(Credit: Robert Mankoff/The New Yorker Collection/The Cartoon Bank)

We have had a reasonable correction on the Nifty. The index returns as compared to the sector-wise returns show a high level of dispersion. Have a look:

| INDEX | JAN 01, 2015 | JUN 05, 2015 | % GAIN/LOSS |

| CNX NIFTY | 8284.00 | 8114.70 | -2.04 |

| CNX PSU BANK | 4294.65 | 3280.15 | -23.62 |

| CNX METAL | 2693.25 | 2315.50 | -14.03 |

| CNX REALTY | 203.05 | 182.25 | -10.24 |

| CNX MEDIA | 2378.30 | 2137.15 | -10.14 |

| CNX BANK | 18750.45 | 17549.25 | -6.41 |

| CNX FINANCE | 7449.95 | 7129.80 | -4.30 |

| CNX FMCG | 20057.60 | 19259.60 | -3.98 |

| CNX AUTO | 8318.80 | 8092.30 | -2.72 |

| CNX ENERGY | 8630.95 | 8502.35 | -1.49 |

| CNX IT | 11215.70 | 11291.55 | 0.68 |

| CNX PHARMA | 10923.25 | 11715.85 | 7.26 |

(The data is in descending order, with the worst performing sectoral index on top and the best performing sectoral index at the bottom)

What is Dispersion?

Dispersion is ‘the total variance in returns between stocks’. In statistics, the term dispersion is used to denote how stretched a sample of numbers is. Considering the prices of various stocks as a statistical sample, I have used it to quantify the variance or the deviation in the percentage returns of different stocks.

Dispersion & Alpha

Since the beginning of this bull run, the index as a whole and individual stocks have moved in unison. Hence, the task of outperforming the index was a bit difficult. Outperformance, the percentage by which the returns on a portfolio of stocks exceeds the gains accruing on the benchmark, is popularly referred to as ‘alpha’. In fact all of us, are trying to generate ‘alpha’. If not, it would make sense just to buy an index fund and not bother about market volatility.

Dispersion as a stock picking tool

Dispersion is a measure of how stocks behave in relation to each other, not just to the overall market. So if the market zigs, some stock must zag and vice versa. In the current calendar year one notices a large number of stocks are zigging and zagging in different directions, independent of the index. Effectively, stock returns and market returns are all over the place. Some stocks are up, some are down, some are flat. The benchmark is down for the year. Why use dispersion as a means for stock selection? The reasons are:

-

In a QE driven world, stocks have tended to rise in unison. The dispersion of individual stock returns has been low.

- Low dispersion is not abnormal. Historically, dispersion among individual stock returns varies over different time periods.

- Hitherto we were in a low dispersion environment. The lower the dispersion, the harder it is to generate alpha.

- However, all this seems to be changing. In the current calendar year, stocks are moving in different directions. We appear to have entered a high dispersion phase in the market. High dispersion tends to go hand in hand with high volatility.

-

I feel that the current high dispersion environment will persist. Hence, I have tried to use dispersion to identify stocks. In the immediate context, I have used it to measure the gap between the best and the worst performing stocks within each sector.

Dispersion Analysis

The table below shows the year to date performance of the benchmark and sectoral indices. The data is in descending order. The sector in which stocks have the highest dispersion appears at the top of the heap, and so on and so forth. The best and worst performing stocks in each sector are also shown, along with their returns as on date. This analysis covers only stocks forming part of the sectoral indices.

| INDEX | YTD(%) | BEST | YTD(%) | WORST | YTD(%) |

| CNX REALTY | 10.24 | HDIL | 45.39 | UNITECH | 46.88 |

| CNX FMCG | 3.98 | BRITANNIA | 47.94 | ITC | 17.12 |

| CNX ENERGY | 1.49 | BPCL | 30.80 | RPOWER | 28.29 |

| CNX PSU BANK | 23.62 | IDBI | 15.12 | ORIENTBANK | 43.97 |

| CNX AUTO | 2.72 | ASHOKLEY | 30.10 | APOLLOTYRE | 23.32 |

| CNX FINANCE | 4.30 | BAJAJFINSV | 17.76 | PNB | 34.58 |

| CNX MEDIA | 10.14 | EROSMEDIA | 20.08 | HATHWAY | 31.46 |

| CNX BANK | 6.41 | AXISBANK | 9.02 | BANKINDIA | 40.58 |

| CNX METAL | 14.03 | COALIND | 6.66 | JINDALSAW | 40.53 |

| CNX IT | 0.68 | HCLTECH | 15.63 | JUSTDIAL | 17.72 |

| CNX PHARMA | 7.26 | LUPIN | 24.31 | CIPLA | 0.92 |

The individual stock returns within the sectoral index vary wildly. In almost all the sectoral indices, there is an enormous disparity between the best and worst performing stocks within the sector. This is typical of a high dispersion environment.The inferences from the above are as follows:

-

Only two sectoral indices viz the CNX Pharma and CNX IT are positive for the year to date. The benchmark CNX Nifty is down by just 2.04 percent for the year. Apart from these two sectoral indices, all the others are buried in red as on date.

-

In the case of the CNX FMCG index, every stock in the index is in green except ITC and TATAGLOBAL. The weight of ITC in the sectoral index has ensured that the index is negative for the year. A word about ITC. It has been a stock that has been recommended on this blog, so I am tempted to indulge in a bit of ‘mea culpa’. The prime reason for the recommendation (apart from what I have already stated) was that the Government of India through SUUTI (Specified Undertaking of Unit Trust of India) is one of the prime stakeholders. The divestment process of this stake is of prime importance to any government that is in office. The government in their eternal wisdom has put this divestment on hold. Click here to read about that. The anti-smoking lobby the world over has always been active. In spite of this, globally cigarette stocks have given stellar returns. However, in India we face a different predicament. The government has single-handedly gone after the tobacco industry and cigarette manufacturers in particular. They probably want to sell the SUUTI stake at the lowest possible price or are just unaware of its ‘real’ value. This is what is called ‘shooting oneself in the foot’. In the myopic investment world that we live in, this ‘buy’ recommendation has apparently not worked.

-

If it were not for the lacklustre performance of ITC on the bourses, the CNX FMCG sector would have been the best performing sector for the year. It remains an evergreen sector in the Indian demographic environment.

-

In the case of the CNX IT sectoral index, the cross currency movement has hit some stocks benefitting others. The Rupee-Euro parity and the Rupee-Dollar parity have historically always moved in the same direction. In the past, whenever the Rupee has weakened vis-a-vis the Dollar it has weakened against the Euro as well. This time it has weakened against the Dollar but strengthened against the Euro. This is reflected in the disparity in prices of different IT stocks.

-

ACC, AMBUJACEM, ASIANPAINT, BHEL, BHARTIARTL, GRASIM, IDEA and LT form part of the benchmark but are not part of any sectoral index. Strangely, ‘infrastructure’, ‘cement’ and ‘telecom’ does not form the basis for ‘sectoral’ differentiation. Of these, BHARTIARTL, IDEA and LT have outperformed the benchmark comfortably.

-

I have used the sectoral indices as a basis for the analysis. However, in the high dispersion environment in which we find ourselves, individual stock selection would take precedence over the sector. In other words individually outperforming stocks in all the sectors are the ones to track, ignoring all others.

What to do?

I am sanguine about the prospects for the market as an investment destination for the following reasons:

-

Most of the negative news flow that is currently in vogue is already priced in. Global cues in the form of bond market volatility and the Greece imbroglio mean that volatility will continue.

-

There are myriad forecasts about the prospects for the Indian economy and the monsoon. When it comes to deciding on economic forecasts and market direction, I prefer to go with what the market is showing, thereby ignoring all economic forecasts.

-

The whole purpose of this dispersion analysis is to identify companies that will do well in good times as well as bad. The tricky part is identifying these. How does one measure quality? How does one buy shares of a company that will continue to do well in all environments?

-

Stocks that continue to withstand the selling onslaught are clearly those which are least affected by economic considerations or are in strong hands. It does make sense to nibble away at these when markets offer an opportunity, as it seems to be now offering.

-

Expecting a ‘V-shaped’ recovery in the benchmark is a tad optimistic. Looking at the benchmark is a folly. One should try to focus on individual stocks instead. It does make sense to invest in names that are outperforming. In high dispersion environments, stocks that outperform tend to continue in the same vein and underperformance tends to get accentuated.

-

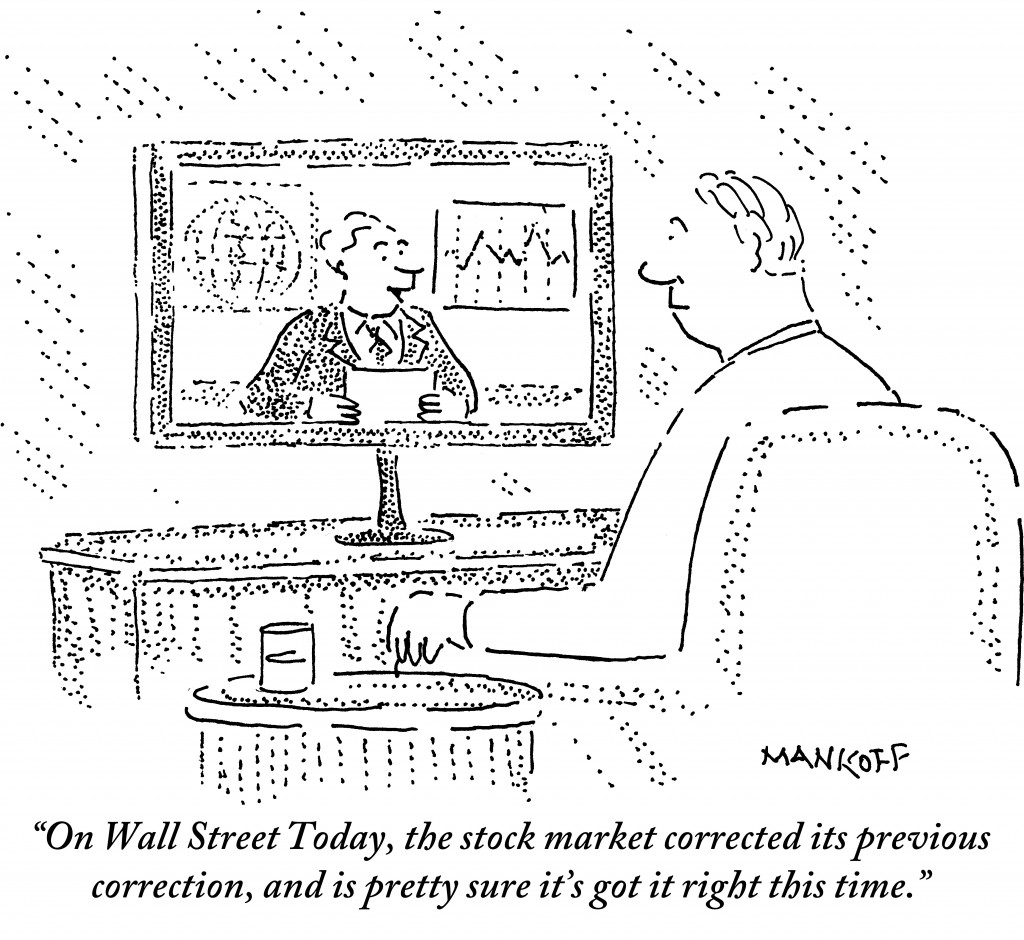

Trying to guess where the Nifty is headed is an impossible task. Many investors keep looking to the media for direction and to find out if ‘a bottom is in place’. They then want to start buying once ‘a bottom is in place’. I have stopped believing that the media can ‘call a bottom’ or that it is well-intentioned. In case any of you think otherwise and are looking for market direction by listening to the media, please remember that someone has rightly said: ‘the road to hell is paved with good intentions’.

Yashodhan

Good to have you back.

I think Rajas is being polite – I found the article to be VERY technical. 🙂

Yes, I too have heard good things about United Spirits. But then, I am biased towards spirits anyway 😉

Regards

Shailesh

I don’t understand what you mean by technical. To me, technical is lines, charts and graphs; there were none. I have just highlighted the fact that within a sector you have a vast disparity in stock returns. Dispersion of returns is what I have written. Conversely ‘correlation’ would mean all stocks in a sector move in tandem. This is not what is happening. I think I should have said this in the post to make things a bit clearer.

ok!

Shailesh

Nice to see your article today. Found slightly technical! From a layman’s view, what is important is he/she should get (outstanding) profit on the (best) stock he/she holds. Obviously it will happen only when he/she thinks out of the box, buys/ accumulates stock with conviction and continue to maintain that foresight. However it is also the fact that this happens rarely!

In my view pharma, IT, selective banking and housing finance companies will continue to grow during the F.Y. 2015-16. I like Marksans Pharma, Anuh Pharma, Ajanta Pharma, Lupin in pharma stocks, Persistant Systems, Cyient, Eclerks in IT space, LIC Housing from Housing Finance sector and Yes Bank, Kotak Bank from Banking sector. An out of the box thought could be United Spirits! L & T and Asian Paints will continue to perform well, I guess, in the current year.

I have tried to highlight stocks worth investing. I find investors are too confused or inundated with information. In such a situation, they prefer to not take any decisions. Maybe the post might help some people make up their mind!