. It is an unprecedented occurrence and seems to suggest the current calendar year is an ‘outlier year.’ In such a scenario, the Indian pharmaceutical sector has bucked the trend.

Investment Thesis

The image below shows the best performing sectors of the Indian Stock Market for the period 01 January 2008 to 31 December 2016.

Historically, the best performing sector in the Indian Stock Market has been the auto sector. What that means that stocks that comprise the S&P BSE Auto index have collectively given the returns shown. I need to highlight that CAGR is the compounded growth rate. In reality, it does not mean that the S&P BSE Auto index has grown @ 15.09 percent every year. In a particular year the S&P BSE Auto Index could have given steeply negative returns. In other words, on a yearly basis, returns would have been all over the place. However, for the patient investor who could ride the volatility, 15.09 percent is what he or she would have earned (mathematically) over the long-term.

In the stock market, what is shown above is also known as the ‘base rate.’ Base rates are one of the most illuminating statistics for stock market investing. Think of a base rate like a cricketers batting average. It tells you what to expect from a particular class of stocks historically. While using base rates, I wish to highlight the following:

- Base rates do not tell you anything about the individual stocks that are comprised therein.

- While using base rates, we want large samples. The sample shown above is just eight years; data is not available for more extensive periods. Hence, the analysis suffers from a dearth of available data, but there is no way out. Ideally, I would have liked to filter twenty-five years of data so that it takes care of many market cycles; unfortunately, the data is not available.

- In the current scenario, Indian Pharma companies are being treated as untouchables. It is despite the fact that the base rate or the batting average for the S&P BSE Healthcare Sector is 14.33 percent. Historically it is the third best performing sector in the Indian Stock Market. In my opinion, by ignoring the base rate, Indian investors are betting against it. That is not a very rational thing to do.

- As investors, we tend to react to short-term events and news flows. We then extrapolate these far into the future. We seem to rely on heuristics instead of probabilities. The rational thing to do is to bet with the base right and improve one’s probability of being right. Effectively in the current scenario, what has worked historically (S&P BSE Healthcare) is getting walloped by what is working in real-time (S&P BSE Realty).

- In the immediate instance, the current regulatory issues faced by the Indian Pharma sector are being extrapolated to mean that the industry is finished. As a result, the prices of pharma stocks have been hammered to 52-week lows. We need to remember that stocks represent businesses; focussing on the stock price is self-defeating. Hence, the need to anchor ourselves to the businesses and not to their stock prices. As Warren Buffett has said ‘focus on the playing field, not the scoreboard.’

S&P BSE Health Care Sector

As investors, we want to invest in a sector that has is sure to grow, over the long-term. In my opinion, the growth of Indian Pharma companies in the long-term is as near to a sure thing as one can get. One of the caveats is that one has to be willing to invest for the long-term; that would be a period of three years at the very least.

I have used the S&P BSE Healthcare Index for my analysis. It consists of seventy names. Will the businesses that comprise the S&P BSE Healthcare sector will be able to navigate themselves out of the regulatory rabbit hole and perform in the future? I think they would. On which of these names should one bet?

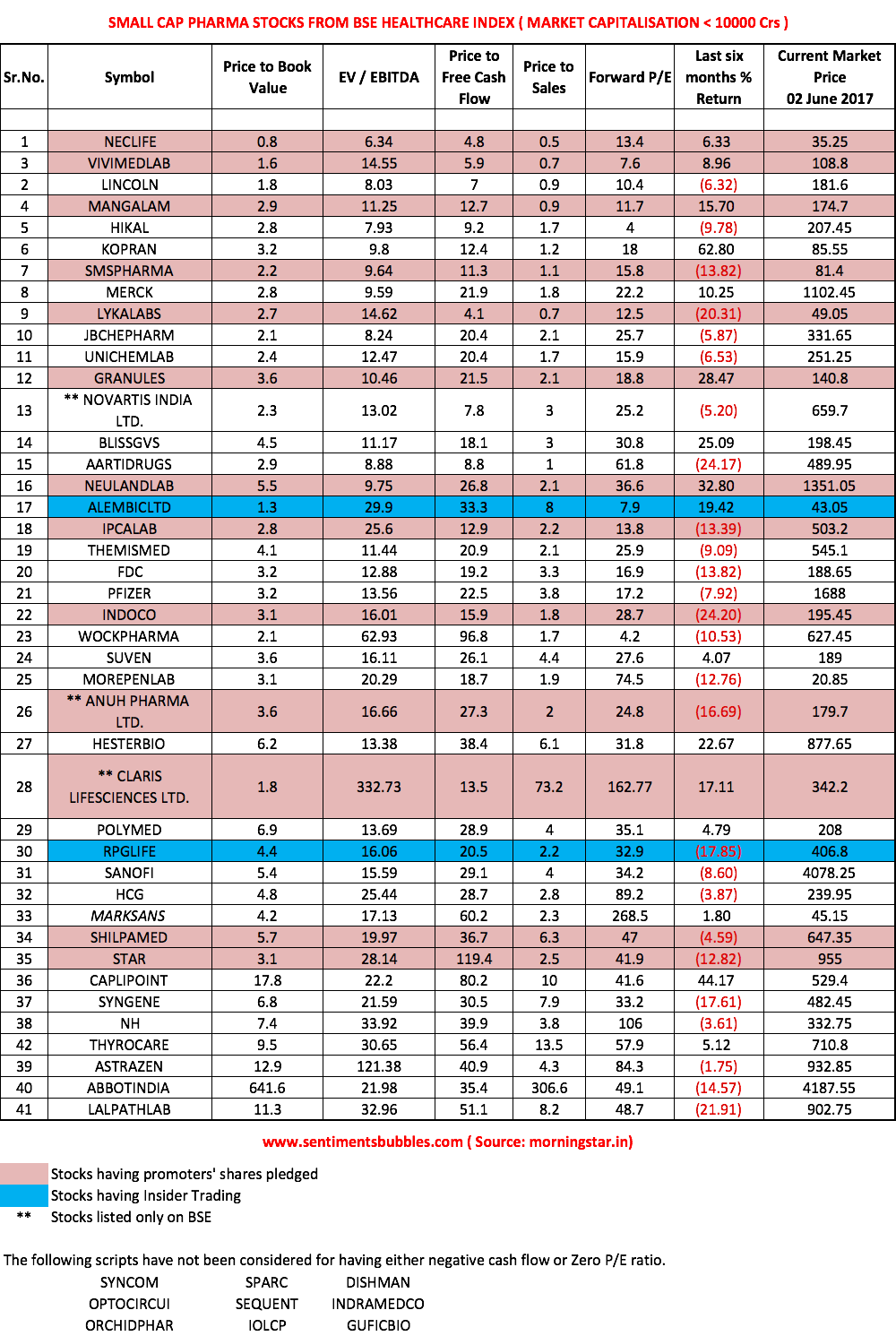

There are many rules that analysts use when looking at stock prices and their relative values vis-a-vis the overall market valuation. These rules of thumb are, price to earnings, book values, free cash flow and a host of others, In my opinion, when used collectively, these rules tend to point in the direction that has the highest probability of achieving investing success. Hence, I have screened all the stocks in the S&P BSE Healthcare Sector for the attributes shown in the table and then ranked these stocks. While running the numbers I have split the stocks based on their market capitalisation. The stock with the best collective attributes is shown at the top (of the respective table) and then in descending order of preference.

While looking at the numbers shown above, readers need to understand the following:

- In each of the tables, I have highlighted stocks wherein the Promoter holding is pledged. I have ignored the percentage of Promoter holding that is pledged. For example, in the case of DRREDDY’s just three percent of the Promoter holding is encumbered; yet I have highlighted the name. In other words, I have ignored the absolute values and highlighted the names.

- There are some stocks that I have ignored completely. These are shown in the footnotes to the table. For example, Fortis Healthcare is in the hospital management business. The hospital management business is expected to have a long runway in the years to come. Fortis does not have any earnings as on date. Hence, I have excluded it from my computation.

- While ranking the stocks, I have considered their six-monthly returns. The idea is to get some perspective on what the market is doing. If one were to assume that the ‘market knows’ things that we don’t, one could use these returns independently and buy the name with the maximum momentum. Alternatively, if one wanted to select a name that is quoting very close to its book value, one can do so by ignoring all other attributes. Risk- averse investors may prefer to avoid all names where Promoter holdings have been pledged, irrespective of the quantum. In other words, there are myriad ways in which the data presented can be used.

- Some amount of caution is warranted while investing in the Small-Cap stocks. In the case of the Large-Cap names, one could use the eighteen names and create an Equal Weight ’Pharma Fund’.

Incidentally, the S&P BSE Healthcare sector was the worst performing sector in May 2017; it fell by nine percent. In any case, the health care stocks have been the worst performing stocks in the ongoing bull market. In other words, there is an attempt to be contrarian in this post. I am acutely aware of the fact that being contrarian is easy; what matters is being contrarian and being right. Hence, what I did next was to highlight the names where the Promoters have been buying shares from the open market and there has been no pledging of the Promoter stake.

For the Insider Sentiments portfolio, I think the four names with insider activity as shown in the two tables above namely ALEMBICLTD (43.05), RPGLIFE (406.80), GLENMARK (650.35) and LUPIN (1165.15) are worth investing as on date.