(Source: www.shutterstock.com/cartoonresource)

Pursuant to Chinese devaluation, Emerging Markets as an asset class experienced a sell-off. Is the selling done with or is there more to come?

Chinese Devaluation and Emerging Markets

Emerging markets account for roughly half of the world economy. Of late, due to the commodity meltdown, Emerging Markets have been suffering from slow growth and weakening currencies. Hence, it seems, they can no longer be considered as the growth engines of the world.

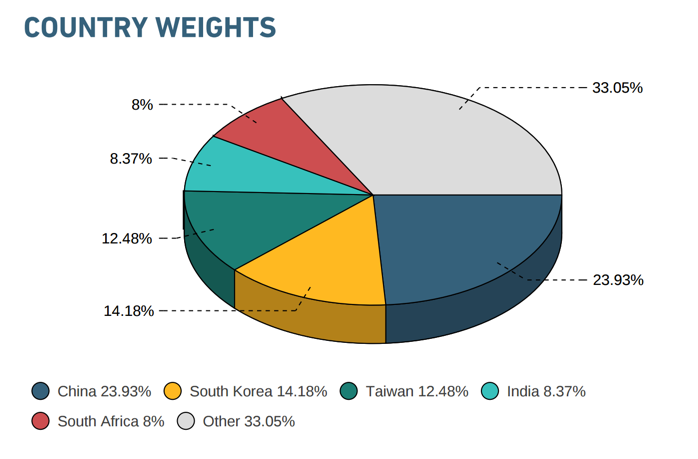

Within the Emerging Market space, the hegemony of China is a given. The Chinese economy was the second largest economy in the world in 2014. Why it is called an Emerging Market is a mystery to me, but let’s ignore that for the time being. The MSCI Emerging Markets Index (MSCI EM Index) captures large and mid cap representation across twenty-three Emerging Markets (EM) countries. The MSCI EM index is the benchmark for funds invested in Emerging Markets. Click here to read about MSCI. Have a look at which countries comprise the MSCI EM index and the country-wise weights:

(Source: www.msci.com)

Emerging Markets v/s Developed Markets

Worldwide, allocation of investable funds by money managers is split very broadly between Developed Markets and Emerging Markets. Hence, a word on this classification. Similar to the MSCI EM Index there is also an MSCI World Index. The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM). The two indices viz., MSCI EM Index and MSCI World Index trade at different price earning multiples. The MSCI EM Index always trades at a discount to MSCI World Index. Keeping this in mind the following points are pertinent:

1. In the past, whenever there has been an Emerging Markets currency crisis, Emerging Markets have traded at half the multiples of the Developed Markets. The fear is that the current Chinese devaluation will result in a full-blown currency crisis for Emerging Markets.

2. Currently, the MSCI World Index is trading at a prospective multiple of roughly seventeen times, and the MSCI Emerging Markets Index is trading at a multiple of twelve. The current view is that this EM discount will widen. Hence, Foreign Investors continue to be net sellers of equities in Emerging Markets including India.

3. The image below shows the MSCI Emerging Markets Index. It has fallen to a four-year low mainly due to a continuous outflow of funds from Emerging Markets. To put matters in the correct perspective, roughly US$1 trillion has fled Emerging Markets over the last 13 months. Most of the money has moved out in the current calendar year.

(Source: ft.com)

4. All of this doesn’t tell us what is likely to happen next. India is part of the Emerging Markets space. Let’s face it, none of us have a very optimistic outlook on our country. Many, not all of us, have high expectations from the current regime. We are all aware how difficult it is to get things done in a democratic environment like ours. In such a situation, what matters is not what you and I think, but what they think. They, as in Foreign Institutional Investors – FII’s. Remember the maxim. ‘he who has the Gold makes the rules,’ FII’s make the rules. In other words, FII flows and their perceptions of the Indian economy determine our equity returns. Our opinions don’t matter.

5. Effectively, it comes down to trying to predict FII flows. I have repeatedly said that flows follow performance; they don’t follow value. In fact, FII flows chase performance. Each week money is allocated to what has been working in the immediate past. This may not agree with conventional investing wisdom, but it is how the system works.

6. We had a similar Emerging Markets sell-off as recently as the first quarter of 2014. What happened after that is history, not only in India but the entire Emerging Markets space. Sell-offs in the Emerging Market space, have been buying opportunities from a historical point of view. However, all sell-offs are not the same. I’ll come to my take on the current sell-off in just a bit.

7. Even though most of the financial media is quoting FII sources to the effect that Indian markets will ‘outperform’, FII’s continue to be net sellers of Indian equities in the current year. How long will the selling continue is a call each investor has to take.

What is the meaning of Indian market ‘Outperformance’?

There is a lot of rhetoric about the fact that India is insulated from the crisis in Emerging Markets, and that Indian equities will outperform the MSCI Emerging Market Index. The following are the riders:

-

The word ‘Outperformance’ is relative. The MSCI Emerging Markets Index has declined by 18 percent since April. The Nifty has dropped by roughly 7 percent during the same period. The fall in the Nifty is less than the decrease in the EM index. In market parlance, this feature is referred to as ‘outperformance’. This is expected to continue.

-

This definition may serve the purpose of the ‘managed funds’ industry. However, as an investor, I wouldn’t want to use this definition for making investment decisions.

What to do?

The recent closing low of the Nifty was 7791.85 on 26th August 2015. The intraday trading low was 7667.25 on 25th August 2015. Are these two figures like lines in the sand, that bulls will defend? Or will they get blown away? Investing is about planning for probabilities. What is the probability of a change in FII sentiment? Sentiment can turn on a dime, consider the following:

1. I think that FII selling in Indian equities has more to do with the sell-off in Emerging Markets, than any perceived weakness in the Indian economy. The fact that the Indian debt market remains largely unaffected lends credence to this view.

2. FII flows cannot form the basis for investment decision-making. However, I prefer to use it as a gauge of FII sentiment. The importance of sentiment while taking investment decisions cannot be understated.

3. Historically, FII selling has always been a buying opportunity. The current sell-off has its epicenter firmly within the Emerging Markets space, China in particular. When comparing historical sell-offs and buying opportunities, this fact must be given its due weight. Every sell-off will have to be evaluated as an independent event.

4. In the immediate instance, while trying to gauge FII sentiment on China and Emerging Markets, my thoughts are:

- There is a consensus that the Chinese stock markets are a manifestation of the Chinese Communist Party and not of the Chinese economy. The FII’s feel that the much-publicized Chinese growth rate of seven percent, is, in fact, closer to five percent. The ham-handed efforts of the Chinese government to prop up their stock market have added an element of justification to this thought process.

- The Chinese were trying to control free markets, this cannot be done. What we are seeing is more a result of Chinese attempts at controlling stock markets than anything to do with the Chinese economy. Nobody trusted Chinese data when the Chinese market was moving upwards. There is no reason to trust it now.

- The Chinese devaluation did hit the markets like an earthquake. A section of the market does expect further devaluation by Chinese authorities. Currency devaluations by central bankers are a ‘one and done’ kind of thing. They are not known to deliver after-shocks. The bearish view is that there is more devaluation to follow. Even if this were to happen, markets seldom react to the same event twice. Whenever markets correct the way they have, the bears always start prognosticating even worse scenarios. This is what seems to be happening with regards to the Chinese currency.

- China has always been an opaque and mysterious investment destination. In spite of this, flows from Foreign Institutional Investors chased the performance of the Chinese stock market week after week, till the first quarter of the current calendar year. FII flows to China have now met their nemesis. These FII’s, after licking wounds inflicted by the Chinese stock market, will return to invest in China and in the Emerging Markets space. Don’t we all do that, even though we have got licked by the markets umpteen times in the past?

5. I would be a ‘dip-buyer’ for the singular reason that it is practically impossible to time the market. Markets may or may not have bottomed out. Nobody rings a bell to signify that they have. You don’t have to rush in and buy aggressively. At the same time, a measured allocation to equities in times of distress does tend to work in the long run.

6. There is already too much commentary on China and its machinations in the financial media. The fact that EM as an asset class is threatened is evident. Will it affect ‘flows’ to the Indian stock market is relevant. Everything else is noise, just ignore it.

Thanks for your studious article as usual. In my view the devaluation in yuan will tend to divert more investments in our economy. If Indian government could able to pass GST bill or at least demonstrate that we are on growth track through numbers; FII will continue to invest in our economy more and more. It seems, Modi Government has already built enough confidence on foreign land, if we look at the growth rate of their investments in our country. Domestically investments by EPOF also should not be ignored which may ignite the market. From long term perspective a prudent investor should invest in software, insurance, banking and pharma industry.

Disclaimer: I do not invest in any share on the stock market.

Yes, GST is critical.