Solar Industries India Limited

Solar Industries India Limited (Solar) is a manufacturer of industrial explosives and explosive initiating systems. Its products are explosives, detonators and allied devices. In fact, Solar is India’s largest manufacturer and exporter of Industrial Explosives. Solar has 25 manufacturing plants across 8 states in India and 3 in overseas locations. Their products are consumed in 42 countries across the globe. They are the market leaders with a 22% share in the domestic market and a 55% share in exports of industrial explosives and initiating systems.

Prospects

The reforms process in India is expected to gather pace in the next couple of years. If things envisaged by the government in terms of the development agenda pan out, India is expected to become the world’s third-largest economy by 2030. With this in mind, the following are positive for the business prospects of Solar.

- Infrastructure: With a growing population in India, demand for road transport is expected to increase further by 2020. While state highways are projected to link most districts in the country, the new all-weather rural roads are expected to provide access to the furthest outlying villages.

- Mining: Coal India Limited (CIL), India’s largest coal company, has set itself an ambitious target of producing 1 billion tonnes of coal by FY2020, aimed at helping India’s power generation needs and lowering its reliance on expensive coal imports.

- Defence: The opening up of the strategic defence sector for private sector participation, and the high government allocation for defence expenditure are encouraging. Of the Defence Budget of approximately 2.58 lakh crore, roughly 80,000 crore has been allocated towards capital spend. This opens up great opportunities for Solar, since they have already rolled out products such as Warheads, High Energy explosives and Composite Propellants.

Valuation, Key Metrics and Investment thesis

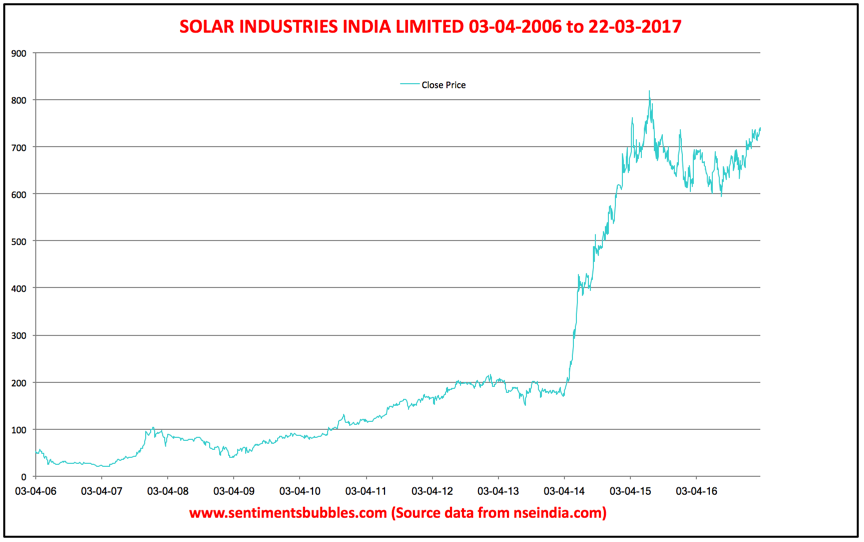

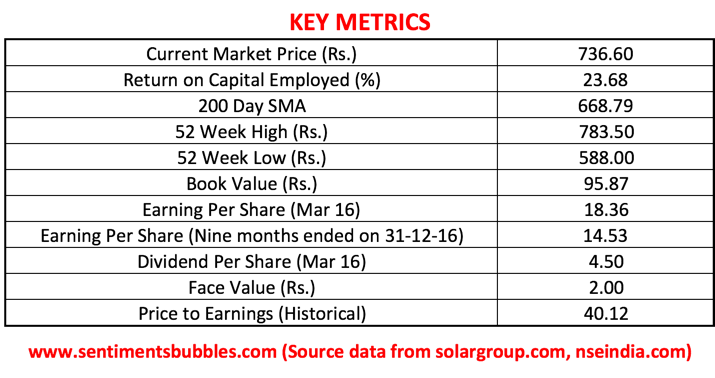

The Key Metrics are shown above. Solar has a low debt to equity ratio. In other words, the Balance Sheet is not a leveraged one. The stock is not cheap. Yet, in my opinion, it is worth buying. My investment thesis is as follows:

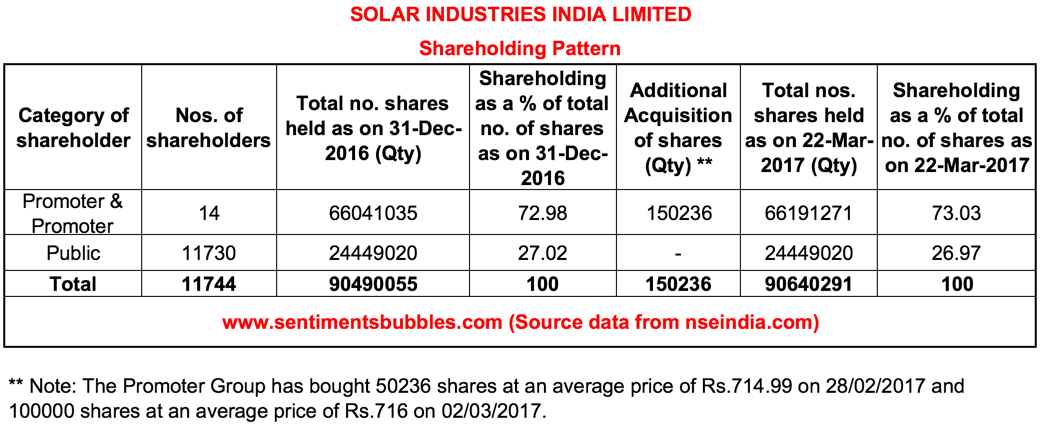

- A massive opportunity exists with the Government’s focus on infrastructure, housing, coal mining and defence. Solar boasts of a very high Promoter shareholding. Despite owning 72.98 percent of the shares as on 31st December 2016, the Promoters have chosen to further enhance their shareholding at these elevated valuations. It is shown below:

- What is shown in the Key Metrics above is the historical Price to earnings ratio. The markets tend to look ahead. Since Solar is categorised as a growth stock and the Earnings Per Share is expected to grow at a compounded rate of 15 percent over the next three years. That would translate to an earnings of roughly thirty per share three years from now. The Forward Price to Earnings would be in the region of twent six per share.

- The Indian Stock Market has been one of the outperforming global markets in the recent past. Trying to time the purchase or sale of a stock is difficult. Very few investors can time markets consistently and correctly. A correction in the market will definitely make things cheaper. Yet, it might be a good idea to buy a small quantity of Solar immediately at the Current Market Price of Rs. 736.60 and then wait for a correction to add more.

- Solar is pretty illiquid and hence immune to market corrections. With the Promoters stepping in to buy, my bet is that the downside will remain capped.