Gulf Oil Corporation Limited

Gulf Oil Lubricants India Ltd (GOLIL) and GOCL Corporation Limited are two listed entities that formed part of the erstwhile Gulf Oil Corporation Ltd (GOCL). It has been almost two years since the two entities are trading on Indian bourses. The companies are promoted by the Hinduja group. The Promoter group has been increasing their stake in both the entities since the date of their separate listings.

The idea behind the demerger was to create a pure play, separate and standalone listed lubricants company. Prior to the demerger, the businesses of the erstwhile Gulf Oil Corporation were manifold; Lubricants, Industrial Explosives, Industrial Explosives, Mining and Infrastructure, and Property development.

Under a Scheme of Arrangement, the company (erstwhile Gulf Oil Corporation Limited) has transferred its Lubricants business to a separate entity viz. Gulf Oil Lubricants India Limited w.e.f from 1 April 2014. The erstwhile Gulf Oil Corporation was renamed as GOCL Corporation and continued to carry on the remaining businesses. Pursuant to the demerger the two stocks (GULFOILLUB & GOCLCORP) were separately listed on the bourses on 31 July 2014.

Gulf Oil Lubricants India Limited

This company has a single line of business viz. Lubricants. The business model is primarily concerned with manufacturing, marketing and rendering technical services in lubricating oils, greases, auto accessories and car care products. The company is a regular supplier to almost all automobile and tractor manufacturers in India and is approved by almost all Original Equipment (OE) manufacturers. The salient features and prospects for the GULF brand and the other businesses can be summarized as follows:

- India is the third largest lubricant market in the world, after the U.S.A. and China. It is also one of the fastest growing markets, worldwide. The lubricants market is broadly divided into three categories viz (a) automotive, (b) industrial and marine and (c) process oils. There are roughly fifteen national level players competing for market share in the Indian Lubricant Market. The state-owned oil companies are the largest players. In the retail lubricants market, the company has a market share of roughly seven percent. The company is working on increasing the distribution and reach of its products so as to increase its market share.

- In the global lubricants business, the ‘GULF’ brand is a known and established one. Worldwide, the Gulf Oil brand is considered to be one of the 100 most valuable brands. The management’s aim is to make GULF one of the top three lubricant brands in India in the years to come. Towards this end, the company has entered into strategic partnerships with various Original Equipment (OE) manufacturers. The company is also focussing on making inroads into India’s rural hinterland. The good monsoon augurs well for the prospects of the tractor and two-wheeler manufacturers, thereby giving a leg-up for the products of the company.

- The company has increased the capacity of its Silvassa plant from 75000 KL to 90000 KL. In addition to this, the company is planning a new production facility at Chennai. This plant is expected to have an installed capacity of 40000 KL per annum. Chennai boasts of several OE manufacturers and is a natural choice for the proposed expansion.

- A revival in the growth rate of the lubricants industry is expected, riding on the back of an expected revival in the automobile sector. In addition to volume expansion, there is bound to be an enlargement of the company’s profit margins (with crude prices being what they are).

GOCL Corporation Limited

This company has a diverse set of businesses. Very briefly:

- Mining Business: According to the management, in the short-term, the prospects for this business are likely to be affected by the global slowdown in the commodity cycle. The management has also cited regulatory issues regarding the mining space in India. As a result, not much is expected regarding growth momentum from the mining business.

- Energetics & Explosives business: The Energetics division manufactures mining equipment. The Explosives business is a part of the wholly owned subsidiary of the company by the name of IDL Explosives Ltd. It seems that the demand for these products is continuously increasing, and the management has an optimistic outlook. In the financial year that ended on 31 March 2015, this division contributed 74 percent of the total revenue.

- Infrastructure Business: This is part of the Mining business and heavily regulated by the government. However, with the coal auctions being completed, the company Is confident that prospects will improve once the process becomes ‘operational’.

- Realty Business: This is the surprise in the pack of businesses that the company operates. In fact, this is the main focus area for the enterprise.

Vital Statistics

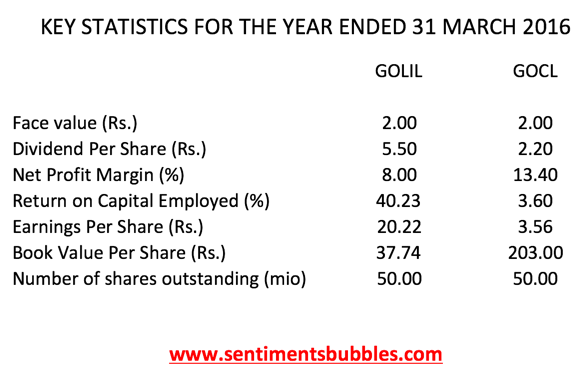

I have given a brief synopsis of the financials and business models of each of the two entities hereinbelow. Strictly speaking, the prior period numbers are not comparable since they relate to the combined entity. As a result, I have refrained from any comparison with the earlier years. The key statistics for both the companies are shown below:

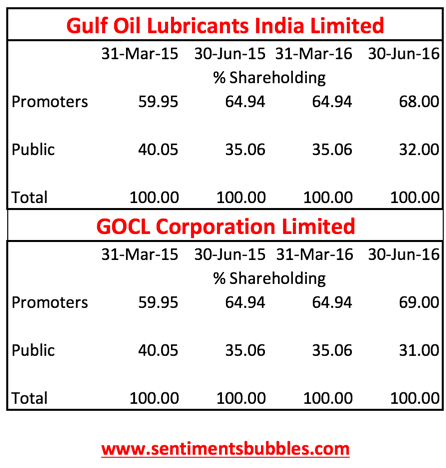

The shareholding pattern and the changes over the last twelve months can be seen in the table below:

Business Prospects & Investing Rationale

What about the business opportunities and growth? In the immediate past, growth has been tepid. However, that is already baked into the current valuation. The government announced initiatives like the ‘Make in India’ program and mining sector reforms are expected to revive India’s economy.

The Promoters seems to be adopting a systematic methodology for increasing their shareholding. SEBI norms restrict the quantum of share purchase that Promoters can make via creeping acquisition (in a financial year) to five percent of the issued capital. The Promoters have acquired 5 percent in the previous fiscal year and 5 percent again in the current fiscal year. As a result, the Promoters cannot make any fresh purchases in the current fiscal year.

What about valuation? To me, it does look like a margin expansion story for GOLIL and the potential for an unlocking of the real estate land bank for GOCL. The Promoters have invested at prices that are very close to the current market prices. Hence, I think buying Gulf Oil Lubricants India Ltd (GOLIL) and GOCL Corporation (GOCL) at their current market prices of Rs. 590.30 and Rs. 177.55 is a safe bet.