(Cartoonist: Doug Pike; Cartoonstock.com)

Prepare don’t predict seems to be the dictum that the smart money is following. The behaviour of world markets in the last two weeks seems to suggest this. The upcoming results season and the fact that the smart money seems to be preparing for a rising rate scenario, are getting factored into stock prices.

It is difficult to pick a stock in a richly valued market. The Indian Depository Receipts (IDR’s) of Standard Chartered PLC., traded on the NSE with the ticker symbol STAN, seem to be worth buying. Why STAN? First have a look at what the market is indicating.

Market Efficiency & the Fed

I have written about market efficiency in one of my earlier posts. (Click here to read). I think the latest meeting of the Federal Reserve drove the point home. Consider the following:

-

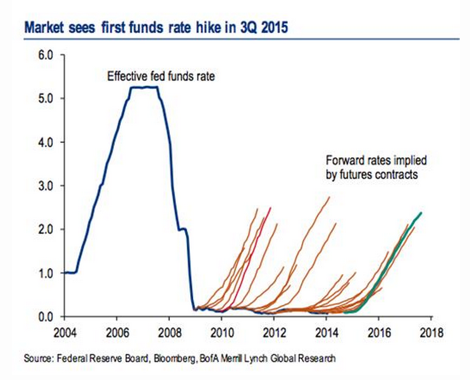

When Janet Yellen took over as Chair of the Federal Reserve, she had said that the first rate hike will come within six months of the termination of QE. Hence, market participants expected the same in the just concluded meeting of the Federal Reserve.

-

The Fed had always been hinting at a rate hike in the mid-year. The market didn’t think so. There has been this continuous disconnect in what the Fed has been saying and what the market thinks will happen. In its latest meeting, the Federal Reserve ended up confirming what the U S bond market had been showing all along.

-

Effectively the Fed ended up following the markets and not vice versa. There is no reason to expect a change in this sequence.

-

As a result of the above, I think it is pointless trying to predict Fed behaviour. It makes sense to look at the market instead. As on date, the market is pointing at a Fed rate hike in the third quarter of 2015. Have a look:

WHY STAN?

Please remember that the entire FAQ is with reference to banks in the U S and U K only.

1. What is a Depository Receipt?

It is a financial instrument that facilitates local investors to buy shares of a foreign company.

2. What is STAN?

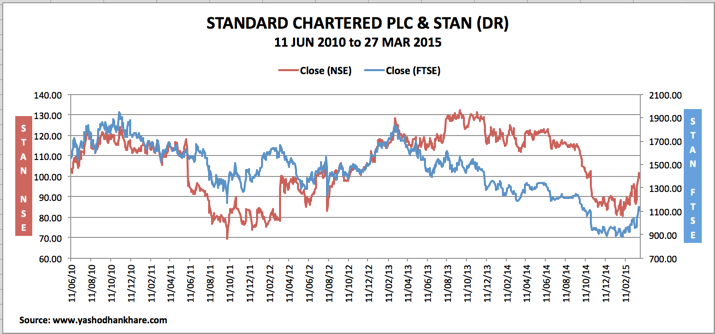

STAN is the Indian Depository Receipt (IDR) of The Standard Chartered Bank PLC. The NSE symbol is STAN. The series is not EQ, but DR. The reference point for the IDR’s is the price of Standard Chartered PLC on the London Stock Exchange (LSE) in the United Kingdom(UK). The image below shows the perfect correlation between the two:

3. Why should I buy STAN?

We are interested in guessing the fortunes of Standard Chartered PLC listed on the LSE. What does a rising interest rate scenario mean for banks listed in the U S and the U K? Higher interest rates are considered a positive for bank balance sheets in the U S and U K for the following reasons:

-

The advent of QE sounded a death knell for the loan growth of banks in the U S and U K. In the absence of loan growth, these banks had to resort to cost cutting to bolster margins. Bank margins were under pressure due to QE.

-

Conversely, the end of QE should signal better days ahead, provided interest rates go up. This will be true even if the rate of increase in interest rates is gradual, as is widely expected.

-

Banks unwillingness to lend during QE was a function of their lack of confidence in the borrowers ability to repay and in the sustainability of the economic recovery.

-

In banking terminology, long-term interest rates represent banks lending revenue. When short-term rates are near zero, the long-term rates are also low. This results in low spreads (margins). Hence, profits are low. When short-term interest rates go up (as is the premise of this post) the long end also tends to go up, resulting in ‘margin expansion’.

- When short-term interest rates are low as they have been, banks are least interested in lending. They do not take any risks. They lend only to the most credit-worthy borrowers. Hence, when interest rates were low, lending fell. Now that interest rates are poised to move higher, lending is expected to grow. The number of potential customers is also expected to grow substantially.

-

There is a bit of common sense in all of this. When we want to boost the sales of a product, we have to increase demand. That is what the Fed was trying to do with QE. So assuming that it did increase demand, banks were unwilling to lend due to low margins. Now this anomaly is likely to be addressed.

-

In analyst terminology, you can call this margin expansion. The expectation is: What banks earn on the assets that they lend, will rise faster than the increased outgo on deposits.

-

The conclusion is that the end of QE and rising rates might just be good for banks in the U S and the U K.

4. What are the salient features of STAN?

Click here to read the full offer document in detail. The most relevant parts are:

-

Standard Chartered Bank is the first foreign company to issue Indian Depository Receipts (IDR). It raised Rs. 2490 crores by selling 24 crores IDR’s started trading on the NSE on June 11,2010.

-

The STAN IDR’s were allotted @ Rs. 104 to successful applicants. The face value is Re.1. Every 10 IDR’s represent one share of Standard Chartered PLC, the parent.

-

The stated objective of the IDR’s was to show commitment to their Indian business and not to raise capital.

-

The STAN IDR’s enjoy two-way fungibility – they can be redeemed to obtain shares of the underlying – Standard Chartered PLC. Click here to read about how to exercise this option.

-

There is a discount at which the STAN IDR’s quote as compared to the parent. This post is not about the arbitrage opportunity hence I will avoid elaborating on the same.

-

The STAN IDR’s do not attract payment of Securities Transaction Tax. Hence, capital gains are payable on profits, long-term or short-term as the case may be. Dividends received by STAN IDR holders will be liable to taxation.

-

The STAN IDR holders have voting rights. They are also eligible to receive bonus, dividends and other corporate benefits that may be announced for shareholders of Standard Chartered PLC. in the future.

5. What’s the big deal with STAN?

-

The Federal Reserve embarked on their QE program in November 2008 and withdrew it in October 2014. The Bank of England launched its QE program in March 2009 and withdrew it in May 2013. Interest rates have not gone up in both the countries.

-

Once interest rates start to rise in the U S, I expect the Bank of England to follow. Standard Chartered PLC is headquartered in the U K. The logic of bank balance sheets being beneficiaries of any hike in interest rates does apply to STAN.

-

The STAN IDR’s are an opportunity for Indian investors to participate in international equities. Buying STAN is a diversification strategy.

6. What kind of valuation does STAN quote at?

Banks in the U S and U K are not as richly valued as some of the other sectors in their indices. The image below shows the Dow Jones Banks Index for one year ending on 27th March, 2015. The year to date return is just +1.42 %.

(Courtesy: The Financial Times, London)

(Courtesy: The Financial Times, London)

-

The reference point for STAN is the price of Standard Chartered PLC on the FTSE. The relevant statistics for Standard Chartered PLC are shown in the table below:

| STANDARD CHARTERED PLC (FTSE) | £ |

| YEAR TO DATE RETURNS (%) | 10.470 |

| 52 WEEK LOW (02 FEB 2015) | 8.675 |

| 52 WEEK HIGH (29 MAY 2014) | 13.555 |

| PRICE TO EARNINGS | 16.040 |

| DIVIDEND YIELD (%) | 5.240 |

| BOOK VALUE | 12.620 |

| TANGIBLE BOOK VALUE (*) | 11.210 |

(*) Tangible Book Value is defined as the price that shareholders can expect to receive in case of bankruptcy. It is basically book value calculated after excluding intangible assets like Goodwill etc.

-

Book value is an important metric when it comes to looking at Bank Balance Sheets. The reasoning is something like this: If you shut down a bank (or it goes into liquidation), what the shareholders would get, is the tangible book value. The assumption is that the books of the bank and effectively its book value are correctly stated.

-

Standard Chartered PLC is quoting below its tangible book value. This is similar to what happened with PSU banks in India at the beginning of 2014.

-

The closing price of Standard Chartered PLC on the FTSE on 27 March, 2015 is £11.03 and that of STAN on the NSE is 99.80.

Disclosure, clarifications etc

I think I need to clarify the following:

-

I think investors need to realign their ‘expectations’ of returns to reasonable levels. A 20 percent return in any asset class should be par for the course.

-

Whenever a stock is recommended as a buy, please remember the context. So in the immediate instance the context is a hike in interest rates in the U S and the U K.

-

Before I forget, yes, I am long STAN. Hence, this is a biased view!

Yashodhan

Thank you for the clarification.

One question:

How high / low can STAN go assuming a rate hike / cut? Assuming the current price to be Rs. 100, can you tell me your guess in terms of percentage?

Other stocks – like say Tata Motors, can get appreciated by 100 % in the next 4 – 5 years. Can such a growth be expected from STAN?

Regards

Shailesh

Difficult to make predictions. Assuming 100, I should expect 20 % in a year. Then if things go our way it could be more. It is a dividend paying instrument. Ballpark figure – 20$

Ok. An yearly movement of more than 15% seems fair enough.

It seems to be highly illiquid or thinly traded though.

As of 2.00 pm today, only 753 shares have been traded. I bet not enough institutional players are active in it.

Regards

Shailesh

Also, there seems to be no face value. Strange…

Regards

Shailesh

FV is 1. Don’t bother about liquidity. You are getting it below book value!

I am sold!

Shailesh

Yashodhan

Correct me if I am wrong, but isn’t this something like derivatives / options?

In other words, something without an actual value attached to it (like shares?)

Regards

Shailesh

No. STAN is traded in the cash segment of the NSE. Nothing to do with F&O. This is not a derivatives exposure, no doubt about that. It tracks the price of Standard Chartered PLC which is listed on LSE. There is a value attached – the price on LSE. They aren’t shares they are depository receipts. For eg., HDFCBANK had depository receipts listed on the NYSE, so does Dr. REDDYS and many other companies. The difference is that Standard Chartered has chosen to list in India. It is the first and in my opinion the only foreign company to list in India under the IDR scheme.