Insider Sentiments – 10 of 2017 – Apollo Hospitals Enterprises Limited

Apollo Hospitals Enterprises Limited (AHEL) is well entrenched in the business of providing healthcare services and infrastructure facilities to India’s teeming millions. Today Apollo is a brand that is synonymous with healthcare in India. AHEL is a pioneer of corporate healthcare in India and was founded by Prathap C Reddy in 1979. AHEL has its headquarters in Chennai, and they have beds across 70 hospitals. AHEL also runs 2556 pharmacies and 172 diagnostic clinics.

Business Overview and Prospects

The fact that infrastructure facilities for healthcare are limited is a given. The existing medical infrastructure is inadequate and unable to meet the demands of a diverse and burgeoning population. As on date, public healthcare facilities do not adequately cover the entire country. Public healthcare suffers from a paucity of funds which leads to a host of other problems like understaffing, antiquated equipment and lack of attention to hygiene. There is no reason to believe that this is about to change.

Rising income levels, increased awareness and technological improvements have resulted in an increase in the average lifespan of the general population. Hence, healthcare is one of the fastest growing sectors in India. AHEL has been in the forefront of making world-class facilities and infrastructure available to the Indian population. The Indian healthcare market has grown at a compounded annual rate (CAGR) of 17 percent since 2011, and this is expected to continue in the foreseeable future. The potential for growth in the long-term is substantial.Consider the following:

- As on date, the private sector accounts for roughly 80 percent of the country’s total healthcare market. The private sector has been investing aggressively in the past and is expected to continue to do so in the future as well. Regarding the number of beds, it is estimated that there is one bed per 1050 population; the global average is 2.90 beds per 1000 people. There is a shortage of beds and infrastructure.

- Currently, India accounts for 15 percent of the world’s population. The demographic trends continue to favor the healthcare industry as they have in the past. Population growth leads to absolute growth and an increase in the size of the market. In India, the number of elderly citizens exceeds the total population of several countries! Rising per capita income and increased longevity ensure that the runway for growth extends almost eternally.

- The diagnostics market as a sub-segment of the healthcare industry has emerged as an independently viable business altogether. In fact, the diagnostic industry is growing exponentially. Among other things, differential pricing has also led to outsourcing of tests. Moreover, testing has changed from being need-based to being imperative to any diagnostic process.

- The evolution of the Indian healthcare industry has resulted in it being considered as a viable destination for the buoyant medical tourism industry. It is estimated that major surgeries in India cost just 20 percent of the cost in the developed world. Hence, India’s healthcare industry attracts patients from across the globe. The private sector, led by institutions such as AHEL have been at the forefront of this transformation. Government policies for encouraging Foreign Direct Investment (FDI) have also helped.

The risk factors are primarily regulatory. Maintaining health care standards is a continuous and cumbersome process. It involves coordination of several agencies and ‘ease of doing business’ cannot be taken for granted. Apart from this, the industry is in an almost continuous need of resources (funding). It is a capital-intensive business. Also, the running costs are pretty high. On the flip side, these can even be considered as entry barriers. Healthcare has its apparent reliance on professional doctors and nurses. As on date, healthcare is a complex market and has not been thoroughly institutionalized. Hence, competition from niche players does exist.

Insider Sentiments

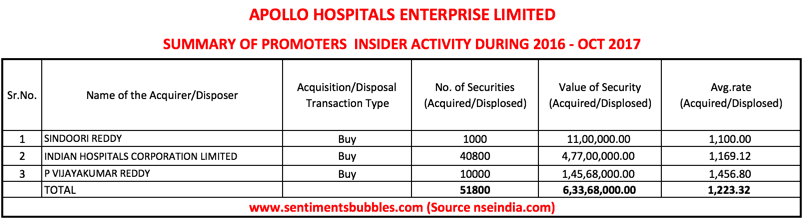

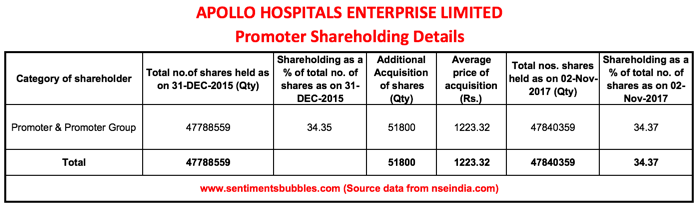

The insider activity has been tepid. They seem to have made just token purchases. Moreover, the stock has continued to slide and is available cheaper than what the Promoters have.

Investment Thesis

Financial analysis of any healthcare provider centres around the Bed Occupancy Rate and the Average Revenue per Occupied Bed Per Day. These statistics are sued to measure the past growth rate and also judge the future potential of stocks that form part of this sector. AHEL boasts of 10000 beds, 2556 pharmacies and 200 clinics, cradles and retail healthcare centres across the country. AHEL has been focused on increasing bed capacity at existing facilities and adding new ones in multiple locations. The new locations are primarily in tier II and tier III cities. Their current expansion plans are expected to be completed over the next five years.

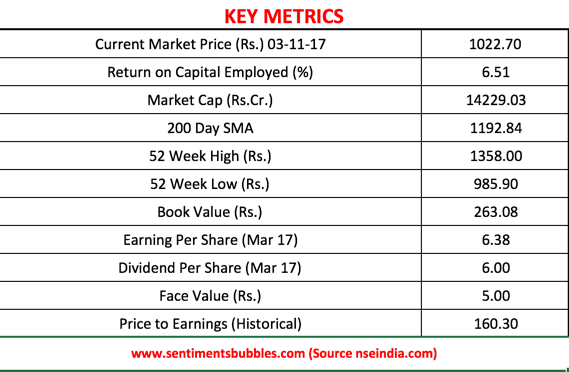

As on 31 March 2017, AHEL had a Bed Occupancy rate of 64 percent and its Average revenue per occupied bed per day was Rs. 31,529. How much can these metrics grow? Forecasting the rate of growth will mean making too many assumptions. The fact that the business of AHEL will grow at a healthy pace is a given. Why then has the stock price been sliding? My thoughts:

- AHEL is part of the Health Care sector. The sector has underperformed grossly in the current year.

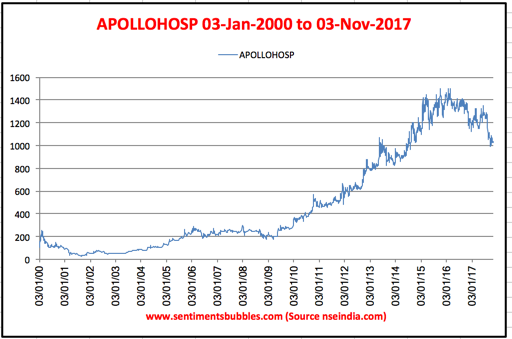

- AHEL hit its 52-week high of Rs. 1358 on 09 June 2017. A story titled IHH Healthcare pulls out of Fortis deal hit the stands at the end of June 2017. While the story is in no way concerned with AHEL, stocks forming part of the sector have all been sliding since. Let’s just say that sentiment has been adverse for the entire gamut of shares in the healthcare space.

- AHEL is a capital-intensive business. In the recently announced yearly results, there is a sharp increase in interest costs. The low Return on Capital Employed (ROCE) is a matter of concern. One needs to factor that 11 New Hospitals (Vanagaram, Jayanagar, Trichy, Nasik, Women & Child – OMR, Nellore, Perungudi, Women & Child – SMR, Vizag new, Malleswaram & Navi Mumbai) having capital employed of Rs. 16,389 million have yet to contribute to the ROCE. These facilities will add to the ROCE over the long-term. Hence, I would not be unduly concerned with the low ROCE.

- In the Annual results as well as the quarterly numbers there is fall in margins and an attendant increase in interest expenses. These are directly related to the expansion ongoing activities that AHEL has undertaken.

AHEL is the largest and most diversified healthcare device provider in the country; scale matters. AHEL also has subsidiaries that engage in healthcare projects consultancy, diagnostics, medical insurance and in the health and lifestyle businesses. In other words, AHEL is an integrated service provider in expansion mode. However, being an integrated service provider has its disadvantages as well. One of them is that expansion and capital expenditure are likely to be ongoing. In my opinion, the integrated business model that AHEL boasts of is a kind of moat. AHEL seems to be expanding that moat. The short-term profitability has suffered as result of this. I would prefer to ignore the short-term and focus on the fact that capital expenditure for expansion of the business and its moat are worth the wait.

The issued share capital of AHEL consists of 139,658,177 Equity Shares of Rs. 5 each. It is a dividend paying stock with positive cash flow metrics. Because AHEL is in a capital-intensive business, the debt levels are not high. The stock closed at 1022.70 on the National Stock Exchange of India (NSE) on 03 November 2017. I think it is worth buying in small lots at these prices and adding on declines.

(The company reports results for the quarter ended September 2017 on 13 November 2017. In my opinion, quarterly results are not worth bothering about. However, price action matters. I think it is pointless trying to predict whether one should buy before the results or after. Hence, it might be a good idea to buy some before the result and the same quantity post the results announcement).