Kansai Nerolac Paints Limited

Kansai Nerolac is the second largest coating company in India and a market leader in Industrial Coatings. A bit of historical data never hurts. In 1999 Kansai Paint Company Limited, Japan took over the entire stake of Tata Forbes group and thus Goodlass Nerolac Paints Ltd became a wholly owned subsidiary of the Kansai Paint Company Limited, Japan.

The parent, Kansai Paint Company Limited engages in the manufacture and sale of all types of paints and coatings. It also designs, manufactures and sells coating equipment, and undertakes painting works. Its products include automotive and industrial coatings, decorative coatings, marine and protective coatings. The company was founded on May 17, 1918, and is headquartered in Osaka, Japan. The parent company has operations in Japan, U.K., Turkey, U.S.A, Canada, Mexico, UAE.

Shareholding Pattern – Historical & Recent Changes

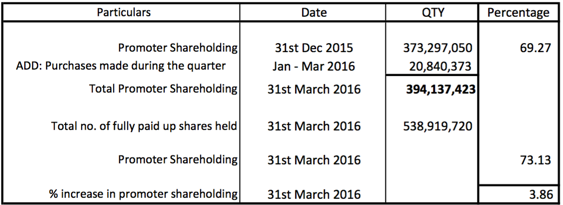

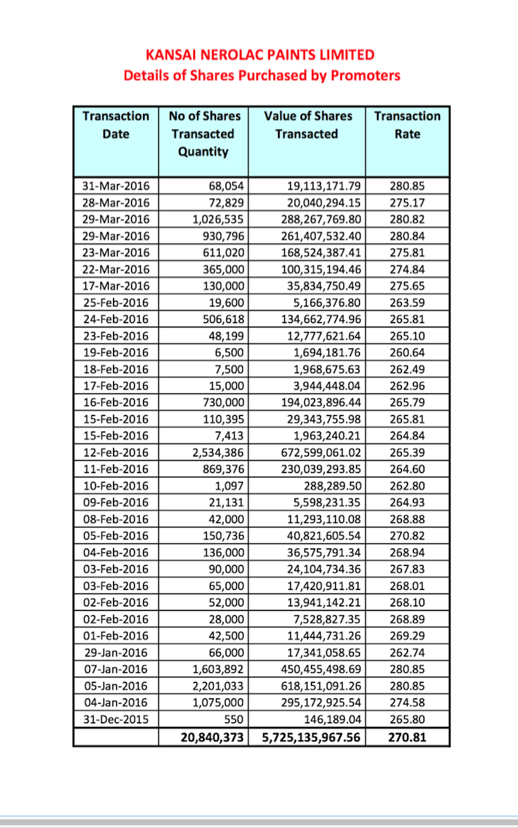

Kansai Paint Company Limited, the Parent company of Kansai Nerolac Paints Limited, has been vigorously increasing its stake in its Indian arm. The table below shows the shares purchased by the parent in the last financial year. As a result of the acquisition of shares by the Promoters (Insider Purchase), the Promoter Shareholding as on 31st March 2016 looks like this:

As a result of the acquisition of shares by the Promoters (Insider Purchase), the Promoter Shareholding as on 31st March 2016 looks like this:

Source: www.sentimentsbubbles.com

Investment Thesis

I think that the shares of Kansai Nerolac Paints Limited are a long-term BUY at the current market price. Apart from the fact that there is very aggressive ‘Insider Buying’, the other factors are as follows:

- Kansai Nerolac Paints Limited is the third largest paint manufacturer in India with a 14 percent market share. It is also the largest industrial paint company in India with a 35 percent market share. Currently Kansai Nerolac Paints Limited has five plants located strategically at Jainpur (Uttar Pradesh), Bawal (Haryana), Lote, Chiplun (Maharashtra), Chennai (Tamil Nadu) and Hosur (Tamil Nadu).

- Recently Kansai Nerolac Paints Limited sold a piece of land at Chennai. The proceeds amounting to roughly Rs. 538 crores are to be utilised for expansion of capacities. The existing capacity is expected to increase by around twenty percent after all expansion plans have been completed in the next two years. You can click here to read the interview of the Managing Director H.M.Bharuka.

- The management of Kansai Nerolac Paints Limited has stated in no uncertain terms that money raised from the sale of assets will be used for expansion. Towards this end, the company has already announced its plans to invest Rs. 220 crores for setting up a paint manufacturing capacity at Goindwal Sahib near Amritsar in the state of Punjab. Also, an amount of Rs. 350 crores are earmarked for a paint manufacturing plant at Sayakha Industrial Estate near Bharuch in Gujarat.

- Kansai Nerolac Paints Limited has a strong relationship with all Original Equipment Manufacturers (OEM’s) and its fortunes are directly related to those of the auto industry. The company counts Maruti Suzuki India Limited as one of its clients and is a direct beneficiary of Maruti’s expansion plans in India. Maruti Suzuki India Limited is, in fact, the largest client of Kansai Nerolac Paints Limited.

- Suzuki Motor Corporation proposes to start three plants in the state of Gujarat. It is part of the ‘Make in India’ initiative. Needless to say, the initiative is aimed at boosting India’s exports. As mentioned above, the fortunes of Maruti Suzuki are inextricably linked with those of Kansai Nerolac Paints Limited. As a result, Kansai Nerolac Paints Limited is bound to benefit from the expansion of capacity at Maruti Suzuki.

- The fact that Maruti has obtained shareholder approval for the expansion was reported in the media on 18 December 2015. Kansai Nerolac Paints Limited has started their creeping acquisition process on 31 December 2015.

- In other words, the Japanese parent Kansai Paint Company Limited seems to have chosen to increase its stake in the Indian venture, as soon as Maruti Suzuki India Limited got the requisite approvals. In the table above, it can be seen that almost all the share purchases made are in the first quarter of 2016. It seems to be the case that the Japanese parent was waiting for shareholder approval by the shareholders of Maruti Suzuki India Limited to start increasing their stake in Kansai Nerolac Paints Limited. Apparently, the management of Kansai Nerolac Paints Limited is banking heavily on the Maruti expansion.

- The term ‘creeping acquisition’ refers to the purchase of company shares by its investors (usually, promoters or shareholders with significant holdings) over many small transactions, so as to increase the investors’ stake in the company by an economically significant amount without requiring any disclosure or other action.

- Creeping Acquisitions are governed by Regulation 3(2) of the SEBI Takeover Regulations of 2011. The regulations provide for a 5 percent creeping acquisition limit per financial year. From the above table, it is apparent that the total Promoter Shareholding stands at 72.69 percent as on 31st March 2016. Kansai Nerolac Paints Limited can take this to 75 percent using the creeping acquisition route in the current financial year if they so desire.

Valuation & Key Metrics

The table below is self-explanatory.

Source: www.sentimentsbubbles.com

Prospects & Risk Factors

The following points are worth highlighting:

- The current size of the paints industry in India is estimated at somewhere between 35000 to 40000 crore rupees. The per capita consumption of paint in India is estimated at roughly 0.5 kg per annum. This is very low as compared with the consumption of 4 kg per annum in South East Asia and 22 kg per annum in the developed world. In reality per capita consumption of a country like India is strictly not comparable to that of countries in the developed world. However, this figure can be used as an indicative one to understand that there is scope for improvement. In other words, upside surprises cannot be ruled out. As the Indian GDP grows, the per capita consumption of paint will mirror this increase. In India, the organised sector controls roughly 70 percent of the market. In the organised sector competition for Kansai Nerolac Paints, Ltd comes mainly from Asian Paints, Berger Paints and ICI.

- Kansai Nerolac Paints Limited is expected to benefit from a revival in the automotive sector. Automotive coatings manufactured by Kansai Nerolac Paints Limited are required not only at the manufacturing stage but also when repairs of cars are to be conducted. Even though these coatings form only a small part of the vehicle or the repair cost as the case may be, they are critical to a vehicle owner’s satisfaction since they affect the appearance of the vehicle.

- By being the leader in the industrial paints category, Kansai Nerolac Paints Limited is in a position to benefit from any expansion in the growth rate of the Indian economy.

- What about margin Expansion from falling raw material costs? Kansai Nerolac Paints Limited has stated that the fall in costs of its raw material components has been passed on to its customers. Productivity cost savings in other areas are expected to result in a margin expansion in the future.

- The Paint industry is projected to grow at the rate of roughly 1.5 times the rate at which the Indian GDP grows – this is the historical trend. It is expected to continue. As a result, if one assumes that the Indian economy will grow at 6 percent, it is safe to assume that the paints business will grow at between 10–12 percent. In any case, the growth of the Paints business is expected to outpace the growth of the Indian economy comfortably. Within the Paints industry, the growth for industrial paints is expected to outpace that for decorative paints in the years ahead.

- The Paints business is sensitive to the price of crude oil and softening crude oil prices are beneficial. Monsoon volatility also affects demand directly. After accounting for the unorganised sector, the supply of paints exceeds the demand. However, the Industrial segment is technology driven. As a result, brand image and distribution strength play a key role. Needless to say, the macroeconomic outlook for the Indian economy plays a key role in deciding the fortunes of Indian paint companies. Improvements in the Indian economy are expected to result in upside surprises on account of margin expansion and improved toppling growth.

Conclusion

The fact that the Promoters of Kansai Nerolac Paints Limited are increasing their stake in the Indian arm seems to be driven by the expansion of capacity at Maruti Suzuki India Limited. I think it is a safe bet. Invest with a three-year view. The analysis is devoid of projections and a price target. The reasons are:

- Projections of future earnings are nothing but extrapolations of an Excel spreadsheet. In my opinion, justifying a BUY call with the help of an Excel spreadsheet is so easy, that it doesn’t serve any purpose.

- When you are buying shares of Kansai Nerolac Paints Limited, you are buying a part of the business and are a partner in the growth of the company. How the growth metrics evolve is unknown. One doesn’t have targets in such scenarios. Moreover, a price target is a forecast. I don’t have the capability of making one.