Zensar Technologies Limited

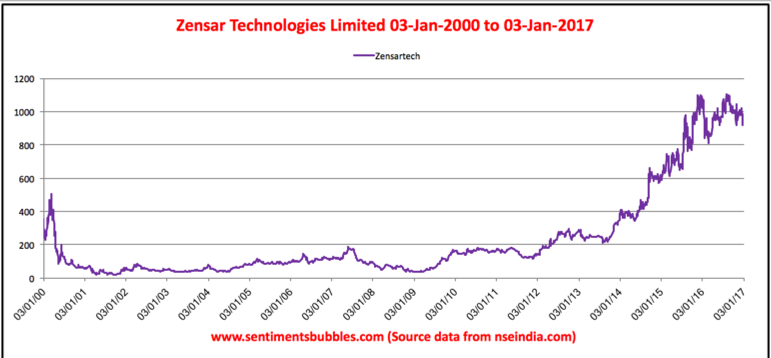

Zensar Technologies Limited is part of the RPG group. Zensar prides itself on being a digital solutions and technology services company. The company offers the complete range of traditional and transformational IT services and solutions across application management and infrastructure management services. It has got a global presence across, and their business is well spread across 29 global locations with a presence in the key regions of US, Europe, Africa, Middle East, India and APAC. They have 11 global delivery centres. The historical chart looks like this:

Over the recent past, the company has changed its focus from project execution to helping their clients realise a Return on their Digital Investments. This is their Unique Selling Proposition. The key components of Zensar’s business model are:

- Strategic focus in the 3 geographies of the US, UK and Africa. In these markets, the key verticals are retail, manufacturing and insurance.

- Oracle offerings and in particular, Oracle Cloud remains one of Zensar’s biggest focus areas. Zensar is an Oracle Platinum Partner and has more than 2900 trained Oracle consultants across global locations. Their range of Oracle expertise encompasses the entire range of Oracle offerings and solutions. A key differentiator for Zensar continues to be in the area of developing customised solutions based on an enterprise’s need.

- Zensar is also a certified SAP Gold partner. With over 400 experienced SAP professionals globally, SAP is a critical and key growth focus area for Zensar. It has complete SAP lifecycle service capabilities across the portfolio of SAP solutions covering Applications (Financials, Supply Chain Management & Distribution, Projects Systems, Human Capital Management), Analytics (Business Intelligence with SAP Business Warehouse, SAP Business Objects) and Mobility capabilities.

Outlook

The global IT sourcing market grew at 9–10% in 2015, in comparison to the previous year, with India contributing 67% to the overall growth. As global enterprises plan their IT budgets, it is expected that roughly 51% of the incremental spend will be towards new and digital technologies like cloud, mobile and big data. According to industry estimates, approximately 67% of the Global 2000 companies will have digital transformation at the core of their corporate planning and strategy. All of this augurs well for the prospects of Zensar.

In October 2015, Marina Holdco (FPI) Ltd., a fund advised by Apax Partners acquired a 23.2% stake in Zensar at a price of Rs. 828 per share (roughly). Apax Partners is an independent global partnership focused solely on long-term investment in growth companies having USD 40 billion of portfolio investments across leading global companies. Zensar is expected to leverage from Apax Partners successful track record in the technology services space, gaining access to a wider global customer base and best industry practices.

Insider Trades & Investment Thesis

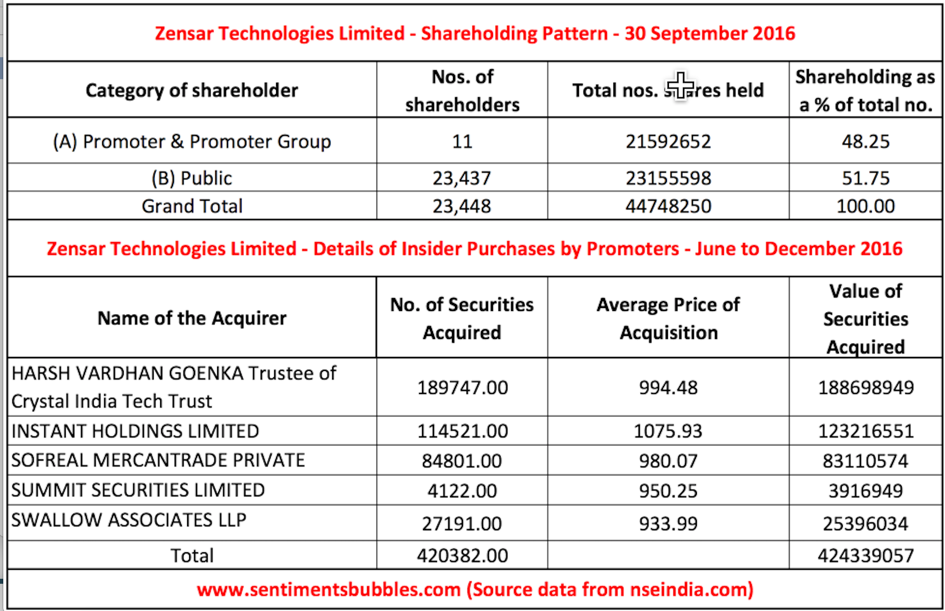

The Promoters of Zensar have been picking up shares from the open market at regular intervals. This is shown below:

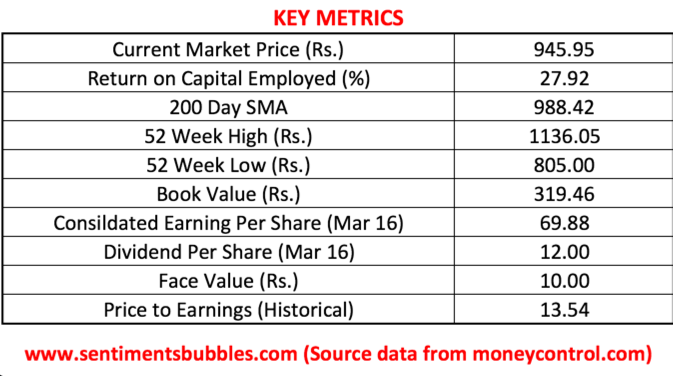

Zensar trades at roughly 14 times historical earnings. The company has practically no debt on its books. The valuation is attractive and I think that investors must buy the stock at its current market price of Rs. 945.95