United Spirits Limited (Mcdowell-N)

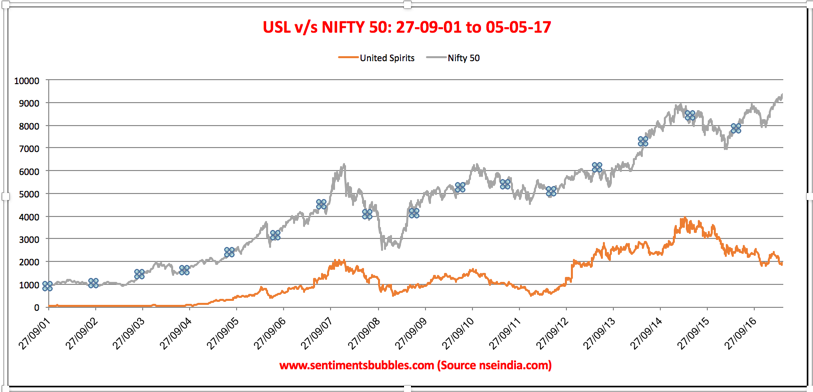

United Spirits Limited (USL) is the largest Indian spirits company. USL is engaged in the manufacture, sale, and distribution of alcoholic beverages. It is also the second largest spirits company in the world. United Spirits Limited (USL) is an indirect subsidiary of Diageo Plc – a global leader in beverage alcohol with an outstanding portfolio of brands across spirits, beer, and wine categories. On the NSE, USL trades under the symbol MCDOWELL-N, and on the BSE the scrip code is 532432.

USL has a big and popular brand portfolio, including much-loved brands such as McDowell’s No.1, Royal Challenge, Signature, and Antiquity. It is engaged in selling Scotch whiskey, IMFL whiskey, brandy, rum, vodka, gin, and wine. Headquartered in Bengaluru, the company also imports, manufactures and sells Diageo’s iconic brands, such as Johnnie Walker, VAT 69, Black & White, Smirnoff, and Ciroc, in India.

Insider Sentiments

There have been no market purchases of USL stock by the Promoter. However, USL qualifies as a stock for Insider Sentiments since the Promoter (Diageo Plc) has acquired shares in USL in two parts. The details are:

- In November 2012, Diageo Plc offered Rs. 1440 for a 26 percent stake in USL. At that price, Diageo completed the purchase of 25.02 percent in USL by acquiring the shares from the UB Group of companies. However, minority shareholders did not tender their shares at Rs. 1440, and the public offer failed. Hence, Diageo Plc was unable to raise its ownership interest beyond 25.02 percent.

- To increasing their shareholding to fifty percent and beyond, Diageo Plc announced another open offer to buy 26 percent from the minority shareholders at a price of Rs. 3030 per share. As a result, in July 2014, Diageo Plc (through their subsidiary Relay BV) managed to get the required quantity of shares. Their shareholding aka ownership percentage now stands at 54.78 percent of USL.

- In other words, Diageo Plc paid approximately Rs. 2235 per share for their 54.78 percent Promoter shareholding in USL. The share price closed at 1898.70 on the National Stock Exchange of India (NSE) on 05 May 2017.

Prospects & Risk Factors

The management led by Diageo Plc has been pursuing a ‘Premiumisation strategy’ – USL is focussed on the ‘Premium brands’ in its portfolio. It has resulted in double-digit net sales growth in the ‘Prestige and Above’ segment which is the one that generates profits. The low margin brands and products are not being pushed. What that means is that the management is concentrating on the ‘sales mix’ and profitability as against absolute quantities and turnover. The prospects for USL can be summarized as follows:

- The alcoholic beverages industry is expected to grow at the rate of 8 to 10 percent over the next five years. In any country, the urban population constitutes the primary consumers of premium and super premium spirits. In India, almost half of the population of roughly 1.2 billion is aged between 20–59 years. It is the prime age group for alcohol consumption. The expected growth rate in this segment of the population is estimated at roughly 35 percent per annum.

- A rise in living standards is expected as a result of the continuous increase in per capita incomes of the Indian population. It is projected to lead to a growing acceptance of alcohol consumption and a shift in attitude among India’s burgeoning middle-class population.

- USL has integrated the Diageo brand portfolio with their own in the current year. Their portfolio consists of over 20 brands, with the key names being Smirnoff, VAT69, Johnnie Walker and Black & White, all of which are positioned in the premium and luxury segment.

- The alcohol industry is heavily regulated. As a result, there is a hidden benefit; regulation acts as an entry barrier. High entry barriers automatically translate into a favorable environment for existing players. In other words, there is likely to be a dearth of competition in times to come. The perception that the rise of Patanjali will hinder the growth of FMCG stocks (like Nestle and Colgate) does not apply to the alcoholic beverages industry.

The Risk Factors that one has to consider before investing in USL are:

- The accumulated losses of USL as on 31 March 2016 have resulted in an erosion of more than fifty percent of its peak net worth during the immediately preceding four financial years. As a result, USL has been referred to the Board for Industrial and Financial Reconstruction (BIFR). In that sense, USL is a BIFR company as on date.

- The increasing price of ethanol – one of the primary raw materials used in the production of alcohol beverages – has severely impacted the industry cost structure in recent years. Prices of ethanol, which accounts for nearly 40% of the total cost of materials, has increased over the past few years following the implementation of the ethanol blending program (EBP) by the government. I should hasten to add that Ethanol pricing affects the industry as a whole and not only USL.

- The Indian spirits industry is one of the most regulated, with prohibition in force in a few states, sales being limited in some states to government approved stores, and drinking prohibited in public places. The question that comes to mind is: what if more states resort to prohibition? There are no clear answers. From the State Governments point of view, as on date, roughly one-third of the annual tax revenues come from the Alcoholic Beverages industry. It seems extremely unlikely that these can be replaced in any way in the event of prohibition being imposed nationwide. In other words, even though the threat of a ban is real, the likelihood is slim.

- Looking at it another way, over-zealous state governments, eager to protect their turf (tax collections) have successfully prevented Alcoholic Beverages from coming under the ambit of the Goods & Services Tax (GST) regime. Would these same state governments now resort to prohibition? I don’t think so.

Financials and Valuation

The current set of financials are a mess; there is no doubt about that. However, markets tend to be forward-looking, and the new management is expected to set things right sooner rather than later. Diageo Plc has acquired a majority shareholding only in the financial year that ended on 31 March 2015. In other words, it has been only two fiscal years since the old management has been replaced.

In my opinion, the BIFR status is a legacy issue and does not reflect upon the long-term prospects of the business that USL is in. A substantial reduction in finance costs and a corresponding improvement in profitability is expected in the years ahead, solely due to improvement in the quality of the management than anything else. The following is worth highlighting from a shareholder value perspective:

- A reduction in the net debt levels has been achieved by the divestment of non-core assets. The borrowing terms have been renegotiated. It has resulted in a decrease of the interest cost. The long-term loans and liabilities have come down from Rs. 13,054,097 as on 31 March 2015 to Rs. 8,594,323 for the year ended on 31 March 2016.

- An improvement in corporate governance and compliance has resulted in an improved credit rating. During the year, ICRA Limited upgraded the Long Term Rating from BBB to A+, while the Short Term Rating improved from A3 to A1+. This augurs well for the future since it would mean cheaper availability of funds.

- The strategic revenue mix (highlighted earlier) strengthened by the Diageo portfolio, has steered the company’s growth charter over the past two years. USL is a market leader in volume and value in the Indian alcohol beverages industry. As a result, USL has improved both the top line and its operating profit.

- The ‘Net cash generated from operations’ as per the cash flow statement was Rs. (1,963,136) On 31 March 2015 and stood at Rs. 2,385,889 as on 31 March 2016. Moreover, the company has been reporting ‘Net Profits’ for the last two years. The Earnings Per Share for the financial period ended 31 March 2016 was Rs. 67. For the current year, consolidated numbers are likely to be lower, but the company is reporting Net Profits and not losses as it used to in the past.

Investment Thesis

In my opinion, all of us are trying to buy low and sell high. What we end up doing, more often than not, is to buy high and sell even higher. I subscribe to the buy low sell high thesis. As a result, buying near the lows or trying to buy near the lows is what makes intuitive sense.

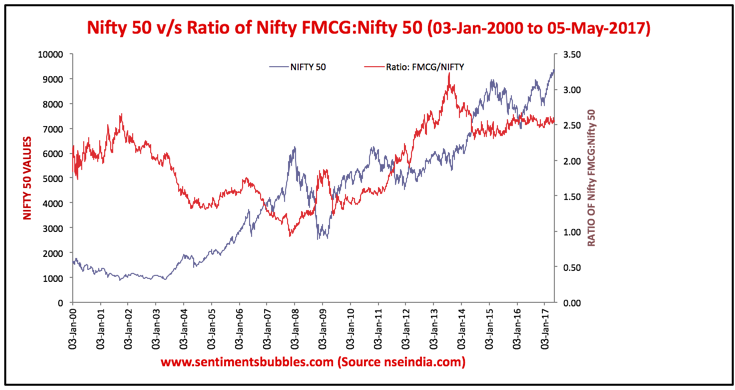

The Nifty has been on a tear of late and the with the benefit of hindsight, one can now say that the index was ‘bottoming out’ when the demonetization announcement was made on 8th November 2016. Since USL is part of the Nifty FMCG Sectoral Index, what I did next was to look at the historical performance of the Nifty FMCG Index and compare it with that of the Nifty. It is shown in the image below:

The image above highlights the fact that stocks comprised in the Nifty FMCG Index tend to move higher as the Nifty moves lower. In other words, the Nifty FMCG Index zigs when the Nifty zags and vice versa. The correlation between the two indices (Nifty and Nifty FMCG) is less than one. What that means is: if the Nifty rises of falls by 1 percent the Nifty FMCG will rise or fall by less.

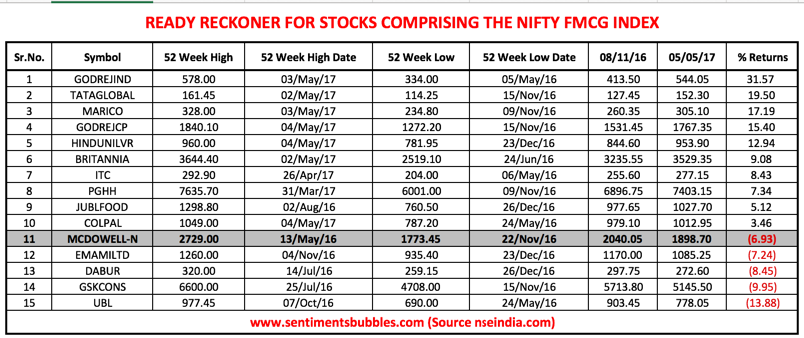

The Nifty FMCG Index comprises of just fifteen stocks. ITC and HINDUNILVR account for roughly sixty-nine percent of the Nifty FMCG Index. USL has a weight of 2.17 percent in the Nifty FMCG Index. Some relevant statistics of the stocks that comprise the Nifty FMCG Index are shown below:

In the image above the stocks are ranked in descending order of their returns from 8th November 2016 till date. The respective 52-week highs and lows are also shown to gain some additional perspective. The price of USL has fallen roughly seven percent since the demonetization announcement. The reason is the recent Supreme Court verdict and related restrictions on the sale of alcoholic beverages near national highways and associated issues.

In my opinion, the current mood and environment surrounding the Alcoholic Beverages industry is a buying opportunity. I have no hesitation in recommending USL at its closing price of Rs. 1898.70 on the National Stock Exchange of India (NSE) on 5th May 2017. The current regulatory environment is being made out to be a bigger threat than it is. Regulation cannot take away the obvious positives. To conclude, these are:

- We keep hearing of India’s demographic dividend. USL is a direct play on India’s consumption story and is a recession-proof stock.

- Alcoholic Beverage stocks in general and USL in particular, boasts of three things that every marketer dreams of; Brand recall, pricing power and a loyal set of customers.

- The Promoter group, Diageo Plc ended up paying Rs. 2235 per share for their ownership stake in USL. The opportunity to buy USL at a price that is lower the one that ‘they’ bought it at has presented itself. It doesn’t get better than this!