Lakshmi Machine Works & Super Sales India Limited

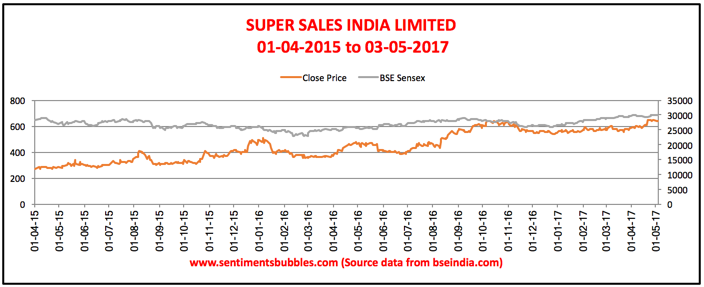

Super Sales India Limited (SSI) and Laxmi Machine Works (LMW) are sister companies. The primary business activity of SSI was to act as a selling agent of LMW. As on date, this activity of acting as an agent has been expanded to cover other group companies was well (for e.g.., Elgi Electric etc.are). SSI has four divisions: Marketing, Textile, Engineering and Wind Energy). The bulk of the profit is from Marketing department.

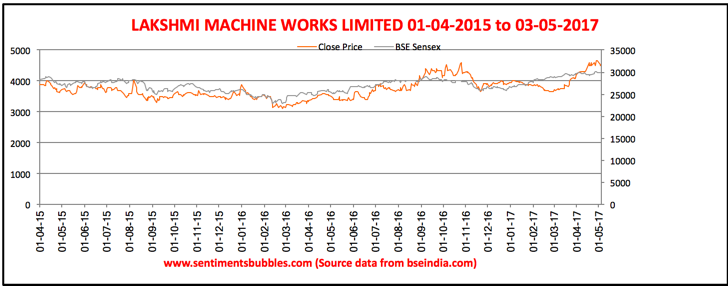

LMW is a global player in the manufacture of Textile Machinery. It boasts of a market share of as high as sixty percent in the domestic Textile Spinning Machinery Industry. LMW has also diversified into CNC Machine Tools. Their foundry exports castings and LMW is also an Original Equipment (OE) supplier to some global companies. LMW has four major product segments, Textile Machinery, Machine Tools, Foundry Division and the Advanced Technology Centre. All of these are located in and around Coimbatore in Tamil Nadu, India.

India’s textile sector has a share of thirteen percent in the exports. The fact that India’s textile industry is globally competitive is worth applauding since that can’t be said for most of the other sectors of the Indian economy. Within this area and in the Textile Machinery segment LMW is the leader. The company is practically debt-free.

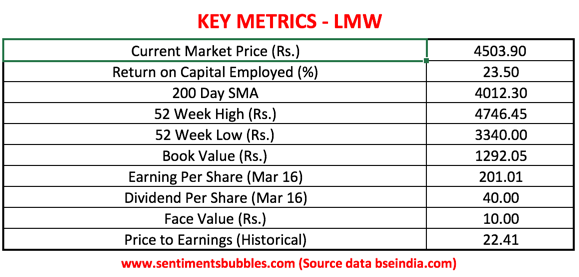

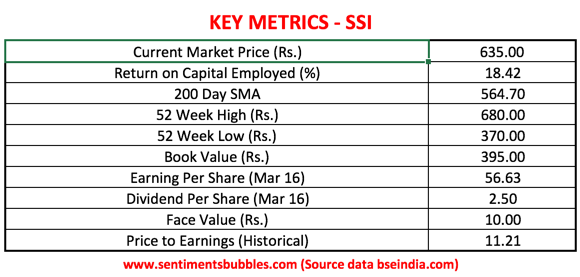

Key Metrics

The Key Metrics are shown below:

Investment Thesis

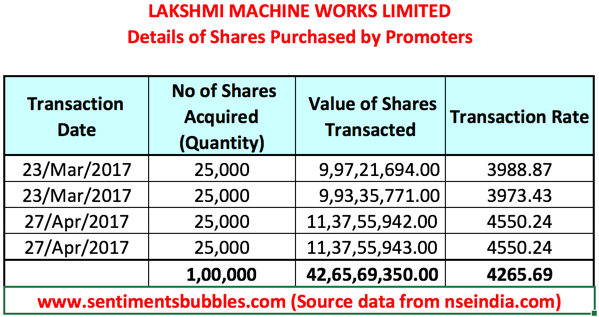

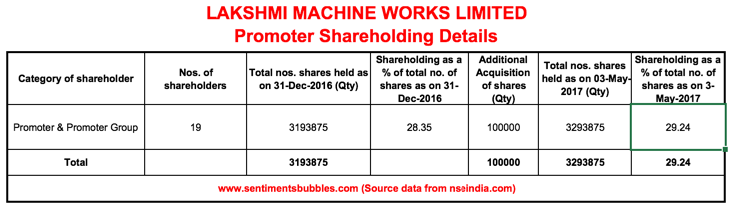

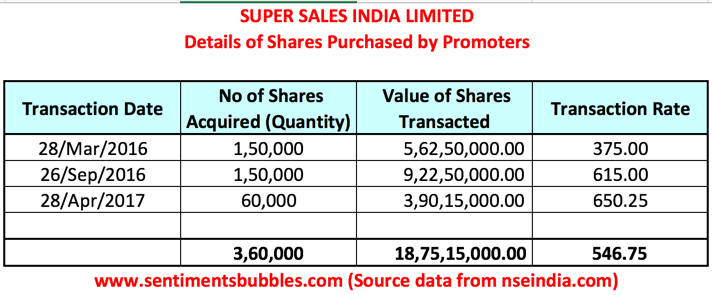

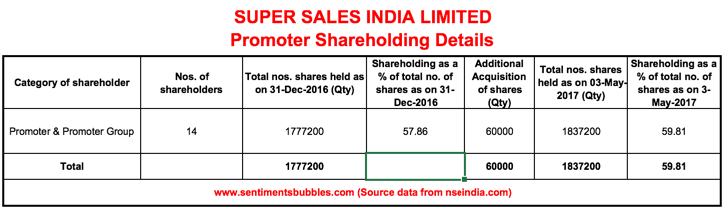

The Promoters of both the companies are shoring up their cross-holdings as can bee seen below:

The Board of Directors of both the companies are slated to announce their quarterly results and dividends on 22nd May 2017. At the same time, they have purchased shares before the commencement of the ‘silent period’. The Promoter group is known to be conservative and honourable. In other words, the quality of the top management is beyond doubt. I think that both these stocks at their closing prices of LAXMIMACH Rs. 4637.25 and SUPER Rs. 596.30 (only listed on BSE) are worth investing at their current prices.